Ever since the RBI increased the repo rate by 40 basis points and the cash reserve ratio by 50 basis points, the stock market in India witnessed a significant fall.

Central banks worldwide are going for a rate hike to combat high inflation in their respective economies.

How does it work?

The repo rate is when the RBI lends short-term funds to banks. So, a rate hike effectively increases the borrowing cost for banks. Banks pass on these higher costs to their customers through higher coupon rates on their borrowings.

With higher EMIs to pay on their loans, consumers are left with less disposable income. When consumers have less disposable income, businesses that thrive on it witness a drop in revenues and profitability due to lower consumer spending. Companies also freeze recruitments or reduce the workforce to adjust to the new reality, which again affects the pockets of households.

Thus, by increasing the interest rate, central banks attempt to tame prices by checking excess demand.

How does it affect the stock market?

The performance of the stock market is generally a function of corporate earnings. Therefore, the better the growth in corporate profits and expectations, the better it is for the stock market.

Interest-rate-sensitive stocks tend to fall more whenever there is a rate hike. For instance, a residential property construction company witnesses a fall in demand due to higher EMIs on home mortgages. So, naturally, this affects the company’s profitability.

Banking and finance, auto, real estate and consumer durables are other interest-rate-sensitive sectors.

On the other hand, some businesses tend to do well whenever the interest rates rise. Take the insurance business, for instance. Whenever rates go up, they are in a position to increase risk premiums for standard products and stabilise cash flows. Technology, pharma and energy stocks are amongst the other resilient ones.

Moreover, nothing needs to happen to consumers or companies for the stock market to react to a rate hike. The market usually goes up or down in anticipation of a cut or hike in the interest rate. Or when the RBI move is not in sync with its expectations.

Investing in a rising interest rate regime is not always bad

The economy goes through its cycles of ups and downs. And inflation is a reality of life. So, RBI will keep raising interest rates whenever inflation shoots and vice versa.

In the short run, be prepared to witness some freefall in the company’s profit and revenues. However, as inflation returns to normal and the economy stabilises, demand will return. And at that time, the stock market tends to move up.

In short, have a long-term orientation and stay put with the intended asset allocation to make the most of equities.

Check the BEER

Change in interest rates also has a bearing on the tactical allocation that flows toward bonds and the stock market. Simply put, bond yields also go up when interest rates go up. Bond yield is measured as interest income on the bond divided by its market price. And the benchmark 10-year government bond yield is currently at 7.3% p.a.

Earnings Yield is the Earning Per Share of the index divided by the index price of the stock. It shows how much companies in a constituent index yield in the form of EPS returns. It is also calculated as the reciprocal of the PE ratio. For instance, if the PE ratio of Sensex is 22, its earnings yield is (1/22*100) 4.5%.

Bond yields and earnings yield (of the stock index) have a theoretical relationship.

The Relationship

Whenever bond yields are more than earnings yield, usually there are tactical flows of short-term funds from equity into bonds and vice versa.

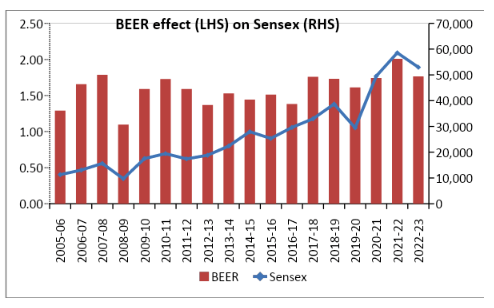

Typically, these investors look for a good spread before making the shift. In the past, it has been seen that whenever the BEER ratio measured as Bond yields / Index earnings yields is less than 0.75 or above 1.25, it triggers action and reallocation.

And BEER ratio is currently at 0.61 – low enough to trigger tactical portfolio reallocations in favour of debt.

However, long-term stock market investors need not worry about tactical portfolio shifts and short-term market corrections coming from a rising interest rate regime. Eventually, losses will be recouped when consumer demand returns and corporate earnings reflect it.

Takeaway

High-interest rates affect corporate earnings (and thereby the stock market) by checking on demand. However, long-term equity investors need not worry as consumer demand will eventually return, recouping their losses.

Show comments