What is a Pension Policy?

Pension policy or a pension plan is a financial product that aims to provide financial independence, stability, and security to retired residents and senior citizens. All pension policies have a predetermined and common goal of providing social security to its investors. A pension plan includes regular income plans, assured benefit on death, surrender, or vesting, lumpsum benefit, etc. An investor or a subscriber may invest in a pension policy or a pension plan with a government backed establishment like Department of Post, with private and scheduled banks, and other financial institutions.

What are the Types of Pension Policies in India?

In India, the pension plans are categorized into two types.

- Personal Pension Plan

- Work-Based Pension Plan

Personal Pension Policy

Individuals purchase personal pension policies out of their interest from a life insurance company. These pension plans are in no way linked to the employer. The premiums paid on these plans get invested in funds as per the investor’s risk understanding and future goals. Personal pension plans are further categorised into three different plans.

- Deferred annuity plans: The pension payment of these plans will start only after a deferment period chosen by the policyholder. The premium payment can be ‘single payment’ or ‘regular premium’. For example, if the policyholder chooses a 30-year plan, then the annuity payments start after 30 years from the policy initiation.

- Immediate annuity plans: The annuity payments for these plans will start immediately or within one year from the date of policy initiation. The only premium payment option available is a single premium. The annuity payment frequency can be monthly, quarterly, half-yearly, or yearly as per the policyholder’s choice.

- Pension plan with or without a life cover: A pension policy with life cover pays the full sum assured to the nominee in case the policyholder, unfortunately, dies during the accumulation stage. A pension plan without life cover pays the corpus accumulated till date to the nominee plus the interest upon the unfortunate death of the policyholder during the accumulation stage.

Work-Based Pension Policy

Work-based pension plans are those plans offered by the employer to the employees—both the current employer and employee contributions to the pension fund on a monthly or yearly basis. While the employer adds money to the pension fund of the employee, the employee’s contribution is deducted from the salary. Work-based pension plans are further categorized into three types.

- Defined Benefit: The defined benefit plan calculates the benefits based on the number of years left in service and salary.

- Defined Contribution or Money Purchase Plan: The benefits of this plan are calculated based on the employer and employee contributions and the performance of the investments made with these contributions.

- Hybrid: It is a plan that combines both a defined benefit plan and a defined contribution plan.

What is the LIC Pension Policy?

The Life Insurance Corporation of India (LIC India) has pension policies for senior citizens and those who want to secure their future post-retirement. The pension plans of LIC provide a steady flow of income during the retirement years. LIC offers three different pension plans namely,

- LIC Jeevan Shanti: This policy is a single premium payment policy. One can choose an immediate annuity payment or deferred annuity payment as per their suitability. The annuity rate is determined at the time of policy initiation, and the annuity payments are made throughout the lifetime of the annuitant.

- LIC Jeevan Akshay – VII: This policy is an immediate annuity policy. The investor can choose from 10 different annuity options. The rate of the annuity is decided and guaranteed at the time of initiation. The policyholders will receive pension payments throughout their lifetime.

- Pradhan Mantri Vyaya Vandana Yojana: The Government of India has launched this scheme to provide a retirement benefit to individuals. The Ministry of Finance decides the pension rate on a yearly basis. The current rate is 7.4% and is applicable until 31st March 2021. The policyholders will receive pension payments throughout their lifetime.

LIC policies allow one to choose the vesting date. Vesting date is the date when one chooses to receive a pension, which coincides with the date that one chooses to retire. LIC pension policy not only gives a regular and hassle-free income. It also guarantees payments for life and is a good alternative for people in the private sector.

Things to Consider While Selecting Pension Plans

One of the popular pension plans available to individuals is the annuity. To choose the best pension plan one needs to consider the following aspects:

- Timing: If anyone needs immediate annuity payments, then the annuity plan is the right choice. Also, in case one needs regular pension payments to start after retirement, then, they should opt for a deferred annuity plan. Furthermore, the choice also depends on the age of the individual. If one is at the start of their career, then the deferred plan is suitable. While, for an individual who is retiring or retired, lumpsum payouts are beneficial.

- Variability: Annuities are two types, fixed annuity and variable annuity. Fixed annuity ensures guaranteed payments. In contrast, variable annuity payouts depend on the performance of the underlying investment. Therefore, an individual seeking a low volatile source of income can choose a fixed annuity plan. The returns for these are low, however regular. In contrast, individuals with a greater tolerance for risk can opt for a variable annuity. These can generate significant returns.

- Coverage: An annuity plan offers cover for either a single individual or joint. A joint annuity covers for another person’s, and they’ll continue to receive regular annuity payments for a lifetime. Therefore, in case one wants to cover for their spouse as well can opt for a joint-life annuity. This way, they can secure the future for their partner.

Frequently Asked Questions

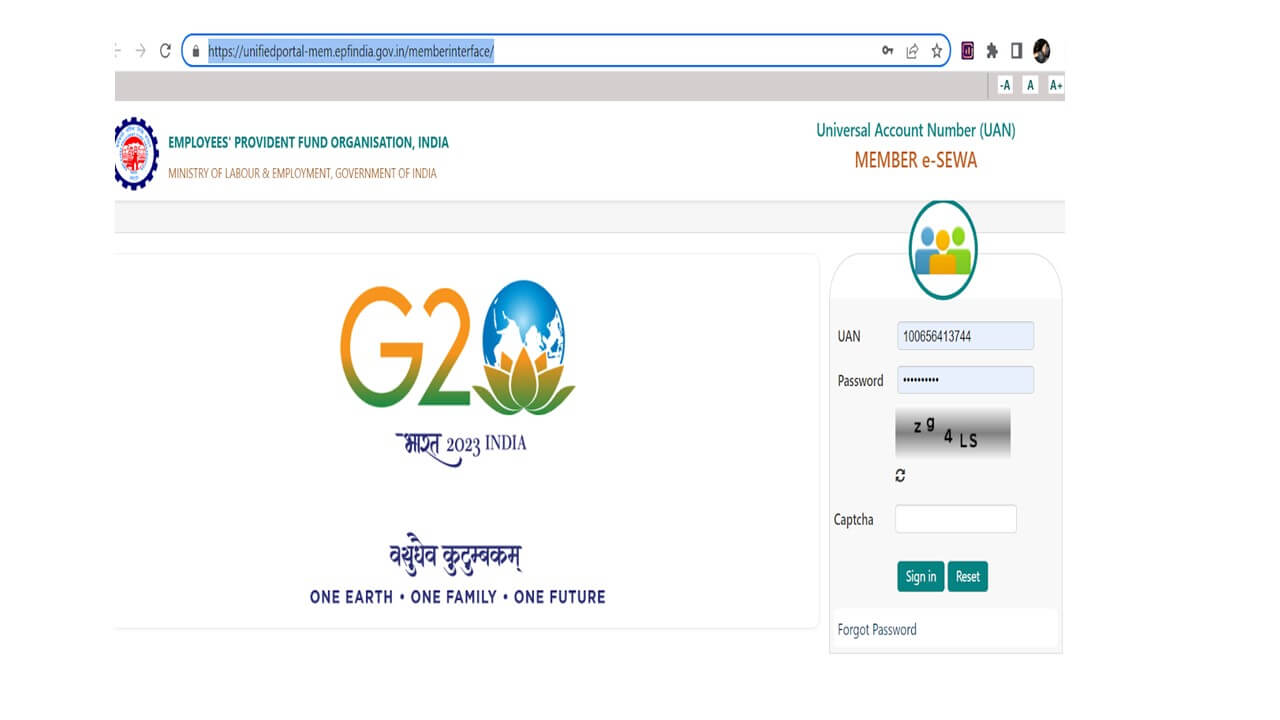

Members of the Employees Provident Fund Organisation (EPFO) can withdraw an early pension provided they have completed ten years of service and are 50 years and above, but below 58 years. However, the pension will not be paid in full. Members will get 4% less pension for every year below 58 years. This is a penalty for withdrawing early.

Withdrawal of pension money from the pension account is feasible in the following two situations: Suppose an individual completes ten years of service on the date of exit (the last day of their employment with a company or organization). Or has reached the age of 58 years, whichever is earlier. In these scenarios, the member is eligible to withdraw a lump sum amount from their EPS account.

Certain Pension schemes offer death benefits. In other words, when a person dies, their beneficiaries can get access to retirement savings. Furthermore, the beneficiaries are not liable to pay any inheritance tax.

Government Pension Payment- An employee must be in service for at least ten years to be eligible for a pension. The Central Government servant who is retiring must be in ten years of qualifying service to get a pension as per the Pension Rules.

Currently, the minimum pension amount per month is INR 9,000. The maximum pension limit is capped at 50% of the highest pay in the GOI. It is currently INR 1,25,000 per month.

The employee can also opt to receive a maximum of up to 40% of the pension amount as a lump sum. A medical examination isn’t necessary for such claims within one year of retirement. Furthermore, in the case of the death of the pensioner, their spouse or beneficiary can claim the pension amount.

Private Pension Payment- For private pension payments, the beneficiary can take the pension amount as a lump sum or use it to purchase an annuity or invest in drawdown. Furthermore, the beneficiaries have only two years to claim for the death pension. Post two years of the pensioner’s death, the beneficiary has to pay a certain tax on the claim amount.

Pension payout primarily depends on how one wishes to need the money. Taking a pension will ensure a regular stream of cash flows and will be a source of income till death. Even after death, the spouse can benefit from regular income. In contrast, lump-sum payouts are suitable for individuals who have to wish to invest or have other plans for retirement that require to have cash in hand.

Also, getting a lump sum amount is quite tempting; however, it is a life decision that varies from individual to individual. Lump-sum payments give access to a large sum of money that one can either invest or spend.

A decision of lump sum or monthly pension shall also have an impact on dependents. For example, pension payments shall stop after the death of the member and their spouse. While, with lump-sum distribution, a beneficiary can receive the leftover money upon the death of the member and their spouse.

Furthermore, unless there are other commitments to fulfil, or have other sources of income, it is not advisable to take a lump sum payout. During retirement, a regular source of income will help in leading stress and worry-free life. Therefore, depending on one’s plan for retirement, it is a personal decision to choose the type of payout.

Show comments