FIRE Calculator

Know your FIRE number (Financial Independence, Retire Early) based on your savings, expenses, and investment returns.

ELSS Calculator

Find out how much your tax-saving investments can grow using the ELSS Calculator for SIP or lumpsum investment returns.

FD Calculator

Find out how much interest you can earn using the FD Calculator. Enter your amount, tenure, rate & compounding to get results.

RD Calculator

Find out how much your recurring deposit will grow using the RD Calculator—estimate interest and maturity value from banks or the Post Office.

Inflation Calculator

Find out how inflation impacts the future value of your tax-saving investments in ELSS funds and calculate real returns.

Best FIRE Calculator in India

Financial Independence, Retire Early (FIRE) is about early financial freedom to retire sooner and enjoy life without depending on a regular paycheck.

By analysing your financial data, our comprehensive FIRE retirement calculator determines your FIRE number, the exact amount you need to retire comfortably without working. This user-friendly tool provides personalised insights to help you reach your financial freedom goals.

What is the FIRE Calculator?

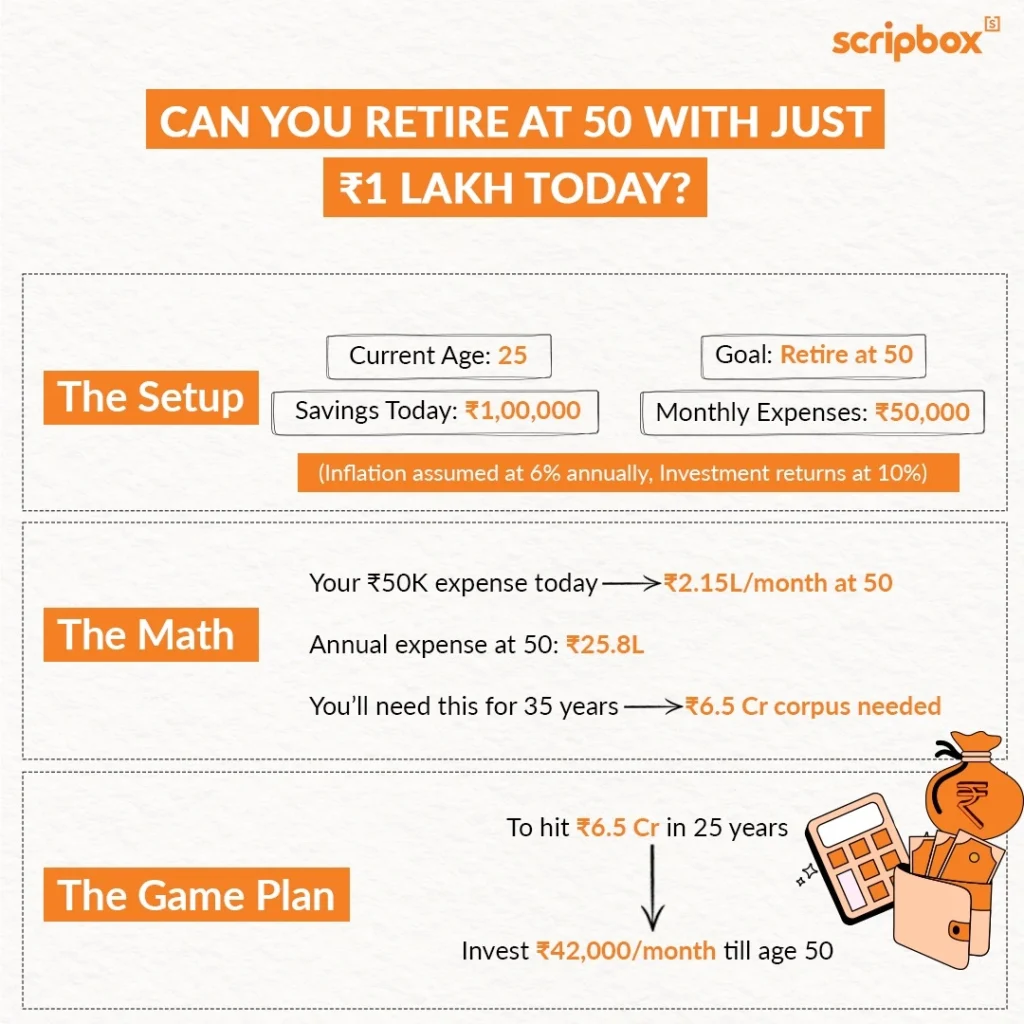

The amount needed to retire without working and pay bills indefinitely is your ‘FIRE number’. FIRE calculators estimate early retirement savings using factors like your savings, monthly costs, expected investment returns, and remaining work years.

FIRE (Financial Independence, Retire Early) enables you to retire early if you can save enough from investment profits to pay living expenses. A FIRE calculator retirement tool simplifies this process by calculating the savings and investments needed for financial independence, early retirement, and personal freedom. A fire calculator with inflation adjustment can help you set a realistic retirement goal, taking into account rising living costs.

Types of FIRE Calculators

As more Indians seek financial freedom that fits their aspirations and lifestyle, the Financial Independence Retire Early (FIRE) movement is growing. Indian investors can use several FIRE calculators to plan their retirement:

1. Lean FIRE Calculator: Ideal for those planning to retire early while living simply and frugally. It is estimated the amount needed for a minimalist lifestyle.

2. Coast FIRE Calculator: Ideal for early retirees who want to invest heavily and let compounded earnings take them to retirement. A Coast Fire Calculator in India helps estimate the savings growth needed for retirement.

3. Fat FIRE Calculator: Fat Fire Calculator India estimates a bigger amount needed for early retirement luxuries like travel, posh accommodation, and fine dining.

4. Barista FIRE Calculator: It is a favoured option among young Indian professionals due to its ability to estimate the savings required for semi-retirement, as well as the opportunity to engage in pleasant part-time or freelance work.

Why FIRE matters for your retirement?

India does not have a comprehensive social safety net, necessitating self-funded retirement.

1. High Healthcare Costs: The necessity for substantial healthcare reserves is exacerbated by the annual rate of medical inflation in India, which ranges from 8 to 10%.

2. Economic Uncertainty: The necessity of financial security is underscored by the job market disruptions caused by automation and the evolution of industries.

3. Impact of Inflation: The increasing cost of living necessitates disciplined saving and investing, as it impacts daily expenses and long-term financial objectives.

4. Lifestyle Freedom: FIRE allows you to retire early, travel, establish a business, or pursue hobbies without financial stress.

5.Financial Stability: A robust financial cushion safeguards against unforeseen emergencies, recessions, and job loss.

How to use FIRE Calculator?

FIRE calculators are easy to use in a few steps. The process begins with these steps:

1. Enter your financial information:

Enter your target retirement age, savings/investments, and monthly/yearly costs. The fire calculator asks these questions to assess your financial situation.

2. Adjust key assumptions

Next, adjust ROI and projected annual inflation (to account for rising costs). Take India, for instance 5% inflation and around 8-10% investment growth if your portfolio is mostly stocks. A fire calculator with inflation adjustments in India will use this to improve estimates. Set a monthly savings or investment goal.

3. View your FIRE number estimate

This free FIRE calculator provides estimates after you enter all your inputs. Whether FIRE corpus is needed and when. To retire at 45 and fulfil your goal by YYYY, you may need ₹X crore based on your data and present route. It symbolises financial independence.

4. Plan and Execute

Plan your savings and investments with statistics. If the calculator displays a difference between your progress and your target, consider adjusting your retirement age, increasing monthly contributions, or taking smart risks. If you prefer spreadsheets, you can track your progress with a fire calculator excel tailored for India. Regularly update assumptions and track progress to stay on track.

5. Example Calculation

Suppose you are 30 years old, have ₹20 lakh money, and spend ₹50,000 monthly. Retirement is your goal at 45. Assuming 8% yearly return and 5% inflation, save ₹50,000 monthly. Based on the FIRE calculator, your corpus might reach ₹6 crore in 20 years. The calculator can help you determine your retirement schedule and savings needs if your target FIRE number is ₹1.5 crore to cover ₹50,000 monthly costs.

Advantages of using Scripbox FIRE Calculator

1. Tells you when you can retire based on your savings and investments.

2. Shows how small changes in savings or returns can speed up financial freedom.

3. Lets you customise your plan based on different retirement lifestyles.

4. Keeps you on track with regular updates as your income or savings grow.

5. Helps you make smarter choices about spending, saving, and investing.

Conclusion

By establishing your individual FIRE number and tracking progress with personalised tools like the Scripbox FIRE calculator, the application of the FIRE strategy essentially helps you to plan for early retirement. This calculator turns financial aspirations into feasible strategies by including inflation, lifestyle, and investment growth. Use the best FIRE calculator in India to make informed decisions and secure a future of financial independence and freedom.

Fire Calculator FAQs

To estimate the corpus required for retirement, it is common to multiply your annual expenses by 25 (based on the 4% rule formula). For example: If your annual expenses are ₹10 lakh, you may need a portfolio of ₹2.5 crore to reach FIRE.

It depends on your assets, investment growth, and FIRE number. No universal number. Deconstructing your goal with an online tool or Excel-based FIRE calculator can determine a monthly savings amount. In general, higher monthly savings and investment returns accelerate FIRE.

Taxes reduce net investment returns, affecting FIRE. Tax-efficient choices like PPF, ELSS, and NPS can boost your investments. Optimising for tax-free or lower-tax assets and carefully managing long-term capital gains can accelerate your FIRE goal.

You may speed up your journey with Lean FIRE (minimum lifestyle), Fat FIRE (luxurious retirement), and Coast FIRE (early aggressive investing). Financial independence can be accelerated by choosing a strategy that fits your goals and lifestyle.

Inflation (about 5-6% in India) reduces your savings’ purchasing power, therefore you need more. High-return stocks and mutual funds offset inflation. Reviewing your portfolio regularly keeps your investments ahead of inflation, enabling FIRE.

Explore : Inflation Calculator

Explore : SIP Calculator