ನಿಯತಿ ಬೆಳಗ್ಗೆ ಏಳುತ್ತಿದ್ದತೆ ಇಂಟರ್ನೆಟ್ಗೆ ಲಾಗಿನ್ ಆಗುತ್ತಾಳೆ. ಇಂಟರ್ನೆಟ್ಗೆ ಲಾಗಿನ್ ಆಗುತ್ತಿದ್ದಂತೆಯೇ ಎಲೆಕ್ಟ್ರಾನಿಕ್ಸ್ ಹಾಗೂ ಇತರ ಐಟಂಗಳ ಮೇಲೆ ಮೂರು ದಿನಗಳ ಸೇಲ್ ಎಂಬ ಸಂದೇಶ ಆಕೆಯ ಸ್ಕ್ರೀನ್ ಮೇಲೆ ಕಾಣಿಸುತ್ತದೆ. ತಕ್ಷಣ ಆಕೆಗೆ ಅದು ಬೇಕೆನ್ನಿಸಿ, ಕಾರ್ಟ್ಗೆ ಹಾಕಿಕೊಂಡು ಖರೀದಿಯನ್ನೂ ಮಾಡಿಬಿಡುತ್ತಾಳೆ.

ಎರಡು ದಿನಗಳ ನಂತರ ಪಾರ್ಸೆಲ್ ಬರುತ್ತದೆ. ಆಗ ಆಕೆಗೆ ತಿಳಿಯುತ್ತದೆ, ಇದೇ ರೀತಿಯ ಡಿಸೈನರ್ ಬೂಟ್ಗಳು ತನ್ನ ಬಳಿ ಎಂಟು ಇವೆ, ಈ ಒಂಬತ್ತನೆಯದು ಬೇಕಿರಲಿಲ್ಲ ಎಂದು!

ಖರೀದಿ ಚಟಕ್ಕೆ ಬಿದ್ದವರ ಒಂದು ಉದಾಹರಣೆಯೇ ನಿಯತಿ. ತಮಗೆ ಅಗತ್ಯವಿಲ್ಲದ ಸಂಗತಿಗಳನ್ನು ಇವರು ಖರೀದಿ ಮಾಡುತ್ತಾರೆ. ತಮ್ಮ ವೆಚ್ಚದ ಮೇಲೆ ಯಾವ ನಿಯಂತ್ರಣವೂ ಇಲ್ಲದ್ದರಿಂದ ಅವರು ಹಣಕಾಸಿನ ಸಮಸ್ಯೆಗೆ ಸಿಲುಕಿಕೊಳ್ಳುತ್ತಾರೆ.

ಆದರೆ, ಇವರು ತಮ್ಮ ಹಣಕಾಸಿನ ಸಮಸ್ಯೆಯನ್ನು ಹಳಿಗೆ ತರಲು ಮತ್ತು ಅನಗತ್ಯ ವೆಚ್ಚವನ್ನು ನಿಯಂತ್ರಿಸಲು ಅವಕಾಶವಿದೆ.

1. ಸಮಸ್ಯೆಯನ್ನು ಕಂಡುಕೊಳ್ಳಿ

ಖರೀದಿಯ ಹುಚ್ಚಿಗೆ ಬಿದ್ದವರು ಯಾವುದೇ ಬಜೆಟ್ ವ್ಯವಸ್ಥೆಯನ್ನು ಅನುಸರಿಸುವುದು ಸಾಧ್ಯವಿಲ್ಲ. ಹೀಗಾಗಿ ಈಗಾಗಲೇ ಸಮಸ್ಯೆಯನ್ನು ಇಲ್ಲಿ ಗುರುತಿಸಿದಂತಾಗಿದೆ.

50-20-30 ರ ಬಜೆಟ್ ಸೂತ್ರವನ್ನು ಅನುಸರಿಸುವುದು ಅತ್ಯಂತ ಸುಲಭದ ವಿಧಾನ. ಅಂದರೆ ನಿಮ್ಮ ಆದಾಯದ 50% ರಷ್ಟು ಬಾಡಿಗೆ, ಆಹಾರ ಮತ್ತು ದಿನಸಿ, ಯುಟಿಲಿಟಿ ಬಿಲ್ ಮತ್ತು ಇತರ ಅಗತ್ಯ ವೆಚ್ಚಗಳಿಗೆ (ಕುಟುಂಬದ ಅಗತ್ಯ) ಹೋಗಬೇಕು. ಉಳಿದ ಶೇ. 20 ರಷ್ಟು ಉಳಿತಾಯ ಮತ್ತು ಹೂಡಿಕೆಯಂಥ ಹಣಕಾಸು ಗುರಿಗಳಿಗೆ ವೆಚ್ಚ ಮಾಡಬೇಕು ಮತ್ತು ಉಳಿದ 30% ರಷ್ಟು ಆದಾಯವನ್ನು ಮನರಂಜನೆ ಮತ್ತು ಪ್ರವಾಸದಂತಹ ಉದ್ದೇಶಕ್ಕೆ ವೆಚ್ಚ ಮಾಡಬೇಕು.

ಖರೀದಿ ಹುಚ್ಚಿಗೆ ಬಿದ್ದವರು ತಮ್ಮ ಕೌಟುಂಬಿಕ ವೆಚ್ಚಕ್ಕೆ ಆದ್ಯತೆ ನೀಡಬೇಕು ಮತ್ತು ಅನಗತ್ಯ ವೆಚ್ಚವನ್ನು ಕಡಿಮೆ ಮಾಡಿ ಹಣಕಾಸನ್ನು ಸುಸ್ಥಿತಿಯಲ್ಲಿಟ್ಟುಕೊಳ್ಳಬೇಕು.

ಊಟ, ಸಿನಿಮಾ, ಐಷಾರಾಮಿ ಪ್ರವಾಸ ಇತ್ಯಾದಿ ವೆಚ್ಚಕ್ಕೆ ಗರಿಷ್ಠ ಮಿತಿಯನ್ನು ಹಾಕಿಕೊಳ್ಳಿ.

2. ಕೂಲಿಂಗ್ ಪೀರಿಯಡ್

ಯಾವುದೇ ಅಗತ್ಯವಿಲ್ಲದ ಖರೀದಿ ಮಾಡುವಾಗ, ಕನಿಷ್ಠ 24 ಗಂಟೆಗಳವರೆಗೆ ನಿರೀಕ್ಷಿಸಿ. ನೀವು ಮಾಲ್ನಲ್ಲಿದ್ದೀರಿ, ಒಂದು ಆಕರ್ಷಕ ಪೀಠೋಪಕರಣ ಕಂಡಿತು ಎಂದಾದರೆ ಅದನ್ನು ಟಿಪ್ಪಣಿ ಮಾಡಿಕೊಳ್ಳಿ. ನೀವು ಆನ್ಲೈನ್ನಲ್ಲಿ ಆಕರ್ಷಕ ಗ್ಯಾಜೆಟ್ ನೋಡಿದರೆ, ಅದನ್ನು ವಿಶ್ ಲಿಸ್ಟ್ನಲ್ಲಿ ಹಾಕಿಕೊಳ್ಳಿ.

ಒಂದು ದಿನದ ನಂತರ ಅದು ನಿಮಗೆ ನಿಜವಾಗಿಯೂ ಅಗತ್ಯವಿದೆಯೇ ಎಂದು ನೋಡಿ. ಬಹುತೇಕ ಸಂದರ್ಭದಲ್ಲಿ ಸ್ವಲ್ಪ ಸಮಯದ ನಂತರ ಮತ್ತು ನಿಮ್ಮ ಹಳೆಯ ಅನುಭವ ನೆನಪಾದಾಗ ನಿಮಗೆ ನಿಜವಾಗಿಯೂ ಅದು ಅಗತ್ಯವಿದೆಯೇ ಎಂದು ಯೋಚನೆ ಮಾಡಲು ಶುರು ಮಾಡುತ್ತೀರಿ. 24 ಗಂಟೆ ಕಡಿಮೆ ಆಯಿತು ಎನಿಸಿದರೆ ಒಂದು ವಾರ ಅಥವಾ ಒಂದು ತಿಂಗಳವರೆಗೆ ಈ ಸಮಯವನ್ನು ವಿಸ್ತರಿಸಿಕೊಳ್ಳಿ. ಒಳ್ಳೆಯ ಸಂಗತಿಗಳು ನಿಮಗೆ ಅಮೂಲ್ಯ ಎನಿಸಿದರೆ ನಿಮಗಾಗಿ ಕಾಯುತ್ತವೆ.

3. ಲಿಸ್ಟ್ ಮಾಡಿಕೊಂಡು ಖರೀದಿ ಮಾಡಿ

ಜನರು ಸಾಮಾನ್ಯವಾಗಿ ಟೂತ್ಪೇಸ್ಟ್ ಖರೀದಿ ಮಾಡಲು ಹೋಗುತ್ತಾರೆ. ಆದರೆ ಗಮ್, ಚಾಕೊಲೇಟ್ ಮತ್ತು ಅನಗತ್ಯ ಅಡುಗೆ ಮನೆ ಸಾಮಗ್ರಿಗಳನ್ನು ತೆಗೆದುಕೊಂಡು ಬರುತ್ತಾರೆ. ಇಂತಹ ಖರೀದಿಯನ್ನು ತಡೆಯಲು ಶಾಪಿಂಗ್ಗೂ ಮೊದಲೇ ಲಿಸ್ಟ್ ಮಾಡಿಕೊಳ್ಳಿ. ಮಾಲ್ಗಳಿಗೆ ಭೇಟಿ ಮಾಡಿದಾಗ ಅಗತ್ಯವಿದ್ದಷ್ಟನ್ನೇ ಖರೀದಿ ಮಾಡಿ. ನೀವು ಆನ್ಲೈನ್ ಶಾಪ್ ಮಾಡುತ್ತೀರಿ ಎಂದಾದರೆ, ಆಫರ್ಗಳು ಮತ್ತು ಪ್ರೊಮೋಷನಲ್ ಮೇಲ್ಗಳನ್ನು ಅನ್ಸಬ್ಸ್ಕ್ರೈಬ್ ಮಾಡಿ ಅವುಗಳನ್ನು ಕಾಣದಂತೆ ಮಾಡಿಕೊಳ್ಳಿ.

ಯಾವುದೇ ಅನಗತ್ಯ ಖರೀದಿ ಮಾಡಲು, ಕನಿಷ್ಠ 24 ಗಂಟೆಗಳವರೆಗೆ ಕಾಯಿರಿ. ನೀವು ಮಾಲ್ನಲ್ಲಿದ್ದಾಗ ಒಂದು ಆಕರ್ಷಕ ಪೀಠೋಪಕರಣ ಕಂಡರೆ, ಅದನ್ನು ನೋಟ್ ಮಾಡಿಕೊಳ್ಳಿ. ಆನ್ಲೈನ್ನಲ್ಲಿ ಆಕರ್ಷಕ ಗ್ಯಾಜೆಟ್ ಕಂಡರೆ, ಅದನ್ನು ವಿಶ್ ಲಿಸ್ಟ್ನಲ್ಲಿ ಇಡಿ.

4. ಹೂಡಿಕೆಯನ್ನು ಸ್ವಯಂಚಾಲಿತ ಮಾಡಿ

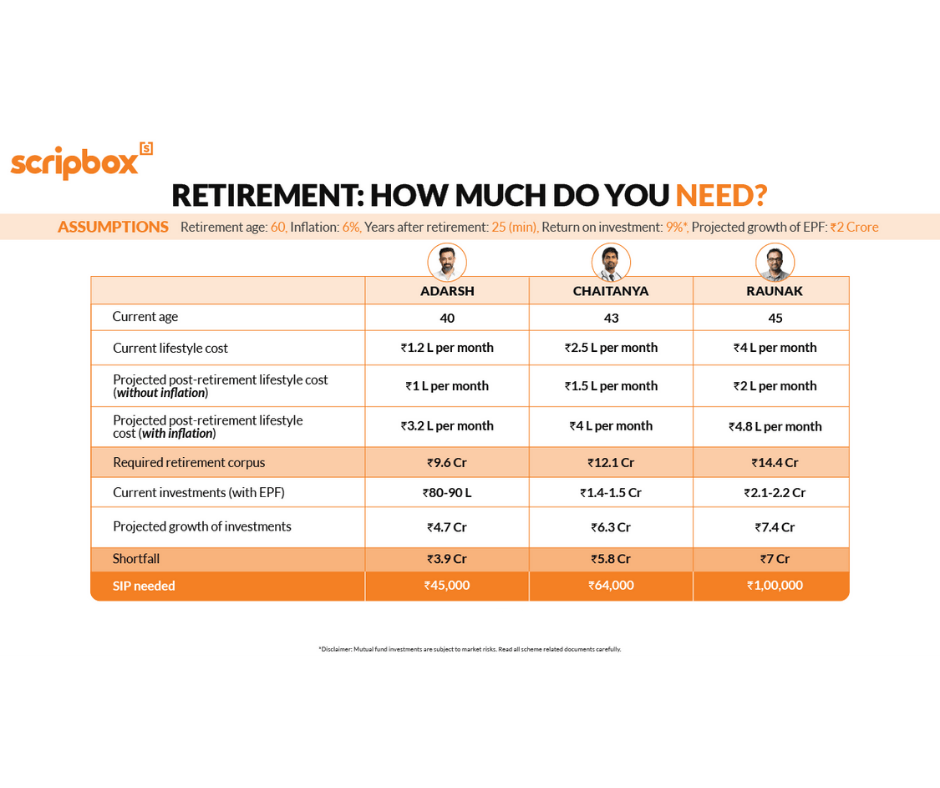

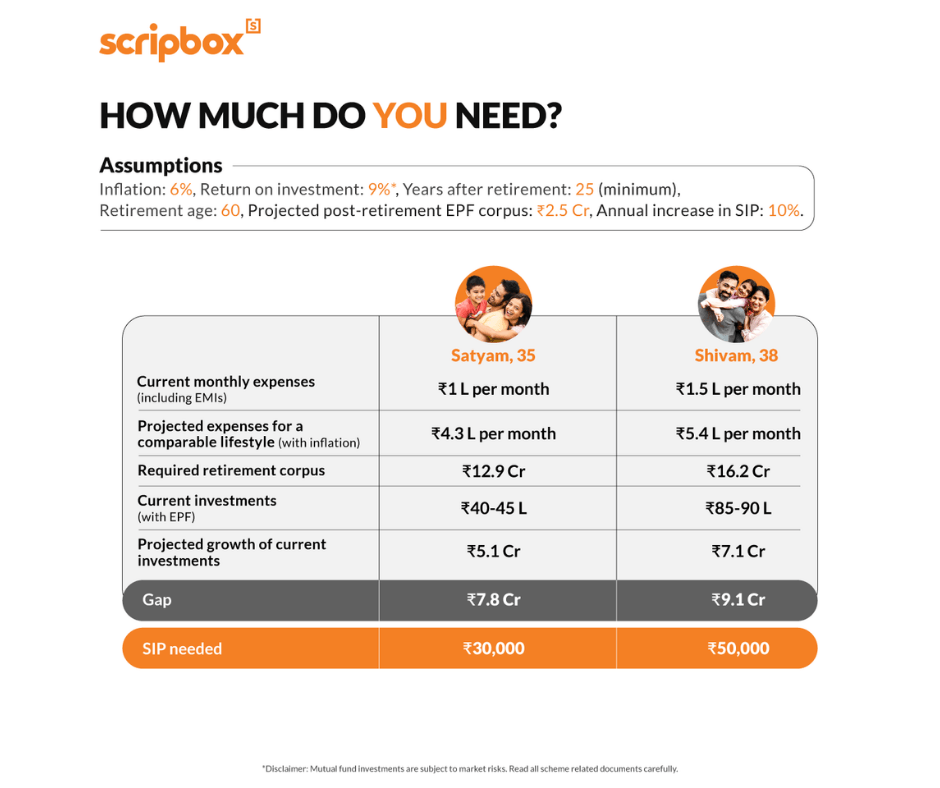

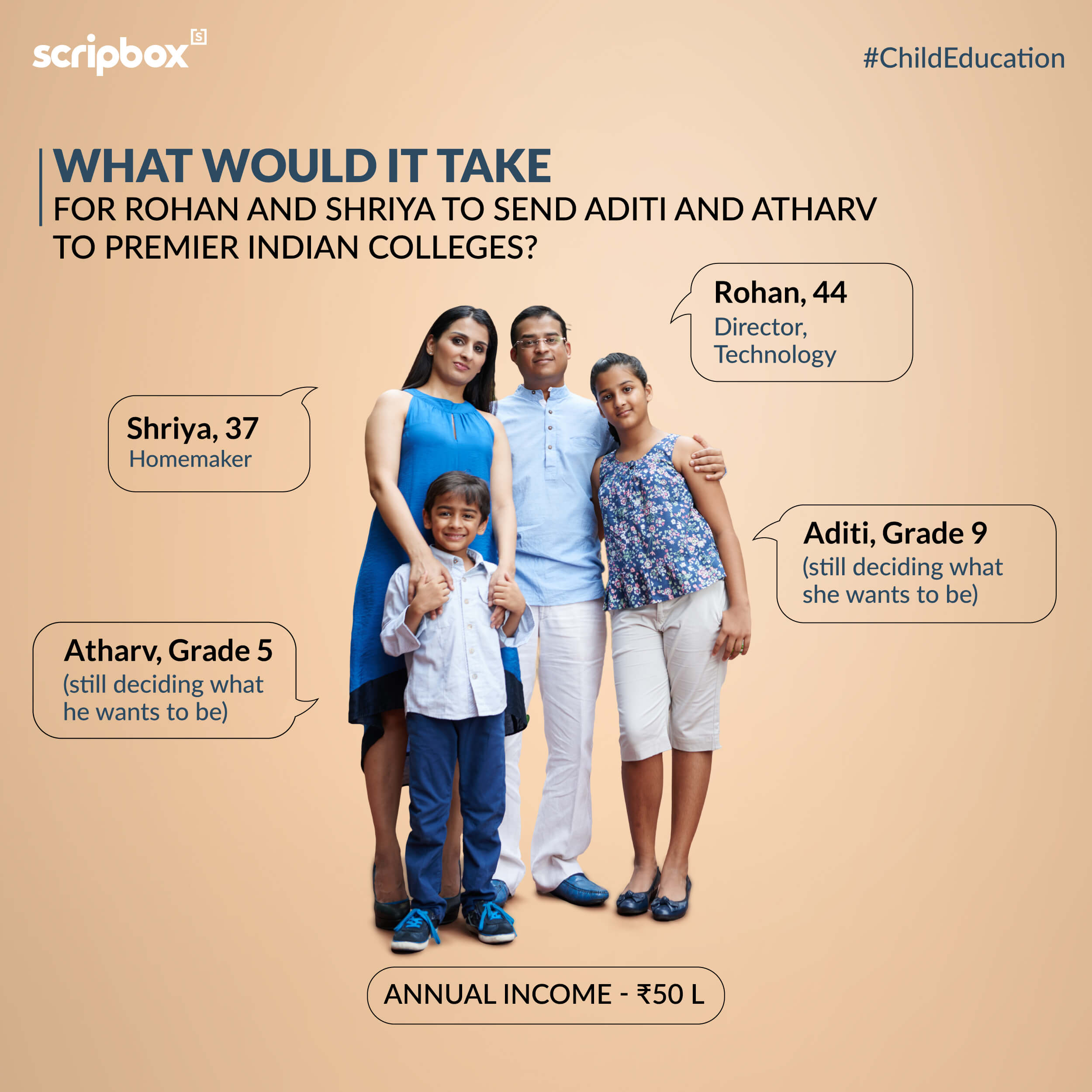

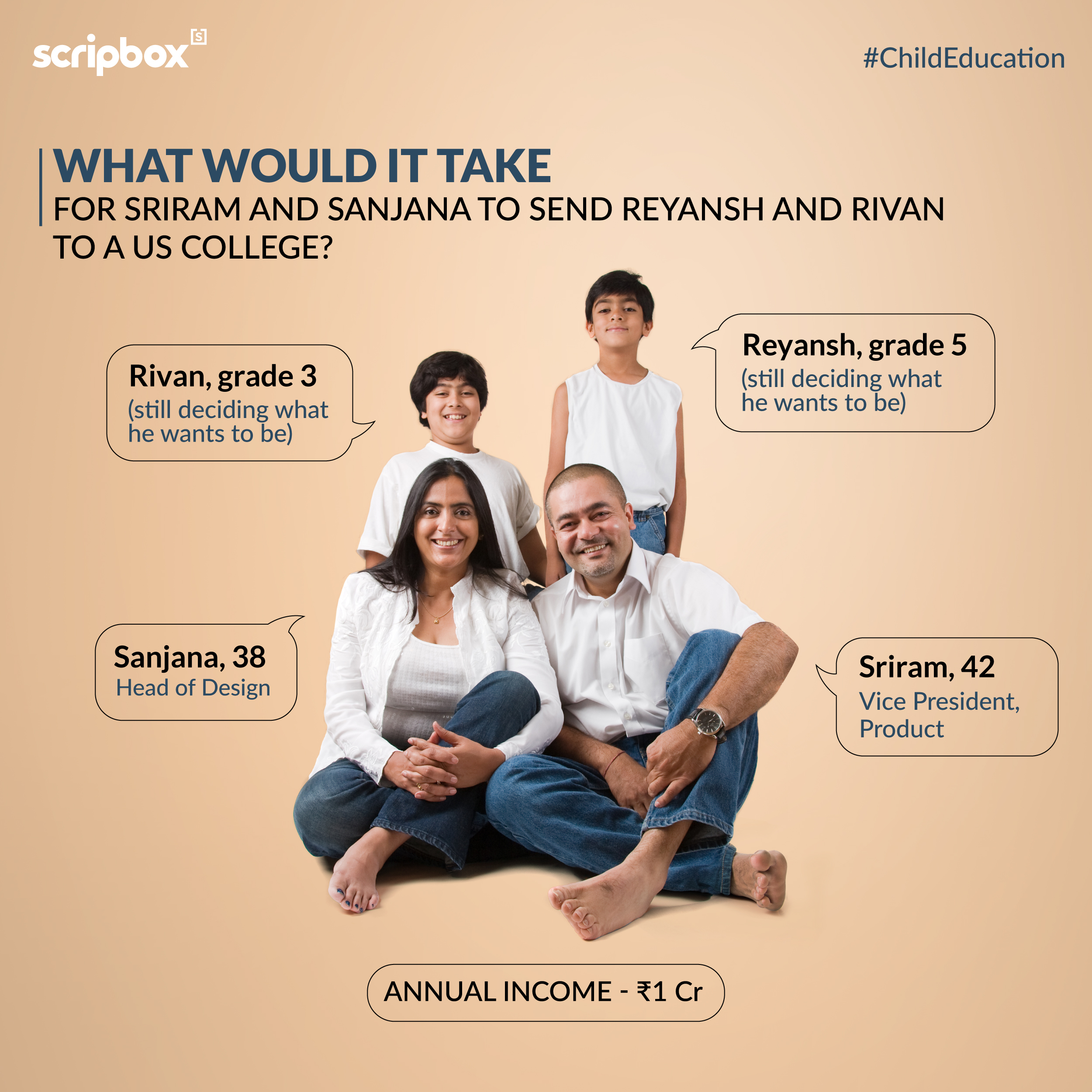

ನಿಮ್ಮ ಹಣಕಾಸು ಗುರಿಗಳನ್ನು ಪೂರೈಸಲು ಹೂಡಿಕೆಯನ್ನು ಸ್ವಯಂಚಾಲಿತಗೊಳಿಸಬೇಕು. ನಿಮ್ಮ ದೀರ್ಘಾವಧಿ ಅಥವಾ ಅಲ್ಪಾವಧಿ ಹಣಕಾಸು ಗುರಿಗಳನ್ನು ಪೂರೈಸಲು ಉದ್ದೇಶಿಸಿ ಮಾಡುವ ಹೂಡಿಕೆಗೆ ಕನಿಷ್ಠ ನಿಮ್ಮ ಶೇ. 20 ರಷ್ಟು ಆದಾಯವನ್ನು ವೆಚ್ಚ ಮಾಡಿ. ನಿಮ್ಮ ಸಂಬಳದ ದಿನದ ನಂತರ ಕೆಲವೇ ದಿನಗಳಲ್ಲಿ ನಿಮ್ಮ ಖಾತೆಯಿಂದ ಸ್ವಯಂಚಾಲಿತವಾಗಿ ಹಣವನ್ನು ಕಡಿತಗೊಳಿಸಿಕೊಳ್ಳುವ ಎಸ್ಐಪಿ ಆರಂಭಿಸಿ. ಇದರಿಂದ ನಿಮ್ಮ ನಿವೃತ್ತಿ ಅಥವಾ ಮಕ್ಕಳ ಶಿಕ್ಷಣದಂತಹ ಹಣಕಾಸು ಗುರಿಗಳಲ್ಲಿ ರಾಜಿ ಮಾಡಿಕೊಳ್ಳುವ ಅಗತ್ಯ ಉಂಟಾಗುವುದಿಲ್ಲ.

ಸಂಕ್ಷಿಪ್ತವಾಗಿ ಹೇಳುವುದಾದರೆ, ಖರೀದಿ ಹುಚ್ಚಿಗೆ ಬಿದ್ದವರು ತಮ್ಮ ಈ ಕ್ರಮ ಕೈಗೊಳ್ಳುವ ಮೂಲಕ ಆರ್ಥಿಕ ಸ್ಥಿತಿಯನ್ನು ಸರಿದಾರಿಗೆ ತಂದುಕೊಳ್ಳಬಹುದು ಮತ್ತು ಭವಿಷ್ಯಕ್ಕಾಗಿ ಉಳಿತಾಯ ಮಾಡಬಹುದು: ಸರಳ ಬಜೆಟ್ ವ್ಯವಸ್ಥೆಯ ಮೂಲಕ ಸಮಸ್ಯೆಯನ್ನು ಗುರುತಿಸುವುದು, ವೆಚ್ಚ ಮಿತಿಯನ್ನು ನಿಗದಿಸುವುದು, ಮೊದಲೇ ಶಾಪಿಂಗ್ ಲಿಸ್ಟ್ ಮಾಡಿಕೊಳ್ಳುವುದು ಮತ್ತು ಖರೀದಿ ಮಾಡುವ ತುಡಿತವನ್ನು ಕಡಿಮೆ ಮಾಡಲು ಕಾಯುವಿಕೆ ಸಮಯವನ್ನು ವಿಧಿಸಿಕೊಳ್ಳುವುದು. ಸ್ವಯಂಚಾಲಿತವಾಗಿ ಹೂಡಿಕೆ ಮಾಡುವುದರಿಂದ, ಹಣಕಾಸು ಗುರಿಗಳಲ್ಲಿ ರಾಜಿ ಮಾಡಿಕೊಳ್ಳುವ ಅಗತ್ಯ ಉಂಟಾಗುವುದಿಲ್ಲ.

Show comments