With changing times, new investment options are available for investors. One such opportunity is a small case. A small case is a basket of stocks that invest in a particular idea, theme, or sector. They might sound similar to mutual funds but are quite different. This article details small cases, how they work, and small cases vs. mutual funds.

What are Smallcases?

Smallcases are a group of securities that are built on a specific strategy, theme, sector, or idea. SEBI-registered professionals create and manage smallcases. A smallcase comprises up to 50 stocks that are carefully picked to reflect a strategy. Smallcases focus on a trending market theme or a financial model, such as zero debt, or risk profiles, such as aggressive, conservative, or balanced.

Let’s take an example to understand smallcase better. Ms Shravani is optimistic about the pharmaceutical sector and plans to invest in it. She wants to invest across different companies rather than one pharma stock. An alternative to a pharma mutual fund is a Pharma Tracker Smallcase. A Pharma Tracker Smallcase comprises nine pharma stocks. The Pharma smallcase invests in the Pharmaceutical sector. Therefore, Ms Shravani can invest in this smallcase to diversify her investments. Similarly, various smallcases represent different ideas, strategies, and themes.

How Smallcases work?

A smallcase is a basket of stocks based on a particular theme, sector, or idea. It was introduced by Smallcase, a fintech start-up, in 2015. The idea behind a Smallcase is to give investors direct access to ready-made portfolios instead of mutual funds. The company itself has many smallcases. However, the idea was adopted by other brokers who tied up with the company to offer their own smallcases.

A smallcase is created by SEBI licenced brokers, advisors, and analysts using algorithms and quantitative models. The stocks are screened and picked through thorough research and analysis.

Investing in a small case requires a demat and trading account. Moreover, one can invest in a lump sum or through systematic investments. The minimum investment varies with the stocks in the portfolio. Since investing in a small case is similar to trading, brokerage charges and transaction fees are applicable. In addition, one has to pay a nominal registration charge of INR 100-150.

Investors can invest in all the small case stocks. However, they can also change the portfolio by adding and omitting a few stocks and changing the weightage given to each stock.

Once investors invest in a small case, the money is debited from their trading account, and the shares are credited to their demat account the next day. Small cases have no lock-in period, and investors can sell them anytime.

Check out: Sectorial / Thematic Mutual Funds

Who should Invest in Smallcases?

Investing in smallcases requires a solid understanding of markets and companies. It’s an excellent option for knowledgeable investors who lack time to analyze every stock. Smallcases also appeal to those who prefer having control over their portfolios. Investors can follow strategies designed by experienced money managers and customize them to align with their goals.

The decision to choose a smallcase and when to buy or sell lies entirely with the investor. This makes smallcases ideal for individuals with clear financial goals, a good grasp of their risk tolerance, and a defined investment horizon. Those who can effectively time their market entry and exit will find smallcases a suitable investment choice.

What are Mutual Funds?

Mutual funds are investment products that invest in different financial products such as securities, bonds, debt instruments, and so on. They collect a pool of funds from investors, create a corpus, and invest in different assets. Investors gain from professionally managing their funds and capital appreciation over time. The suitability of any mutual fund scheme depends on the investor’s investment objective and the fund’s objective.

Benefits of Investing in Mutual Funds

Investing in mutual funds offers several compelling benefits. One of the primary advantages is diversification, which helps to reduce risk by spreading investments across various asset classes, sectors, and geographic regions. This means that if one investment underperforms, others may perform well, balancing the overall risk.

Mutual funds also provide professional management. Experienced fund managers make investment decisions on behalf of the investors, leveraging their expertise to make informed choices that can potentially lead to higher returns. This is particularly beneficial for those who may not have the time or knowledge to manage their investments actively.

Additionally, mutual funds offer liquidity, allowing investors to easily buy or sell units of the fund. This flexibility ensures that you can access your money when needed. Moreover, mutual funds provide a convenient way to invest in a diversified portfolio with a relatively small amount of money, making them accessible to a wide range of investors.

Furthermore, mutual funds are regulated by the Securities and Exchange Board of India (SEBI), ensuring that investors’ interests are protected. This regulatory oversight adds a layer of security to your investments.

Mutual funds also offer various tax benefits. For instance, investments in Equity Linked Savings Scheme (ELSS) qualify for tax deductions under Section 80C of the Income Tax Act. Additionally, dividends received from mutual funds are tax-free, adding to the overall attractiveness of these investment vehicles.

Types of Mutual Funds

There are various types of mutual funds available in the market, each catering to different investment objectives and risk profiles. Understanding these types can help you choose the right fund to invest in.

Equity Funds: These funds invest primarily in stocks and are suitable for investors seeking long-term growth. They come with higher risk but also the potential for higher returns.

Debt Funds: These funds invest in fixed-income securities, such as bonds and debentures. They are ideal for investors seeking regular income with lower risk compared to equity funds.

Hybrid Funds: These funds invest in a combination of equity and debt securities, offering a balanced portfolio. They aim to provide both growth and income, making them suitable for moderate risk-takers.

Sectoral Funds: These funds invest in specific sectors, such as technology or pharmaceuticals. They are suitable for investors who want to capitalize on the growth potential of a particular sector but come with higher risk due to lack of diversification.

Index Funds: These funds track a specific market index, such as the Nifty or Sensex. They are suitable for investors who want to invest in the overall market and benefit from its growth.

Exchange-Traded Funds (ETFs): These funds are traded on stock exchanges and offer flexibility and transparency. They combine the features of mutual funds and stocks, providing an easy way to invest in a diversified portfolio.Money Market Funds: These funds invest in short-term debt securities and are suitable for investors seeking liquidity and low risk. They are often used as a place to park funds temporarily.

How to Choose the Right Mutual Fund

Choosing the right mutual fund can be a daunting task, given the numerous options available. Here are some steps to help you make an informed decision:

- Define Your Investment Objectives: Start by clearly defining your financial goals. Are you saving for retirement, a down payment on a house, or your child’s education? Your objectives will guide your choice of mutual fund.

- Assess Your Risk Tolerance: Understand your risk tolerance. Are you comfortable with high-risk, high-reward investments, or do you prefer stable, low-risk options? This will help you narrow down your choices.

- Determine Your Time Horizon: Consider how long you plan to invest. Long-term goals may allow for more aggressive investments, while short-term goals may require more conservative options.

- Research and Compare Funds: Look at different mutual funds and compare their investment strategies, performance track records, expense ratios, and portfolio compositions. Pay attention to the fund’s historical performance, but remember that past performance is not indicative of future results.

- Evaluate the Fund Manager: The experience and track record of the fund manager can significantly impact the fund’s performance. Look for managers with a proven history of managing similar funds successfully.

- Read the Prospectus: The fund’s prospectus provides detailed information about its investment strategy, risks, and fees. Make sure you understand these aspects before investing.

- Consider Tax Implications: Different mutual funds have different tax implications. For example, ELSS funds offer tax benefits under Section 80C. Be aware of how your investment will be taxed.

- Consult a Financial Advisor: If you’re unsure, consider consulting a financial advisor. They can provide personalized advice based on your financial situation and goals.

By following these steps, you can choose a mutual fund that aligns with your investment objectives, risk tolerance, and time horizon, helping you achieve your financial goals.

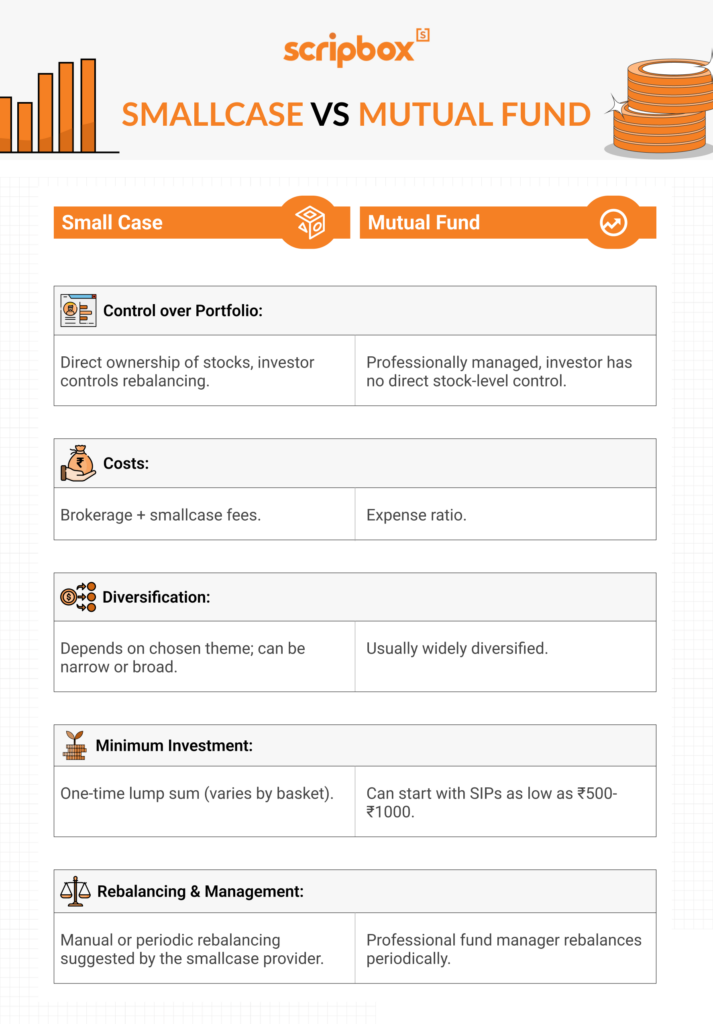

Difference between Smallcase Vs Mutual Fund

| Particulars | Smallcase | Mutual Funds |

| Control Over Investment Portfolio | Better control as shares are in the investor’s Demat Account | Least control, as an investor has no control over where the money is invested after investment. |

| Portfolio Diversification | Restricted diversification with strategy or theme-based investment in stocks | Higher diversification depending on the investment objective |

| Capital Requirement | Higher capital is required, with Rs 5000 as the minimum investment | Lower capital is required with minimum investment as low as Rs 500 |

| Expense Ratio | Varies as per the subscription and fund house. | Low expense ratio ranging between 1% to 2% |

| Exit Load | Smallcase does not have an exit load | Mutual funds have an exit load of 1% if the units are sold before the expiry of 1 year. This might vary depending on the holding period and the scheme type. |

| Holding Pattern | Shares are held in Demat account with direct control over holdings | Units are allocated and not the shares in which the fund has invested. Hence, no holding of these shares. |

| Return Volatility | Linked to market volatility. Investors must track the performance continuously. | Returns are linked to market volatility. However, the fund houses manage the portfolio and aim for capital appreciation. |

| Risk | Higher risk due to exposure to the equity market and lower diversification | Lower risk in comparison to small cases due to portfolio diversification and professional management |

| Taxation | Short Term and Long-term Capital Gain applicable on the sale of equity shares | Short- and Long-term capital gains are applicable depending on the type of scheme- equity vs. debt. Section 80C deduction available for ELSS |

1. Control Over Investment Portfolio

Smallcase investing gives better control on investments as the shares are in the investor’s Demat Account. Having the shares in the demat account gives the investor the control to time their exit and know exactly where their investments are.

On the other hand, investing through mutual funds doesn’t give the investor control over the investment portfolio. One can select between equity or debt or any theme or sector. In a given mutual fund, the investor will not have control over where the AMC invests the money.

2. Portfolio Diversification

Smallcases invest in a bunch of stocks that follow a strategy, theme, or idea. Therefore, diversification is restricted. Smallcase investments are ideal for investors who want to invest in a particular sector for a short term gain or have the motive to earn a high dividend or have a high growth rate. Hence, these are suitable for active investors.

On the other hand, mutual funds offer a good diversification for small capital investment. A mutual fund can invest in more than 100 companies depending on its investment objective. As a result, it offers good diversification, which can act as a hedge against market crashes or high volatile scenarios.

3. Capital Requirement

Smallcase requires a higher capital for investing than mutual funds. Since it is like investing directly in shares, one must buy each unit to create a portfolio. Therefore, it requires a higher capital. Some small cases have an initial investment of INR 5,000; in such cases, they invest money in ETFs. However, this is similar to investing in mutual funds. Also, the minimum investment can go up to INR 90,000.

Mutual funds, on the other hand, are suitable for all kinds of investors. The minimum lump sum amount is INR 5,000, and the minimum for a Systematic Investment Plan (SIP) is INR 500 monthly. As a result, small investors can also enjoy the benefits of portfolio diversification.

4. Expense Ratio

The investment houses charge an expense ratio, a fee for their management services. The expense ratio for a small case works slightly differently. Different cases have different expense ratios. Some small cases are open to the public, while some are with subscriptions. The in-house teams create some cases, while external analyst companies make some. Therefore, the charges vary accordingly. For small cases, one has to pay the fees separately, which will be deducted from the trading ledger. The expenses are not part of the investment amount. Also, the expenses are levied only if one has a discount broker.

Conversely, mutual funds have a low expense ratio. However, the expense ratio varies across mutual funds. It is about 1-2% of the investment amount. With mutual funds, the expense ratio is not paid separately. The amount is automatically deducted from the investment. In other words, the fund houses adjust the expenses in the Net Asset Value (NAV).

5. Exit Load

Smallcase: The in-house teams create some casesload charges or have any lock-in period.

Mutual funds, on the other hand, have exit load charges. A fund can charge up to 1-2% as an exit load if an investor sells their investment before the lock-in period. The minimum investment duration for holding a mutual fund can vary between 1 to 5 years.

6. Holding Pattern

Smallcase investments give direct control over the holdings. The shares are held directly in the investor’s demat account, and the dividends are transferred to the bank account. Also, in case a particular stock isn’t performing well, the investor can sell those shares and continue to hold the remaining part of the smallcase.

On the other hand, investing in mutual funds allows the investor units of the fund and not the separate stocks in which it invests. As a result, the investor cannot make adjustments to their investment portfolio. Furthermore, returns are calculated based on the value of the mutual fund units.

7. Return Volatility

Equity investments are subject to market ups and downs, and returns depend on performance, not past trends. Smallcase investors need to handle market risks and keep track of stocks regularly. Mutual funds provide steadier returns of 8-12%, with fund managers actively managing holdings and using hedging strategies like derivatives and gold to minimize risk.

8. High Risk

Smallcase investments carry higher risk due to less diversification and no hedging. Mutual funds, managed by experts, offer lower risk with diversified portfolios and strategies to handle market volatility.

Check Out: Highest FD Rates Today

9. Fund Cut off Time

With small-case investments, investors can utilize dips on an investment day. In mutual funds, trading happens before the fund cutoff time. The units are computed at the NAV, announced after the market closes. Furthermore, a mutual fund typically reinvests the dividend. Small-case investors can control and time the market to earn better returns.

10. Taxation and Benefits

Equity mutual funds and small cases are taxed the same. Capital gains for investments held for less than one year are taxable at a Short-Term Capital Gains (STCG) tax rate of 15%. For investments with a holding period over one year, Long-Term Capital Gains above INR 1,00,000 are taxable at 10%.

Furthermore, small-case investments do not attract any tax benefits. Investments in Equity Linked Savings Scheme (ELSS) qualify for tax exemption under Section 80C of the Income Tax Act 1961. Investments up to INR 1,50,000 per financial year qualify for this exemption.

Explore our article on Mutual Fund Charges

Smallcase Vs Mutual Fund Which is Better?

Both smallcases and mutual funds aim to grow your wealth by investing in a basket of securities, but they operate differently. To decide which is better for you, ask yourself these key questions:

- Do I have enough knowledge about the markets?

- Can I actively manage my investments?

- What is my investment horizon?

- How much control do I want over my portfolio?

Answering these questions will help you determine the best fit for your needs.

Mutual Funds:

- Costs: Typically have higher fees.

- Lock-in Periods: Some funds have lock-in requirements (e.g., ELSS).

- Transparency: Limited insight into where your money is invested.

- Control: Fund managers handle all decisions, so your control is minimal.

Smallcases:

- Costs: Lower fees compared to mutual funds.

- Lock-in Periods: No mandatory lock-in periods, offering flexibility.

- Transparency: Clear visibility into the stocks in your portfolio.

- Control: You decide when to buy, sell, or hold shares, providing greater control.

Important Considerations for Smallcase Investors

Investing in smallcases requires a good understanding of the market and active involvement. You’ll need to:

- Choose smallcases that align with your goals.

- Decide the best time to enter and exit investments.

In contrast, investors do not require any knowledge of the market in the case of mutual funds. The fund managers will manage the portfolio and time the entry and exit from the market. All investors must do is choose a mutual fund that aligns with their goals and profile.

Though smallcases look better regarding costs and returns, they come with a prerequisite of market knowledge. Investors with the requisite knowledge to manage their portfolio can consider investing in smallcases. Otherwise, they are better off investing in mutual funds.

Frequently Asked Questions

Yes, you can start a SIP in Smallcase. However, the SIP in Smallcase is different from mutual funds. Here the SIP is just a reminder for you to invest on the predetermined date. Unlike mutual funds, the amount will not be automatically deducted from your account and invested in the scheme. You will have to invest your money in the Smallcase.

Yes, you can stop your SIP in Smallcase anytime. The alert for the SIP investment will be paused.

Yes, the smallcase charges a fee. The fee depends highly on the subscription. If the smallcase is public then there might be no fee. If the smallcase is a subscription based then the investor might have to pay a fee.

No, smallcase is not tax-free. On sale of the shares belonging to the smallcase, capital gain tax is applicable. Since the entire investment is in equity shares, the capital gains are dependent on the holding period of 12 months. If the shares are held for a period of 12 months or more then LTCG is applicable. LTCG or long-term capital gain is exempt upto Rs 1 lakh. Any LTCG over and above Rs 1 lakh is taxable at a rate of 10%. An STCG or short-term capital gain will arise if shares are held for less than 12 months. The STCG is taxed at a rate of 15%.

Yes, you can exit from Smallcase at any time. There is no lock-in period.

The expense ratio for mutual funds usually varies between 1% to 2% depending on the type of scheme. A regular scheme charges a higher expense ratio in comparison to a direct plan scheme.

Smallcases provide lower costs, no lock-in periods, greater transparency, and greater portfolio control to investors. However, buying smallcases requires market knowledge. Although smallcases appear more advantageous in terms of expenses and profits, they require market understanding. And those who possess the necessary skills to manage their own portfolio may consider making a smallcase investment.

The major disadvantage of investing in smallcases is that it requires in-depth knowledge and understanding of the financial market. It also requires a continuous assessment of the portfolio and its performance. Hence, an investor has to possess adequate knowledge and necessary skills along with the time to perform an analysis of the portfolio.

No, debt, equity, and hybrid mutual funds do not have a lock-in period. You can sell the units of the mutual funds anytime. However, it is recommended to stay invested until your investment objective is met. Furthermore, equity-linked saving schemes have a lock-in period of 3 years. An investor cannot sell the units of an ELSS before the expiry of this lock-in period.

Yes, smallcases are risker than mutual funds. Since smallcases invest across a limited set of stocks and focus on a strategy or theme, they are risker. On the other hand, mutual funds invest across many stocks and assets, thus creating a well diversified portfolio.

Yes, with smallcase investment you must manage your portfolio. Each investment is credited to your demat account. You are free to buy and sell the securities anytime. On the other hand, mutual funds are managed by experienced fund managers. They do all the heavy lifting and invest on your behalf. Here, you will hold mutual fund units rather than shares of the company.

Yes, when investing in smallcase, having sound market knowledge is a plus. Even though an expert advises and picks stocks for you, you have full control over the portfolio. You will be managing all your investments. You can buy and sell securities as you may see fit. On the other hand, to invest in mutual funds, you don’t need extensive knowledge about the markets. The fund manager will analyse and pick stocks that align with the fund’s investment objective.

Related Pages

- What are Smallcases?

- How Smallcases work?

- Who should Invest in Smallcases?

- What are Mutual Funds?

- Benefits of Investing in Mutual Funds

- Types of Mutual Funds

- How to Choose the Right Mutual Fund

- Difference between Smallcase Vs Mutual Fund

- Smallcase Vs Mutual Fund Which is Better?

- Important Considerations for Smallcase Investors

- Frequently Asked Questions

Show comments