What is Expense Ratio in Mutual Fund?

An expense ratio is the annual cost of managing and operating an investment fund, such as mutual funds or ETFs. It is calculated as a percentage of the fund’s total expenses and assets under management. A percentage of the daily investment value is used to cover these costs, impacting the overall returns for investors. The expense ratio is the per-unit cost of managing a fund. The expense ratio of mutual funds and ETFs impacts investment costs and potential returns. What is an expense ratio? It is a critical factor in determining the overall investment cost and the potential profitability for investors.

As per SEBI regulations, mutual funds can charge certain operating expenses when managing a fund. In-depth knowledge of the market is required to operate a fund. A group of people, such as fund managers, analysts, etc., manages the fund to generate better returns for the investors. These guys track the markets and the companies in the fund’s portfolio.

The expense ratio will be higher if the fund’s asset under management is lower. Alternatively, the ratio will be lower if the fund has a higher asset under management.

Understanding the Expense Ratio

The expense ratio is a critical metric that investors should understand when evaluating a mutual fund or ETF. It represents the percentage of a fund’s assets that are used to cover its operating expenses, such as management fees, administrative costs, and marketing expenses. A lower expense ratio is generally better for investors, as it means that more of their investment returns will be retained.

It’s essential to know how the expense ratio is calculated to understand it. The expense ratio is calculated by dividing a fund’s total expenses by its average net assets. The result is expressed as a percentage representing the annual cost of owning the fund.

For example, if a mutual fund has an expense ratio of 1.2%, it means that for every $100 invested, $1.20 will be deducted annually to cover the fund’s operating expenses. This may not seem significant, but over time, it can add up and eat into an investor’s returns.

Components of Expense Ratio

The fund house recovers costs from the investor daily through the mutual fund expense ratio. The investors are informed of this six months in advance. The expense ratio’s impact on take-home return is significant.

- Management Fee: The fund’s investments depend on the decisions made by the fund managers, who have decades of experience in the field. The management fee compensates these managers for their expertise. Generally, .5%—1% of the total asset under management is deducted as a management fee.

- Administrative Charges: These are the costs incurred for managing the fund. They include customer support, client communication, and other expenses and depend on the fund’s total assets.

- 12-1B Distribution Fee: A 12-1B fee is an annual marketing or distribution fee on a mutual fund. It is considered part of the fund’s operational expenses and is included in the total expense ratio.

- Entry Load: This fee was charged when joining a mutual fund, reducing the initial amount available for investment. However, thanks to recent SEBI regulations, entry loads have been removed from mutual fund expense calculations, making it easier for investors to start without extra charges.

- Exit Load: This fee you pay when withdrawing money from a mutual fund usually around 2-3% of your total investment. Exit loads are designed to discourage premature withdrawals and help fund managers maintain stability in the fund.

- Brokerage Fees: The fees can be divided into 2 plans:

Direct Plans: The mutual fund company handles all transactions directly, without intermediaries. These plans have lower expense ratios as there’s no brokerage fee.

Regular Plans: Transactions are processed through brokers hired by the asset management company (AMC). This adds brokerage fees to the expense ratio, making them slightly more expensive.

How to Calculate Expense Ratio?

The ratio is calculated by dividing the total expenses incurred by the average value of the portfolio.

Expense Ratio Formula

Expense Ratio = Total expenses ÷ Average value of the portfolio

Let’s understand the same with the help of an example :

Suppose a fund house has an asset under management worth Rs. 5 crores. To manage the fund, the fund house charges management fees, administrative fees, and other expenses amounting to Rs. 5 lakhs.

The TER for this fund would be calculated as below :

TER = 5 lakhs/5 crores = 1%

To clarify the above further, 1% is the amount of the total assets that need to be paid out to manage the fund.

Of course, the return earned on the above investments by the fund house has to be higher for you to not lose any money.

Suppose the fund has earned a return of 15% on the investment, and if 1% is the expense ratio, then you would earn a return of 14%.

Importance of Expense Ratio

The expense ratio indicates the per-unit cost of managing the funds, which is calculated by dividing the total expenses by the total assets under management.

The higher the ratio, the more funds are being incurred to manage the fund. A lower ratio indicates that fewer resources are being used to manage the same assets.

If there is a higher expense ratio, the take-home return will be lower, and vice versa.

Recommended Read: Mutual Fund Charges

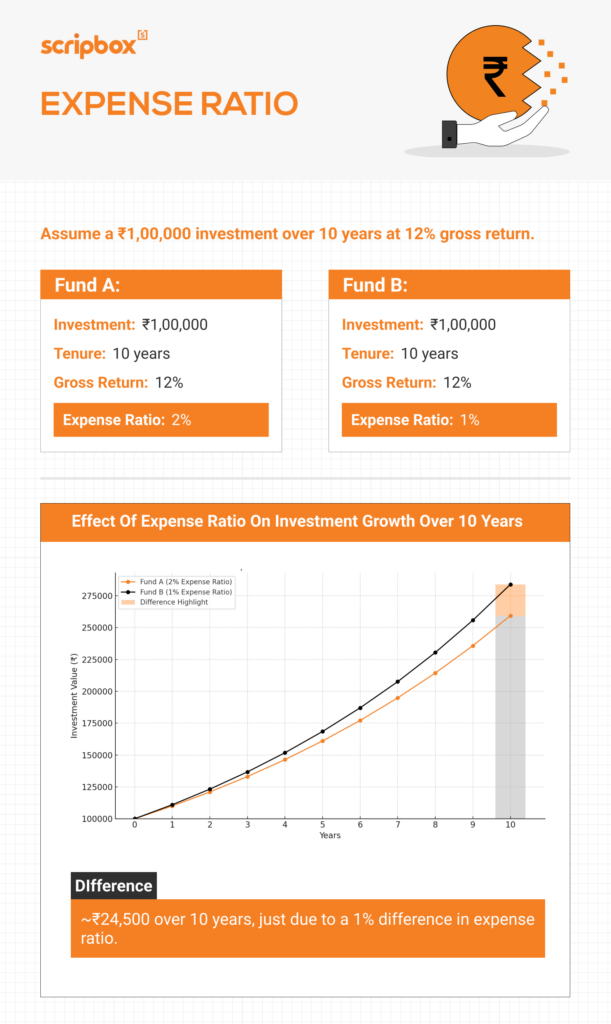

How Does the Expense Ratio Affect Fund Returns?

The expense ratio tells you how much a fund charges annually to manage your investments. These charges are deducted from the fund’s earnings before the returns are distributed to investors. Since this directly impacts your returns, it’s crucial to understand it before investing.

For example, if you invest ₹50,000 in a fund with an expense ratio of 2%, you’ll pay ₹1,000 annually to the fund house to manage your investment.

Passive vs. Active Funds: Expense Ratio Comparison

One key difference between passive and active funds is their expense ratios. Passive funds, such as index funds and ETFs, typically have lower expense ratios than actively managed funds.

Passive funds have lower expense ratios because they don’t require a team of portfolio managers to manage the fund’s investments actively. Instead, they track a specific market index, such as the S&P 500, and invest in the same securities as the index. This approach reduces the fund’s operating expenses, resulting in a lower expense ratio.

Conversely, actively managed funds have higher expense ratios because they require a team of portfolio managers to actively manage the fund’s investments. This approach involves more research, analysis, and trading, which increases the fund’s operating expenses.

For example, the Vanguard S&P 500 ETF (VOO) has an expense ratio of 0.03%, while the Fidelity Contrafund (FCNTX) has an expense ratio of 0.39%. This means that for every $100 invested in the Vanguard ETF, only $0.03 will be deducted annually to cover the fund’s operating expenses, compared to $0.39 for the Fidelity Contrafund.

Evaluating a Good Expense Ratio

When evaluating a mutual fund or ETF, it’s essential to consider its expense ratio. A good expense ratio depends on the type of fund and its investment strategy. Here are some general guidelines to help you evaluate a good expense ratio:

- An expense ratio of 0.10% or less is considered good for index funds and ETFs.

- An expense ratio of 0.50% or less is considered good for actively managed funds.

- An expense ratio of 0.75% or less is considered good for sector-specific funds or funds that invest in less liquid asset classes.

It’s also important to consider the fund’s investment strategy and performance record. A fund with a higher expense ratio may still be a good investment if it has a strong performance record and a solid investment strategy.

Ultimately, the key is to find a fund with a low expense ratio that aligns with your investment goals and risk tolerance. By doing so, you can minimize the impact of fees on your investment returns and achieve your long-term financial goals.

What Does the Expense Ratio Mean for You?

The expense ratio has a direct impact on your take-home returns. Here’s what you need to know:

- A higher expense ratio means you’ll take home less, as more returns go towards fees.

- A lower expense ratio doesn’t mean the fund is poorly managed. Skilled professionals run many funds with lower ratios and can deliver strong returns.

It’s also important to understand the difference between direct and regular mutual fund plans:

- Direct Plans: You buy the fund directly from the mutual fund company, avoiding extra costs.

- Regular Plans: You buy through an advisor, and their commission is included in the expense ratio.

Check Out FDI vs FPI

Expense Ratio Limit by SEBI

| AUM (In INR Crore) | TER for equity funds | TER for debt funds |

| 0 – 500 | 2.25% | 2% |

| 500 – 750 | 2% | 1.75% |

| 750 – 2,000 | 1.75% | 1.5% |

| 2,000 – 5,000 | 1.6% | 1.35% |

| 5,000 – 10,000 | 1.5% | 1.25% |

| 10,000 – 50,000 | Starts at 1.5% and goes down by 0.05% for every rise of INR 5000 cr in AUM | Starts at 1.25% and goes down by 0.05% for every rise of INR 5000 cr in AUM |

| >50,000 | 1.05% | 0.80% |

Frequently Asked Questions

The NAV is calculated after deducting the expense ratio. And NAV is published daily by the fund houses. Hence this ratio is deducted daily from the NAV of the fund. If the fund’s TER is 2.25%, then this means that the fund will charge 2.25% for managing your investment. Since the NAV is published every day, the fund house will deduct 2.25% from the NAV.

It is a fee that fund houses charge for managing mutual funds. It includes brokerage, commission, registrar fee, transaction costs, selling and marketing expenses, and management and advisory fee. SEBI has capped the TER for all mutual funds. For equity funds, the maximum TER that can be charged is 2.25%. For debt funds, the maximum is 1.75%. If the TER of a fund is 1.25%, then this means that the fund will charge 1.25% for managing your investment. This ratio is deducted from the NAV. Hence the profits are reduced to the extent of the TER. Therefore ratio is also an important parameter to consider while investing in mutual funds.

There is no definite number that qualifies as a good ratio. However, a fund with a lower TER may generate higher returns for the capital.

Yes, the TER is deducted automatically.

No, you cannot avoid TER. Managing a mutual fund comes with a cost. The fund management charges for managing the investor’s assets. Thus, if you are investing in a mutual fund you cannot avoid the expense ratio.

NAV is calculated after deducting the expense ratio.

Check Out IDCW in Mutual Funds

- What is Expense Ratio in Mutual Fund?

- Understanding the Expense Ratio

- Components of Expense Ratio

- How to Calculate Expense Ratio?

- Importance of Expense Ratio

- How Does the Expense Ratio Affect Fund Returns?

- Passive vs. Active Funds: Expense Ratio Comparison

- Evaluating a Good Expense Ratio

- What Does the Expense Ratio Mean for You?

- Expense Ratio Limit by SEBI

- Frequently Asked Questions

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

Show comments