Returns from an investment can be estimated using both absolute returns and CAGR. Absolute returns measure the total return from an investment, irrespective of the time period. CAGR, on the other hand, is the return from an investment during a specific period. Both absolute returns and CAGR are used to determine the return from an investment. However, they use different ways to calculate the return. This article covers absolute return and CAGR in detail and elaborates on absolute return vs. CAGR.

Absolute Return vs CAGR: What Are They in a Mutual Fund?

Absolute returns in mutual funds refer to the return from a fund over a certain period. They are the total return from the date of investment. Absolute returns are expressed as a percentage and show how much the investment has grown or depreciated.

Evaluating mutual fund performance using absolute returns helps investors understand the effectiveness of their investment strategies over a specific period.

Absolute returns are pure returns from the investment and don’t compare to any other benchmark. Also, absolute returns can be positive or negative. The fund managers of mutual funds seek a positive return by using multiple strategies like short selling or derivatives.

The tenure of the investment is the least important factor in calculating absolute returns. Only the actual investment and its current value are considered.

Understanding Absolute Returns

Absolute returns refer to the total return generated on an investment, expressed in percentage terms. It is a straightforward way to see how much an investment has grown in absolute terms between two points in time. Absolute returns are primarily concerned with only two values: the initial and final investment value or maturity amount. This metric is particularly useful for short-term investments, typically those held for less than a year.

Absolute returns are crucial for investors who want a clear and simple measure of their investment’s performance without considering the time factor. This makes it easier to understand the pure growth or depreciation of the investment. Some popular investment strategies that rely on absolute returns include futures & options, arbitrage, and leverage. These strategies often aim for quick gains, making absolute returns a suitable metric for evaluating their success.

Definition and Importance

Absolute returns refer to the total return generated on an investment, expressed in percentage terms. It is a straightforward way to see how much an investment has grown in absolute terms between two points in time. Absolute returns are primarily concerned with only two values: the initial and final investment value or maturity amount. This metric is particularly useful for short-term investments, typically those held for less than a year.

Absolute returns are crucial for investors who want a clear and simple measure of their investment’s performance without considering the time factor. This makes it easier to understand the pure growth or depreciation of the investment. Some popular investment strategies that rely on absolute returns include futures & options, arbitrage, and leverage. These strategies often aim for quick gains, making absolute returns a suitable metric for evaluating their success.

The formula for Absolute return:

The formula to calculate the absolute return is: ((Current value of the investment/ Actual investment) – 1) * 100.

Let’s understand absolute returns with an example. An investor invests INR 1,00,000 in a mutual fund. Over a certain period, the investment grows to INR 3,00,000. The absolute return from this investment can be calculated using the above formula.

Absolute return = (300000/100000 – 1) * 100

The absolute return on the above investment is 200%. The tenure of the investment is not considered while calculating the return. The 200% return could’ve been earned over months, years, or decades. Using absolute return alone, one cannot determine whether the investment is good or not, as the tenure of the investment isn’t known.

Therefore, absolute returns only tell how much the investment depreciated or appreciated. It doesn’t tell how fast the investment grew or fell. Hence, absolute returns cannot be used to compare two different investments.

What is the Compound Annual Growth Rate (CAGR) in a Mutual Fund?

CAGR (Compounded annual growth rate) is the rate of return from a mutual fund during a specific period of time, assuming the profits are reinvested. In other words, CAGR shows how much the investment has grown from the beginning to ending value over some time.

CAGR shows the rate at which an investment grows each year to reach its final value. It smoothes out a fund’s performance so that it is easily understood and comparable to other investments. One can use CAGR to compare two investments and determine which has performed better during a specific period.

The formula for Compounded Annual Growth Rate CAGR

CAGR = ((Ending value/ Beginning value) ^ (1/n)) – 1

Where n is the tenure of the investment

Let’s understand CAGR better with an example. An investor invested INR 2,50,000 in a mutual fund, which grew to INR 4,00,000 in 3 years. The CAGR of this investment can be calculated using the above formula.

CAGR = ((400000/250000) ^ (1/3)) – 1

CAGR = 16.96%

This means the investment grew 16.96% every year for three years to reach INR 4,00,000. In other words, the average return from this mutual fund is 16.96%. The absolute return from this investment is 60%, but the CAGR is 16.96%.

CAGR enables investors to compare multiple investments and helps them plan their financial future. Let’s say an investor has an opportunity to invest in stocks and bonds with a CAGR of 18% and 15%, respectively. The investor will choose stocks because they have a higher CAGR than bonds.

Moreover, CAGR can be used to estimate an investment’s average growth. Due to market volatility, an investment might grow by 10% one year and only by 2% the other year. CAGR helps smooth out the returns and gives a better picture of an investment’s overall growth.

Calculating CAGR can be a time-consuming process. Hence, one can use a CAGR calculator to estimate returns from a mutual fund investment. Scripbox’s CAGR calculator is a simple online tool that helps calculate the CAGR of an investment to analyze an investment opportunity.

Enter the initial value, final value, and investment tenure. The calculator will estimate the CAGR within seconds.

Uses of CAGR

The Compound Annual Growth Rate (CAGR) is a handy tool for anyone managing money. It’s not just a fancy term—it helps you make better choices with your investments. Here’s how it can help:

- Check How Investments Grow

CAGR shows how much an investment has grown over time. Instead of focusing on how returns change each year, it gives you a steady, average growth rate. This makes it easier to understand how well your investment is doing in the long run.

2. Compare Different Investments

If you’re choosing between two investments, CAGR can help. It shows growth in a way that’s easier to compare. Unlike total growth (absolute return), CAGR includes the effect of compounding, giving you a clearer picture.

3. Set Goals for the Future

CAGR helps you plan. You can see how much your money might grow and check if your investments are on track to meet your goals, like saving for a big purchase or retirement.

4. Check Business Growth

Businesses also use CAGR to see how their sales, profits, or value are growing. It shows if the growth is steady and likely to continue.

5. Plan for the Long Term

Whether you’re saving for retirement or a child’s education, CAGR helps you figure out how long it will take to reach your target. It’s a simple way to plan ahead.

Difference Between Absolute Return Vs CAGR

Investments are made to earn profits, and understanding what is the difference between absolute return and CAGR is crucial for evaluating investment performance. There are different ways to represent returns from an investment. Absolute returns are a simple method that helps determine the return from an investment, irrespective of the period or tenure of the investment. Absolute returns simply take the initial investment amount and the maturity amount. On the other hand, compounded annual growth rate considers the investment duration or tenure. Hence, it gives a more accurate and comparable earnings percentage.

The key is the difference between absolute return and CAGR lies in how they account for the investment period, with CAGR providing a more accurate measure over time.

The formula for Absolute return

((Current value of the investment/ Initial investment) – 1) * 100.

The formula to calculate CAGR

CAGR = ((Ending value/ Beginning value) ^ (1/n)) – 1

Where n is the tenure of the investment

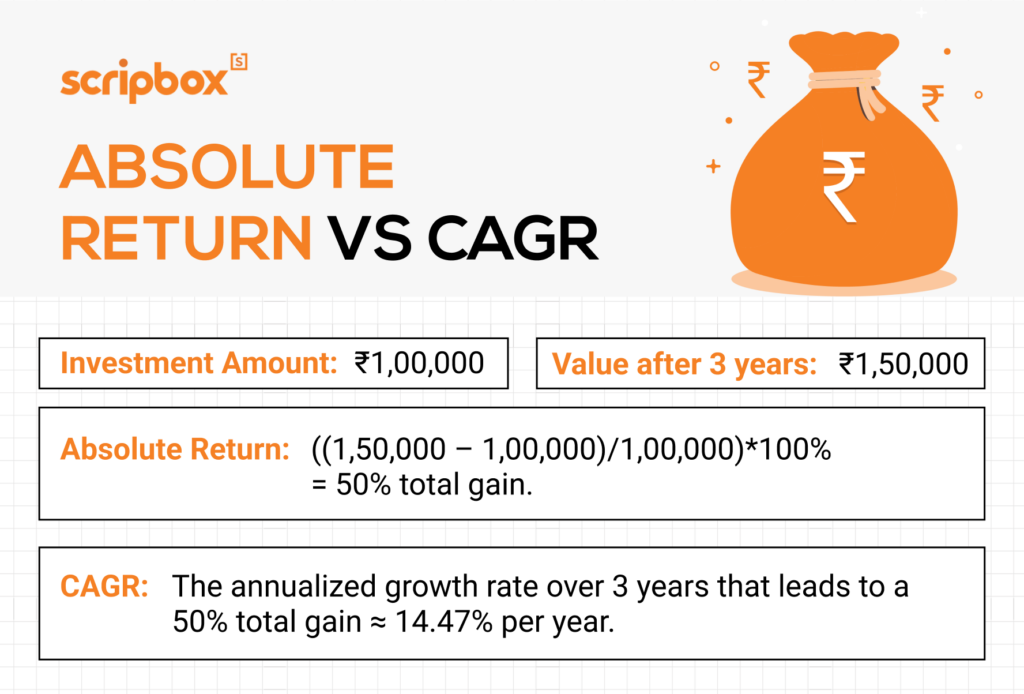

Example for Absolute Return Vs CAGR

To better understand the difference between absolute return and CAGR, let’s take Mr Krishna, who invested INR 5,00,000 in a mutual fund in 2010. He withdrew the investment in 2020, and the value of the investment is 8,00,000.

The absolute return for Mr. Krishna is ((8,00,000/5,00,000) – 1) * 100

Absolute Return = 60%

While, the CAGR is ((8,00,000/5,00,000)^(1/10)) – 1

CAGR = 4.81%

While the above absolute return looks promising, the investment has grown only 4.81% yearly for ten years.

Absolute returns tell how much an investment depreciates or is appreciated. And it doesn’t tell how fast the investment grew or fell. Therefore, absolute returns are not ideal for comparing two different investments.

On the other hand, CAGR can be used to determine an investment’s average growth. With volatile markets, the returns are never the same over the years. For example, an investment might grow by 12% one year and only by 5% the other year. Therefore, CAGR addresses the volatility and smoothens out the returns. Hence, it gives a clear picture of an investment’s overall growth. Also, it is a good measure to compare different investments.

In short, if the absolute return is the distance your investment has traveled, then CAGR is the rate at which your investment has traveled or grown.

CAGR Vs Absolute Return – Which is Better?

Both absolute returns and compounded annual growth rates are useful in determining an investment’s returns. However, the difference between the two lies in time consideration. For investments with longer durations, the CAGR value is a better measure. CAGR determines an investment’s annual growth rate, whose value fluctuates over the investment tenure. On the other hand, absolute returns consider only an investment’s purchase and sale values to calculate returns.

One can consider the absolute return for investments with a duration of less than a year. For investments with tenure greater than a year, CGAR gives a better picture. Also, with CAGR, one can compare two or more investments held for different periods. When it comes to tenure less than one year, CAGR may inflate or shrink the returns, therefore not giving the actual return.

Frequently Asked Questions

Annualized return is the measure of an investment’s performance during a specific period. In other words, annualized return shows how much your investment has grown from the beginning to ending value over a certain period of time. It is the same as CAGR.

To convert absolute returns to CAGR, one should take the nth root of (Current value of the investment/ Actual investment) and subtract 1 from it. In other words,

((Current value of the investment/ Actual investment)^(1/n)) – 1 will give the CAGR value.

CAGR considers the tenure of an investment and helps in determining the annual growth rate. On the other hand, absolute return considers only the investment value and the maturity value. Therefore, the absolute return cannot be used for comparison of different investments. Hence, CAGR is a good metric that helps investors compare the performance of different investments. It also gives a complete picture of the gains made from your investments. Furthermore, for investments with a tenure of more than one year, CAGR gives a better picture of the returns. Finally, CAGR determines the return from an investment over a specific period of time while taking into consideration the market volatility.

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Absolute Return vs CAGR: What Are They in a Mutual Fund?

- What is the Compound Annual Growth Rate (CAGR) in a Mutual Fund?

- Uses of CAGR

- Difference Between Absolute Return Vs CAGR

- CAGR Vs Absolute Return – Which is Better?

- Frequently Asked Questions

Show comments