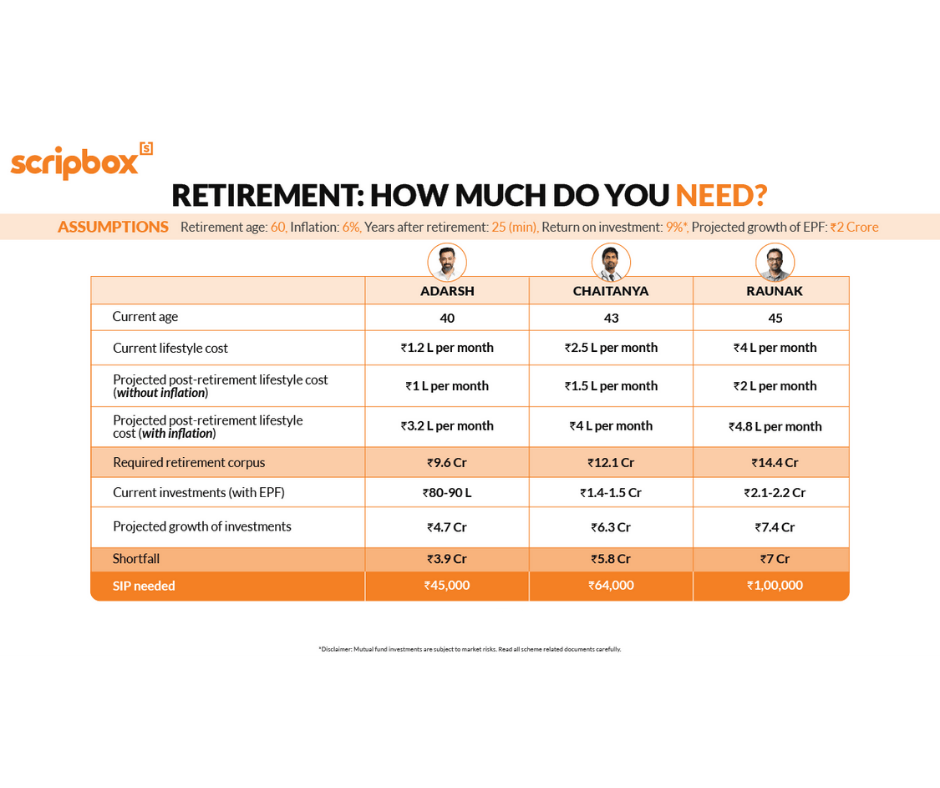

What does it take to retire comfortably if you start planning in your 40s?

Want to see a plan that can help you get started with your retirement goal, if you are in your 40s?

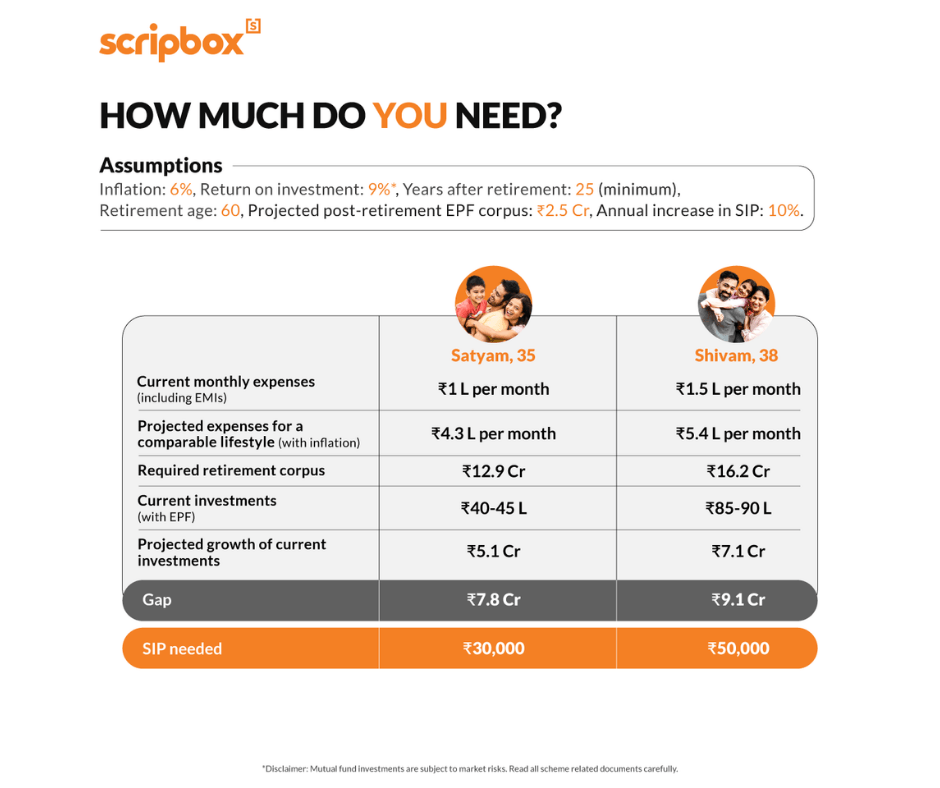

What does it take to retire comfortably if you start in your mid-30s?

Want to see a plan that can help you get started with your retirement goal, if you are in your 30s?

2022-23 Report Card: Performance of Scripbox Recommended Mutual Fund Portfolio

Here’s how the Scripbox recommended set of funds performed last year.

Your Scripbox plans are being consolidated

Some of our older investment plans have been renamed or consolidated into Long Term Portfolio or Short Term Portfolio. Learn what’s behind this change.

With rates rising, are bank FDs back in vogue for your financial goals?

Interest rates are rising. Does that mean FDs are now more attractive for investors? Let’s do a little digging to find the reality.

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

FAQs for Transaction Process

What is the ‘Transact’ tab? ‘Invest’ is now renamed to ‘Transact’‘Transact’ brings together all your transactional requirements. You can do everything listed below and much morea. Start a new investment, one-time or SIPb. Explore new investment plans and productsc. View...

Where can I find all my investments?

All your investments will be visible under the ‘Wealth’ page in the ‘Wealth’ tab.

Where can I see my portfolio audit report?

You can view your portfolio audit report and recommendations on the‘Dashboard’ tab → ‘Action Plan’ section → ‘Portfolio Audit’ card