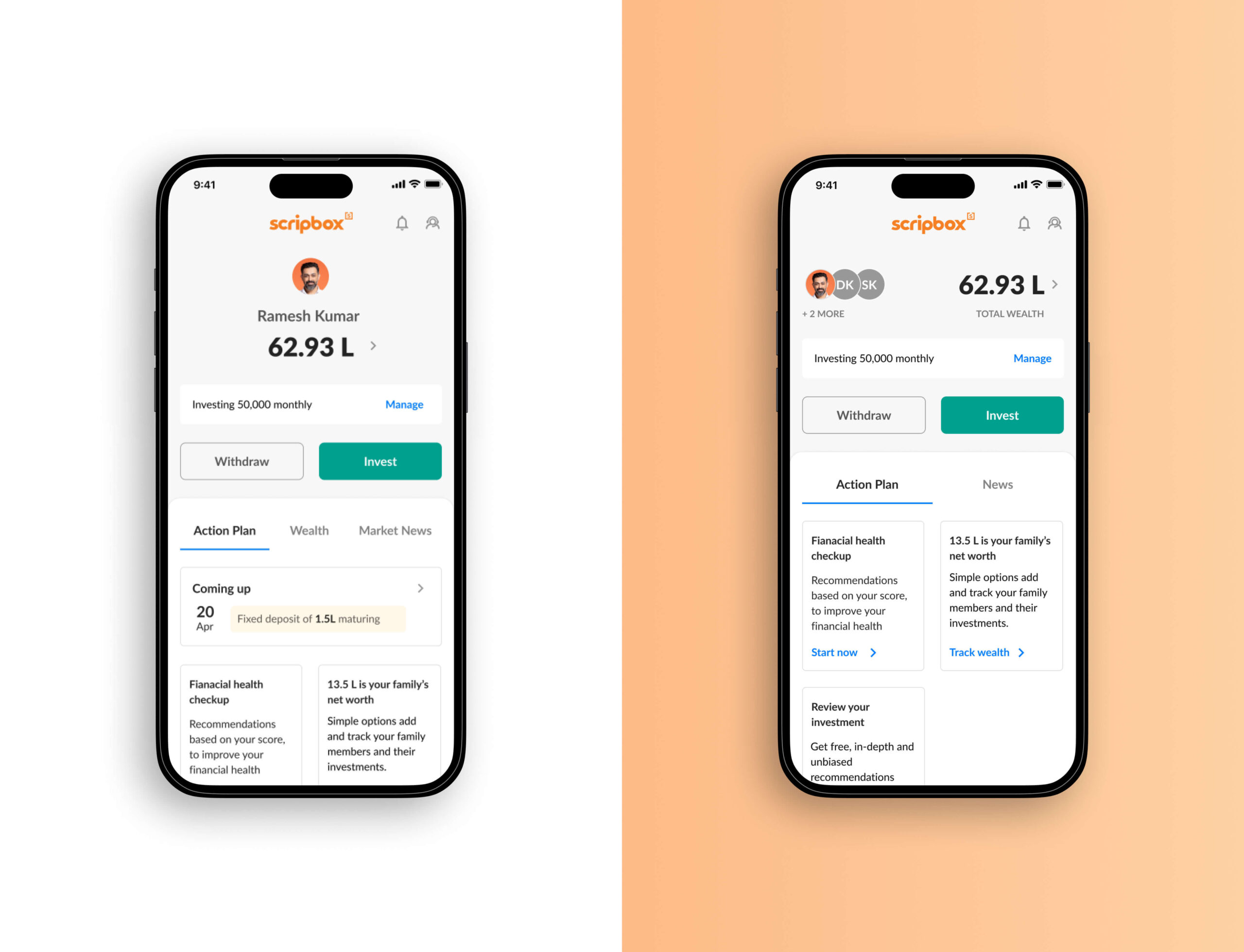

We heard you! Your Scripbox app is changing for the better.

You wanted a better Scripbox app? Well, we are making it happen!

FED Hikes the Repo Rate by 75 Basis Points

Another expected rate hike from the US Fed has increased the chances of a recession in the US. This is unlikely to influence the Indian central bank’s thinking on rate hikes. The impact on your investments is muted so far but the situation calls for prudent asset allocation on the part of investors.

Currencies Swing Wildly across the Global Market

The global rise in uncertainty amidst rising interest rates is leading to the strengthening of safe haven dollar. This is impacting other global currencies, including the Rupee. Expect near term volatility in your portfolio. Look at your asset allocation before adding to equity in the current environment.

Why have recommendations been disabled for me?

Of the 43 mutual fund companies, only 3 now permit online investing by US/Canada NRIs. This reduces the universe of options and severely impacts the ability of our algorithms to make the right recommendations. As we are not able to...

Will I still be able to see my Investment journey in MyWealth?

Yes, your investment journey will be shown as a consolidation of all plans that you have invested in. Please note Core Mutual Fund Portfolio is a consolidation of the following plans - Long term wealth, Tax saver plan, Core mutual...

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

Why is my XIRR different from what it was before?

Due to consolidation of different plans, XIRR has been updated according to the new consolidated plan. XIRR at a mutual fund level will still be specific to that particular folio.

Will I still be able to download my tax statement?

Yes, your tax statements will still be available in ‘Statements > Tax Statements’.

Where can I find my tax saver plans?

All tax saver plans have been clubbed under Core Mutual Fund Portfolio.