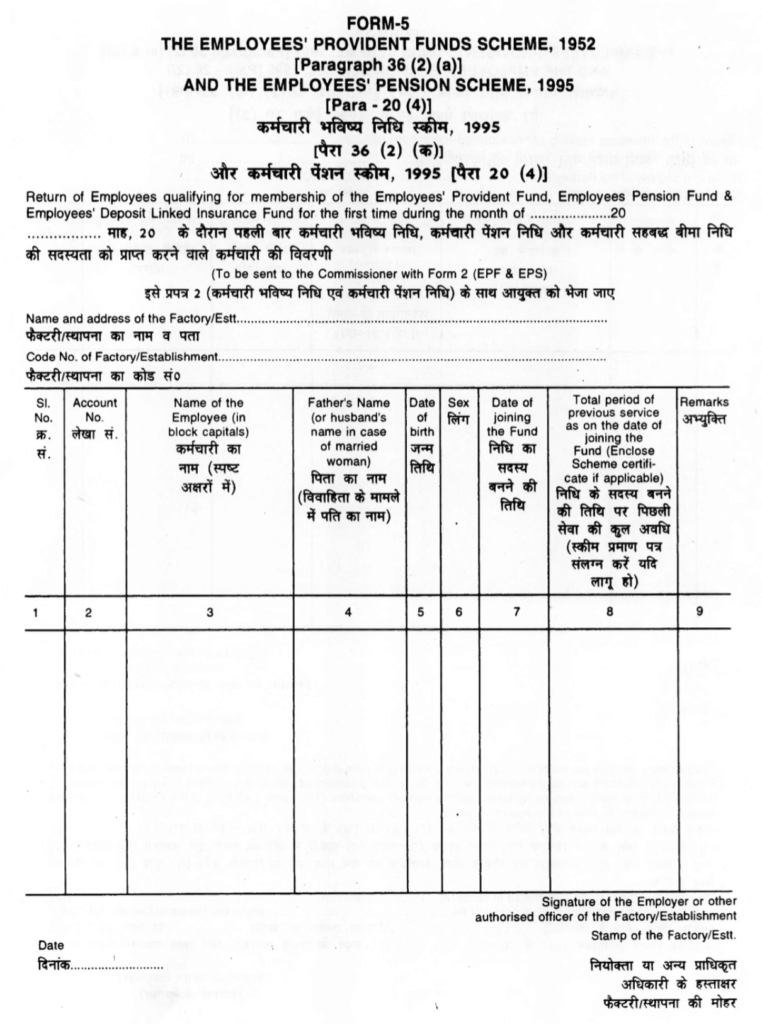

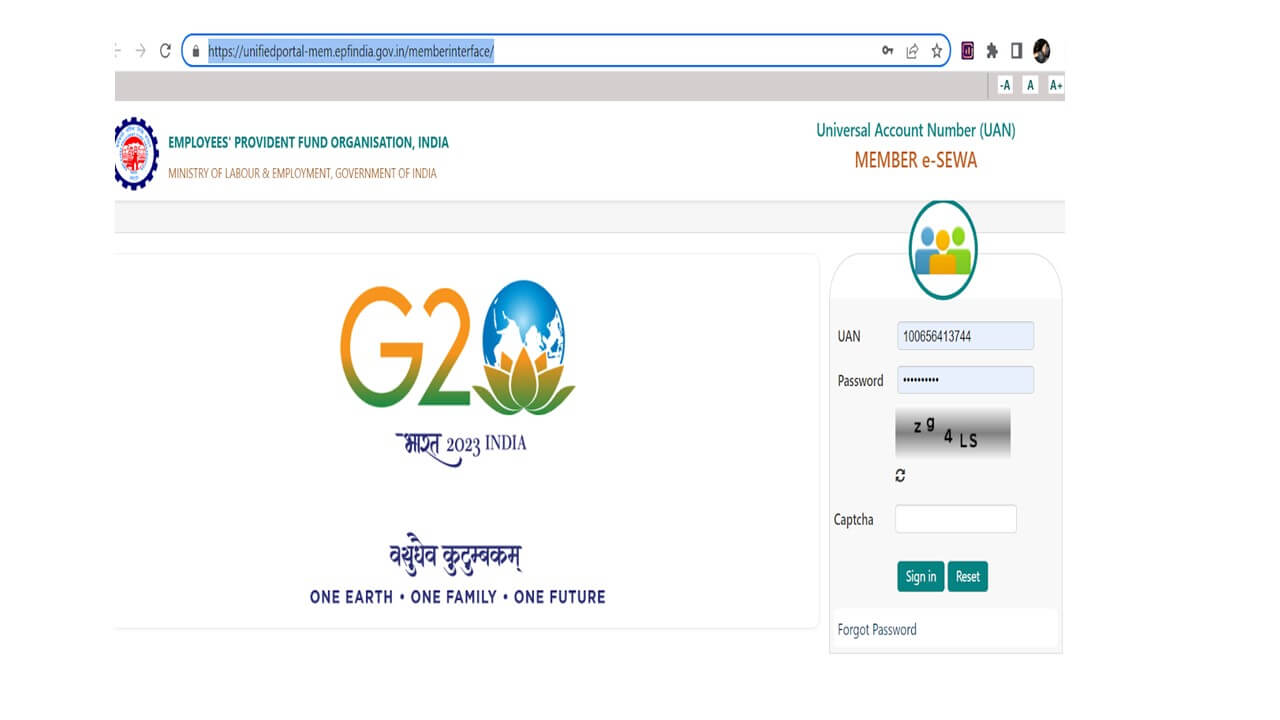

EPF Form 5 is an important form for companies that are registered under the Employee Provident Fund Scheme. The main purpose of Form 5 is to inform the Official EPFO Website about new joinees who are eligible for EPF services. EPF Form 5 comprises the details about the new employee. Upon submission of these details, the EPFO generates the Universal Account Number for the employee. This article covers what is EPF Form 5, its components, due date and how to file Form 5.

What is EPF Form 5?

EPF Form 5 is a form that the employers (companies) have to submit to the EPF Commissioner’s office every month. The main purpose of Form 5 is to get the details of the new joiners and to allot them a Universal Account Number (UAN).

While submitting Form 5, the employer has to mention all the details of newly joined employees. Employees who are eligible for EPF benefits in the previous month are mentioned in Form 5. The employer files return of employees who qualify for the following:

- Employee Provident Fund (EPF)

- Employee Pension Scheme (EPS)

- Employee Deposit Link Insurance Scheme (EDLI)

Once the employer submits Form 5, a Universal Account Number is allotted to each employee. All the further contributions of the employer and the employee are deposited to their respective account.

Components of EPF Form 5

Following are the components of Form 5:

- Month and year of form submission

- Name and address of the Company

- Code Number of Company

- Details of the new employees

- Account Number

- Name of the Employee

- Father’s Name or Husband’s Name (for married women)

- Date of Birth

- Gender

- Date of Joining the Fund

- The total period of the previous service as on the date of joining the Fund.

- Remarks, if any.

- Signature of the employer or any authorised officer of the company.

- Stamp of the Company

- Date of filing the Form

- Signature and stamp of the employer along with the date of filing.

How To Fill Form 5?

The employer has to fill the Form 5 and provide all the details of the new employee. The employer has to refer to Form 11 (basic EPF details) and Form 2 (for nomination details) and fill in all the employee details.

Due Date of Filing Form 5

Every month the employer has to file Form 5. Before the 25th of the month, the employer has to submit Form 5 with all the new employee details to the EPF Commissioner’s office. For example, if an employee joins the company on 10th October 2020, the employer has to submit the details to the EPFO through Form 5 by 25th October.

Check Out EPF Interest Rate

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- What is EPF Form 5?

- Components of EPF Form 5

- How To Fill Form 5?

- Due Date of Filing Form 5

Show comments