What is Yield?

Yield measures the cash flow generated by an investment over a specific period. Expressed as a percentage, it accounts for all dividends or interest received during the investment’s term. Unlike total return, which includes capital gains, yield focuses on income, indicating an investment’s profitability. It can be calculated based on the purchase or current market prices.

Types of Yield:

- Yield on Cost: This is the yield calculated based on the original purchase price of the investment.

- Current Yield: This reflects the yield calculated using the investment’s current market price.

Yield in Stocks

For stocks, yield measures the return from dividends and excludes any profit from selling the shares. Here’s the formula for calculating yield in stocks:

Yield = (Price Increase + Dividend Paid) ÷ Purchase Price

Example: If a stock’s price increases by $10 and pays a $2 dividend on a $100 purchase price, the yield is:

Yield = ($10 + $2) ÷ $100 = 12%

Yield in Bonds

For bonds, yield refers to the return earned from interest payments, also known as the coupon rate. This is often expressed as the normal yield, which shows the annual return relative to the bond’s face value.

Normal Yield = Annual Interest Earned ÷ Face Value of the Bond

Example: If a bond has a face value of $1,000 and pays $50 in annual interest, the normal yield is: Normal Yield = $50 ÷ $1,000 = 5%

Another important bond measure is yield to maturity (YTM), which defines the expected annual rate of return on bonds if held until their maturity date, accounting for all coupon payments made on time and reinvested at the same rate.

Understanding yield for stocks or bonds can help you better evaluate an investment’s income potential and make smarter financial decisions.

Yield To Maturity (YTM) Formula

Below is the YTM formula-

To understand yield to maturity (YTM), is the expected annual rate of return from a bond if held until maturity, factoring in the reinvestment of coupon payments.

Where,

bond price = the current price of the bond.

Coupon = Multiple interests received during the investment horizon. These are reinvested back at a constant rate.

Face value = The price of the bond set by the issuer.

YTM = the discount rate at which all the present value of future cash flows of the bond equals its current price.

One can calculate yield to maturity only through trial and error methods.

However, one can easily calculate YTM by knowing the relationship between bond price and its yield. When the bond is priced at par, the coupon rate equals the bond’s interest rate. If the bond sells at a premium (above par value), the coupon rate is higher than the interest rate. And if the bond sells at a discount, the coupon rate is lower than the interest rate. This information will help an investor to calculate yield to maturity easily.

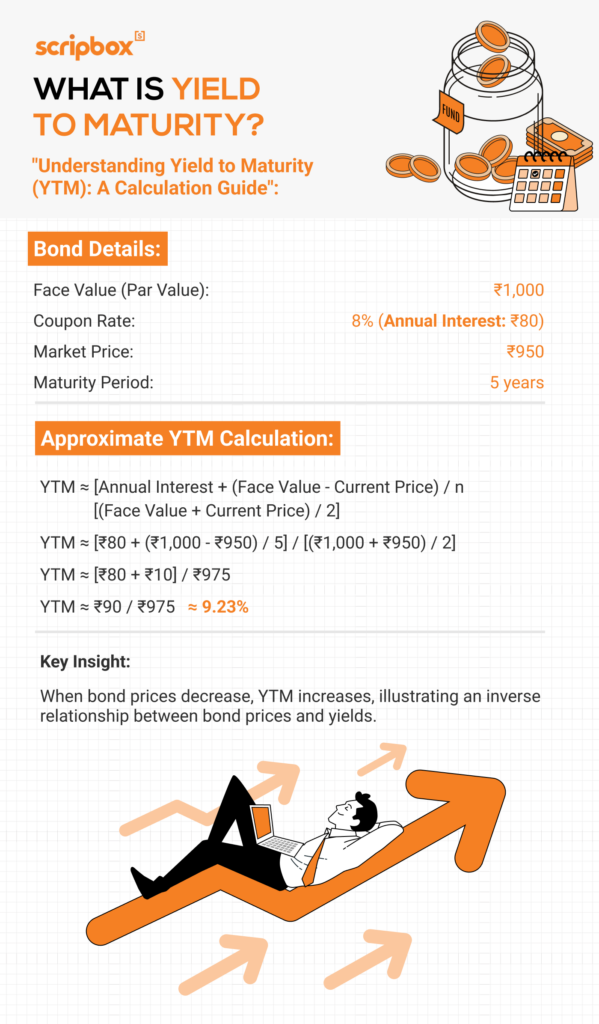

How to Calculate Yield To Maturity (YTM)?

To calculate YTM, let’s take an example of a corporate bond with a face value of INR 1,000. The current market price of the bond is INR 950. The bond pays a coupon of 4% annually and matures in 3 years.

The details of the corporate bond are shown in the table below:

| Face Value | INR 1000 |

| Coupon rate | 4% or INR 40 |

| Time to Maturity | 3 years |

| Current market value | INR 950 |

Since the bond sells at a discount, the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined.

INR 950 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 40/(1+YTM)^3+ 1000/(1+YTM)^3

We can try out the interest rates of 5% and 6%. The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865%, the price of the bond is INR 950.02

Hence, the estimated yield to maturity for this bond is 5.865%.

Variations of Yield to Maturity

Yield to Call

Yield to Call is the return from a callable bond. However, the bondholder must redeem the bond before maturity at the earliest call date. The YTC measure suggests a callable bond was redeemed before its maturity date. The most common reason an issuer calls a bond early is to refinance during low-interest rates or reduce the percentage of debt in the capital structure.

Yield to Worst

The yield to worst (YTW) is the lowest possible yield on a bond, assuming the issuer will not default on any of its payments. YTW is especially appropriate for bonds where the issuer exercises options such as calls, prepayments, and sinking funds.

This return makes sense when the issuer pays back the bond early. Or where the put option is included in terms of issue. A YTW estimate provides investors with a reasonable understanding of how their future income may be impacted in the worst-case situation and what they can do to mitigate such risks.

Yield to Put

Yield to put (YTP) is identical to yield to call (YTC), except that the holder of a put bond can sell it back to the issuer at a fixed rate, depending on the bond’s terms. YTP is computed with the expectation that the bond will be returned to the issuer as soon as possible and financially viable.

Why does Yield to Maturity keep changing in Debt Funds?

Yield to Maturity is a return metric for Debt Funds. However, it fluctuates with changing market conditions. Thus, in practice, the YTM of an open-ended Debt Fund is different from the scheme’s actual returns.

Furthermore, since debt funds invest in multiple funds, a change in the YTM of a single bond will impact the YTM of the debt fund. However, the magnitude of this change will be proportionate to the bond’s weightage in the debt mutual fund portfolio.

Taking the above example, let us understand how the changing market conditions impact the bond’s YTM. Let’s assume the bond’s rating has been downgraded due to its poor performance after one year. As a result, the bond’s market value is now INR 700. Based on the changes, the details of the corporate bond after one year are shown below:

| Face Value | INR 1000 |

| Coupon rate | 4% or INR 40 |

| Time to Maturity | 2 years |

| Current market value | INR 700 |

Using the YTM formula, the required yield to maturity can be determined.

700 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 1000/(1+YTM)^2

The Yield to Maturity (YTM) of the bond is 24.781%

After one year, the bond’s YTM is 24.781% instead of 5.865%. Hence, changing market conditions like inflation, interest rate changes, downgrades, etc. affect the YTM. An increase in the bond’s YTM due to a change in market conditions indicates the bond or debt fund is of low quality. Conversely, a decrease in the YTM due to a change in market conditions shows the bond or debt fund is of high quality.

How do you interpret YTM for your debt funds?

Yield to Maturity helps determine the potential returns of a debt mutual fund. However, it also gives a fair idea of the risks associated with the investments. For example, a debt fund with a high YTM means that the scheme has substantial investments in bonds with low credit ratings. Bonds with low credit ratings offer higher coupon rates than bonds with higher credit ratings.

However, it is essential to note that these bonds also have a downside. Low-credit-rating bonds have a greater level of credit and liquidity risk. Credit risk occurs when the bond issuer defaults on interest payments. At the same time, liquidity risk occurs when the fund manager is unable to exit their position on the bond quickly.Therefore, one should consider one’s risk profile when investing in debt funds. High-risk investors can consider investing in debt funds with higher YTM to generate greater returns, while low-risk investors can opt for funds with lower YTM that invest primarily in bonds with high credit ratings.

How do you calculate future returns for your debt funds?

The YTM of debt funds changes over time. However, one can estimate one’s future returns from Debt investments. Estimating the future returns helps in many ways, such as determining how much one should invest to reach one’s target amount or pay for a future expense.

The calculations only estimate potential returns and do not guarantee any returns. To compute the potential future returns, one should know the following details of a fund:

- Yield to Maturity (YTM)

- Expense Ratio

- Modified Duration

Also, one should consider the interest rate cycle of the Reserve Bank of India (RBI).

The below formula can be used to estimate a year return from a debt fund investment:

Expected 1 Year Return = YTM + (Interest Rate Change x Modified Duration ) – Expense Ratio

Let’s understand the calculation with an example. A debt fund has a modified duration as five years, YTM 9%, and an expense ratio of 1.25%. The anticipated interest rate change is 0.5% (decrease), and the expected one year return is 10.25%.

Expected 1 Year Return = 9 + (5*(0.5)) – 1.25 = 10.25%.

Now, instead of a decrease in interest rate, if there is an increase (0.5), then the Expected return would be:

9 + (5*(-0.5)) – 1.25 = 5.25%.

Therefore, from the above example, the bond’s expected one-year return was the same when the interest rates have decreased by 0.5%.

Understanding the key terms in the yield to maturity formula is essential to grasp how it works. Let’s break down these important concepts:

1. Face Value (Par Value)

- The face value, or par value, is the amount the bondholder receives when the bond matures.

- It represents the principal value of the bond, paid back to the investor along with the final interest payment.

2. Present Value (Market Value)

- The present or market value is the bond’s current trading price in the market.

- This value fluctuates based on changes in market interest rates.

- Key Insight: Price and yield have an inverse relationship—when bond prices increase, yields fall, and vice versa.

3. Coupon Rate

- The coupon rate is the fixed interest rate the bond issuer pays to the bondholder based on the bond’s face value (not its market value).

Example:

If a bond’s face value is ₹1,000 and the coupon rate is 10%, the bondholder receives ₹100 annually as interest.

4. Interest Rate

- The effective interest rate differs from the coupon rate, especially when bonds are purchased at a premium or discount.

Example Scenarios:

- At Par: Mr. Ananth buys a bond at ₹1,000 with a coupon rate of 10%. His effective interest rate is 10% (₹100/₹1,000).

- At a Premium: Ms. Sushma buys the same bond at ₹2,000. Her effective interest rate is now 5% (₹100/₹2,000).

- At a Discount: If the bond is purchased below ₹1,000, the effective interest rate will exceed the coupon rate.

5. Discount and Premium Bonds

Bonds are often categorized as trading at par, a discount, or a premium:

- At Par: Market Value = Face Value.

- At Premium: Market Value > Face Value.

- At Discount: Market Value < Face Value.

6. Time to Maturity

- Maturity refers to the date when the bond’s principal is repaid along with its interest.

- Example: A 10-year bond matures in 10 years, and the bondholder receives the original investment (face value) plus interest.

- “Time to maturity” reflects the remaining period before this repayment.

YTM vs. Current Yield

- Current Yield: Reflects the bond’s actual yield based on its market price. Calculated as:

Current Yield = Annual Income ÷ Current Market Price

It evaluates the relationship between the bond’s price and yearly yield. - Yield to Maturity (YTM): The total return expected if the bond is held until maturity, accounting for reinvestment and the time value of money.

Uses of Yield to Maturity

YTM is a valuable tool for investors, offering insights like:

- Evaluating Investment Potential: Compare YTM with the required rate of return to determine if a bond is worth buying.

- Comparing Bonds: Analyze bonds with different maturity terms to understand what each offers.

- Anticipating Market Changes: Recognize how price changes affect yields—for example, when bond prices fall, yields rise.

- Assessing Risk: Use YTM to compute risk metrics like duration and convexity, which measure a bond’s sensitivity to market changes.

Limitations of Yield to Maturity

While YTM is helpful, it does have its drawbacks:

- Excludes Taxes: YTM does not consider taxes paid on bond income.

- Assumptions May Fail: YTM assumes coupon reinvestment at the same rate and that the bond will be held until maturity—neither of which is guaranteed.

- Approximation Issues: YTM calculations often rely on estimates, which can reduce accuracy and reliability.

MF Top Articles

Frequently Asked Questions

YTM assists in estimating the potential returns. Thus, you can compare the expected returns from different assets. Furthermore, you can use YTM to understand how changes in market circumstances may affect your portfolio, as yields rise when security prices fall and vice versa.

A higher YTM indicated high returns. However, it also implies that the bonds are more volatile. In other words, higher YTM means that the bond is a high-risk investment.

If YTM is higher than the coupon rate, it means that the bond is sold at a discount to its par value. On the other hand, if YTM is lower than the coupon rate, then the bond is sold at a premium.

The yield to maturity (YTM) is the rate of return on a bond based on the assumption that the investor holds it to maturity. On the other hand, the coupon rate is the annual interest rate that the bond owner will receive.

A bond’s price has an inverse relationship to its yield to maturity rate. As interest rates rise, there is a demand for greater returns. Therefore, the price of bonds will fall, and subsequently, the yield to maturity rate will increase.

The yield of an investment is its earnings over a specified period. The interest rate is the proportion that a lender charges for a loan. The interest rate can also refer to the amount of recurring return an investor can anticipate from a financial instrument such as a bond.

Bond yield is the projected return from a fixed-income investment over a specific period of time. The bond’s yield to maturity is the interest rate at which the present value of all future cash flows is equal to the bond’s current price. These cash flows consist of all coupon payments and the security’s maturity value.

- What is Yield?

- Yield To Maturity (YTM) Formula

- How to Calculate Yield To Maturity (YTM)?

- Variations of Yield to Maturity

- Why does Yield to Maturity keep changing in Debt Funds?

- How do you interpret YTM for your debt funds?

- How do you calculate future returns for your debt funds?

- Terms Related to Yield to Maturity (YTM)

- Uses of Yield to Maturity

- Limitations of Yield to Maturity

- MF Top Articles

- Frequently Asked Questions

Show comments