What Is SIP? A Simple Guide to Systematic Investment Plans

A Systematic Investment Plan (SIP) is a simple way to invest in mutual funds by putting in a fixed amount of money at regular times—like a fixed date on each month. This method helps you build your investment portfolio over time. By investing regularly, SIPs help you develop a disciplined savings habit and can potentially lead to significant wealth accumulation over the long term. It is especially helpful for investors with regular streams of income Eg. Salaried Employees.

How Does SIP Work?

A Systematic Investment Plan (SIP) allows you to invest a fixed amount in mutual funds regularly, usually every month. When you invest through SIP, your money buys units of a mutual fund at the prevailing NAV. By investing regularly, you can also balance the cost over time.

The true value of SIPs is in the savings habit that it instills in individuals. By automating the investment process, the investors have a higher probability of making that investment rather than spending the amount.

Here’s how SIP works:

- Fixed Investment Amount: You decide on a set amount to invest monthly.

- Regular Investments: SIPs are automated on a specific date each month, building investment discipline.

- Buying Units: Your money buys units based on the fund’s Net Asset Value (NAV) at the time. NAV is the value of each unit of the mutual fund on a given day, calculated by dividing the total value of the fund’s assets by the number of units outstanding.

- Rupee-Cost Averaging: SIPs tend to spread the investment over time and thereby average out the cost of units purchased

SIPs generally work best over the long term. With regular investments, rupee-cost averaging, and compounding, your money has time to grow steadily.

How Does SIP in Mutual Funds Work?

Stage 1 – SIP Mandate

Investors need to give a mandate (authorization to invest via SIPs) to invest in MF This can be done online by selecting the “Systematic Investment Plan” option while you are investing. But for the offline method, you need to fill a mandate form and submit it along with the application form. Also, on the form, you need to indicate your choice for the date (on which the amount will be invested) and the amount. If done subsequently, then the mandate forms can be submitted online through your MF account.

In the offline method, you need to submit the mandate to the office of the mutual fund house, Karvy, or CAMS.

Stage 2 – Auto Debit/ ECS

When you give a mandate, the fund house auto-debits your bank account for the indicated Investment amount through standing instruction. The funds are then transferred through ECS for investing in a MF scheme. Likewise, the subsequent investment amounts will also be auto-debited at your indicated Systematic Investment Plan interval. This way, you need not worry about missing any payments.

Stage 3 – Allotment of Mutual Fund Units

The amount debited from your bank account is utilised for purchasing MF units. And, you are allotted MF units at the closing NAV of the day of money transfer or realisation of the cheque. Let us understand how it works with the help of an example.

Suppose you start a Systematic Investment Plan of Rs. 1000 on the 5th of a particular month. Then Rs. 1000 will be auto-debited from your specified bank account on the 5th of every month and will be utilised in buying units of the MF. Also, the MF units will be purchased at that day’s closing NAV.

With every payment, you will receive units of the particular MF scheme, which will get added to your mutual fund account. Hence, Systematic Investment Plan is like indicating “How Much” and “How Often” you will invest in a mutual fund scheme.

Recommended Read: How to Invest in SIP?

When to Invest in SIP?

SIPs allow you to invest without stressing about market timing. Here’s when to make the most of a SIP:

- Start Early: Beginning early gives you an advantage, as compounding has more time to grow your money. Even small investments made early can add up.

- Long-Term Goals: SIPs work best for goals five or more years away, like higher education for your children or retirement planning.

- Market Conditions: SIPs don’t require perfect timing. SIP’s real power lies in consistent investments rather than market highs or lows.

- Financial Stability: Invest only what you can manage comfortably each month, as SIPs benefit from uninterrupted investments.

- Consistent Income: SIPs are ideal for regular income earners. Set your SIP close to payday to make investing a monthly habit.

In short, any time is generally a good time to start a SIP, but starting early and sticking with it long-term can help you gain the most.

Types of SIP

There are a few common types of SIPs that cater to different investment needs:

- Regular SIP: You invest a fixed amount on the same date every month. This helps you stay disciplined with your saving and investing habits.

- Flexible SIP: This type lets you change the amount you invest based on your current financial situation. It gives you more flexibility to adjust your investments when needed.

- Top-Up SIP: You can increase your investment amount from time to time to match your income growth. This helps you reach your financial goals faster.

- Perpetual SIP: This SIP continues until you decide to stop it. It offers a longer time to build wealth, giving you a broader horizon for your investments.

Each type of SIP helps you invest in a way that matches your financial goals and how much money you have available.

Benefits of SIP

Investing through SIPs comes with many advantages, especially if you want to grow your money steadily without stressing about market timing. Here are some main benefits:

- Builds Investment Habit: With SIP, you invest a fixed amount regularly, making it easy to develop a habit.

- Power of Compounding: When you keep your money invested over time, your earnings also generate additional returns. This “earning on earnings” can greatly grow your wealth if you stay invested long-term.

- Flexibility: SIPs let you start small, sometimes with as little as ₹500 per month. You can also increase your SIP amount over time to match your financial growth.

- Rupee-Cost Averaging: By investing regularly, you buy more units when the market is down, but lesser units when the market is up. This balances out the cost per unit over time.

In summary, SIPs help you save and grow your money step-by-step without needing a large initial amount or perfect market timing.

How to Calculate Capital Gain on Mutual Fund SIP?

Calculating capital gains on mutual fund SIPs means figuring out how much profit you made from your investment. Capital gains can be short-term (if units are sold within 1 or 3 years depending on the asset class) or long-term (if sold after 1 or 3 years depending on the asset class). Here’s how to calculate it:

- Track Each Investment Date: Since each SIP instalment has its purchase date, you need to check how long each instalment was held.

- Determine Purchase and Sale Prices: Subtract the purchase price from the sale price from each of the investments you make.

- Separate Gains by Duration: Classify gains as short-term or long-term based on Asset class and how long you have held the units.

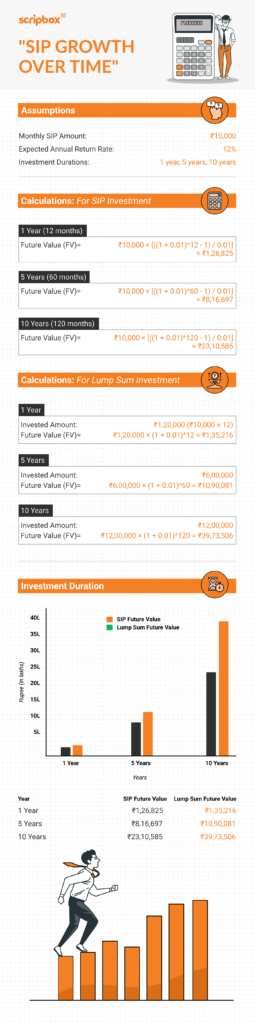

How to estimate SIP outcomes? (Using a SIP Calculator)

An SIP calculator is a tool that shows returns based on the invested amount, rate of return, and time period.

- Total Investment: Multiply the monthly SIP amount by the number of instalments (months).

- Estimated Returns: Use an SIP calculator by entering the monthly investment, expected annual return rate, and period. The calculator will show how much your investment may be worth.

Example: Let’s say you invest ₹1,000 monthly for 5 years at a 12% annual return. Using an SIP calculator, you’ll see that the total investment of ₹60,000 could grow to about ₹81,000, giving a profit of ₹21,000.

What to know before starting SIP?

Starting a SIP investment plan is a great way to build wealth, but it’s important to keep a few things in mind to make the most of it:

- Investment Goal: First, decide on a clear goal—like saving for a home, education, or retirement. Knowing your purpose helps you pick the right mutual fund.

- Investment Duration: SIPs work best when held for the long term. The longer you invest, the more your money can grow due to compounding and market growth.

- Risk Level: Different funds carry different levels of risk. For example, equity funds have high growth potential but are riskier, while debt funds are more stable but offer lower returns.

- Monthly Investment Amount: Choose an amount you can afford consistently. Even small amounts add up over time, so start with what’s comfortable.

- Fund Performance: Research the mutual fund’s past performance and fund manager’s track record. While past results don’t guarantee future returns, a well-managed fund often performs better.

Flexibility to Increase SIP: Some SIPs allow you to top up, meaning you can increase your monthly investment over time, which can speed up goal achievement.

Best Mutual Funds to Invest In 2024

| Fund Name | Category | Return Since Inception |

| Canara Robeco Bluechip Equity Fund | Large Cap Fund | 12.2% |

| Parag Parikh Flexi Cap Fund | Flexi Cap Fund | 18.5% |

| Canara Robeco Emerging Equities Fund | Large & Mid Cap | 16.7% |

| Nippon India Value Fund | Value Fund | 16% |

| Mirae Asset Tax Saver Fund | Tax Saving | 17.3% |

| DSP Tax Saver Fund | Tax Saving | 14.3% |

| Franklin India Feeder Franklin U.S. Opportunities Fund | US Equity | 14.8% |

| ICICI Prudential US Bluechip Equity Fund | US Equity | 15.2% |

| Kotak Gold Fund | Gold | 7.3% |

| HDFC Gold Fund | Gold | 5.4% |

| ICICI Prudential Liquid Fund | Liquid | 7.1% |

| HDFC Overnight Fund | Overnight Fund | 5.8% |

| Nippon India Arbitrage Fund | Arbitrage | 6.8% |

| HDFC Floating Rate Debt Fund | Floating Rate | 7.8% |

| Aditya Birla Sun Life Money Manager Fund | Money Market | 6.8% |

| Aditya Birla Sun Life Savings Fund | Ultra Short Duration | 7.4% |

Recommended Read: Best Mutual Funds for SIP

Features of Systematic Investment Plan

Small Investment Plan

As the name suggests, SIP full form can also be a Small Investment Plan. SIP helps you start a mutual fund investment with a smaller amount in comparison to a lump-sum where you need a larger sum of money for investment.

You can start an SIP for an amount as small as Rs. 500 per month. As your income grows , you can increase the Systematic Investment Plan amount.

Regular Investment Intervals – SIP Approach

SIP in mutual fund means it allows investment at regular intervals. You have the flexibility to choose the investment cycle, be it, weekly, monthly or quarterly. A regular investment approach makes you disciplined in savings and investments.

The regular investment is a better option for investors as compared to a one-time single investment. Your investment is spread over time and you benefit from rupee cost averaging.

Fixed Investment Amount

SIP investment is that the investment amount is fixed when starting a Systematic Investment Plan. However, you can use the “SIP-Top Up option” offered by various mutual fund houses to make an additional contribution.

Systematic Investment Plan amount cannot be decreased. You need to cancel the existing Systematic Investment Plan and start afresh if you want SIP investment plan for a lower amount.

Option to Pause Investment

You can ‘pause’ the investment for a temporary period of one month to three months. Which is useful if you face financial crunch. The Systematic Investment Plan does not stop during ‘pause’. It starts automatically at the end of the pause period. You need to check with your mutual fund house for the pause facility.

Flexibility to Shorten or Extend the SIP Interval

It provides you the flexibility in changing your investment intervals into weekly, monthly, or quarterly SIPs. You can make an online or a written request to change your existing SIP interval.

No Cap on Maximum SIP Amount

The minimum amount of SIP investment is Rs. 500. It gives you the benefit of investing a smaller amount.On the other side, there is no restriction for the maximum amount for SIP investment plan. You can choose to invest Rs. 1000, ten thousand, lakhs or even a higher amount using Systematic Investment Plan. As an investor, you have the flexibility to invest any sum of money through SIP investment plan. But make sure that you have the fixed Systematic Investment Plan amount on a regular basis for the period of the Systematic Investment Plan.

Cancel SIP

SIP investment comes with the option to cancel. If you want to stop your SIP investment plan or cancel for any reason, then you can do so by logging into your account online and opting for canceling the SIP anytime. The offline method would require you to fill the SIP cancel form and submit to the mutual fund house. Additionally, you can remove the AMC as a biller from your bank account.

Factors to Consider While Starting SIP Investment Plan

Keep the following factors in mind while investing in SIP:

SIP Amount

SIP amount meaning is that You have the flexibility to choose the investment amount. You can start Systematic Investment Plan with a minimum amount of Rs. 500. Pick any amount depending on your monthly income (cash flows) and the investment objective. For example, if you are in a position to save and invest Rs. 5,000 monthly for purchasing your dream car then do that.

SIP Investment Plan Tax Benefits

If your investment objective is tax savings then you can do an SIP of Rs. 12,500 per month to get Rs. 1.5 Lakhs tax deduction under section 80C of the Income Tax Act. There is no upper limit for the SIP amount.

SIP Frequency

The frequency of SIP investment Plan is usually weekly, monthly or quarterly. SIP mode of investment depends entirely on you. Analyse your cash flows to know when you receive money. For example, the salaried person gets a monthly income. For him, a monthly SIP frequency is best. The best way is to choose a SIP frequency is to pick a period that is aligned with your cash flows.

SIP Tenure

The SIP tenure can be one year, three, five or ten years until your investment objective is fulfilled. In case of open-ended mutual funds, you can even have a Perpetual SIP that will continue forever until you stop it. Hence, there is no fixed tenure, you can keep on investing until your financial goal (investment objective) is achieved.

Purpose

Systematic Investment Plan is not an investment instrument. The Systematic Investment Plan objective is the same as the investment objective of the mutual fund. For example, if you are investing through Systematic Investment Plan in Equity mutual funds to build a corpus for retirement, then your Systematic Investment Plan purpose is for retirement.

Likewise, if you are investing in Debt mutual funds having an investment objective of providing liquidity (goal – emergency funds). Then your Systematic Investment Plan purpose is creating emergency funds.

How to Calculate Capital Gain on Mutual Fund SIP?

Capital gains are profit made from the sale of an asset such as land, property, mutual funds, shares etc. To calculate capital gains, mutual funds are classified into types, namely, equity and debt funds. For equity funds, the short term is any time before one year from the purchase of the fund. While the long term is after one year from the purchase of the mutual fund. For debt funds, short term is any time before 36 months or three years from the date of purchase. While the long term is any time after 36 months from the date of purchase.

Systematic Investment Plan can be done for both equity and debt funds. However, it is usually preferred for equity funds. Capital gains can be estimated using the following formula:

Capital Gains = Value of the fund (at the time of sale) – Cost of the fund.

In SIP investment done on a monthly basis, each Systematic Investment Plan is considered as an independent investment. For example, when an investment is made in January 2026, the long term for that investment will be in January next year. Similarly, for an investment in February 2026, February next year is when the investment will be considered long term. So when an investor redeems the investment before completion of one year, it is considered a short term.

Example

The number of units Mr Karthik received in January was 1,000 (10,000/10), and February was 909 (10,000/11)

The capital gain for January would be:

(INR 15 – INR 10 ) * 1000 units = INR 5,000

The capital gains for February would be:

(INR 15 – INR 11) * 909 units = INR 3,636

The gains from January would be long term capital gains, and the gains from February would be short term capital gains.

How to Withdraw Money from a SIP Mutual Fund?

An investor can choose to withdraw their investments either periodically or as a lump sum. In other words, one can choose the Systematic Withdrawal Plan (SWP) route in case they want to cash out at regular intervals. On the other hand, an investor can also make a lump sum withdrawal in case they need a lump sum amount. Also, in case the SIPs have a lock-in period, then they can withdraw periodically after the lock-in is over. Furthermore, it is important to meet the minimum withdrawal requirement of the funds. This information is often mentioned in the disclosure document. One can redeem their funds by filling the redemption form. They can redeem through any of the following ways:

- Asset management company

- Online portals

- Agent

- Demat Account

- CAMS

How to Calculate SIP Returns?

One can calculate SIP returns using the future value of the annuity (FVA) formula.

FVA = C [ ((1+r)^n) – 1] * [(1+r)]/r

Where, C = the investment

r = the rate of interest

n = duration of the investment in months

Let’s take the example of Ms Divya, who invests INR 15,000 per month for a tenure of 30 months and expects a return of 10% per annum. The investment returns for Ms Divya can be calculated using the above formula.

FVA = 15,000 [((1+10%/12)^20 – 1] * [1+10%12)]/ 10%/12

FVA = INR 5,13,093.17

The investment is INR 4,50,000, and the returns are INR 63,093.17. Hence the total value of the investment after 30 months is INR 5,13,093.17.

Conclusion

SIPs are an easy way to grow your money over time. If you save the same amount of money regularly, you don’t need to worry about when to invest. Even small amounts can grow over time because of compounding. SIPs work best when you invest for a long time, helping you reach goals like buying a house, paying for education, or saving for retirement. Remember to be patient and stick with it; your money will grow steadily over time.

You can check your investment returns with an sip calculator.

Check out our article on Which is the best date for sip?

Frequently Asked Questions

Top-up SIP is a facility that allows investors to increase their SIP instalment amount at predetermined intervals by a defined amount. The annual SIP top-up amount can be defined as a percentage or a fixed sum in addition to the initial SIP contribution.

No, all SIP plans are not tax saving. Equity Linked Savings Scheme (ELSS) is the only type of mutual fund that qualifies for tax saving under Section 80C of the Income Tax Act, 1961. Investments up to INR 1,50,000 per annum are eligible for a tax deduction. Therefore, only ELSS mutual fund SIPs qualify for tax savings. Also, it is important to note that ELSS funds have a three year lock-in period.

There are 7 Different Types of SIP’s are there.

1. Regular SIP

2. Top-Up SIP

3. Flexible SIP

4. Perpetual SIP

5. Trigger SIP

6. SIP with Insurance

7. Multi SIP

Every SIP investment in a tax saving mutual fund has a three year lock-in period. Therefore, you can withdraw the money after the three year lock period. You can redeem the funds through the asset management company or online portal or agent or demat account or through CAMS. You just have to fill the redemption form or raise a redemption request and submit it. Through online portals such a Scripbox, one can redeem their investments with just a click of a button.

Returns from mutual fund SIP aren’t tax-free. However, the tax rate varies as per the type of fund. For equity funds, short term capital gains are taxable at 15% per annum. And long term capital gains are taxable at 10% per annum (if the gains exceed INR 1,00,000). For debt funds, the short term capital gains are taxable at the investor’s respective income tax slab rates. And long term capital gains are taxable at 20% with indexation benefit and 10% without indexation benefit.

Investing in SIP online is quite easy and can be done within a couple of minutes. The following steps will help you start your SIP investments instantly:

1. Visit Scripbox website

2. Login/ Sign Up and quickly answer some questions

3. Set a goal for your investments

4. Decide investment amount

5. Review the mutual fund schemes

6. Click on the Invest button

7. Keep all the necessary documents handy

8. Become KYC compliant

9. Set up SIP mode and date

10. Submit to complete the transaction

The choice between SIP or one-time investment largely depends on the investor’s investment goals and availability of funds. For example, if you are comfortable investing a small amount at regular intervals, SIPs are the best choice. On the other hand, if you are holding some cash and looking for immediate investment, you can invest the sum as a lumpsum investment. Alternatively, you can invest the lump sum amount in a fund and do a Systematic Transfer Plan (STP) on a regular basis to average out the market volatility.

Yes, you can withdraw your SIP investments anytime. However, most mutual funds charge an exit load (around 1%) for withdrawals within 1 year. Therefore, consider these costs before exiting your SIPs. Furthermore, you will not be able to withdraw your ELSS SIPs until the lock-in period is completed. Each SIP of ELSS funds will have a three-year lock-in period.

You can stop SIPs anytime. For physical application, you will have to inform the AMC or the distributor through which you have made your investments. You can simply log in to your profile and stop the SIP for online applications. Through Scripbox, just log into your profile, select the fund for which you would like to stop the SIP and click on the ‘Stop’ button.

Net Asset Value is the per unit price of a mutual fund scheme. Mutual fund units are bought and sold at the NAV price. NAV is the market value of all the securities that are held in the fund portfolio. The fund houses are required to publish the NAV of a fund at the end of each day.

You can open a SIP account either online or offline. For offline SIP investments, you will have to submit all the documents and the SIP form along with cheque/ cash/ DD and provide an investment mandate. For online investing, create a profile on the AMC website or FinTech platform and invest in the funds. Here you can complete your e-KYC online itself.

Selecting mutual funds for SIP depends on the investor’s investment objective, investment tenure and risk tolerance levels. For example, large-cap mutual funds are suitable for investors with high-risk tolerance levels and long-term investment objectives. Equity mutual funds are best suited for long-term financial goals because, in the long term, the market volatility can be averaged out.

Redeeming SIP mutual funds online is very simple. Just log in to the portal, and select the fund that you wish to redeem. Click on the redeem button, and the redemption request will be submitted. It may take up to 2-3 working days for debt mutual funds and about 3-4 working days for equity mutual funds.

To increase your SIP amount, you can opt for a top-up sip. It can be a percentage or a fixed sum in addition to the initial SIP contribution. If the top-up option isn’t available, you can simply start a new SIP in the same fund.

A systematic Investment Plan (SIP) in mutual funds is a mode of investing where investors can save regularly. At frequent intervals, say, every month, you can invest in the fund to build the desired corpus over time. The SIP way of investing is automated, i.e., the investment amount will automatically be deducted from your bank account through a mandate.

You cannot change the SIP date for an existing and ongoing SIP. In case you want to change the date, you will have to stop the existing SIP and start a new one with the new date.

In comparison to FD, SIP is a better investment option. This is because SIP offers greater investment flexibility, diversification, tax benefits, and superior returns. Though SIP doesn’t guarantee returns like FD, they have the potential to generate significant returns in the long term.

Discover More

- What Is SIP? A Simple Guide to Systematic Investment Plans

- How Does SIP Work?

- How Does SIP in Mutual Funds Work?

- When to Invest in SIP?

- Types of SIP

- Benefits of SIP

- How to Calculate Capital Gain on Mutual Fund SIP?

- How to estimate SIP outcomes? (Using a SIP Calculator)

- What to know before starting SIP?

- Best Mutual Funds to Invest In 2024

- Features of Systematic Investment Plan

- Factors to Consider While Starting SIP Investment Plan

- How to Calculate Capital Gain on Mutual Fund SIP?

- How to Withdraw Money from a SIP Mutual Fund?

- How to Calculate SIP Returns?

- Conclusion

- Frequently Asked Questions

Show comments