Understanding SIP

A Systematic Investment Plan (SIP) is a way to invest money in mutual funds regularly. Instead of investing a large amount at once, you can invest small amounts over time, making investing easier and more affordable.

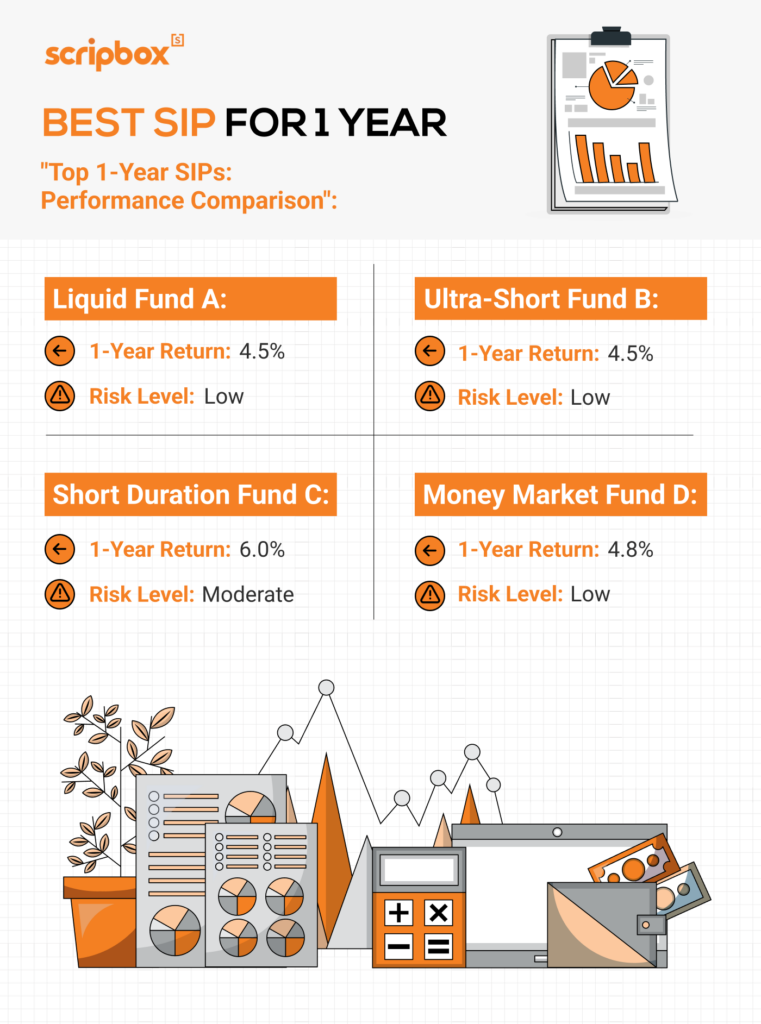

When thinking about SIPs for 1 year, here’s what you need to know:

- Regular Investments: You put in a fixed amount of money at regular times, like every month, to fulfill your short-term goals..

- Best SIP for short-term goals.: Choosing the best SIP plans for 1 year can help you reach short-term goals.

- Flexibility: SIPs let you start with amounts that fit your budget.

What is SIP?

A Systematic Investment Plan (SIP) is a popular investment strategy that allows you to invest a fixed amount regularly in mutual funds. It is a convenient and disciplined way to invest in the stock market, helping you to reduce the risk of market volatility and increase your investment returns over time. With an SIP, you can invest a fixed amount of money at regular intervals, such as weekly, fortnightly, monthly or quarterly, in a mutual fund of your choice. This helps you take advantage of rupee cost averaging, reducing the risk of investing in the market.

Benefits of Investing in SIP

Investing in a SIP offers several benefits, including:

- Disciplined Investing: A SIP helps you to invest regularly without having to think about the market.

- Rupee Cost Averaging: An SIP helps reduce the risk of market volatility by averaging the cost of your investments.

- Power of Compounding: The power of compounding helps increase investment returns over time, making SIPs a valuable investment tool.

- Flexibility: A SIP allows you to invest a fixed amount of money at regular intervals, which can be adjusted according to your financial situation.

- Low Risk: A SIP is a low-risk investment option, as it allows you to invest in a diversified portfolio of stocks or bonds.

Advantages of 1-Year SIP Plans

Investing in SIPs for short term goals has many benefits:

- Which SIP Is Best for 1 Year: Picking the right SIP depends on your goals and how much risk you’re willing to take.

- Easy to Start: You don’t need much money to begin. Even small amounts can grow over time.

- Disciplined Saving: Regular investing helps you build a habit of saving money.

- Best SIP to Invest: By choosing the best SIP plans that can provide the highest returns with the lowest amount of risk, you can make your money work harder.

Remember, the best SIP to invest for 1 year matches your needs and financial goals.

5 Best SIP Plans for 1 Year Investment in 2025

Our financial experts have picked up the top 5 best-performing SIPs you can invest in to fulfill your short-term goals in 2025.

| Fund Name | 1 Yr CAGR | Expense Ratio |

| ICICI Prudential Liquid Fund | 6.90% | 0.29% |

| Aditya Birla Sun Life Savings Fund | 7.20% | 0.54% |

| Aditya Birla Sun Life Money Manager Fund | 7.50% | 0.33% |

| HDFC Overnight Fund | 6.40% | 0.20% |

| HDFC Floating Rate Debt Wholesale Plan | 7.50% | 0.48% |

1. ICICI Prudential Liquid Fund

The ICICI Liquid Fund allocates its assets to fixed-income debt securities. This fund is particularly suitable for short-term investors looking for stability and liquidity.

Since its inception in 2005, the fund has a significant history and track record. As of 20 September 2024, it is the second largest in the category in terms of size. The fund’s performance has consistently outperformed its category average. Additionally, the fund has maintained a higher average level of return predictability. At the same time, it ensures its market-determined risk is the lowest among its category peers, with an expense ratio of 0.29.

Scripbox recommends investing in the fund and believes that the securities’ credit quality is superior to the category average. The fund has also generated inflation-beating returns in the long term. Moreover, the impact of interest rate fluctuations is very low.

Fund Details

- Minimum SIP Amount: ₹1,000

- Minimum Lumpsum: ₹5,000

- Expense Ratio: 0.29

- Benchmark: CRISIL Liquid Fund TR INR

- Risk Level: Moderate Risk

- AMC: ICICI Mutual Funds

2. Aditya Birla Sun Life Savings Fund

Aditya Birla Sun Life Savings Fund aims to create monthly income through investments in debt and money market instruments.

Scripbox recommends the scheme under the ultra-short duration debt funds category for an investment duration of 1 year. The fund was introduced in 2001 and outperformed its competitors substantially. Although the instruments’ credit quality is below average, the issuers are relatively strong. The market-determined risk and credit quality deviation are among the lowest in the category.

Fund Details

- Minimum SIP Amount: ₹1,000

- Minimum Lumpsum: ₹5,000

- Expense Ratio: 0.54%

- Benchmark: NIFTY Ultra Short Duration Debt TR INR

- Risk Level: Moderate Risk

- AMC: Aditya Birla Sun Life Mutual Fund

3. Aditya Birla Sun Life Money Manager Fund

Aditya Birla Sun Life Money Manager Fund invests in money market securities traded on the secondary marketThe fund best suits risk-averse investors with an investment horizon of one year. This fund is well-suited for short-term investors looking for consistent returns and low risk.

The scheme aims to create consistent income by investing primarily in floating-rate debt and money market instruments. It will seek to maximize investors’ risk-reward proposition.

Scripbox suggests Aditya Birla Sun Life Money Manager Fund investing in the fund under the floating rate mutual funds category. ABSL Money Manager fund was established in 2005 and has the second-largest average assets under management with over Rs 25834.4 crore managed assets as of Sep 30, 2024. Over the period, the fund topped the charts. The fund’s return predictability is average and has one of the lowest market-based risks.

Fund Details

- Minimum SIP Amount: ₹1,000

- Minimum Lumpsum: ₹5,000

- Expense Ratio: 0.33%

- Benchmark: NIFTY Ultra Short Duration Debt TR INR

- Risk Level: Moderate Risk

- AMC: Aditya Birla Sun Life Mutual Funds

4. HDFC Overnight Fund

The HDFC Overnight Fund is a debt mutual fund that invests in overnight fixed-income securities. The fund’s corpus is invested in Collateralised Borrowing and lending Obligations (CBLO), overnight reverse repo, and other fixed-income securities. Furthermore, this fund is Ideal for investor who wants to invest for 1 day to 1 month max

HDFC Overnight Fund seeks to create profits by investing in debt and money market instruments having overnight maturities. Scripbox suggests investing in HDFC Overnight Fund among the liquid-debt mutual fund category.

The fund was introduced in 2002 and has the highest average assets under management in its category. Scripbox believes the fund manager has maintained a solid and consistent credit quality profile over the past five years.

As per the standard deviation of the YTM, this fund has the lowest market-determined risk (Liquidity risk & Credit risk). Overall, the fund management has ensured safety without sacrificing profits.

Fund Details

- Minimum SIP Amount: ₹1,000

- Minimum Lumpsum: ₹5,000

- Expense Ratio: 0.20%

- Benchmark: CRISIL Overnight Index TR INR

- Risk Level: Low Risk

- AMC: HDFC Mutual Funds

5. HDFC Floating Rate Debt Wholesale Plan for SIP

The HDFC Floating Rate Debt Wholesale Plan Fund generally invests in floating-rate debt, fixed-rate debt securities with floating-rate returns swapped, and money market products. Principally, it invests in bonds whose interest rate fluctuates with the current interest rate of the economy. Due to their investment mandate, these funds are often less volatile in response to changing interest rates. They may be a viable option for the fixed-income portion of your portfolio.

Scripbox suggests investing in the HDFC Floating Rate Debt Wholesale Plan Fund within the floating rate mutual funds category. The fund was introduced in 2007 and has the highest average assets under management in its category. In Scripbox’s opinion, the fund has the lowest market-based risk.

Fund Details

- Minimum SIP Amount: ₹1,000

- Minimum Lumpsum: ₹5,000

- Expense Ratio: 0.48%

- Benchmark: NIFTY Low Duration Debt Index TR INR

- Risk Level: Low Risk

- AMC: HDFC Mutual Funds

Factors to Consider While Choosing a 1-Year SIP Plan

It’s important to think carefully when looking for the best SIP plans for 1 year. A Systematic Investment Plan (SIP) helps you invest money regularly. Here are some key factors to consider:

- Your Investment Goal

Why are you investing? Maybe you want to save for a gadget, a trip, or just grow your money. Knowing your goal helps you pick the best SIP to invest that matches your needs. - Risk Level

How much risk can you handle? Some SIPs are safer but offer lower returns, while others might be riskier with the chance of higher returns. For a 1-year SIP, you might prefer lower-risk options. - Past Performance

Check how the SIP has done before. Look at the returns over the past year. Remember, past results don’t guarantee future returns, but they can give you an idea. - High Return SIP for 1 Year

Are you looking for high returns? Some SIPs aim for bigger gains in a short time. These might be the best SIP plans if you’re okay with a bit more risk. - Fees and Charges

Look at the costs. Some SIPs have fees that can eat into your returns. Lower fees mean more money stays invested for you. - Fund Manager Experience

Who is managing the SIP? An experienced fund manager can make good decisions with your money. This can help in choosing the best SIP to invest for 1 year. - Liquidity

Can you take out your money when you need it? Some SIPs might lock your money in. When looking for a 1-year investment, make sure you check if you can withdraw after one year. - Which SIP Is Best for 1 Year

Compare different SIPs. Don’t pick the first one you see. Look at reviews and ask for advice to find the best SIP plan for you. - Exit load Criteria

Not all funds levy an exit charge. Hence, while choosing a plan, consider the exit load and its expense ratio.

When evaluating SIP plans for short-term investment horizons, consider the following factors:

Furthermore, Scripbox’s Mutual Fund SIP Calculator helps you estimate the potential returns from a fund. The calculator estimates the returns based on the fund’s historical performance. The calculator gives tabular and graphical return estimations that you can use to analyze return estimates.

The calculator also estimates returns on three growth scenarios: above-average, average, and below-average. It helps you test numerous investing possibilities and make informed decisions.

Common Mistakes to Avoid

When investing in a SIP, there are several common mistakes to avoid, including:

- Not Having a Clear Investment Objective: Before investing in an SIP, it is essential to have a clear investment objective.

- Not Choosing the Right Mutual Fund: Choosing a mutual fund that aligns with your investment objective and risk profile is crucial.

- Not Investing Regularly: A SIP requires regular investments to be effective.

- Not Monitoring Your Investments: It is essential to monitor your investments regularly to ensure they align with your investment objective.

- Not Having a Long-Term Perspective: A SIP is a long-term investment option, and it is essential to have a long-term perspective when investing in it.

Discover More

- Best SIP Plans for 5 Year Investment

- Best SIP Plans for 10 Year Investment

- Best one time Investment Plan

- Best SIP Plan for 1000 per Month

- Best SIP Plans for Long Term Investment

- Best Investment Plan for Middle Class

- Best Investment Plans for 1 Year

- Understanding SIP

- What is SIP?

- Benefits of Investing in SIP

- Advantages of 1-Year SIP Plans

- 5 Best SIP Plans for 1 Year Investment in 2025

- 1. ICICI Prudential Liquid Fund

- 2. Aditya Birla Sun Life Savings Fund

- 3. Aditya Birla Sun Life Money Manager Fund

- 4. HDFC Overnight Fund

- 5. HDFC Floating Rate Debt Wholesale Plan for SIP

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Factors to Consider While Choosing a 1-Year SIP Plan

- Common Mistakes to Avoid

Show comments