Universal Account Number (UAN) is a 12-digit unique number that EPFO assigns to every employee. This number remains the same throughout the employment tenure of an individual. All the PF contributions from various jobs can be managed with one UAN. This article covers UAN, its generation, its benefits, features and login and KYC procedures in detail.

What is UAN Number?

Universal Account Number or UAN is a 12-digit unique number assigned by the Employees’ Provident Fund Organisation (EPFO) and Ministry of Labour and Employment. UAN is assigned to both employee and employer and stays the same throughout the employee’s employment years and the company’s business. Despite the change in jobs, UAN will not be changed.

Every time an employee changes jobs, the EPFO will allot a new member ID which will be linked to the UAN. One can request a new member ID directly through the new employer by submitting the UAN details. Hence UAN will act as an umbrella for different member IDs and PF accounts.

Also, with UAN, there will be lesser involvement of the old employer when one wants to withdraw or transfer the PF amount from one account to another. Also, UAN enables faster and easier withdrawals and transfers. For any queries related to UAN and KYC, one can contact the EPFO help desk seven days a week from 9:15 AM to 5:45 PM on their toll free number 1800118005.

Check Out the Difference Between UAN and PF Number

How to know your Universal Account Number?

To know the UAN, one can use any of the following methods:

Through the employer

The employer allots the UAN number, which EPFO gives. Some employers also print UAN cards for their employees.

Through UAN portal

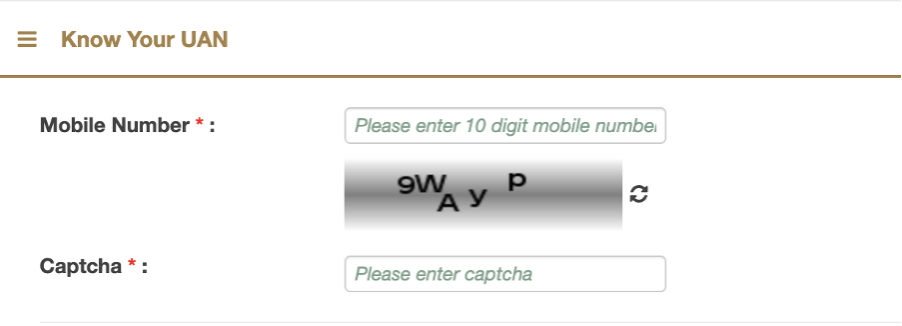

If the employer doesn’t give the UAN to an employee, then an employee can find the UAN through the UAN portal. Following are the steps to know UAN through the UAN portal:

Firstly, visit the UAN portal website.

Then, under important links, click on ‘Know Your UAN’.

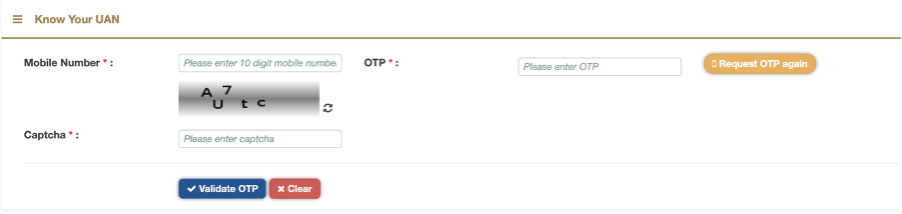

Next, enter the registered mobile number and request for OTP.

Upon entering the OTP, you will have to enter additional details. These include name, date of birth, and member ID, or PAN or Aadhar.

After entering the above details, one can click on ‘Show my UAN’ and can see the UAN.

How to Activate and Login to the EPFO Website using UAN?

- To be able to login and access UAN portal services, one has to activate their UAN. To activate UAN, one has to visit the Official website.

- Under ‘Important Links’ click on ‘Activate UAN’

- Enter the required details like UAN number, name, date of birth, mobile number and request for authentication pin.

- Enter the pin and create a username and password for the UAN portal.

- Then, go to the EPF website. Under the ‘Services’ section, select ‘For employees’.

- Under this, select ‘Member UAN/Online Service (OCS/OTCP)’. You will be redirected to the UAN member portal website.

- On the UAN member portal website, enter the UAN number and password to login and use the services of the EPFO website.

Features and benefits of Universal Account Number or UAN

Features of UAN

The UAN is a unique number for an employee, and it is the same even if they change jobs. Employers may create a new member ID for their new employees that join their organization. However, all the member IDs will be linked under one UAN.

Following are the features of UAN:

- UAN is a 12 digit unique number that helps an employee manage their EPF account effectively.

- The UAN is independent of the employer. Furthermore, it centralizes all the PF accounts across different companies and functions.

- EPFO has access to the bank and KYC details of an employee through the UAN.

- UAN ensures the genuineness of all the PF accounts that an employee holds.

- An employee can track the employer’s PF contribution to their account every month through UAN. However, for this, the employee has to complete the online registration process first. They can register through the EPF Member Portal.

- UAN eliminates the chances of the employer holding back or not contributing towards the employee’s PF account.

- Employees can easily withdraw their PF amount online.

- UAN also tracks the number of times an employee has changed jobs.

- One can do full withdrawals, partial withdrawals, and transfer of PF using the online portal.

- UAN has reduced the burden of the verification process by the company of a new employee joining them.

Benefits of UAN

Following are the benefits of UAN.

Easy management

UAN number helps in better and easy management of the current and previous PF accounts. Moreover, when a contribution is made, SMS alerts will be sent. UAN also enables easier and faster transfers and withdrawals.

No transfers required

When an employee moves jobs, they can just give the UAN number and KYC details for verification to the new employer. The old PF amount will automatically be transferred to a new PF account post verification.

Less involvement of the old employer

To withdraw money from an old PF account or to transfer it to a new account, one doesn’t have to approach the old employer. With the UAN number, the fund transfer automatically takes place post verification.

UAN Customer Care

One can contact the EPFO help desk at their toll-free number 1800118005 from 09:15 AM to 05:45 PM. The help desk is open on all seven days for any query relating to UAN or KYC Services.

Why is it important to know your Universal Account Number or UAN?

It is important to know the Universal Account Number (UAN) as the entire process relating to Employee Provident Fund (EPF) services are now available online. The universal account number collects details of all the PF accounts associated with multiple ids of different organizations in one place.

With UAN, one can access their PF account online without any hassle. Also, since a part of one’s salary gets accumulated in the EPF account, it is important to know the UAN. One can withdraw, check their EPF balance without the help of an employer, and easily get a loan against their PF.

How to generate Universal Account Number or UAN?

UAN is allotted by the EPFO and is usually communicated by the employer. However, if the employer hasn’t shared the UAN, an employee can generate it by following the steps below.

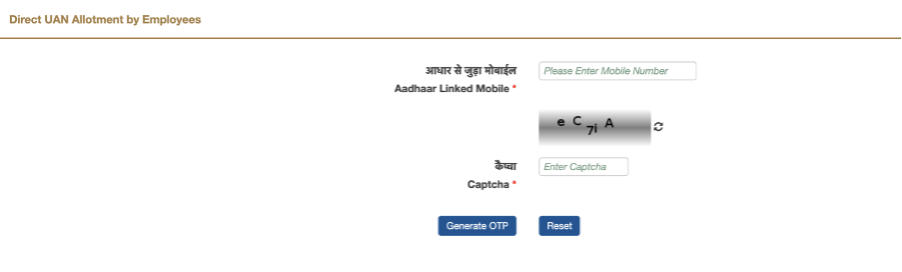

Firstly, visit the UAN member portal website.

Secondly, click on ‘Direct UAN allotment by Employees’ under important links. Upon clicking, you will be redirected to a page that looks like this.

Enter the mobile number that is linked with Aadhar and request for OTP.

After entering the OTP, wait for the system to fetch the data from the Aadhar database and auto-fill the fields.

Then, click on, obtain UAN. UAN will also be sent through SMS to the registered mobile number.

What are the documents required to get your UAN?

To get a UAN number, one has to submit the following documents to their employer:

- Bank account details: Account number, branch name, and IFSC code.

- Identity Proof: Passport, Driver’s license, voter ID, Aadhaar card, etc.

- Address Proof: Any of the above mentioned ID proofs or utility bills, lease or rental agreement, or ration card.

- PAN Card: The PAN should be linked to UAN.

- Aadhaar Card: Since the bank account and mobile number are linked to the Aadhaar card, it is mandatory to submit it to get UAN.

- Employee State Insurance Corporation Scheme (ESI) Card

Benefits of Universal Account Number or UAN to employees

Following at the benefits of UAN to employees:

- Often with every new employment, a new PF account is created. All the accounts come under the umbrella of a single unified account.

- With UAN, one can easily withdraw PF online either fully or partially.

- Employees can themselves transfer the PF balance from old to new using UAN.

- One can instantly download their PF statement using UAN. They can do it either by logging in to the member portal or by sending an SMS.

- New employers need not validate an employee’s profile if the UAN is KYC and Aadhaar verified.

- Employees can ensure whether the employers are regularly contributing their share in the PF account. Also, it ensures that employers cannot access or withhold the PF money of their employees.

How to link Aadhaar with UAN and PF?

Linking Aadhaar with UAN has been made mandatory by the government. One can link Aadhar either through online or offline modes.

Linking Aadhaar with UAN Offline

Take an Aadhar linking application form and fill in all necessary details like UAN, Aadhar Card number, contact details, etc. Along with the form, attach self-attested copies of PAN, UAN Card and Aadhar Card. Submit the form in the EPFO office or Common Services Centres (CSC). Once the Aadhar is linked with UAN, a notification will be sent to the registered mobile through an SMS.

Linking Aadhaar with UAN Online

With UMANG App

- Download the UMANG App and register yourself. Then, select EPFO under ‘All Services’.

- Select ‘Aadhar Seeding’ under eKYC services.

- Enter UAN and OTP to login. Then enter Aadhar details and wait for OTP. Then enter OTP and wait for the Aadhar to be verified. Upon verification, the Aadhar is successfully linked.

With the e-KYC portal of EPFO

- Visit the website and login.

- Under the ‘Manage’ tab, select the KYC option.

- Here, select ‘EPFO members’ and click on ‘Link UAN.’

- Enter UAN and OTP for verification.

- Then enter Aadhar and other personal details.

- Verify these by entering the mobile number linked to Aadhar, and an OTP will be sent.

- Enter the OTP for verification and completion of linking Aadhar with UAN.

You may also like to read about How to update KYC in your EPFO account?

How is UAN allocated?

Employees’ Provident Fund Organization (EPFO) allocates UAN or Universal Account Number to every provident fund account. It is a 12-digit unique number that is allotted to an employee. Also, one person will be allocated only one UAN, and it stays the same throughout their entire lifetime. Usually, allotment of UAN is done by EPFO, and the employer communicates it. If the employer doesn’t give UAN details, they can be retrieved from the UAN member portal website.

How to upload my KYC document through the UAN Members e-Sewa portal?

To upload KYC details, visit the website and login. After logging in, click on the ‘Manage’ tab and select KYC. In this section, you can update your KYC details like PAN Card, Aadhar Card, Passport, Driving License, Election Card, Ration Card and National Population Register number. All supporting documents need to be uploaded as proof.

How to update your personal details at the UAN portal?

The following are the steps to update basic personal details at the UAN portal –

Firstly, log in to the EPFO UAN portal.

After logging in, click on ‘Manage’ and select ‘Modify basic details’.

On the modification page, you can enter your Aadhaar number in the tab provided. Additionally, you can enter details like name, gender and date of birth as per your Aadhaar. Click on ‘Update Details’.

You can view this request under “Pending requests” in the UAN portal.

Note: If your Aadhaar is already linked with UAN, basic personal details cannot be changed on the UAN portal. Therefore, for any changes, you will have first to get your aadhaar details corrected.

How to Reset Password at the UAN Member Portal?

The following are the steps to reset password at the UAN member portal after logging in –

Firstly, log in to the EPFO UAN portal.

After logging in, click on “Account” on the top menu bar.

After the tab opens, click on Change Password.

Now enter the UAN login old password. Then enter the new password that you wish to keep in the following two sections.

Click on “update.”

You will receive a notification at the top of the screen that the password has been updated successfully.

How to transfer my account if I have changed job?

The following are the steps to transfer your PF account if you have changed your job.

Firstly, log in to the EPFO UAN portal with your UAN and password.

After logging in, click on “Online Services” on the top menu bar and select “One Member – One EPF Account (Transfer Request)”

The personal information and present employee PF account details will appear on the screen.

Click on “Get Details” for the PF account details of previous employment.

On the next screen, you have the option of choosing either the previous employer or the current employer for attesting to the claim form. It is based on the availability of the authorized signatory holding DSC. You can choose either of the employers and provide member ID/UAN.

In the next step, click on “Get OTP. OTP will be received on the registered mobile number. Enter the OTP and click on Submit.

The employer will digitally approve the EPF account transfer request by accessing the employer interface of the UAN portal. You will also have to fill Form 13 with all details, including the PF account number from both previous and current employers. Now download the transfer claim form and submit the physical copy of the online PF claim form to the selected employer within 10 days.

Check Out EPFO Mobile Number Change

Frequently Asked Questions

Yes, you can change your mobile number and email ID on the UAN member portal. Login to your account with UAN and password. Under the ‘Manage’ tab, click on contact details. Here you can change the mobile number and email ID.

The photo will appear on the UAN card after you update your KYC of Aadhaar. UAN picks the photo directly from the Aadhaar database.

First, you need to update your new mobile number on the EPFO member portal and then follow the steps to activate the UAN.

No, each individual will have only one UAN.

Yes, UAN is mandatory for online claims. Without the number, you cannot submit the claims.

Yes, UAN is linked with the PAN of the employee.

No, one doesn’t have to pay any fees for UAN registration.

Related Articles

- What is UAN Number?

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- How to know your Universal Account Number?

- How to Activate and Login to the EPFO Website using UAN?

- Features and benefits of Universal Account Number or UAN

- Why is it important to know your Universal Account Number or UAN?

- How to generate Universal Account Number or UAN?

- What are the documents required to get your UAN?

- Benefits of Universal Account Number or UAN to employees

- How to link Aadhaar with UAN and PF?

- How is UAN allocated?

- How to upload my KYC document through the UAN Members e-Sewa portal?

- How to update your personal details at the UAN portal?

- How to Reset Password at the UAN Member Portal?

- How to transfer my account if I have changed job?

- Frequently Asked Questions

Show comments