Mutual Fund Cut Off Time Rules by SEBI

Mutual Fund investments are driven by fluctuations in the stock market. Investors had to submit applications at offices of Asset Management Companies (AMCs) or their Registrar and Transfer Agents (RTAs). You had to submit the application before the cut-off time. Only then you could redeem at a high market or for purchase at a low market. By submitting the application before cut-off time only you could get the same-day NAV (Net Asset Value).

However, as per new NAV rules by SEBI, the cut-off time is now less relevant. Therefore, from February 1, 2021, the mutual fund houses will only allot units after the realization of funds. This rule is applicable for investment (purchase) purposes in equity-oriented and debt Mutual Funds. So, even if you submit the application before the cut-off time the allotment will be upon realization of funds. You can simply understand this as NAV applicable on your transaction will depend on when the fund house receives your money.

Earlier, this rule of allotment of MF units was applicable only on investments of Rs 2 lakh or above. For investments of smaller amounts allotment was on the same day NAV upon submitting the applications before cut-off time. However, the provision of NAV applicability remains unchanged for liquid and overnight funds.

What is Mutual Fund Cut Off Time?

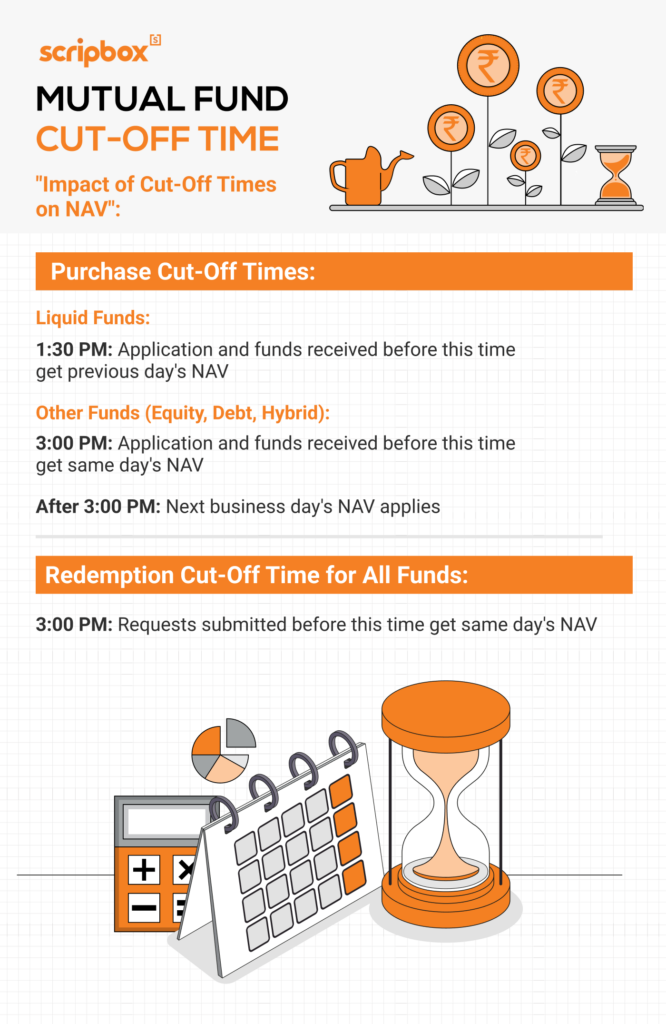

The cut-off time for mutual funds is the deadline by which investors must submit their applications or transactions to be eligible for the current day’s Net Asset Value (NAV). The cut-off time varies depending on the type of mutual fund scheme. For instance, liquid and overnight funds typically have an earlier cut-off time of 1:30 p.m., while other mutual fund schemes have a cut-off time of 3:00 p.m. This means that if you submit your application before the cut-off time, you will receive the NAV of the same business day. However, if you submit your application after the cut-off time, the NAV of the next business day will be applicable.

Cut-Off Time for Mutual Fund Transactions as per SEBI

| Type of Schemes | Cut-off Time in IST |

| Liquid Funds and Over Night Funds (Subscription including switch-ins) | 1:30 PM |

| Liquid Funds and Overnight Funds (Redemption including switch-ins) | 3:00 PM |

| All other schemes (Subscription including switch-ins) | 3:00 PM |

| All other schemes (Redemption including switch-ins) | 3:00 PM |

The mutual fund cut-off time in India is now based on the realization of funds. SEBI has declared this change under the New Rule on Applicable NAV. The amended rule is effective from February 1, 2021. The cut-off timings for mutual fund transactions up to Rs. 2 lakh applicable earlier were as given in the above table.

Note: The fund withdrawal Cut-off timing at Scripbox is 12 noon.

SEBI New Rule for Mutual Fund Cut Off

SEBI in its circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 as on September 17, 2020, announced the change in cut-off timings. The rule has been brought to effect from February 1, 2021, in accordance with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020.

According to the New Rule, the applicable NAV in respect of the purchase of units of a mutual fund scheme is subject to the realization of funds. It means the availability of funds in the bank account of the mutual fund house before purchase transactions. The rule is applicable to all investments irrespective of the amount of investment. It covers all mutual fund schemes except Liquid funds and Overnight Funds.

Importance of Mutual Fund Cut Off Time

According to the SEBI Mutual Fund Regulations, fund houses declare the NAVs of all mutual fund schemes after the markets close. In simple terms, they declare the NAV at the end of the trading day. This makes the cut-off time for the submission of applications so important for investors. In order to get the end-of-day NAV of a particular business day, you must invest before the cut-off time.

The cut-off time for most mutual fund schemes is 3:00 PM for purchase transactions. This timing, however, is not applicable to liquid fund schemes. This means if you invest till 3:00 PM you will get NAV applicable for the day. In case you submit the application after the cut-off time, the mutual fund company will accept your application. But in such cases, you will get the NAV of the next business day. The cut-off time rules apply similarly for redemptions too.

The cut-off time is applicable on all mutual funds as per SEBI Mutual Fund Regulations. It does not apply to liquid fund schemes. According to the guidelines allotment of mutual fund units is on the basis of prospective NAV. The NAV is based on the closing market value of the securities held in the respective schemes. It is declared at the end of the day.

Impact of Cut Off Time on Investors

The cut-off time has a significant impact on investors, as it determines the NAV at which their transactions are processed. If an investor submits their application before the cut-off time, they will receive the current day’s NAV. However, if they submit their application after the cut-off time, they will receive the next business day’s NAV. This can result in a difference in the NAV, which can affect the investor’s returns.

For example, if an investor submits a purchase application for a mutual fund at 2:00 p.m. on a trading day, and the cut-off time is 3:00 p.m., they will receive the current day’s NAV. However, if they submit the application at 3:30 p.m., they will receive the next business day’s NAV. This difference in NAV can be crucial, especially in a volatile market, as it can impact the overall returns on the investment.

Redemption Processing Time

The time it takes to process your redemption request and transfer the funds to your bank account can vary based on the type of fund, the amount, and the procedures of the mutual fund company. Typically, here’s how long it takes:

- Liquid Funds: 1–2 working days

- Equity, Debt, and Conservative Hybrid Funds: 2–4 working days

Keep in mind that bank holidays or unexpected delays might extend these timelines.

The Securities and Exchange Board of India (SEBI) oversees the mutual fund industry in India. It sets rules and guidelines to ensure fairness, protect investors, and maintain market integrity. These regulations include specific cut-off times for mutual fund transactions.

SEBI has revised the rule for the allotment of mutual fund units. The new rule for NAV is based on the realization of funds. It is applicable for all purchase transactions from February 1, 2021.

The calculation of NAV based on Realization of Funds is applicable on the following transactions:

- All purchase transactions- The rule is applicable on all transactions including initial purchase or additional purchase of units. It also applies to both lump-sum investments and Systematic Investment Plan (SIP). Unlike earlier, the rule does not apply to the amount of investment.

- Purchase of units through Inter-Scheme switching of investments- The rule also applies to switch transactions under Systematic Transfer Plan (STP) irrespective of the amount of investment.

The Applicable NAV for Mutual Funds Transactions includes all purchase transactions other than Liquid and Overnight Funds. It also includes Switch-In transactions and other transactions under all mutual fund schemes. The NAV applies as per the following rules irrespective of the amount of investment:

| Time of receipt of Transaction and Money | Applicable NAV |

| The purchase transaction application is received up to the cut-off time of 3.00 PM. Submission on a business day at the official point(s) of acceptance. The funds for subscription/purchase amount are available for utilization up to 3.00 PM on the same Business Day. | NAV of the same Business Day shall be applicable |

| The transaction is received up to the cut-off time of 3.00 PM. Submission on a business day at the official point(s) of acceptance. Funds for the purchase of units are available for utilization after 3.00 PM on that Business Day. The funds are available on a subsequent Business Day. | NAV of the subsequent Business Day when the funds are available for utilization prior to 3.00 PM shall be applicable. |

| The transaction is received AFTER the cut-off time of 3.00 PM. Submission on a business day at the official point(s) of acceptance. Funds for the entire amount of subscription are available for utilization up to 3.00 PM on the same Business Day. | NAV of following Business Day shall be applicable. |

| The transaction application is received after the cut-off time of 3.00 PM. Submission on a business day at the official point(s) of acceptance. Funds for the entire amount of subscription are available for utilization after 3.00 PM on the same Business Day or subsequent Business Day. | NAV of subsequent Business Day on which fund realized prior to 3.00 PM shall be applicable |

An investor can opt for Inter-scheme switching of investments by submitting an application for the same. It is valid for processing on the earliest day. You can understand this to be the Business Day for both the ‘Switch out’ and ‘Switch in’ schemes. ‘Switch in’ applications shall be treated as purchase applications. The Applicable NAV for these will be based on the cut-off time for purchase. Applications for ‘Switch out’ shall be treated as redemption applications. The Applicable NAV for them will be based on the cut-off time for redemption.

Transaction wise NAV applicability (applicable from 01-Feb-2021)

| Type of Transaction | Transaction Application received before cut-off timing | Money Received by Mutual Fund before cut-off timing | Applicable NAV |

| Purchase / SIP Installment | Y | Y | Same Business Day |

| Purchase / SIP Installment | N | Y | Next business day, whenever Time Stamping is done before the cut-off time |

| Purchase / SIP Installment | Y | N | Next business day on which money received by the fund before the cut-off time |

| Inter scheme Switch Transaction | |||

| Transaction Type | The transaction received before cut-off timing | Money Received by Mutual Fund before cut-off timing | Applicable NAV |

| Switch out | Y | N/A | Same Business Day |

| Switch in | N/A | Y | Business Day on which funds are received in Switch-in scheme before the cut-off time. It is in line with the redemption payout of the Switch Out scheme. |

How many days does it take for my withdrawn funds to reach my bank account?

Equity, Debt, & Conservative Hybrid Funds: You can expect to receive the money to your registered bank account within 2-4 working days once the withdrawal is processed.

Liquid Funds: You can expect to receive the money to your registered bank account in 1-2 working days once the withdrawal is processed.

Note:

If we receive the withdrawal instruction before 1:30 PM on a working day then it will be processed on the same working day else on the next working day (i.e. excluding weekends & holidays).

When are the Mutual Funds Units Allotted to me?

The date of allotment of mutual fund units depends on the payment method selected by you to make the investment.

Investment via UPI:

- If you have transferred money using the UPI payment method before 12:30 PM on a working day, then the mutual fund units will be allotted to you on the same day itself.

- If you have transferred the money after 12:30 PM, then the mutual fund units will be allotted for the next working day. Scripbox will clearly show you the date of Investment.

Investment via Net Banking :

- If you have transferred money using the Net Banking payment method from 12:00 AM to 11:59 PM on a working day, then the mutual fund units will be allotted for the next working day. i.e. T+1, irrespective of what time you place the investment instruction.

- For instance, if you place an investment instruction around 11am or 11pm on a working day through Internet Banking, your investment will get processed with the NAV of the next working day.

Check out: Mutual Fund Cut Off Time

Automated transfer based on linking your bank account

- You can expect the mutual funds units to be allotted to you on the next (maximum 2) working days from the scheduled date of your investment.

For example:

January 10: The date on which you have scheduled your investment

January 10: Money get transferred from your bank account

January 11: We receive confirmation of transfer from your bank

January 11: We inform the mutual fund company/s on your investment instruction and send your details. Units get allotted to you with 11th January’s applicable NAV

January 12: You receive confirmation from the mutual fund company/s and Scripbox on your successful investment/s.

Please note that the above example assumes all days are working days. In case of holidays or weekends, the next working date will need to be considered. So, if 11th and 12th are on Saturday or Sunday, the entire process will only be completed by the 14th.

Your Mutual Fund Investments will reflect as successful in the Scripbox account by the next working day once your investments are successfully confirmed by the Mutual Fund Companies in which you have invested through us.

Conclusion

In conclusion, the cut-off time for mutual funds is an important concept that investors need to understand. It determines the NAV at which their transactions are processed, which can affect their returns. Investors should be aware of the cut-off time for their mutual fund schemes and plan their transactions accordingly. By doing so, they can ensure that they receive the best possible NAV for their investments. Understanding the cut-off timings for different mutual fund schemes and submitting applications before the cut-off time can help investors optimize their returns and make informed investment decisions.

Frequently Asked Questions

Ex-dividend NAV is applicable on allotment of units upon reinvestment of dividend.

The units for NFO subscription allotment are on the basis of all valid applications that the fund house receives on the NFO closure date. It considers all applications for which the funds have been realized till the close of business hours on that date. Allotment of units will be done against all applications for which the funds have been submitted to the mutual fund collection account. In case of switch transactions, you can apply to switch from an existing scheme into an NFO scheme. All Switch-Out requests received & time stamped before the applicable cut-off timing of the source schemes are processed. Allotment of NFO scheme units on the allotment date is at face value as specified in the Scheme Information Document.

Let’s say your SIP date is the 5th of every month. As per the rule, your units are allotted at the NAV of the 5th (assuming it’s a business day) only if the AMC receives it in their bank account before 3pm. If they receive the money after 3pm, NAV of the next business day will be applicable.

Yes, you can redeem your mutual fund investments anytime. However, the applicable NAV will vary depending on the time of redemption. If redemption is before 3pm, the same business day NAV will be applicable. In case the redemption is after 3pm, NAV of the next business day is applicable.

The cut off time for all mutual fund schemes, except for liquid and overnight funds, is 3pm. NAV calculation happens after the market closes. Thus, if you invest before 3pm, you will get the same day’s NAV.

Learn Ex Dividend Date

- Mutual Fund Cut Off Time Rules by SEBI

- Cut-Off Time for Mutual Fund Transactions as per SEBI

- SEBI New Rule for Mutual Fund Cut Off

- Importance of Mutual Fund Cut Off Time

- Redemption Processing Time

- NAV Based on Realization of Funds

- Applicable NAV for Mutual Funds Transactions

- Which NAV is applicable on switching mutual funds?

- How many days does it take for my withdrawn funds to reach my bank account?

- When are the Mutual Funds Units Allotted to me?

- Conclusion

- Frequently Asked Questions

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

Show comments