A Public Provident Fund (PPF) is ideal for small investors looking at creating long-term wealth. You can invest small amounts of money regularly and accumulate a large corpus to fulfill your long-term goals. In fact, you can earn tax benefits as well upon your PPF investment in HDFC Bank. In this article, we will let you know how to open PPF account in HDFC Bank.

Things to Remember before opening HDFC PPF Account

You can open a PPF account in HDFC Bank online or by visiting a bank branch. If you are an existing HDFC Bank customer, you can easily open a Public Provident Account in HDFC online. Following are the important points you must remember to open the PPF account online.

- The process is available 24X7.

- The process is instant and paperless.

- HDFC Bank Savings Account holders only can avail the online account opening facility.

- Net Banking/ Mobile Banking services must be enabled for your account to be linked to PPF.

- You must link your ‘Aadhaar’ number to your HDFC account.

- The mobile number linked to your Aadhaar should be active. You will receive an OTP on the mobile number for e-signing/ e-authorizing the opening of the PPF account online.

How to Open PPF Account in HDFC Online?

Time needed: 10 minutes

Following is the step by step procedure to open PPF Account in HDFC Bank.

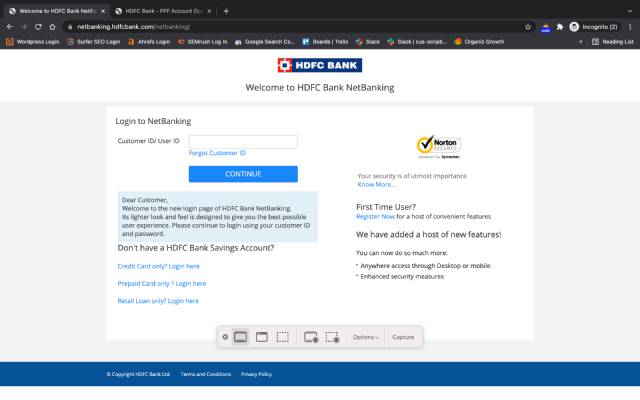

- Login to HDFC Net Banking.

Log in to your HDFC Bank Net Banking on the bank portal.

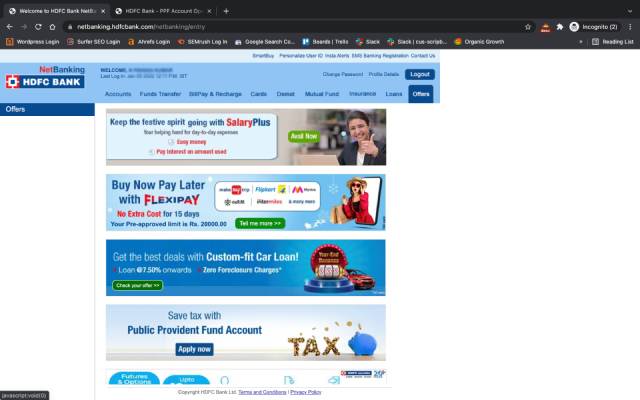

- Visit Offers Tab

Click on the banner ‘Public Provident Fund’ under the ‘Offers’ tab.

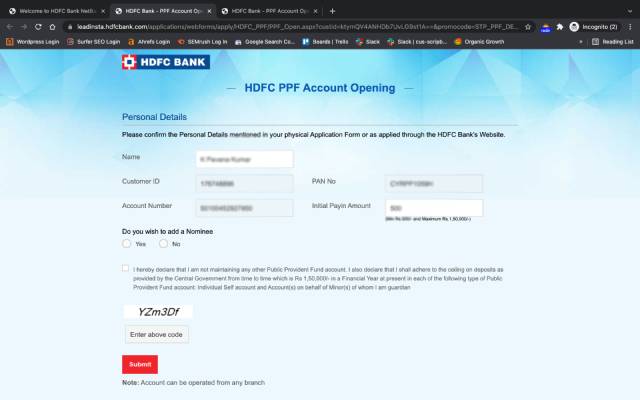

- Verify Personal Details & Enter the amount to Deposit

Your details will appear on the next screen. Verify and accept them by clicking ‘Confirm’ & Enter the amount you wish to deposit in your HDFC PPF Account.

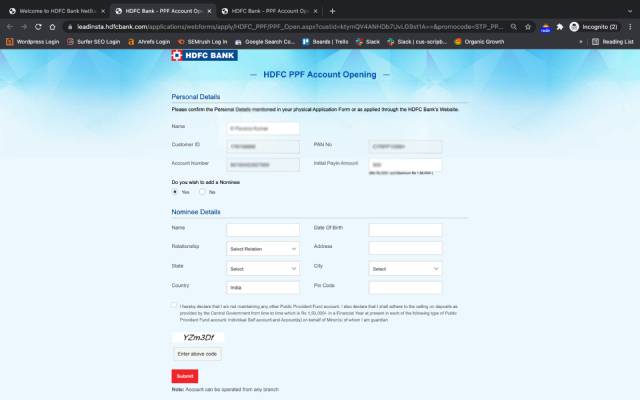

- Add the Nominee & Click on Submit Button

If you want to add a nominee, provide the nominee details & Click submit to save the details.

- Get the Congratulations! Message on the Screen.

You will get a message that your account will open in one working day.

Use Scripbox’s HDFC PPF Calculator tool that provides an estimate of interest earned, maturity value for a given amount invested and investment period.

How to Open a PPF Account in HDFC Offline?

- You must visit an HDFC Bank branch to acquire a PPF account opening form. Download the form online as well by visiting the Post Office website.

- The duly filled form must then be submitted, along with KYC documents and passport size photograph at the bank branch.

- You must also make a minimum deposit of Rs. 500 to open the PPF account. However, you can later make the maximum deposit of Rs. 1.5 Lakh as allowed in a financial year.

- Upon successful submission of all the documents and the initial deposit, your PPF account will be opened. You will also receive a passbook for the PPF Account with details such as the name and PPF Account number.

Documents Required to Open a PPF Account in HDFC

- Any Government-issued identity proof (Voter ID/ PAN Card/ Aadhar Card)

- Proof of residence

- Passport size photographs

- Pay-in-slip for the initial deposit (available at the post office)

- A nomination form with details of the nominee

READ ALSO

- Bank of Baroda PPF Account

- Post Office PPF Account

- Axis Bank PPF Account

- SBI PPF Account

- PPF Interest Rate

Related Articles

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Things to Remember before opening HDFC PPF Account

- How to Open PPF Account in HDFC Online?

- How to Open a PPF Account in HDFC Offline?

- Documents Required to Open a PPF Account in HDFC

Show comments