Every parent wants to give the best education to their children. Your child might likely opt for a career in engineering, medicine, architecture, or finance. They could also choose something unconventional, like music. There are lots of courses coming up, and it is difficult to predict your child’s interest. Still, you can plan for it financially by taking the following steps:

Estimate the education cost

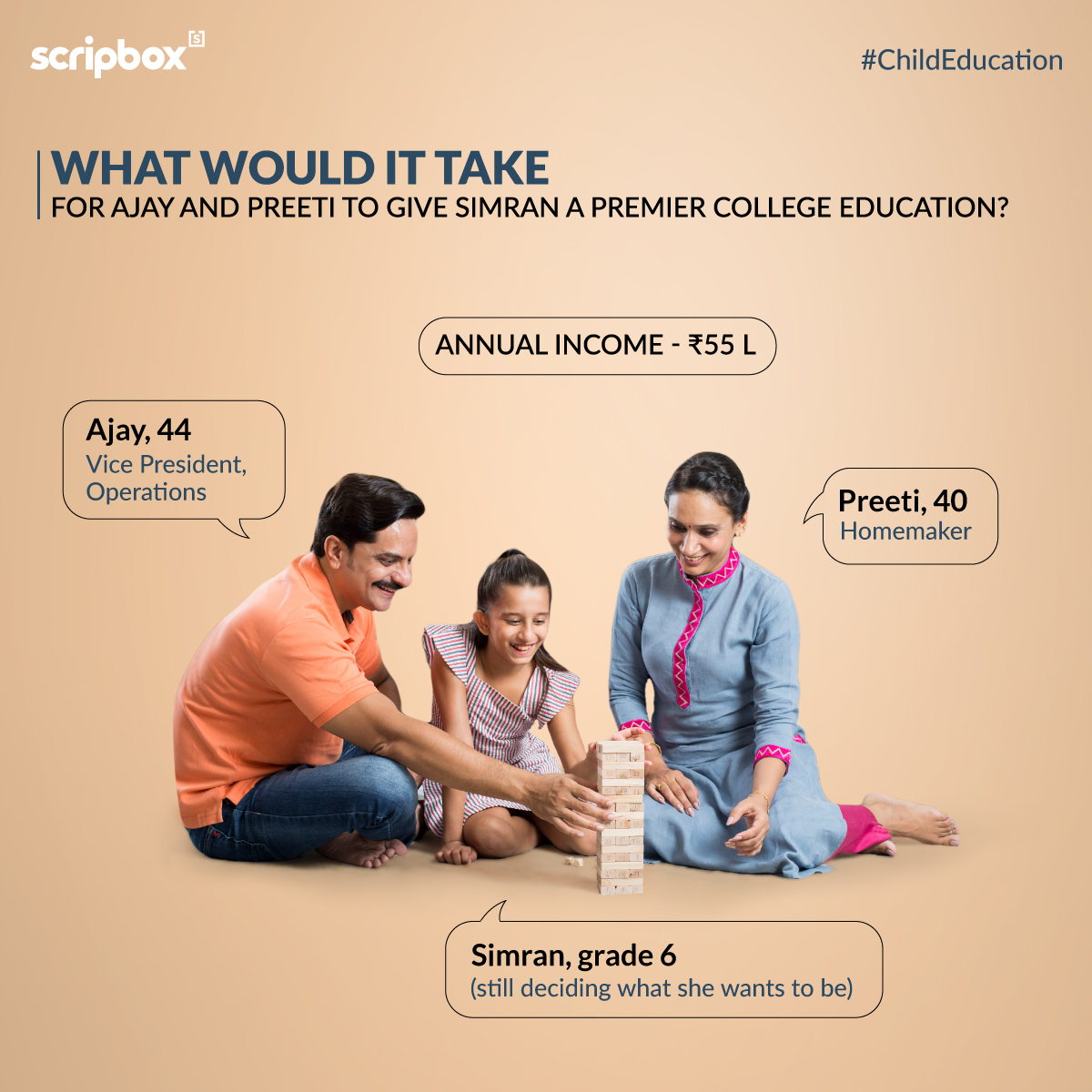

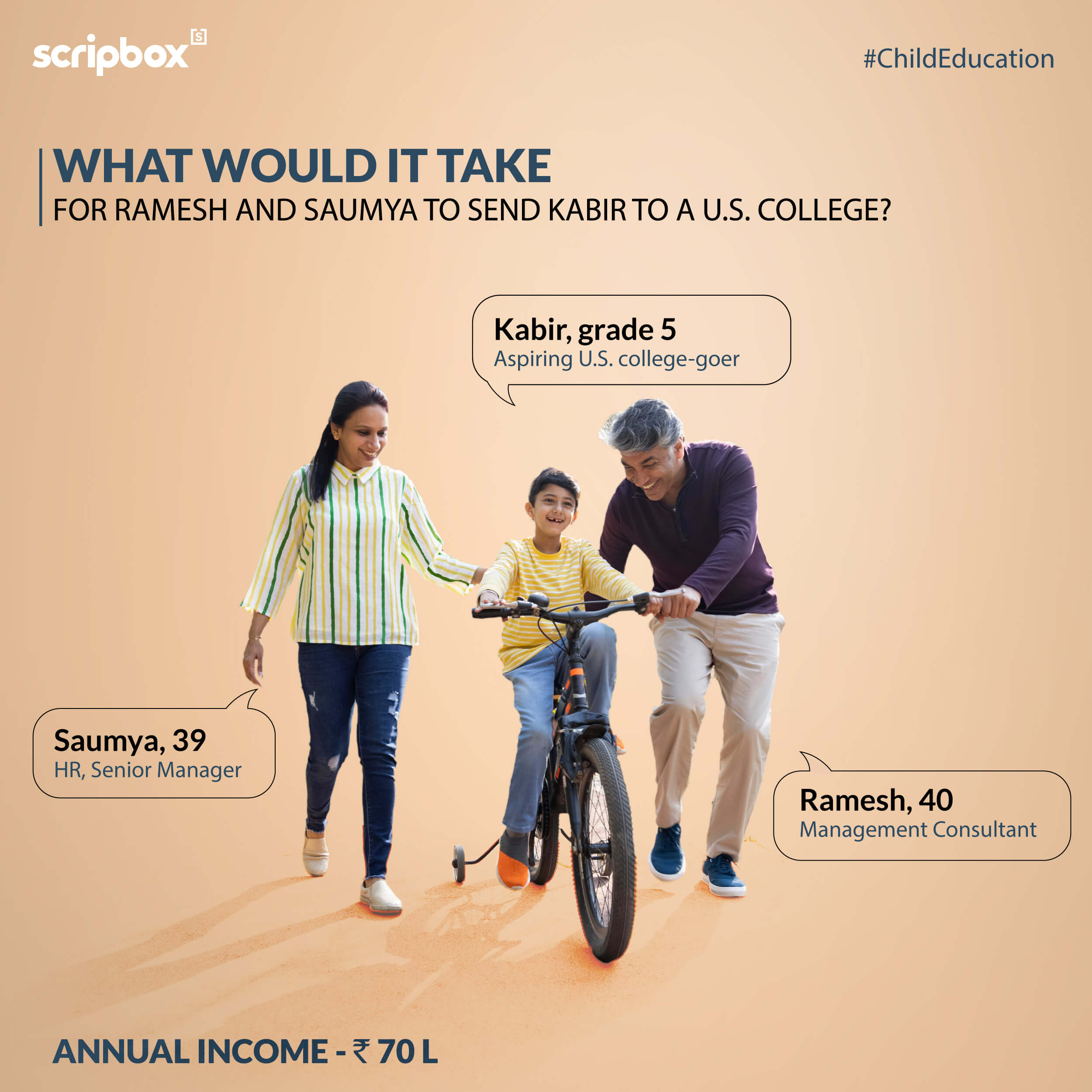

A degree in an IIT can cost over Rs 10 lakh today and an MBBS upwards of Rs 50 lakh (in a private Indian institution). Education abroad, be it for undergrad or post-graduation, like MBA or MS, could cost a minimum of Rs 1.5 crore depending on the course length and the destination.

Parents of a five-year-old child would have 15 years to build the required corpus for their child’s post-graduation. And a relatively lesser time horizon of 10 years for sponsoring their under-graduation.

While it is difficult to predict the child’s career interest, make an informed start. Start by identifying two or three career options based on their current interests. Estimate the education cost and pick the costliest of the lot as your financial target. By doing that, you would not be in for any future surprises.

As things become clear, you can tweak your financial target. Also, prepare for the unexpected by keeping a safety margin, as it is likely that the hostel, accommodation, and tuition fees could move at a faster clip than you had planned.

The next step is to determine the future education cost after factoring-in inflation. Assume a minimum annual inflation rate of 10%, given the past trends in education inflation. So, if you are looking towards sponsoring MBA education in India, today, it costs about Rs 25 lakh, and after ten years, it could increase to Rs 1 crore.

If you have two children, you might have to delineate the financial goals and chase each separately. It’s advisable to start the investment journey as early as possible. It gives more time to build the corpus and the power of compounding to work its wonders over the long term

How much to save?

Once you know the time horizon at hand and the financial target to achieve, you can calculate the monthly savings that need to be done. The SIP route to investing helps in building assets systematically over a while and in a less risky way.

In this approach, asset allocation plays an important role. For instance, if you are looking to build Rs 1 crore over the next 10 years, then you need to invest about Rs 51,000 every month for the next decade. This is assuming that 100% of your corpus is in equities for seven years, and then you switch to debt in the last three years.

However, if you go for 50% equities, you need to save more (Rs 58,000).

Among all the asset classes, equity has the best potential to provide inflation-beating portfolio growth (10-12% annually). By investing in equities, you could achieve the goal faster or with a smaller SIP.

It’s equally important to go all debt as you approach the goal so that you don’t take unnecessary portfolio risk. It calls for a regular rebalancing of portfolios in favour of debt instruments.

Goal-based financial planning

Invest separately to achieve each of your financial goals. By doing that, you also figure out your progress in the investment journey. And if it needs any course correction. So, have a separate fund for retirement, another for education, and so on.

Education-related responsibilities typically come before retirement. And often, parents tend to liquidate their assets or retirement corpus to sponsor their child’s education. This, in turn, could delay their retirement goal achievement or compromise their retirement lifestyle.

Not resorting to financial planning has its element of risks. If you don’t plan early, there are chances you might have to compromise on the quality of education to fit your budget. Prestigious institutes often have considerable fees but also assure quality education and careers for their alumni.

Studying abroad costs a lot. Not building an extensive corpus could mean looking at domestic avenues for education.

Takeaway

Planning for children’s education is akin to planting a tree. Estimate its future costs, start investing early, and adopt equities to get there swiftly.

Show comments