Experience the Scripbox difference.

Scientific investing aligned to your goals, risk management, and 8am to 8pm customer support by phone, email and chat.

Grow wealth.

Clients who started investing with Scripbox have been able to build meaningful long-term wealth through disciplined investing.

I've accumulated my first 50 Lakh Mutual fund savings thanks to Scripbox. I've been a customer since 2017 & I am pleasantly surprised how you manage to keep things simple despite the complexities involved.

Scripbox CustomerInvestor since 2017

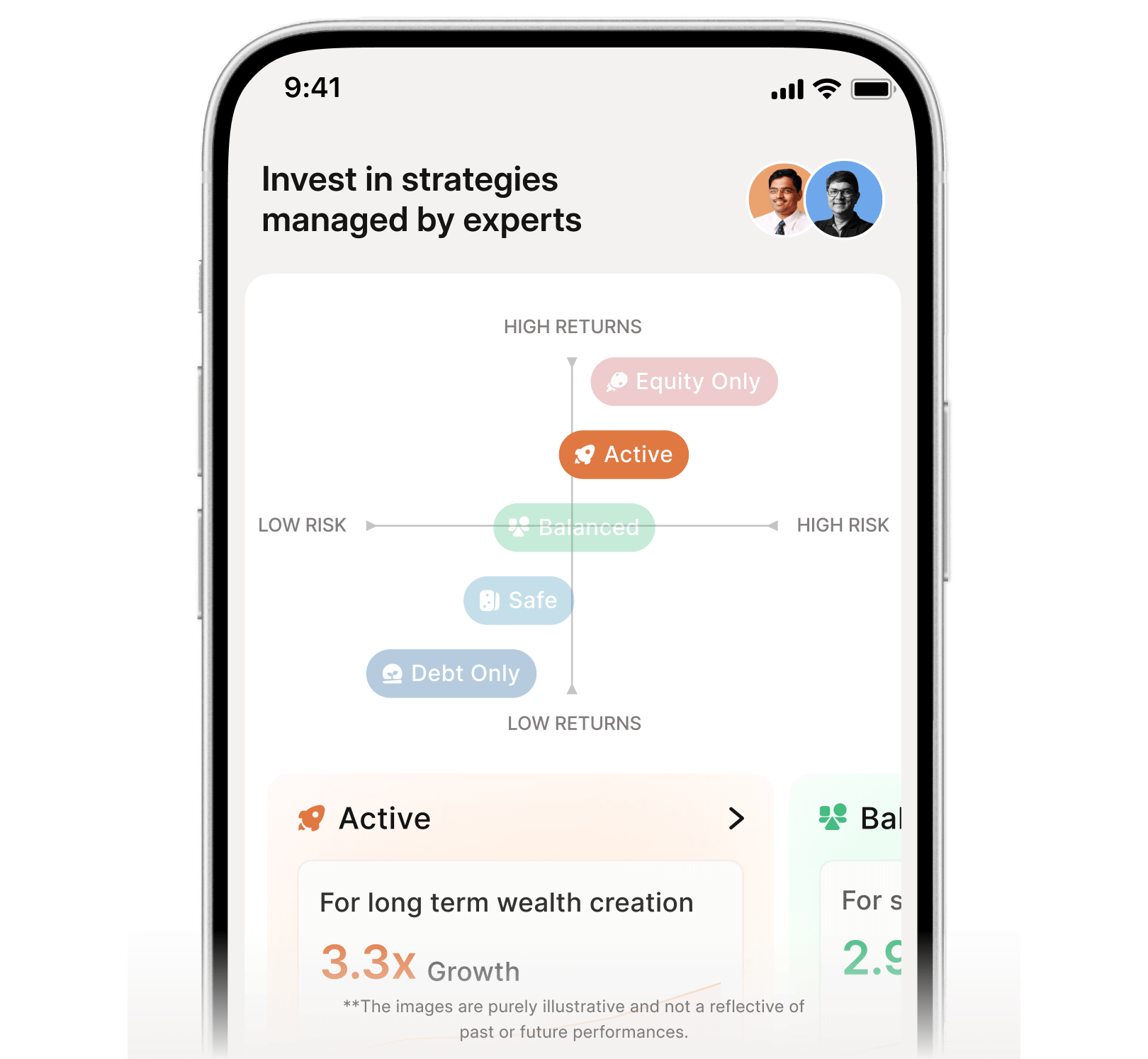

Invest in the best mutual funds.

Scripbox recommendations are shaped by expert advisors and data-backed algorithms.

Like their end to end service for investment. They select the best funds, monitor them and then rebalance periodically. I think its best for people who want hasslefree and complete peace of mind service.

VivekScripbox App User

Trusted by over 1 lakh Indians.

Regular or Direct? Choice is yours.

Scripbox offers both options Regular and Direct funds.

Create wealth by investing in mutual funds.

| BHARAT Bond FOF - April 2031 Direct (G) | 3Y CAGR 8.2% | |

| Parag Parikh Flexi Cap Fund Direct (G) | 3Y CAGR 21.9% | |

| DSP ELSS Tax Saver Fund Direct (G) | 3Y CAGR 20.0% | |

| ICICI Prudential Liquid Fund Direct (G) | 3Y CAGR 7.1% |

| Parag Parikh Flexi Cap Fund Direct (G) | 3Y CAGR 21.9% | |

| HDFC Large and Mid Cap Fund Direct (G) | 3Y CAGR 20.5% | |

| ICICI Prudential Large Cap Fund Direct (G) | 3Y CAGR 18.1% | |

| DSP ELSS Tax Saver Fund Direct (G) | 3Y CAGR 20.0% |

| ICICI Prudential Large Cap Fund Direct (G) | 3Y CAGR 18.1% | |

| Canara Robeco Large Cap Fund Direct (G) | 3Y CAGR 16.1% | |

| Nippon India Large Cap Fund Direct (G) | 3Y CAGR 19.5% | |

| DSP Large Cap Fund Direct (G) | 3Y CAGR 18.1% |

| Kotak Midcap Fund Direct (G) | 3Y CAGR 22.4% | |

| Nippon India Growth Mid Cap Fund Direct (G) | 3Y CAGR 25.4% | |

| Motilal Oswal Midcap Fund Direct (G) | 3Y CAGR 27.0% |

| HDFC Mid Cap Fund Direct (G) | 3Y CAGR 26.3% |

| Nippon India Multi Cap Fund Direct (G) | 3Y CAGR 22.2% | |

| ICICI Prudential Multicap Fund Direct (G) | 3Y CAGR 19.8% | |

| Mahindra Manulife Multi Cap Fund Direct (G) | 3Y CAGR 20.8% | |

| Invesco India Multicap Fund Direct (G) | 3Y CAGR 18.8% |

Stay informed with market insights always.

Subscribe and follow us if you haven't already.

Subscribe to Newsletter