NSDL Portal Details

| NSDL Details | Details |

| Official Portal | https://nsdl.co.in/ |

| NSDL Mobile App | https://nsdl.co.in/value/MobileApp.php |

| NSDL Customer Care Number | (022) 2499 4200 |

| Toll-free (Investor Helpline) | 18001020990 / 1800224430 |

| info@nsdl | |

| Address | Trade World, A-wing, 4th Floor, Kamala Mills Compound, Lower Parel, Mumbai – 400013 |

Download the PAN online on NSDL?

Tax-payers can download the e-PAN from the NSDL website. Below steps need to be followed in order to download the e-PAN on the NSDL website.

- Visit the website

- Enter either the acknowledgement number or your PAN.

- Enter the Aadhar number and the date of birth.

- As part of the verification process in the next screen, you will also need to enter the otp send to your registered email id or mobile number.

- After the otp is entered you have to pay the relevant fee for download the e-PAN

If the PAN is allotted / changes in PAN Data are confirmed by the income tax department prior to 30 days then charges applicable for download of e-PAN Card is Rs.8.26/- (inclusive of taxes).

You may also like to read about the How to Download the PAN Card?

How can I get a new PAN card from NSDL?

Application for PAN can be made online by visiting the NSDL website

The online application is straightforward and easy to navigate which allows the user to submit the form without any issues. The assessee has to select the application type as below:

- New PAN – Indian Citizen(Form 49A)

- New PAN – Foreign Citizen(Form 49AA)

- Changes or corrections in existing PAN Data/Reprint of PAN card

After selecting the above, the required information such as category, applicant information, etc. needs to be filed in order to successfully validate the form. Once the form is submitted, the user will get the acknowledgment. The acknowledgment will be shared on their registered email ID through which they can track their application.

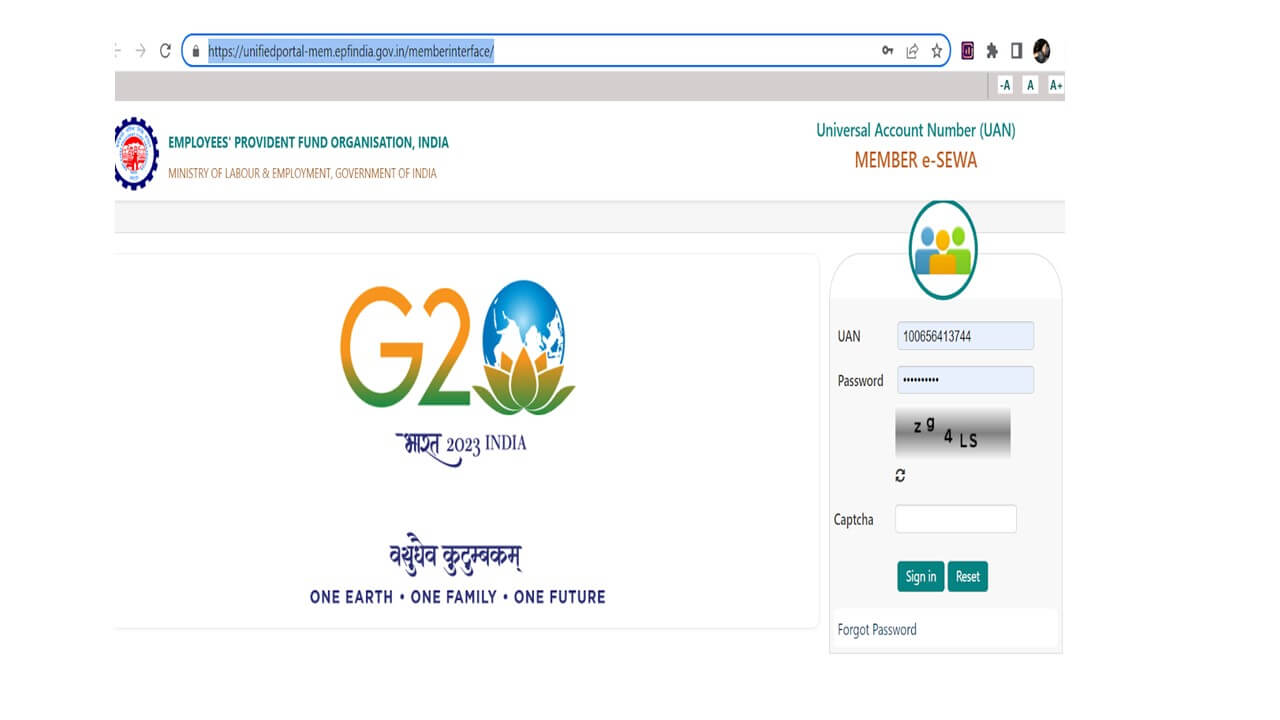

How to Check my PAN Status on NSDL website?

Most people find it hard to believe that the government has been continuously spending a lot towards the tech driven platforms in order to shift everything online. This includes the basic application forms, checking the status etc. for which the taxpayers had to previously face a lot of issues.

Once the application for PAN is submitted, the same can be tracked through the NSDL

After clicking on the above website, the taxpayer can select the type of application and enter the acknowledgement number. The acknowledgement number would have been received earlier on the registered email id and mobile number. Ensure to carefully put in the email id and mobile number in order to avoid any possible errors.

Is PAN card necessary for bank account?

The Reserve Bank of India (RBI) has made Aadhaar and PAN cards mandatory for opening bank accounts.

The RBI mandated know-your-customer (KYC) requirement. The central bank updated its master circular on KYC norms which banks follow while opening the bank account of the customers.

How can I know my PAN number in an Aadhar card?

The income tax department has provided the option of linking aadhaar to PAN. Taxpayers can directly link their PAN to the aadhaar from the income tax portal. Aadhaar can be linked from this Official link

Both aadhaar and PAN are mutually exclusive identities. If the taxpayer wants to verify their PAN they can do the same from this link.

You may also like to read about the How to link Pan card with Aadhaar card?

Can we download the PAN card online on NSDL?

PAN applicants can download their e-PANs directly through UTIIYSL’s website, this option is available only for those who applied for fresh PAN or the most recent update and must have linked their mobile number or email address to the PAN upon registering. This is a free service.

How can I get a new PAN card?

It is easy to get a new PAN Card in case the original card was lost or damaged. It can be done by filling the application online through the official website TIN-NSDL or send the application to the PAN service department of NSDL however the online application is much faster and less costly

How can I check my PAN card status?

The process of checking the status of a PAN card application can be carried out either online or offline. You can also track the status of your application by providing your name and date of birth, coupon number, etc. It can also be tracked on the UTI website using an application coupon number or PAN number.

Is a PAN card necessary for a bank account?

PAN Card is not required for normal or saving bank account however it has been made compulsory for company bank accounts processing financial transactions. This helps in the process of monitoring the income tax and ease of tax refunds.

How can I know my PAN number in Aadhar card?

PAN number can be checked by using an Aadhar card provided that the PAN number is linked to it. It is done by accessing the Aadhar Website through logging the Aadhar number in order to retrieve the linked PAN number.

You may also like to read about CDSL vs NSDL

NSDL Branch Office Address and Phone Numbers

| City Name | Address | Telephone Number |

| Ahmedabad | 402, 4th Floor, Heritage Horizon, off. C. G. Road, Navrangpura, Ahmedabad-380009 | (079) 26461375 |

| Bengaluru | Office No. 106, DBS house 26, Cunningham Road, Bengaluru – 560052 | (080) 40407106 |

| Chennai | 6A, 6th Floor, Kences Towers, #1 Ramkrishna Street, North Usman Road, T. Nagar, Chennai – 600017 | (044) 2814 3917 /11 |

| GIFT City, Gandhinagar | Unit No.625, Hiranandani Signature, GIFT SEZ, GIFT City, Gandhinagar – 382355 | 9819318123 |

| Hyderabad | Office No. 123, Hyderabad Regus Mid-Town, 1st Floor, Mid Town Plaza, Road No. 1, Banjara Hills, Hyderabad – 500033 | (040) – 44334178 |

| Jaipur | 207, 2nd Floor, Arcade Tower, K-12, Malviya Marg, C – Scheme, Jaipur – 302001 | (0141) 2366347 |

| Kochi | Suite No. S – 105, Monlash Business Center, 4th Floor, Crescens Tower, NH 47, Changampuzha Nagar Post, Kochi – 682033 | (0484) – 2933075 |

| Kolkata | Unit 2E, 2nd Floor, The Millenium 235/2A, A.J.C. Bose Road Kolkata – 700020 | (033) 2290 4243 / (033) 2290 4246 |

| Lucknow | Unit No. 438, 4th Floor, Regus Business Center, Halwasia Court, Hazratganj, Lucknow – 226001 | (0522) 6672325 |

| New Delhi | Unit No.601,603,604, 6th Floor, Tower – A, Naurang House, Kasturba Gandhi Marg, Connaught Place, New Delhi – 110001 | (011) 2335 3814 / (011) 2335 3815 |

NSDL Investor Grievances

Contact Person in case of NSDL Investor Grievance

| Name | Mr. Malav Shah |

| Designation | Vice President – Investor Relationship Cell |

| Address | National Securities Depository Limited, Trade World, A Wing, 4th floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400 013. |

| Contact Number | (022) 2499 4200 |

| Fax | (022) 2497 6351 |

| relations@nsdl.co.in | |

| Online Form | epass.nsdl.com/form |

- NSDL Portal Details

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Download the PAN online on NSDL?

- How can I get a new PAN card from NSDL?

- How to Check my PAN Status on NSDL website?

- Is PAN card necessary for bank account?

- How can I know my PAN number in an Aadhar card?

- Can we download the PAN card online on NSDL?

- How can I get a new PAN card?

- How can I check my PAN card status?

- Is a PAN card necessary for a bank account?

- How can I know my PAN number in Aadhar card?

- NSDL Branch Office Address and Phone Numbers

- NSDL Investor Grievances

Show comments