Employees Provident Fund is a social security scheme to safeguard the future of employees working with industries and organisations. EPF coverage extends from the time an employee starts working up until retirement. It provides individuals protection against loss of income during periods of lack of suitable employment opportunities or upon retirement. Subsequently, UAN and PF number are useful to keep track of your contributions to EPF. However, there is some difference between UAN and PF number which you must understand to monitor your EPF details correctly.

What is an EPF Number?

An organisation has to provide EPF facilities to its employees. Whereas, in an un-exempt organisation, the EPFO issues an alphanumeric number to each employee, known as the EPF number. The number represents your current place of employment as well as EPFOs. It represents details such as your state, establishment, regional office, and the PF member code. Whereas, in an exempt organisation, a trust may manage the EPF facility. They may also issue Provident Fund numbers that comprise only numbers.

Though the PF number is unique for each employee of the organisation, it changes every time you change your organisation. Your EPF number is mentioned on your salary slip.

Format of the EPF Account Number

EPF Account Number is an alphanumeric number. The account number has the organization’s code and also the information about the EPF office that oversees the EPF account activities.

Following is an example of an EPF account number:

- First two alphabets represent the State. For example, KA for Karnataka or TS for Telangana State.

- The next three letters state the regional office.

- First seven numbers represent the organization code/ establishment ID.

- The next three numbers represent the extension code of the establishment.

- The last seven numbers are employee-specific and are the actual EPF account number.

Importance of the PF Account Number

Prior to the introduction of the UAN number, the EPF number was necessary for EPF withdrawals and transfers. But, after the introduction of the UAN number, most of the functions are taken care by it. However, the EPF number is important to identify your EPF account.

What is a UAN Number?

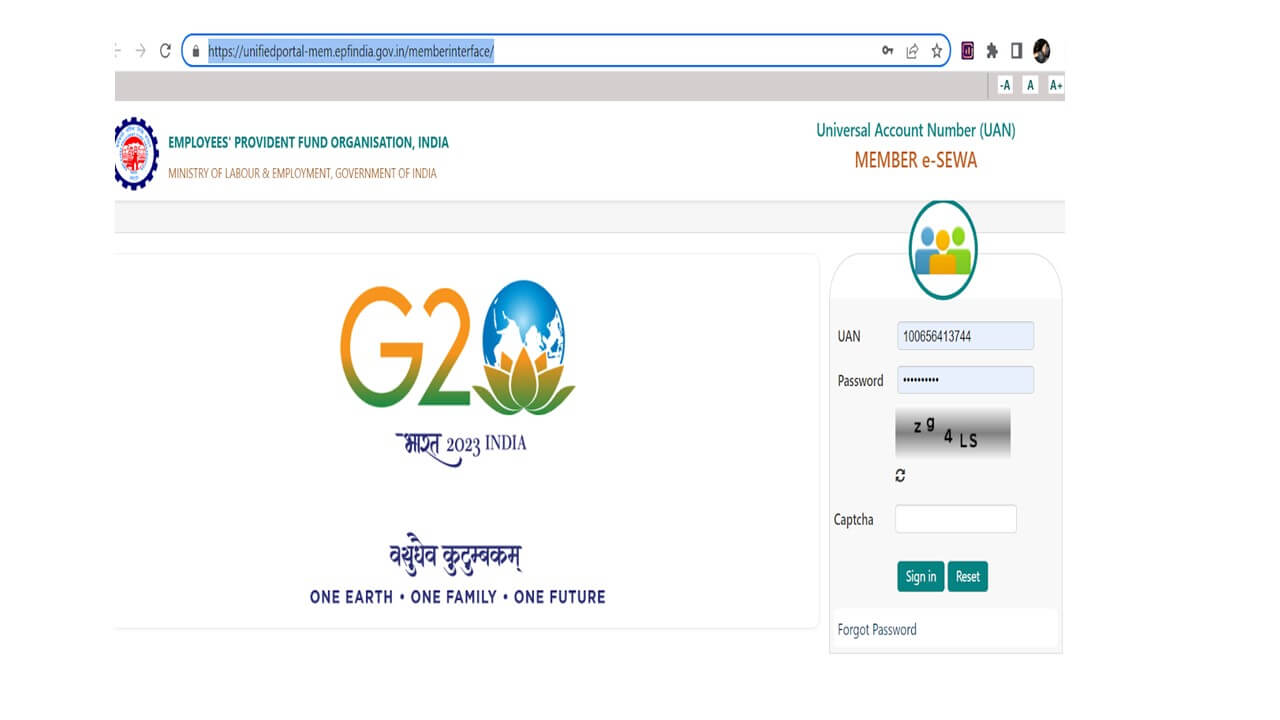

UAN stands for Universal Account Number and it is allotted to all eligible employees by Official EPFO Website. It is a common number that contains details of the multiple Member Ids different organisations allot you. It is a 12-digit number that remains the same throughout your employment. So the concept is to link all Member Identification Numbers of an individual under a single Universal Account Number. It offers convenience by enabling you to track details of all your EPF Member IDs through a unique number.

Difference Between UAN and PF number

Both UAN and PF number are useful for employees, however, following are the differences between UAN and PF number:

| UAN Number | PF Number |

| The acronym UAN stands for Universal Account Number that comprises information of all Member Ids of an employee. | PF Number comprises all Provident Fund information and details of related transaction of an employee with the issuing organization. |

| UAN is a permanent number, eligible throughout an individual’s lifetime. | Your PF number changes when you switch jobs. |

| It is a 12-digit number. | This is an alpha-numeric and specifies the region code, office code of your EPFO. It also states the Establishment ID, Establishment Extension, Employee Member ID, and PF number. |

| An individual has only one UAN number. | An individual may have multiple Provident Fund numbers. |

| You can track the details of all your PF transactions through UAN. | You can track details of only the PF transactions of the linked account through the PF number. |

| UAN is a standalone number and cannot be mapped to any other member identification number. | Multiple PF numbers can be mapped to a single UAN number. |

| Your UAN allows you to withdraw the entire amount in your Provident Fund account. | The Provident Fund Number allows you to withdraw funds from the corresponding PF account only. |

| Withdrawal and transfer of funds is easier through UAN. | Withdrawal and transfer of funds becomes complex when using PF number. |

Check Out EPF Interest Rate FY 2021-22

Frequently Asked Questions

The uses of the PF account number are:

To find UAN

For the withdrawal of the provident fund

Transfer the amount to new member IDs

Check EPF and PF balance

You can know your EPF number by visiting the EPFO office or through the UAN portal, or you can find it on your salary slip.

EPFO customer care number is 1800 118 005 (toll-free number).

Show comments