SCRIPBOX WEALTH MANAGEMENT SERVICES AGREEMENT

Date of last revision: Aug 23, 2021

This Wealth Management Services Agreement (“Agreement”) is made and entered into:

BETWEEN

Scripbox Wealth Managers Private Limited, having its principal place of business at Wilshire III by MFAR, 5th Floor, 492, Hobli, RHB Colony, Mahadevapura, Bengaluru, Karnataka 560048 (hereinafter referred to as "SWMPL");

AND

- You(hereinafter collectively referred to as "Client" or "You"). If you are entering into this Agreement on behalf of a legal entity you represent that you have the authority to bind such entity to these terms and conditions, in which case the term "Client" or “You” shall refer to such entity.

WHEREAS:

- SWMPL, along with the Scripbox Group (together referred to as “Scripbox” or “We”), is engaged in providing a host of wealth management services as set out under Annexure 1 to this Agreement (“Services”) in accordance with applicable law.

- You wish to utilise the Services of the Scripbox Group.

For the purposes of this Agreement, the “Scripbox Group” means and refers to the following entities:

- Scripbox Wealth Managers Private Limited, a SEBI registered investment advisor bearing registration number INA200001041 (hereinafter referred to as “Mitraz” or “Investment Adviser”) engaged in providing investment advisory services and allied financial services.

- Scripbox Wealth Managers Private Limited, an AMFI registered mutual fund distributor bearing ARN - 341934 engaged in the business of distribution of mutual funds and other financial services (“SIPL”). SIPL is also licensed as a Point of Presence - Sub Entity (POP-SE) by the PFRDA for providing services to subscribers of the National Pension Scheme bearing registration number POPSE31122020 and as an Insurance Corporate Agent (Composite) by the IRDAI for distribution of insurance products bearing registration number CA0758; and

- Scripbox Wealth Managers Private Limited, a personal finance tools, content, technology & operations support platform for consumers and businesses.

NOW, THEREFORE, for and in consideration of the mutual promises, benefits and covenants contained herein, Scripbox and You hereby agree as follows:

- Using Our Services

- You may make use of our Services through our online web portal, mobile app; other online mechanisms and through interaction with our relationship managers, financial planners and investment advisors, as the case may be.

- Scripbox complies with all regulations and compliances as per Indian law. If you are accessing our Services from any jurisdiction outside India, the onus of compliance with the local laws lies on you.

- Some of the Services, provided by us or our Service Partners, may have restrictions on use depending on criteria such as, but not limited to, your place of residence, nationality, age, wealth, source of income/wealth etc. You agree to provide accurate information for us and our Service Partners to comply with such restrictions.

- If you have provided us with your contact details, such as email or phone number, we may send you announcements, messages or information on our Services and how to use them. You may opt out of some of these messages unless they are necessary for the delivery of Services; for compliance with regulations; or, for information security, for e.g., password change alerts cannot be opted out of.

- You agree that in the event the Services rendered by Scripbox under this Agreement are availed by multiple persons, then, Client 1 will be designated as the primary contact and appointed as the single point of contact by the signatories of this Agreement. The primary contact shall communicate with Scripbox with respect to this Agreement and any other matters pertaining to the Client’s accounts. Any change in the designated primary contact shall forthwith be communicated to Scripbox, in writing. In case of a legal entity, the primary contact shall be the person duly authorised by the legal entity to sign this agreement.

- Your clicking on the “I accept” checkbox is the legal equivalent of your signing this Agreement and accepting the terms thereof. Utilisation of certain Services shall require your additional consent which shall be recorded as and when you choose to utilise such Services. Any additional details or information regarding provision of any Services, as required by Applicable Law, shall be displayed to you prior to your utilisation of any such Services.

- Please don’t misuse, disrupt, interrupt, destroy or limit the functionality of our Services; or try to access them using a method other than the interface and the instructions that we provide. If you do so, we may stop providing our Services to you and pursue legal action against you.

- Identity & Authentication

Scripbox will establish your identity on its online Services by means of a phone number or email and will authenticate it by either a password selected by you, or a one time password (OTP) sent to your email or mobile phone, or third party authentication services provided by third parties such as Google and Facebook, or biometric identification enabled by your device. Any instructions provided to, or communication with, Scripbox or its Service Partners which are so authenticated will be considered to have originated from you.

- Choice of Advisory & Distribution services with respect to capital market products

You have the choice to subscribe to and be classified as either:

- an Advisory Client with Mitraz, governed by SEBI (Investment Advisor) Regulations, 2013 ("Investment Adviser Regulations") or

- a Distribution Client with SIPL.

- You may need to meet certain threshold requirements, as described in the description of Services, to be an Advisory Client. Scripbox reserves the right to add certain stipulations for offering services for the choice made by you and these will be added in relevant annexures.

- Terms of investment advisory services agreement, as have been set out in Annexure 2 shall apply only to Advisory Clients and Terms of Distribution Services, as have been set out in Annexure 3 shall apply to Distribution Clients as well as Advisory Clients, to the extent applicable and permissible by law. The Investment Advisory Services Agreement and Terms of Distribution Services are hereafter collectively referred to as “Subscription Agreements”.

- As per current regulations, You and your dependant family cannot be simultaneously provided distribution and advisory services by companies of the same group. Therefore, from the date of assignment of assets for advisory services with Mitraz in accordance with the Investment Advisory Services Agreement, You and your dependant family shall be Advisory Clients and can no longer invest in fee / commission based products as Distribution Clients, unless otherwise permitted by applicable law. Your investments with SIPL, if any, shall remain with SIPL, and you will continue to have the ability to withdraw / transfer your existing investments. However no further investments can be made through SIPL.

- The choice of your subscription shall define the range & scope of Services which shall be made available to you in accordance with applicable laws.

- Third Party Service Partners

For the provision of Services, Scripbox may utilise third party service partners (“Service Partners”) other than Scripbox. The use and operation of any integrated services from our Service Partners such as investment advisory, portfolio management, investing, borrowing, insurance, data aggregation, etc. will be additionally governed by the relevant service terms and contracts of the respective Service Partners. Scripbox shall not be liable for any penalties, loss or damage which is incurred by You due to the negligence or actions of any Service Partner of Scripbox and not caused by any action of Scripbox. A list of service / fulfillment partners is available here.

- Provision of Services

You acknowledge and agree that, for the provision of Services under this Agreement:

- Scripbox shall carry out all activities that are required to fulfil its regulatory obligations for the provision of Services under this Agreement.

- Your access to our Services is associated with a username and password (together “Login Credentials”) and Scripbox will consider the instructions placed with the use of your Login Credentials to have originated from You. You are solely responsible for the security of your Login Credentials. Scripbox shall not be held liable for carrying out any instructions placed from your account utilising your Login Credentials which may be unauthorized due to any reason including an information leak or security breach on your part.

- Scripbox may utilise third party vendors (“Vendors”) for support in provision of Services. A list of Vendors utilised by Scripbox is available here.

- Scripbox, or its Vendors, may

- contact you on issues relating to provision of Services;

- communicate with its Service Partners or Manufacturers (as defined under Annexure 3) and their authorized service providers on your behalf for financial or non-financial transactions; and

- record all your interactions with them including phone calls, chats, conversations and emails, with its employees for legal compliance, security, employee training, and other lawful purposes.

- Any sort of graphical representations, recommendations, feedback and reviews, provided on the investment platform, are in no way a guarantee for the performance of the securities, mutual funds and other financial products.

- Other than as expressly set out in this Agreement, neither Scripbox nor any of its Service Partners, as the case may be, make any specific promises about the Services provided. The Services are provided ‘as is’.

- Your bank may charge you a fee for facilitating transactions, or for failing to maintain sufficient balance to make an investment from your bank account. Scripbox does not levy nor does it receive those charges.

- Grievance Redressal & CommunicationScripbox provides multiple channels for you to request for support or to communicate any grievances you may have:

- By sending an email to [email protected]

- By phone on 1800-102-1265.

- By whatsapp on 8884448026.

Any of your queries & requests shall be responded to within 24 hours of receipt. Resolution, appropriate and to your satisfaction shall be provided as soon as possible depending upon the nature of the request.

If you are not satisfied by the resolution provided, you may escalate your grievance to [email protected]

- Privacy and Data Protection

- Under no circumstances will we sell or rent your personal information to anyone, for any reason, at any time.

- Scripbox shall use your data specifically for the provision of Services you have subscribed to, and in accordance with the Privacy Policy set out in Annexure 4 of this Agreement.

- You provide your explicit consent to share your data across the entities comprising the Scripbox Group to the extent required for provision of the Services, and as may be required to comply with any regulatory requirements.

- Where the Services under this Agreement are being availed together as a family by multiple Clients, each Client provides explicit consent to Scripbox to share their data with the other Clients who are signatories under this Agreement for the purpose of provision of Services.

- Scripbox may use the unique identifier of your device for security purposes to track suspicious activity and for enabling certain features. For instance, if we detect that your account is being accessed from multiple devices, we may contact you to ensure that you have authorised such access.

- Use of Google Analytics

Scripbox uses Google Analytics, a web analytics service provided by Google, Inc. Google Analytics uses first-party cookies to report on user interactions with our web-based services. These cookies store non-personally identifiable information. Google Analytics aggregates technical data (non personally identifiable data relating to your usage of our website) with data collected from other users. Scripbox uses this information to identify the most popular areas of the Services and how to best present and customise them.

For more information about how Google handles technical information, please visit the site, "How Google uses data when you use our partners’ sites or apps", (located at:www.google.com/policies/privacy/partners ). Under no circumstances will your email, password, any personal financial data be collected by or shared with Google Analytics.

- Fiduciary Duties and Fairness of ChargesIn providing you its Services, Scripbox will:

- Put your best interests first;

- Act with prudence, that is, with the skill, care, diligence and good judgment of a professional;

- Provide conspicuous, full and fair disclosure of all important facts and not mislead you in any manner;

- Avoid conflicts of interest; and

- Fully disclose and fairly manage, in your favour, any unavoidable conflicts.

- Limitation of LiabilityYou will not dispute and/or hold Scripbox responsible for:

- Any act that is not an obligation of Scripbox in this Agreement.

- Any disclosures made by Scripbox to any statutory body under any law.

- Any loss, notional or otherwise, incurred because of:

- Delays either at the bank, bank payment systems, Registrar and Transfer Agency or any Manufacturer (as defined under Annexure 3 hereunder) or any other similar agencies or entities;

- Rejection of your instructions by the Bank, Registrar and Transfer Agency or any Manufacturer;

- Providing access to information and/or processing of instructions authenticated by your Login Credentials;

- Non-availability or non-accessibility of the website, mobile application, electronic payment gateway, telephone(s), or office(s) of Scripbox for reasons including those beyond Scripbox’s control;

- Any penalties, loss or damage to you which is due to the negligence or actions of any Service Partner of Scripbox and not caused by any action of Scripbox;

- Any act of Force Majeure (as defined hereunder);

- Any inaccuracy or typographical error on our website or the mobile application or any written, E-mail & SMS communication. Scripbox specifically disclaims any liability for such inaccuracies or errors;

- Depletion of value of securities or Products (as defined under Annexure 3) as a result of fluctuation in value of the securities / Products or on account of non-performance or underperformance of the securities or Products or any other market conditions; or

- Any act, omission or delay attributed to you or any Service Partners resulting in Scripbox not being able to provide the Services to you.

- Scripbox Intellectual Property

- Scripbox owns all intellectual property rights in respect of the Services including any literature, reports, data, drawings, copyrights, designs, diagrams, tables, software, source code or object code or other information or materials, howsoever stored or held, acquired, created, developed, designed or in any way prepared, by Scripbox. The “Scripbox” name and logos and all related names, trademarks, service marks, design marks, and slogans are the trademarks or service marks of Scripbox Wealth Managers Private Limited.

- Using our Services does not give you ownership of any intellectual property rights, including any branding or logos, in our Services or the content you access. You shall not copy, reproduce, sell, redistribute, publish, enter into a database, display, perform, modify, transmit, license, create derivatives from, transfer or in any way exploit any part of any information, content, materials, services available from or through Scripbox, except that which you may download for personal, non‐commercial use. You may not use content from our Services unless you obtain our permission first, and attribute ownership appropriately.

- You may not use the Scripbox logo in any manner that is deceptive or disparaging, or in connection with any product or service that Scripbox does not explicitly endorse. If you wish to use Scripbox's trademarks, please contact [email protected].

- Your Content in Our Services

Some of our Services allow you to upload, submit, store, send or receive content. When you upload, submit, store, publish, send or receive content to or through our Services, you provide us with your consent to utilise such content, including for our marketing purposes, subject to our Privacy Policy.

Such content must not:- be harmful, harassing, blasphemous, defamatory, obscene, pornographic, paedophilic, libellous, invasive of another’s privacy, hateful or racially or ethnically objectionable, disparaging, and relating to, or encouraging money laundering or gambling.

- harm minors in any way.

- infringe any patent, trademark, copyright or other intellectual property rights.

- deceive or mislead the reader about the origin of such messages or communicate any information that is grossly offensive or menacing in nature;

- contain software viruses or any other programs designed to interrupt, destroy or limit the functionality of another computer or mobile device.

- threaten the unity, integrity, defence, security or sovereignty of India, friendly relations with foreign states, or public order.

- cause the incitement to commit any offence or prevent the investigation of any offence.

- be insulting to any other nation.

- impersonate another person.

- violate the provisions of the Information Technology Act, 2000 and rules and regulations thereunder or any other applicable laws.

- Modification and Termination of Services

We are constantly changing and improving our Services. We may add or remove functionalities or features, and / or we may stop a Service altogether, either due to a management decision or regulatory restrictions. In each case, we will give you reasonable advance notice. In case you wish to discontinue using the Services of Scripbox, you may terminate your subscription in accordance with the termination provisions under the applicable Subscription Agreement. Even upon termination of the Subscription Agreement, the terms of this Agreement, to the extent applicable, shall continue to remain in force.

- Indemnity

You agree to indemnify, defend, and hold Scripbox, its Service Partners and its Vendors harmless from and against any and all losses, including legal fees, arising out of or relating to your failure to comply with the provisions of this Agreement.

- Limitation of Remedies

- In no event will Scripbox, its Service Partners, its Vendors or their respective officers, directors, or employees be liable for any action performed or omitted to be performed or for any errors of judgment in relation to your account.

- Scripbox shall not be held accountable for any losses incurred as a result of any actions / occurrences as set out in Clause X (Limitation of Liability) of this Agreement or such actions / occurrences not attributable to Scripbox.

- A gesture of goodwill on behalf of Scripbox such as refunds and / or reimbursement of transaction charges or any other sum, shall not constitute an acknowledgment of any wrongful act or liability by Scripbox and you shall not have any further or additional recourse, legal or otherwise against Scripbox.

- Governing Law and Jurisdiction

- This Agreement shall be construed in accordance with the laws of India. Notwithstanding the provisions of sub-clause (b) below, each of the parties submit to the exclusive jurisdiction of the courts of competent jurisdiction in Bengaluru, Karnataka, insofar as it relates to any party seeking to obtain injunctive or equitable relief.

- If any dispute, controversy or claim among the parties arise out of or in connection with this agreement, the parties shall use all reasonable endeavors to resolve the dispute amicably. If a party gives the other party notice that a dispute has arisen, and the parties are unable to resolve the dispute amicably within fifteen days from the date of service of notice, then the dispute shall be referred to and finally be resolved by arbitration under the Arbitration and Conciliation Act, 1996.

- The tribunal shall consist of a sole arbitrator, who shall be jointly appointed by the parties. If the parties to the dispute are unable to agree on a sole arbitrator within fifteen days after the dispute is referred to arbitration, the tribunal shall consist of three arbitrators, one to be appointed by claimant, the second to be appointed by the respondent, collectively, with the third arbitrator to be appointed by the first two arbitrators so appointed. The arbitral award shall be final and binding on the Parties.

- The seat and venue of the arbitration shall be Bengaluru, India. The language of arbitration shall be English.

- The parties shall bear their own legal and other costs and expenses necessary for resolution of the dispute.

- If you do not comply with the terms of this Agreement, and we do not take action immediately, it will not be construed as our consent to your non-compliance. If any term contained in this Agreement is unenforceable, it will not affect the other Terms.

- General Provisions

- Force Majeure: The parties hereby agree that the period of time during which Scripbox is prevented or delayed in the performance or fulfilling any obligation hereunder, due to unavoidable delays caused by an event of Force Majeure shall be added to Scripbox’s time for performance thereof; and Scripbox shall have no liability by reason thereof. In such an event Scripbox agrees and endeavours to fulfil its obligations under this agreement as expeditiously as possible upon ceasing of such event of Force Majeure. A “Force Majeure” event for the purposes of this Agreement shall include an act of God, flood, earthquake, fire, explosion, strike, war, civil commotion, insurrection, embargo, riots, political disturbances, lockouts, epidemics, pandemics, any act, law, regulation or order of the government, systemic electrical, telecommunications, network or other utility failures affecting Scripbox to render services, including failure on account of a cyber threat / risk.

- Severability: If any provision of this Agreement is held by a court of competent jurisdiction, or arbitration panel, as applicable, to be unenforceable under applicable law, then such provision shall be excluded from this Agreement and the remainder of this Agreement shall be interpreted as if such provision were so excluded and shall be enforceable in accordance with its terms; provided however that, in such event this agreement shall be interpreted so as to give effect, to the greatest extent consistent with and permitted by applicable law, to the meaning and intention of the excluded provision as determined by such court of competent jurisdiction or arbitration panel, as applicable.

- Further Assurance: Each of the parties shall perform such further acts and execute such further documents as may reasonably be necessary to carry out and give full effect to the provisions of this Agreement and the intentions of the parties as reflected hereby.

- Assignment: Neither You or Scripbox may assign or otherwise transfer the rights under this Agreement without written consent of the other.

ANNEXURE 1

DESCRIPTION OF SERVICES OF SCRIPBOX

Scripbox has the capability to provide the following services as per the consent and requirement of the Client. The specific set of Services provided to You shall depend upon your specific requirements and consents.

| Sr No | Service | Description of Service |

|---|---|---|

| Scripbox Wealth Managers Private Limited | ||

| 1 | Data aggregation |

|

| 2 | Self serve app based Financial Planning |

|

| 3 | Customised Financial Planning |

|

| 4 | Risk Analysis & Asset Allocation |

|

| 5a | Tax Filing |

|

| 5b | Tax Filing |

|

| 5c | Tax Filing |

|

| 5d | Tax Filing |

|

| 6a | Servicing & Reporting |

|

| 6b | Servicing & Reporting |

|

| 7 | Will creation |

|

| 8 | Financial Awareness |

|

| Scripbox Wealth Managers Private Limited | ||

| 9a | Mutual funds distribution services (& advice incidental to) |

|

| 9b | Distribution services for capital market advisory products from parties other than Scripbox |

|

| 10 | Distribution/ Execution services for other investment products |

|

| 11 | Advisory & execution services for Insurance products |

|

| 12 | Servicing & Reporting |

|

| Scripbox Wealth Managers Private Limited | ||

| 13a | Investment Advisory Services & related execution services for capital market products (Requires a minimum of Rs 50 lakhs of advised assets across capital markets and others) |

The above are as permitted under the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 |

| 13b | Investment Advisory Services & related execution services for products other than capital market products (Requires a minimum of Rs 50 lakhs of advised assets across capital markets and others) |

|

| 14 | Servicing & Reporting |

|

| 15 | Financial Awareness |

|

Note:The provider of Services under this Annexure is subject to change depending on any alteration in the regulatory landscape under applicable law or due to operational decisions by Scripbox.

ANNEXURE 2

Investment Advisory Services Agreement

(Applicable only to Advisory Clients)

- Appointment of Mitraz as Investment %Adviser:By subscribing to the investment advisory services of Mitraz in accordance with Clause III of the Agreement, You hereby appoint, entirely at your risk, the Investment Adviser to provide You with investment advisory services in accordance with the terms and conditions of this Agreement as mandated under Regulation 19(1)(d) of the Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 (“Investment Advisers Regulations”). The parties agree to be legally bound by this Agreement. For the purposes of this Annexure You shall be referred to as “Advisory Client”.

- The specific services being provided by the Investment Adviser are set forth in Annexure 1 of this Agreement.

- Advisory Client Consent:The Advisory Client hereby consents to the following:

- I / We have read and understood the terms and conditions of the investment advisory services provided by the Investment Adviser along with the fee structure and mechanism for charging and payment of fee.

- Based on our written request to the Investment Adviser, an opportunity was provided by the Investment Adviser to ask questions and interact with ‘person(s) associated with the investment advice’.

- The Investment Adviser has informed us of the availability of distribution services being provided by its group company and I / We have chosen to utilise the services being provided by the Adviser.

- Investment Adviser Declaration:The Investment Adviser hereby undertakes and declares the following to the Client:

- The Investment Adviser shall neither render any investment advice nor charge any fee until the Advisory Client has executed this agreement AND expressly indicated the scope of advised assets via a declaration in the prescribed format.

- The Investment Adviser shall not manage funds and securities on behalf of the Advisory Client and that it shall only receive such sums of monies from the Advisory Client as are necessary to discharge the “Client’s” liability towards fees owed to the Investment Adviser.

- The Investment Adviser shall not, in the course of performing its services to the Advisory Client, hold out any investment advice implying any assured returns or minimum returns or target return or percentage accuracy or service provision till achievement of target returns or any other nomenclature that gives the impression to the Advisory Client that the investment advice is risk-free and/or not susceptible to market risks and or that it can generate returns with any level of assurance.

- Fees specified under the Investment Adviser Regulations:In accordance with the provisions of the “Investment Advisers Regulations”, an investment adviser is entitled to charge fees from a client in the manner prescribed by the Securities and Exchange Board of India (“SEBI”) and accordingly, an investment adviser shall charge fees in either of the two modes:

Assets under Advice (AUA) mode:

- the maximum fees that may be charged under this mode shall not exceed 2.5% of AUA per annum per client across all the services offered by the investment adviser;

- the investment adviser shall be required to demonstrate AUA with supporting documents like demat statements, unit statements etc. of the client; and

- any portion of AUA held by the client under any pre-existing distribution arrangement with any entity shall be deducted from AUA for the purpose of charging fee by the investment adviser.

Fixed fee mode:

The maximum fees that may be charged under this mode shall not exceed INR 1,25,000/- (Indian Rupees One Lakh Twenty-Five Thousand) per annum per client across all services offered by the investment adviser.

General conditions under both the modes:

- In case “family of client” is reckoned as a single client, the fees referred to above shall be charged per “family of client”.

- The investment adviser shall charge fee from a client under any one mode i.e. (i) or (ii) on an annual basis. The change of mode shall be effected only after 12 months of on boarding/last change of mode.

- If agreed by the client, the investment adviser may charge fees in advance. However, such advance shall not exceed fees for two quarters.

- In the event of pre-mature termination of the investment adviser services in terms of the agreement, the client shall be refunded the fees for unexpired period. However, the investment adviser may retain a maximum breakage fee of not greater than one quarter fee.

- Fees Charged by the Investment Adviser:The Investment Adviser shall charge fees as per Assets under Advice (AUA) mode prescribed by the Investment Adviser Regulations. The specific details of Fees and charges are set out below:

Fee Schedule: The applicable fee is as outlined in the table below + GST on a per annum basis. This is within SEBI’s prescribed limit of 2.5% per annum.

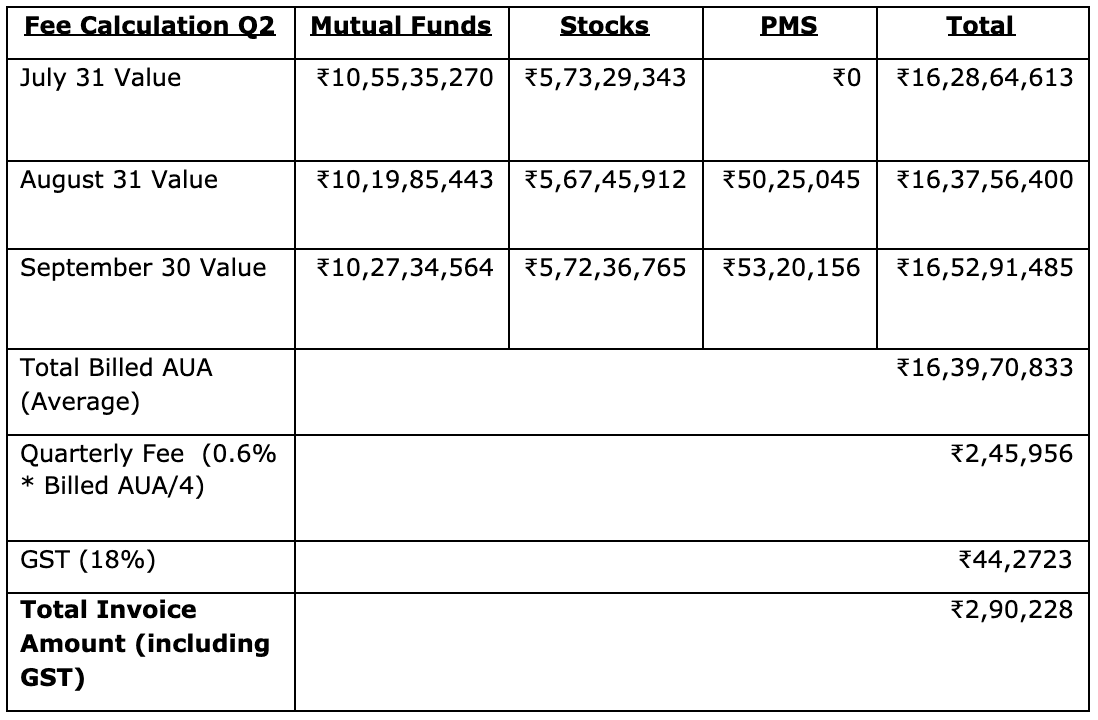

Assets Under Advice Fee Rs. 0 - Rs. 49,99,999 1.0% Rs. 50,00,000 lakhs - Rs. 4,99,99,999 0.8% Rs. 5,00,00,000 - Rs. 24,99,99,999 0.6% Rs. 25,00,00,000 or more 0.4% Fee Period: The Fee is applied quarterly on the average Billed Assets under Advice (AUA) for a quarter. The quarters are identified as – FYXX-XX Q1 (Apr-Jun), FYXX-XX Q2 (Jul-Sep), FYXX-XX Q3 (Oct-Dec) FYXX-XX Q4 (Jan-Mar). The “Client’s” fee statement with quarterly invoice is shared in the months of February, May, August and November in a year for the preceding quarter.

Service Period: The services shall be provided by the Investment Adviser to the Advisory Client until the Agreement is terminated by either party in accordance with the provisions of Clause K of this Annexure.

Billed AUA: The Billed AUA is calculated by taking an average of the month-end values of the Assets Under Advice. The Assets Under Advice are evidenced by the Fund Statements and Demat Statements available on the provider platforms, online systems and physical documents. Any investment either legacy, where the Investment Adviser or another entity within the Scripbox Group is earning commissions or where Direct option is not available are excluded from the calculations.

Payment Mode: The Advisory Client authorizes the Investment Adviser to debit the fee directly from the designated bank account any time after two weeks from the communication of quarterly fee statement and invoice. The Advisory Client agrees to sign the One-Time Mandate (OTM) form in favor of Mitraz to enable the direct fee debit. The Advisory Client shall maintain adequate cash balance or approve redemption of investments to fund the fee recovery from the designated bank account. The Investment Adviser will send an electronic confirmation to the Advisory Client on receipt of the fees.

Fee Illustration:

Other fees & charges: The Investment Adviser requires all clients who opt for its implementation services to open various trading and execution accounts. There may be direct/indirect charges, e.g., account opening charges, transaction fee that may be levied by product and platform providers separately. Fee shown above does not include these charges and need to be paid by the Advisory Client directly, as per the Investment Advisers Regulations.

The billing starts from the date of this Agreement OR the date of declaration of advised assets, whichever is later. The Advisory Client, per their choice, may update the assets to be managed by the Investment Adviser in a prescribed format at any time. On and from the date of receipt of such revised declaration, or as may be permitted by applicable law, the fee schedule set out above shall apply in accordance with the revised declaration.

- Undertakings, Representations & Warranties by the Advisory Client:

The Advisory Client represents and warrants as below for availing the investment advisory services offered by the Investment Adviser under this Agreement:

- The Advisory Client agrees to provide current and accurate information to the Investment Adviser concerning the services to be availed by the Advisory Client and any changes to this information is to be intimated, in writing, to the Investment Adviser.

- The Advisory Client shall make an annual declaration to the Investment Adviser in relation to the details of their dependent family members, if any, in a format as prescribed by the Investment Adviser.

- The Advisory Client has the experience and understands the risks involved in investments and related transactions. The Advisory Client understands that the investments need to have a long-term horizon of more than 3 years for Debt instruments and more than 5 years for Equity instruments. In cases, where client has any concern, insufficient knowledge or experience regarding some advice, investment product and/or transaction, he/she will share the information, in writing, promptly.

- The Investment Adviser shall be safeguarded against any claim made on it for missed opportunities for investment gains on account of any reason determinable.

- The Investment Adviser shall not be responsible for those omissions and commissions by any third party including those recommended by it or those over whom it has no control including asset management companies, advisers, brokers and vendors.

- The Advisory Client agrees to pay the applicable fee as communicated by the Investment Adviser within 2 weeks of the receipt of the invoice. The Investment Adviser shall levy an interest of 1% per month or a part thereof, for fee payment delayed beyond 2 weeks. If the Advisory Client fails to pay the fee, then the Investment Adviser may discontinue services until further notice.

- The Advisory Client further agrees that any risk undertaken and / or loss incurred by employing the advice provided by the Investment Adviser to a third party shall be the responsibility and the liability of the Advisory Client and/or any legal representative thereof.

- The Advisory Client has obtained all necessary approvals and consents from third parties for execution of this agreement and performance of its obligations hereby.

- The Advisory Client has all the power and authority to execute and deliver this agreement and perform its obligations contemplated hereby.

- The Advisory Client acknowledges that the purchase prices and redemption prices are subject to market, currency, economic, political and business risks and that the prices quoted by the Investment Adviser are only indicative and not conclusive. The Investment Adviser shall not be held responsible for the losses incurred on the investments made on its recommendations.

- Rights & Responsibilities of the Investment Adviser:

- The Investment Adviser is registered with SEBI under the Investment Advisers Regulation and is in compliance with: (i) all provisions of the "Investment Advisers Regulations", including but not limited to the code of conduct as specified in the third schedule, conducting yearly audit, resolving grievances and eligibility criteria for grant of registration; and (b) the notifications and circulars issued thereunder.

- The Investment Adviser, the principal officer and the persons associated with investment advice have the necessary experience and knowledge to provide the services to the Advisory Client as outlined in this agreement.

- The Investment Adviser shall put forth investment policy statement for the Advisory Client based on his/her objectives, needs and risk profile. Any recommendations from the Investment Adviser shall be based on the mutually agreed upon investment policy statement. The objectives needs and risk profile shall be reviewed at least once a year.

- The Investment Adviser requires to ensure proper planning of investment corpus and as a best practice the Investment Adviser will allocate the initial corpus into liquid funds/liquid ETF as a temporary & immediate asset allocation and there on use the same for further strategic investment planning. The Investment Adviser allocates the cash balance arriving out of transfer into investment accounts and/or sale proceeds of various investments, into liquid mutual funds/ETF until further allocation as per the investment plan approved by the Advisory Client.

- The Investment Adviser, while providing investment advice, shall make adequate disclosure to the Advisory Client of all material facts relating to the key features of the products/securities including performance track record. The Investment Adviser shall specifically draw the Advisory Client’s attention towards warnings, disclaimers in documents, advertising material related to its investment advice. The Investment Adviser shall provide reports to the Advisory Client on potential and current investments.

- The Investment Adviser shall consider the Advisory Client’s experience, knowledge, investment policy statement, risk appetite and capacity before recommending a financial product. The Investment Adviser shall obtain all consents and permission from the Advisory Client prior to undertaking any actions in relation to the securities or investment products advised by the Investment Adviser.

- The Investment Adviser shall not act on its own account, knowingly to sell securities or investment products to or purchase securities or investment product from the Advisory Client.

- The Investment Adviser is carrying on its activities independently, at arms-length basis with its related parties and to the best of its ability, shall disclose all conflict of interest promptly to the Advisory Client and shall not derive any direct or indirect benefit out of the Client’s securities / investment products. The conflict, actual or potential, may pertain to association with any issuer of product/securities, including any material information or facts that might compromise the Investment Adviser objectivity or independence in the carrying on of investment advisory services.

- The Investment Adviser shall maintain all records pertaining to Know Your Client (KYC), Risk Assessment and Profiling, Financial Planning, Analysis Report of Investment Advice and Suitability, Agreements, Investment Advice, related books of accounts and register containing list of clients along with dated investment advice and rationale, Statements and relevant documents in electronic and/or physical form while the Advisory Client is active and for a period of five years after the Advisory Client disengages with the Investment Adviser.

- The Investment Adviser shall not seek any power of attorney or authorizations from the Advisory Client for implementation of the investment advice.

- The Investment Adviser shall not provide any distribution services for securities and investment products, either directly or through its group to an Advisory Client.

- The Investment Adviser shall not provide any investment advisory services, for securities and investment products, either directly or through its group to any distribution client.

- Risk Factors:Investment advice implemented on the Advisory Client’s investment account is subject to market, currency, economic, political and business risks. These risks may mean volatility in asset prices on a daily basis including loss of capital permanently. The Investment Adviser shall disclose applicable risks related to a particular product to the Advisory Client at the time of providing the investment advice.

- Confidentiality:All information and advice furnished by either party to the other hereunder including respective agents and employees shall be treated as confidential. The Investment Adviser shall limit its disclosure of the confidential information in accordance with the Privacy Policy set out in Annexure - 4.

- Term & Termination:

- This Agreement shall remain in force until terminated by the Advisory Client or the Investment Adviser as per clause (b) below.

- This agreement may be terminated voluntarily at any time, by either the Advisory Client or the Investment Adviser, for any reason, upon 30 days’ written notice to the other party of its intention to do so.

- This agreement shall be terminated upon suspension/cancellation of the registration of the Investment Adviser by SEBI.

- This agreement shall be terminated in the event any action is taken by any other regulatory body/government authority which affects the services provided under this agreement, requiring the Investment Adviser to terminate its Services.

- This agreement shall terminate forthwith upon the Advisory Client’s death or disability and the Investment Adviser shall not have any further liability or obligation; provided however that the Advisory Client’s legal heirs shall receive the refund amounts, if any, payable by the Investment Adviser under this Agreement.

- Notwithstanding clause (a) and (b) above, either party shall have the right at any time to give immediate notice, in writing, to the other party in case of breach of any terms and conditions in this agreement and failure to remedy the same by the defaulting party.

- Termination of this Agreement will not however affect the liabilities or obligation of the parties under this Agreement with respect to transactions prior to such termination.

- The Advisory Client agrees to pay the Investment Adviser all fees due, prorated till the end of the month in which the 30-day notice expires.

- Amendment:This agreement may be amended only in writing with the mutual consent of the Advisory Client and the Investment Adviser.

ANNEXURE 3

TERMS FOR DISTRIBUTION SERVICES

- Whereas:

- SIPL is a distributor or corporate agent of multiple issuers of financial products, securities and contracts (“Manufacturers”) as set out in Appendix to these terms for provision of Distribution Services (“Terms”). SIPL may, in the future, partner with other Manufacturers and obtain licenses / permissions to provide additional services which shall be updated on its channels of use and covered by the terms of these Terms.

- SIPL provides Distribution Services via multiple channels including website(s) and mobile application(s) of aggregators and other Service Partners.

- These Terms record your understanding and arrangement in relation to the Distribution Services being availed by you from SIPL.

- Words not specifically defined under these Terms shall have the same meaning as has been defined under the Agreement.

SIPL will provide access to its online technology platform for provision of Services which include:

- facilitation of subscription and redemption of any financial products, securities, contracts or units (“Products”) by transmitting your money and instructions to the relevant Manufacturers through your distribution account;

- facilitation of non-financial transactions which will include services such as changes in your information recorded by any Manufacturer, as the case may be;

- provision of information and offer documents of all mutual funds available through its platform along with recommendation of mutual funds for specific asset classes;

- responding to your queries relating to Distribution Services and acting as your point of contact for various Manufacturers;

- conduct any other actions similar to the above for any additional services which may be provided by SIPL; and

- any other Services as have been set out in Annexure 1 of the Wealth Management Services Agreement as permitted by Applicable Law and consented to be utilised by You.

- Compliance with Law

You acknowledge and agree that:

- Your investments through SIPL are subject to, and will be in full compliance with, the laws of India; any international agreements / treaties which India is a party to; relevant regulations from SEBI, RBI, PFRDA, IRDAI & other regulatory bodies; the terms & conditions of respective mutual fund schemes and AMCs; and the codes and guidelines applicable to mutual fund distributors (“Applicable Law”).

- You shall provide true and correct information to SIPL and agree to provide, in a timely manner, SIPL and the AMCs with such information, documents and consents, as may be required to comply with Applicable Law. SIPL has your consent to carry out verifications and validations of your information and instructions.

- Investments made by you shall be from your verified bank account (primary holder’s bank account where such account is a joint account), from legitimate sources and if you are a non resident of Indian origin, You will remit funds from abroad only through approved banking channels from funds in your NRE/NRO account in accordance with Applicable Law.

- Provision of Services

You acknowledge and agree that:

- You have the necessary authority to place investment and other instructions:

- using netbanking or unified payments interface(UPI) through your verified bank account; or

- using a mandate approved by your bank.

- using a credit card, wherever permitted

- Your instructions will be processed the same day if received before the cut-off times specified by SIPL subject to the norms followed by the relevant Manufacturer relating to receipt of your investment funds. If not, they will be processed on the next business day or in accordance with the applicable norms of the specific Manufacturer. SIPL may specify cut-off times earlier than the times specified by a Manufacturer.

- SIPL or its Vendors will forward your instructions to the AMC electronically, and the AMC will process the transactions on the basis of such electronic instructions. AMCs are not obliged to accept your application for subscription to units of their mutual fund schemes in part or in full.

- You have the right to transact directly with the Manufacturers or any of their other Service Partners even in respect of the investments made through SIPL, as permissible by applicable law and the Manufacturer. You understand that if You transact directly with the Manufacturers or their other Service Partners, SIPL may not have accurate information in relation to such investments. You have this right even after the termination of this Agreement.

- Mutual fund investments are subject to market risks and You shall have read all relevant scheme documents issued by the AMC, such as Offer Document, Scheme Information Document, Statement of Additional Information, Key Information Memorandum (“Offer Documents”) carefully before investing. You understand that the past results of a mutual fund are not a guarantee to its future performance.

- Investments in any Products are subject to market and other risks and You shall have read the relevant documents relating to details of the Products issued by the Manufacturer of the relevant Product carefully before investing. You understand that past results of a particular Product are not a guarantee to its future performance.

- Based on the Products in which you are investing / may invest, you may need to seek independent financial planning, legal, accounting, tax or other professional advice before investing or withdrawing.

- You have the necessary authority to place investment and other instructions:

- Term and Termination

These Terms are valid for a continuous period unless you terminate your acceptance of these Terms by closing your account with SIPL or, SIPL, at its sole discretion, closes your account for non-compliance with this Agreement, these Terms or any Applicable Laws.

- Effects of Termination

- SIPL will continue to securely maintain a record of your personal information and your financial transactions to fulfill regulatory obligations. SIPL will provide you details of the Manufacturers in whose Products you are invested in and will fulfill your redemption/transfer requests or any other transactional requests, if required and permitted by Applicable Law.

- Your obligations set out under Clause 3, Clause 5, Clause 6 and Clause 7 of these Terms and provisions of the Agreement, as may be applicable, shall continue to remain in force post termination of Distribution Services under this Agreement.

- Miscellaneous

- These Terms as well as the Agreement set out above entirely governs the relationship between SIPL and You. They do not create any third party beneficiary rights.

- Any appendix to these Terms shall constitute a part of these Terms.

- If any provision contained in these Terms is unenforceable, it will not affect the other provisions of this Agreement.

Appendix

Details of Manufacturers

- Association of Mutual Funds of India (AMFI): Distributor of mutual fund units registered with AMFI under ARN 341934

- ARN details: The date of initial registration is 27 Feb, 2012 and the same is valid till 26 Feb, 2027. The certificate can be found here

- Pension Fund Regulatory and Development Authority (PFRDA): Distributor of units of the National Pension Scheme under license as a Point of Presence - Sub Entity (POP-SE) bearing registration number POPSE31122020.

- Insurance Regulatory and Development Authority of India (IRDAI): Distribution of insurance products under license as a Corporate Agent (Composite) bearing registration number CA0758.