Any Investment plan has its own advantages, be it short-term or long-term. Investors are usually keen on investing in Mutual Funds because of their risk management. However, needless to say, these investments also come with some disadvantages. This article explains the advantages and benefits of mutual funds.

What is Mutual Fund?

A Mutual Fund scheme is a financial instrument made by a pool of money collected from many investors. The AMCs invest in securities like company shares, bonds, stocks, debts, and other assets by mutual fund companies. The AMCs manage these open-ended investments. Mutual fund companies allocate the funds in different securities. This helps its investors to grow their wealth through their investments as part of an effective investment strategy.

The capital gain on a Mutual Fund scheme depends on the performance of the securities it decides to buy. The market condition also determines the value of the particular security purchased.

The income or gain generated from these investments is then distributed among the investors. The distribution is done after deducting certain expenses by calculating the scheme’s Net Asset Value.

Mutual Funds can be a higher-risk investment, but the returns are generally more significant than any other investment plan.

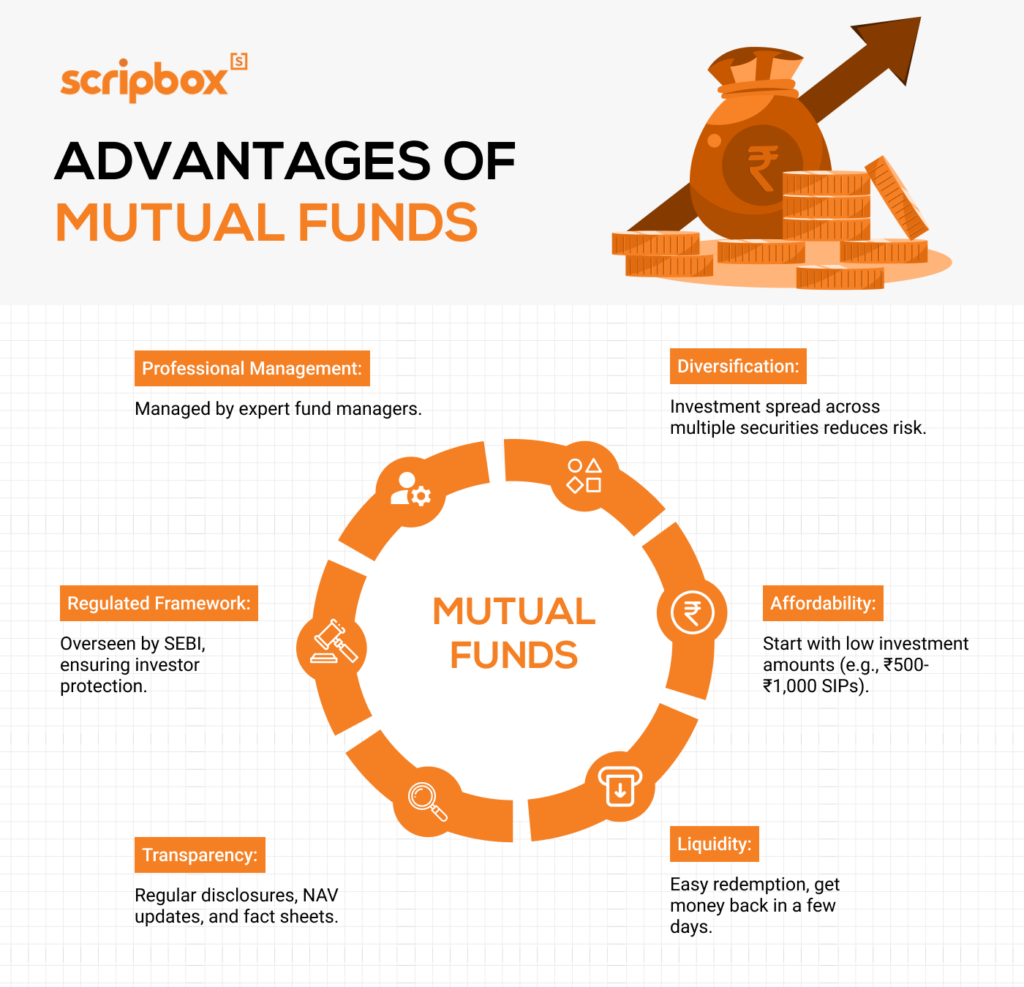

Mutual Funds have advantages and disadvantages. The benefits of investing include professional management, low risk, diversification, liquidity, and economies of scale. The disadvantages of investing include high fees, poor trade execution, tax inefficiency, etc.

Definition and Overview

A mutual fund is a type of investment vehicle that pools money from several investors to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. The primary objective of a mutual fund is to provide investors with a convenient and affordable way to invest in various assets while also providing professional management and diversification. Mutual funds are managed by experienced fund managers responsible for making investment decisions on behalf of the fund’s investors. This professional management ensures that the investments are handled with expertise, aiming to achieve the best possible returns for the investors.

How Mutual Funds Work

Mutual funds work by pooling money from multiple investors to create an extensive portfolio of assets. The fund manager then uses this pool of money to invest in various assets, such as stocks, bonds, and other securities. The fund manager’s goal is to generate returns for the fund’s investors by investing in a diversified portfolio of assets. Mutual funds are typically open-ended, meaning that investors can buy or sell shares in the fund at any time. The price of the shares is determined by the fund’s net asset value (NAV), which is calculated by dividing the total value of the fund’s assets by the number of shares outstanding. This structure allows investors to have flexibility and liquidity in their investments.

Types of Mutual Funds

Several types of mutual funds are available to investors, each with unique characteristics and investment objectives. Some of the most common types of mutual funds include:

- Equity funds invest primarily in stocks and are designed to provide long-term growth.

- Fixed-income funds invest primarily in bonds and other fixed-income securities designed to provide regular income.

- Balanced funds: These funds invest in a mix of stocks and bonds and are designed to balance growth and income.

- Index funds: These funds track a specific market index, such as the S&P 500, and are designed to provide broad diversification and low costs.

- Sector funds invest in a specific sector or industry and are designed to expose investors to a particular market area.

Each type of mutual fund caters to different investment goals and risk tolerances, allowing investors to choose the one that best fits their financial objectives.

Advantages and Benefits of Investing in Mutual Funds in India

The following are explain about the advantages of mutual funds.

Liquidity

The most important benefit of investing in a Mutual Fund is that the investor can redeem the units anytime. Unlike Fixed Deposits, Mutual Funds have flexible withdrawals, but factors like the pre-exit penalty and exit load should be considered.

This liquidity in mutual funds can help investors meet their financial goals by providing easy access to their funds when needed.

Diversification

The value of an investment may not rise or fall in tandem. When the value of one investment is on the rise, the value of another may decline. As a result, the portfolio’s overall performance has a lesser chance of being volatile.

Diversification reduces the risk involved in building a portfolio, reducing the risk for an investor. As a key component of risk management, Mutual Funds consist of many securities, safeguarding investors’ interests if there is a downturn in other securities purchased.

Expert Management

A novice investor may need to learn more about how and where to invest. The experts manage and operate mutual funds. They pool money from investors and allocate it to different securities, thereby helping the investors earn a profit.

The experts manage the investment portfolio, monitoring timely exit and entry and handling all the challenges. One only needs to invest and be least assured that the rest will be taken care of by the experts who excel in this field. This is one of the most important advantages of mutual funds.

Flexibility to invest in Smaller Amounts

The most important benefits of Mutual Funds are their flexible nature and various investment options. Investors need not invest a huge amount of money in a mutual fund. Investment can be as per the cash flow position.

If you draw a monthly salary, you can opt for a systematic investment plan (SIP). Through SIP, a fixed amount is invested monthly or quarterly, according to your budget and convenience.

Accessibility – Mutual Funds are Easy to Buy

Mutual funds are easily accessible, and you can start investing and buying mutual funds from anywhere in the world. An Asset Management Companies (AMC) offers the funds and distributes them through channels like :

- Brokerage Firms

- Registrars like Karvy and CAMS

- AMC’S Themselves

- Online Mutual Fund Investment Platforms

- Agents and Banks

This factor makes mutual funds universally available and easily accessible. You do not require a Demat Account to invest in Mutual Funds. Mutual funds are easy to buy, track performance, and one-click investment with Scripbox. Learn how to invest in mutual funds.

An investment platform provides a convenient way to access and manage your mutual fund investments.Mutual funds are easy to buy, track performance and one-click investment with Scripbox.

Learn: how to invest in mutual funds.

Schemes for Every Financial Goals

The best part of a Mutual Fund is that the minimum investment amount is Rs. 500, and the maximum is whatever an investor wishes to invest.

The only points one should consider before investing in Mutual Funds are income, expenses, risk-taking ability, and investment goals. Therefore, everyone, regardless of income, can invest in a Mutual Fund.

Safety and Transparency

All Mutual Fund products have been labeled with the introduction of SEBI guidelines within the regulatory framework. This means that all Mutual Fund schemes will have color coding. This helps an investor ascertain the risk level of his investment, thus making the entire investment process transparent and safe.

This color-coding uses 3 colors indicating different levels of risk-

- Blue indicates low-risk

- Yellow indicates medium risk, and

- Brown indicates a high risk.

Investors are also free to verify the fund manager’s credentials, qualifications, years of experience, and the fund house’s AUM and solvency details.

Lower cost

In a Mutual Fund, funds are collected from many investors, and this cost efficiency is achieved by using the pooled funds to purchase securities. However, These funds are invested in assets, which helps one save on transactions and other costs compared to a single transaction. The savings are passed on to the investors as lower costs of investing in Mutual Funds.

Besides, the Asset Management Services fee cost is lowered, and the same is divided between all the fund’s investors.

Best Tax Saving Option

Mutual Funds provide the best tax benefits and tax-saving options. ELSS Mutual Funds have a tax exemption of Rs. 1.5 lakh a year under section 80C of the Income Tax Act. You can use Scripbox’s income tax calculator to ensure tax plan requirements.

All other Mutual Funds in India are taxed based on the type of investment and the tenure of investment.ELSS Tax Saving Mutual Funds has the potential to deliver higher returns than other tax-saving instruments like PPF, NPS, and Tax Saving FDs.

Lowest Lock-in Period

Tax-saving mutual Funds have the lowest lock-in periods, at only 3 years, making them suitable for a shorter investment horizon. This is lower than the maximum of 5 years for other tax-saving options like FDs, ULIPs, and PPF.

On top of that, one can stay invested even after the lock-in period has ended.

Lower Tax on the Gains

With an equity-linked savings scheme, you can save tax up to Rs. 1.5 Lakh a year under section 80C of the Income Tax (IT) Act, enhancing your tax efficiency. All other types of Mutual Funds are taxable depending on the type of fund and tenure.

Before investing, one should consider the various advantages Mutual Funds provide. Thorough knowledge of these benefits will lead to better future gains.

Although there are a lot of advantages to investing in Mutual Funds, there are also certain disadvantages.

We will now learn about the disadvantages of Mutual Funds.

Explore Loan Against Mutual Funds

Disadvantages of Investing in Mutual Funds

Cost to Manage the Mutual Fund Scheme

Management fees are crucial as Market Analysts or Fund Managers manage and operate mutual funds. These Fund Managers work for fund houses that manage huge investments every day. This requires a lot of efficiency, expertise, and experience in the subject matter.

Dilution

Due to dilution, investing in too many Mutual Funds at the same time is not recommended. Although diversification can save an investor from major losses, it also restricts one from making higher investment returns.

Lock-in Periods

Equity-linked Saving Scheme (ELSS) has a longer lock-in period of 3 years, which defines the investment tenure. This prevents an investor from withdrawing the investment before the lock-in period ends. However, withdrawing these funds before the lock-in period could lead to huge penalties.

A portion of the fund is kept in cash to safeguard investor’s interest. This is done to compensate the investor in case he desires to withdraw the fund before maturity. This part of the cash fund does not earn any interest.

Despite certain disadvantages, mutual funds in India are considered one of the best investment plans. The advantages and long-term benefits of investing in a Mutual Fund make it a win-win situation for all. Professional expertise makes it easier for a novice to invest without knowing it.

Here at Scripbox, our expert market professionals analyze and research the different Mutual Funds available. With proper market research, we bring you the best investment plans that allow our investors to gain profits.

Who Should Invest in Mutual Funds?

Mutual funds are a popular investment option for many types of investors, including:

- Individual investors: Mutual funds offer a convenient and affordable way for individual investors to invest in a variety of assets.

- Institutional investors: Mutual funds, such as pension funds and endowments, are also popular among institutional investors due to their ability to provide broad diversification and professional management.

- Retirement accounts: Mutual funds, such as 401(k) plans and IRAs, are often used in retirement accounts due to their ability to provide long-term growth and income.

Whether you are an individual looking to diversify your portfolio, an institution seeking professional management, or someone planning for retirement, mutual funds offer a versatile and effective investment solution.

SIP Vs Lump Sum: What to Choose?

When it comes to investing in mutual funds, investors have two main options: systematic investment plans (SIPs) and lump sum investments. SIPs involve investing a fixed amount of money at regular intervals, while lump sum investments involve investing a single large sum of money.

SIPs are often preferred by investors who want to invest a fixed amount of money at regular intervals, as they provide a disciplined approach to investing and can help reduce the impact of market volatility. Lump sum investments, on the other hand, are often preferred by investors who have a large sum of money to invest and want to take advantage of market opportunities.

Ultimately, the choice between SIPs and lump sum investments depends on an investor’s individual financial goals and risk tolerance. It’s often a good idea to consult with a financial advisor or investment professional to determine the best investment strategy for your specific needs. Investing in mutual funds through either method can help you achieve your financial objectives, but understanding the differences can help you make a more informed decision.

Conclusion

Investing in a good plan not only derives a good profit but also secures one’s life. Money invested now will lead to a safer tomorrow. Hence, one should plan an investment according to one’s needs and risk-taking capacity.

With advantages of mutual funds like expert management, cost-efficiency, hassle-free process, tax-efficiency this makes for a better investment scheme.

In this article, we have explained the advantages of mutual funds and benefits along with the disadvantages.

We advise investors to estimate the investment returns and maturity before investing. This will ensure your investment plans match your financial goals. You can use Scripbox’s SIP calculator and income tax calculator to estimate your returns and tax plan requirements.

Frequently Asked Questions

Mutual funds are diversified investment options that offer good growth in the long term. The investments are managed by professional fund managers, and thus, you don’t have to worry about tracking and managing your investments. Different types of mutual funds are suitable for every type of investor. Mutual funds offer high liquidity, flexibility, convenience, expert fund management and tax saving benefits. Thus, they are a good choice for long term wealth creation.

One can invest in mutual funds through SIP or lumpsum investment. At the same time, SIP refers to periodic investments of a fixed amount on a predetermined date every month, whereas lumpsum refers to a one-time investment. Most of the mutual funds demand a minimum lump sum investment of Rs. 1000 to 10,000. However, investors can start a SIP of Rs.500 every month. There are some AMCs that accept SIP investment as low as Rs.100 every month. Therefore, investors can choose to invest Rs.1000 or even lower based on their financial capability and future financial goals.

One can cash out their mutual fund holdings as long as it is an open-ended fund. Both equity fund and debt fund are quickly withdrawn after the investment is made. For instance, an investor can withdraw their mutual fund investment the next day post-investment. However, one should always keep in mind the exit load. i.e. the penalty fee that the mutual fund charges for early withdrawals.

Both equity and debt mutual funds have different periods for exit load. Usually, equity schemes charge an exit load of 1% if the fund is withdrawn within a year.

Furthermore, it takes T+1 days for the funds to receive the investor’s bank account in debt funds withdrawals. For equity funds, it takes T+3 days for funds to credit investors’ bank account. Therefore, liquidity is one of the most significant advantages of mutual funds.

The profit and loss in a mutual fund depend on the financial market’s performance and the underlying security performance. Hence, there is no guarantee that you will not lose money in mutual funds. However, it is always advisable to understand how mutual funds work before investing in them. Mutual funds are professionally managed by fund managers who invest in a wide variety of stocks, bonds and commodities. It is not that all mutual funds will fail to perform. Therefore, the profit and loss of a mutual fund depend on various factors such as market volatility, economic growth, stock performance, etc.

When you are losing money in mutual funds, this does not mean that you should start redeeming your funds. One should think twice when you see the markets are performing poorly. Moreover, investment in mutual funds is made for longer horizons. Investors can also choose the SIP route for leveraging the rupee cost averaging benefit. i.e. adding more units when markets are falling.

Mutual Fund vs FD. The answer depends on your investment goal and preferences. Due to exposure to the equities mutual funds are relatively riskier than fixed deposits. Fixed deposits offer guaranteed returns at the end of the tenure. This is not the case with a mutual fund. The return is completely dependent on the market ups and downs. However, mutual funds have the potential to provide inflation-beating returns in the long-term. If you are an investor who understands the risk associated with equities and has an objective of capital appreciation then mutual funds are a better option. Moreover, if you only want to park your surplus for a shorter period than you may opt for debt funds.

Debt funds have the potential to provide returns higher than FDs. Debt funds carry a risk ranging between low to moderate risk. Hence, you must consider this factor before investing. Even if you compare a tax-saving FD and ELSS then as well risk and long-term are the factors you must always consider. Both FD and ELSS provide tax saving benefits under section 80C. But due to equity exposure ELSS is riskier. But ELSS provides inflation beating returns in the long-term. Hence, before investing always set your investment goal, understanding of risk, and tenure. This way you will be able to take a well-informed investment decision.

No, mutual funds are not free. The income or capital gain earned is taxable. Long term capital gain or short term capital gain is applicable depending on the holding period of the mutual fund investment. The tax rate is different for different types of mutual funds and different types of capital gains. However, an investment made in ELSS is tax exempt. This means that if you invest in an equity linked savings scheme then you can claim a tax benefit of up to rs 1.5 lakhs under section 80C of the Income Tax Act, 1961.

As per SEBI categorization, there is no such fund categorized as Blue Chip Fund. The mutual fund houses use the blue chip as a synonym for large cap fund. Many AMCs use the term ‘Blue Chip’ in the name of the large-cap funds and mid-cap funds. For example- SBI Bluechip Fund, ICICI Prudential Bluechip Fund, Principal Emerging Bluechip Fund, Mirae Asset Emerging Bluechip Fund, etc. However, the term blue chip in the name of the fund does not necessarily mean that these large-cap funds or mid-cap funds invest in bluechip companies.

Blue chip companies are large companies with higher growth potential, higher stability, and offer stable and regular growth. The companies such as Reliance, TATA, Infosys are considered as Blue Chip companies. Blue chip funds are basically large cap funds which invest more than 80% of its corpus in large cap companies. Most large cap companies are Blue Chip companies. The large cap fund is an equity oriented mutual fund and hence invests more than 65% of its corpus in securities of large cap companies.

No, mutual fund charges are not charged monthly. There are many different types of mutual fund fees depending on the type of transaction. Such mutual fund expenses are exit load, entry load, and expense ratio. The exit load is the charge on the redemption of mutual funds. Exit load is charged as a percentage of the NAV on the date of redemption. This percentage differs from one AMC to another. The exit load is charged either as a flat percentage on withdrawal or as a period of holding percentage on the number of units withdrawn.

For example No exit load if up to 10% of Units allotted are redeemed or switched out within 1 year from the date of allotment. For example- if redeemed or switched out in excess of 10% of units allotted within one year from the date of allotment an exit load of 1%. Expense ratio is the fee charged by the asset management companies against the annual management of the mutual fund scheme. The TER total expense ratio formula is used to calculate the annual fee percentage.

TER = Total expense incurred / Fund’s net assets. Expense ratio is higher for actively managed funds in comparison to the passively managed funds. Entry load is the charge which is charged at the time of purchase of a mutual fund scheme. This expense. The purpose of this expense is to cover the various expenses such as distribution, advertisement, promotion, etc. The SEBI abolished the entry load in the year 2019. Hence, it is not charged by any AMC now.

Mutual funds are market-linked instruments and, thus, do not guarantee returns. Therefore while investing in them, you should consider the following: performance of the fund over the years, compare the fund’s performance with the benchmark and category, mutual fund house track record, fund manager’s experience and expertise, expense ratio, taxation, investment objective, lock-in period, AUM, etc.

Check Out IDCW in Mutual Funds

Show comments