NPS or National Pension System is a central government retirement scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It is an initiative to encourage regular savings among Indian citizens. Also, it offers dual benefits of tax saving plus pension. The interest rate on NPS is not fixed. The returns are dependent on the performance of underlying securities. NPS has two types of accounts, namely, NPS Tier 1 and NPS Tier 2 accounts. This article covers the NPS Tier 2 account in detail.

What is Tier 2 in NPS?

NPS Tier 2 account is a voluntary account. Also, only subscribers holding Tier 1 accounts can open a Tier 2 account. The minimum initial contribution for a Tier 2 account is INR 1,000. For additional contribution, the investment amount is INR 250.

Tier 2 NPS account does not have any minimum balance requirement, nor do they have any contribution requirement to keep the account active. Also, the Tier 2 account doesn’t have any withdrawal restrictions. Individuals can withdraw money from Tier 2 accounts without any restriction on the amount of withdrawal. Also, there is no restriction on the number of withdrawals. Hence investors can make multiple withdrawals.

There is no lock-in period for Tier 2 accounts. All citizens of India can invest in a Tier II account. Furthermore, the scheme doesn’t offer any tax benefits to the private sector and self-employed individuals. However, a Government employee can claim tax benefits of INR 1.5 lakhs under Section 80C with a lock in period of 3 years.

Eligibility for an NPS Tier-2 Account

Following are the eligibility criteria for NPS Tier 2 accounts:

- All Indian citizens, including NRIs, can invest in Tier 2 NPS accounts.

- Subscribers have to be of age 18 years to 65 years.

- Also, subscribers need to have an active Tier I account to open a Tier II account.

How to Open NPS Tier 2 Account?

Any investor who has an active NPS Tier I account can open the Tier II account through online and offline mode.

Offline

To open NPS Tier 2 through offline mode, one has to complete the registration. They have to follow the steps below:

- Firstly, locate the nearest POP-SP or Point of Presence – Service Provider.

- Then, one has to fill the Tier II details form. The same is available with any POP-SP or one can be download it online by clicking here.

- While filling the form, one has to ensure they give nominee details. They also need to choose a fund manager and investment option (active vs auto).

- Next, they have to submit the form with all necessary documents like PAN Card and Aadhar Card.

- While opening NPS Tier II account, ensure that the correct bank details are provided as all future withdrawals will be facilitated to this bank account.

Online

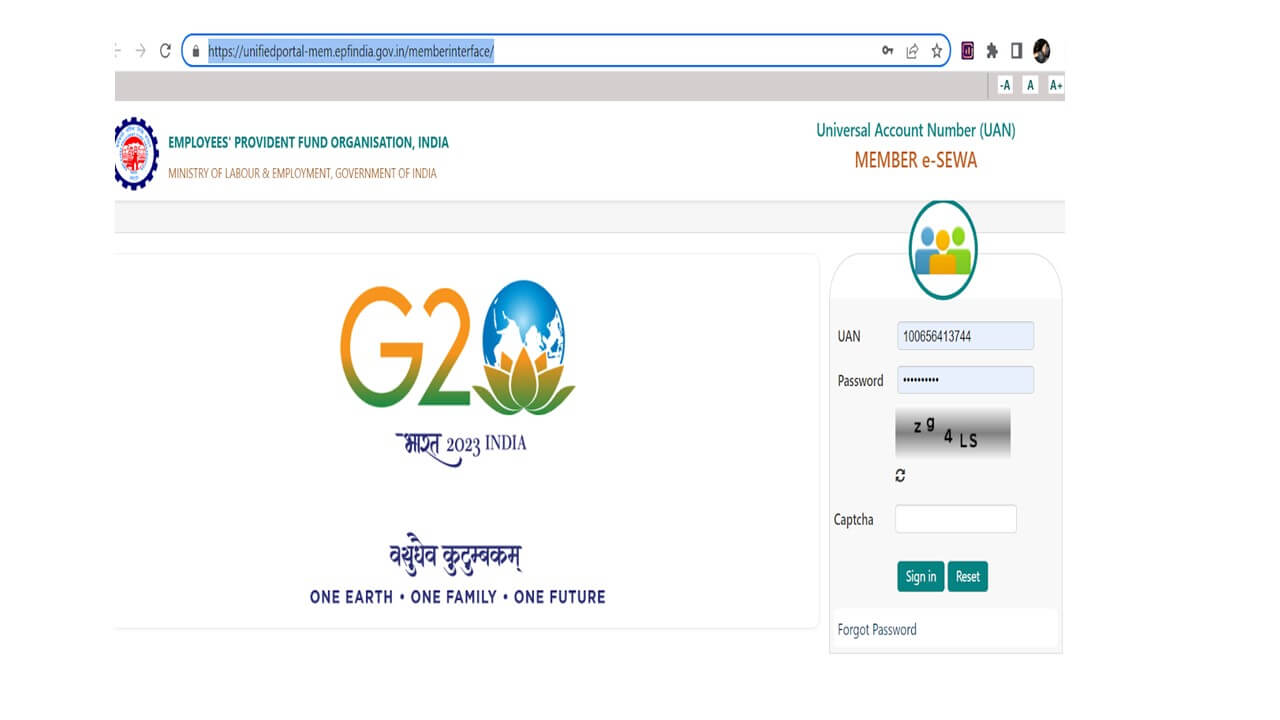

To open a National Pension Scheme Tier II account online, one has to follow the steps below.

- Firstly, visit the eNPS website and click on ‘Tier II activation’.

- Upon clicking on ‘Tier II activation,’ the subscriber is directed to a page that needs information like PRAN (Permanent Retirement Account Number), date of birth and PAN Card number. This is done to verify the PRAN.

- Then, once the Permanent Retirement Account Number details are verified with the subscriber’s Tier I account details, the Tier II account will be activated.

- Finally, the investor has to make an initial contribution of INR 1,000 to the scheme while activating their Tier II account.

Features of an NPS Tier 2 Account

Following are the features of NPS Tier II account:

Voluntary account

The National Pension Scheme Tier II account is not mandatory. Tier 1 account members can open Tier II accounts.

Bank Account

To open a Tier II account, it is mandatory to have a bank account.

Contribution amount

The minimum contribution at the time of opening the NPS Tier 2 account is INR 1,000. Also, there is no minimum balance requirement or any annual contribution towards an NPS Tier 2 account.

Tenure

The Tier II account does not have any lock-in period. However, government employees can claim tax benefits from the scheme, if they have keep their investments for 3 years.

Withdrawal

The entire Tier 2 NPS account corpus can be withdrawn as a lump sum or multiple withdrawals without any limit.

Taxation

Investments in Tier 2 NPS account does not qualify for any tax benefit. Also, the withdrawals are taxable as per the investment holding period.

Transfer

One can easily transfer funds from Tier 2 account to Tier 1 account.

Activation and transaction charges

The NPS account investor pays for the activation and transaction charges.

Withdrawal Process of an NPS Tier 2 Account

The National Pension Scheme Tier 2 account does not have any lock-in period. Therefore, subscribers can withdraw their deposits at any time. However, there is a three-year lock-in period for central government and state government employees if they wish to avail of tax benefits.

Following is the withdrawal process for NPS Tier 2 account:

- Completely fill the UOS-S12 form for withdrawal.

- The subscriber should submit the application only to the POP-SP with which they are currently registered with CRA for Tier 2.

- The redemption amounts may vary as it is dependent on the applicable NAV at the time of redemption.

- It takes up to three days to transfer the funds from the trustee’s bank account to the subscriber’s bank account.

Taxation of an NPS Tier-2 Account

Investments in Tier II accounts doesn’t qualify for any tax benefits u/s 80C of the Income Tax Act. However, government employees can avail of a tax benefit up to INR 1.5 lakhs u/s 80C, provided they keep their investments locked-in for three years. Furthermore, this exemption is not available under the new tax regime.

All withdrawals from the Tier II account are taxable. Withdrawals within three years (36 months) attract short-term capital gain tax and are taxed as per the investor’s tax slab rate. Furthermore, after three years, they have a long term capital gains tax of 20% with indexation benefit.

Difference between NPS Tier 1 and Tier 2 Account

Following are the differences between NPS Tier 1 and Tier 2 account:

| Basis of Difference | NPS Tier I Account | NPS Tier II Account |

| Eligibility | Indian citizens between 18 years and 65 years | Members of tier I account only |

| Lock-in period | Till the subscriber is 60 years old | Nil |

| Minimum number of contributions per financial year | 1 | Nil, the subscriber can choose not to make any contribution in a year. Nor do they have the need to maintain a balance in the account. |

| Account opening contribution | INR 500 | INR 1,000 |

| Minimum subsequent contribution | INR 1,000 | INR 250 |

| Tax Benefits on the contribution | Contributions up to Rs 1.5 lakhs in a financial year qualify for tax deduction under Section 80C of the IT Act, 1961. An additional contribution up to INR 50,000 also qualifies for tax deduction under Section 80CCD (1B) of the Income Tax Act, 1961. | No tax benefit |

| Tax on withdrawals | On maturity, the entire corpus is tax-exempt. | Withdrawals are taxable as per the investment holding period. |

| Limit on withdrawals | 60% of the corpus can be withdrawn in a lump sum. The remaining 40% has to be used to purchase an annuity plan. | The entire corpus can be withdrawn as a lump sum, or in multiple redemptions without any limit. |

| Transfer of Funds | Funds from Tier 2 can be transferred to Tier 1 accounts. Also, existing funds from EPF can be transferred to Tier I accounts. | Fund cannot be transferred. |

Discover More

Show comments