Many ask which is the best investment option: mutual funds or stocks. Let’s differentiate between mutual funds and stocks to get the best returns on your investment.

Regarding investments, there are many fundamental differences between mutual funds and stocks.

Both instruments differ in investment style and management from the Return on Investment and Risk. As an informed investor, you should be prudent enough to know these differences before making an investment decision.This article helps you understand the differences between stocks and mutual funds and explains why investing in mutual funds is better than investing in stocks.

Mutual Fund vs Stock: What are Mutual Funds?

Mutual funds are investment tools that gather money from multiple investors to create a pool, which is then invested in different assets like stocks, bonds, or money market instruments. This pooling method helps investors diversify their portfolios, reducing risk and making it easier to reach their financial goals. When you invest in a mutual fund, you own units of the fund but not the underlying assets. Mutual funds are managed by professional fund managers who make informed investment decisions, further reducing risks for individual investors. Platforms like Bajaj Finserv make investing in mutual funds simple and accessible for investors in India.

What are Stocks?

Stocks, also called equities, represent partial ownership in a company. When you purchase a stock, you become a shareholder, giving you a claim on the company’s assets and profits. Investing in the stock involves comparing the costs and benefits of individual stocks versus mutual funds, considering transaction costs, and understanding personal investment goals.

Stocks are categorized into two main types: common and preferred. Common stockholders enjoy voting rights and may receive dividends, while preferred stockholders usually get fixed dividends but have limited or no voting rights. Over the long term, stocks have historically delivered higher returns than most other investment options, making them a key component of many investment portfolios.

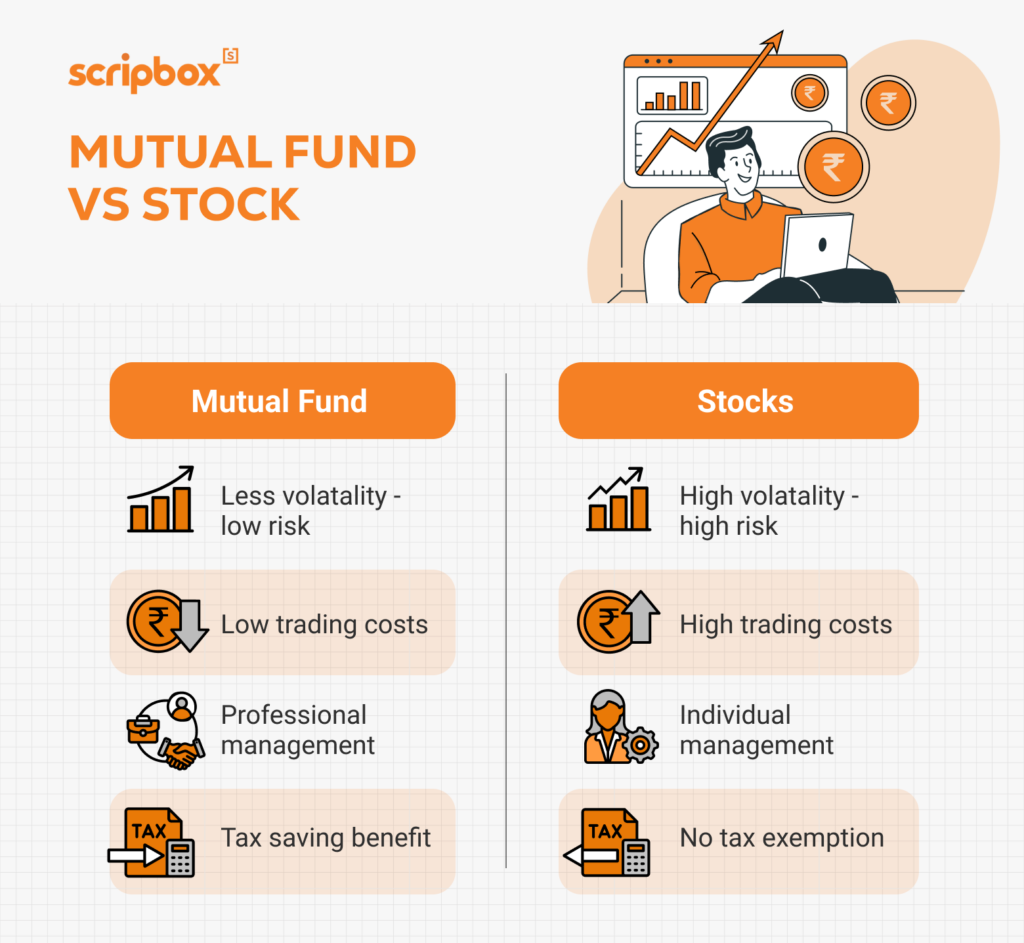

Difference Between Mutual Funds and Stocks Investment

The following table summarizes Mutual Fund Vs Shares

| Basis of Difference | Mutual Fund | Shares |

| Risk | High Risk, but lower than shares. | High Risk |

| Return | High | High |

| Management | Fund Manager | You must manage your investments. |

| Diversification | Instant diversification | You must invest in at least 15-20 stocks to achieve diversification. |

| Cost | Low | High |

| Price | NAV is finalized at the end of the trading day. | Prices fluctuate in real time. |

| Tax Benefit | ELSS fund qualify for Section 80C deductions | No tax benefit |

When you buy a share, you get legal ownership in the company with voting rights and the entitlement to a share of the profits earned by the company. You can also participate in the Annual General Meetings and correspond with the company.

Buying stock, however, is direct participation in the Stock Market, the earnings from which can be in two ways:

- Dividends received and,

- Sale of stocks

When you invest in mutual funds, you get a share in the pooled fund collected by several investors. Your share is the number of units of mutual funds you purchased during the investment. Your rights and benefits are restricted to the mutual fund house.

While investing in stocks, you can consider equity an asset class, but in the case of mutual funds, you can invest in one or more asset classes or sub-asset classes because mutual fund schemes can hold a diversified portfolio.

Investing in mutual funds is directly participating in the share market.

In mutual funds, you can earn only through the sale of units, and the dividends received on scheme shares may or may not be directly available to you.

If you have selected the “Dividend” option, the fund house shares the dividend received. If you have opted for the “Growth” option, the dividends are reinvested in the fund to generate returns.

If you have selected the “Dividend” option, the fund house shares the dividend received. If you have opted for the “Growth” option, the dividends are reinvested in the fund to generate returns.

Now that you understand the difference between mutual funds and stock market investments. Now, let’s compare the features of stocks and mutual funds to understand which option is better for you.

Check Out Basics of Stock Market

Mutual Funds Vs Stocks Investment

1. Risk and Return

Individual stock purchases are a high-risk – high-return proposition. There is also a chance that you may end up with negative returns.

Even though Equity mutual fund schemes have a higher risk due to the asset class they invest in, they have a diversified portfolio. The returns generated by another stock can compensate for any negative returns on a single stock.

Thus, by investing in mutual funds, you avoid scenarios of negative returns.

2. Management

You solely rely on your research, knowledge, and skills while making an equity investment, which may or may not be adequate in all market scenarios. You may be constrained by tools and resources that could help you manage your equity investment properly.

Mutual fund purchases do not present all of these drawbacks. Mutual fund houses have experienced financial experts who manage your investments. Additionally, the fund house has access to all the tools and resources required to manage the funds.

3. Diversification

A well-diversified portfolio should include at least 15 to 20 stocks, which might be a huge investment for an individual investor.

With mutual funds, investors with little funds, as low as INR 1000, can access a diversified portfolio. Buying units of a fund allows you to invest in multiple stocks without investing a considerable amount.

4. Cost

Due to the economies of scale, mutual funds attract lesser transaction costs when purchasing shares and, therefore, pay lower brokerages than individual investors.

You can also save the annual maintenance charges on Demat accounts as you do not require it while investing in mutual funds.

5. Investment Style

When you invest in stocks directly, you have to do your research based on the knowledge of which you enter and exit the market and devote time to managing them.

The decision to buy and sell rests with you. Hence, you have full control over your investment decisions when you invest in stocks, which makes you an active investor looking to optimize your returns.

In the case of mutual funds, you do not have the freedom to choose or transact in stocks or any assets during the investment period.

The fund manager does all the investment, tracking, and management on your behalf, which makes you a passive investor. So, if you are new to stock investing and don’t want to spend a lot of time on stock analysis, then mutual funds are the best option for you.

Explore our article on Best Time to Invest in Mutual Funds

6. Investing / Trading time

Stock can be bought at any time during the exchange trading hours, which start at 9:15 a.m. and end at 3:30 p.m., during which the transactions happen at the existing price.

In the case of mutual funds, you can buy them at any time. However, the applicable NAV depends on the time of purchase. If you purchase the units before 3 PM, the applicable NAV will be on the same day. The applicable NAV will be the following day for all purchases after 3 PM.

7. Tax Benefits

ELSS mutual funds offer you the option to save taxes and can help you save up to INR 1.5 Lakhs under Section 80C of the Income Tax Act, 1961, by investing in tax-saving mutual funds,

There is no such option to save tax while investing in stocks.

Explore: What is Equity Shares?

Pros and Cons of Mutual Funds

Pros

- Diversification: Mutual funds combine money from various investors to create a diversified portfolio of stocks, bonds, and other securities, helping reduce the risk for individual investors.

- Professional Management: Managed by expert fund managers, mutual funds benefit from their research and experience, ensuring informed investment decisions on behalf of investors.

- Accessibility: They are suitable for investors with different budgets, allowing even small contributions to be part of a diversified investment pool.

- Liquidity: Mutual fund units can be bought or sold based on their Net Asset Value (NAV), providing investors with the flexibility to access their money when needed, subject to market conditions.

- Convenience: Features like Systematic Investment Plans (SIPs) and Systematic Withdrawal Plans (SWPs) make mutual funds easy to use, helping investors automate their investments and withdrawals.

Cons

- Fees and Expenses: Mutual funds come with costs like management fees, administrative charges, and sales fees, which can reduce overall returns over time.

- Lack of Control: Investment decisions are made by fund managers, meaning investors have no direct say in choosing or timing investments.

- Market Risk: Mutual funds are exposed to market fluctuations, and adverse conditions can impact the value of the underlying assets, leading to potential losses.

- Over diversification: While diversification reduces risk, excessive diversification can spread investments too thin, limiting the potential for significant returns in high-performing stocks or sectors.

- Tax Implications: Depending on the type of mutual fund and the holding period, investors may face taxes like capital gains or dividend distribution tax, which can lower overall returns.

Pros and Cons of Stocks

Pros:

- Potential for High Returns: Stocks can deliver significant long-term returns, especially when investing in growing or emerging sector companies.

- Ownership Stake: Buying stocks gives you partial ownership in a company, offering benefits like voting rights and a share in profits through dividends.

- Liquidity: Stocks are easy to buy and sell on public exchanges, making them a highly liquid investment option for quick access to funds.

- Diversification Opportunities: You can diversify your portfolio and spread your risk by investing in stocks from different industries, regions, and market sizes.

- Hedge Against Inflation: Stocks can help protect against inflation since companies often adjust their prices for goods and services to match rising costs.

Cons:

- Volatility: Stock prices can be highly volatile, leading to significant short-term losses or fluctuations in portfolio value.

- Risk of Loss: Investing in stocks comes with losing some or all of your investment, particularly if the company underperforms or faces bankruptcy.

- Lack of Control: As a shareholder, you have limited influence over the company’s decisions, usually made by executives and board members.

- Emotional Investing: Market swings and media buzz can drive emotional decisions, such as panic-selling during downturns or overconfidence during bull markets.

- Research and Due Diligence: Successful stock investing demands thorough research, analysis, and staying updated on market trends to make informed choices.

Why You Should Choose Mutual Funds Over Individual Stocks

1. Professional Management

When you choose to invest through a mutual fund, you need not worry about analyzing, picking, timing, tracking, and managing the purchases. The fund manager will do all the heavy lifting on your behalf.

2. Diversification

In order to get a diversified equity portfolio, you need to invest in at least 15 to 20 stocks, which means that you need to make a large upfront investment.

This is where investing through a mutual fund is more beneficial. With INR 1000 of investment, you get a diversified portfolio across assets, meaning that if you are investing in Equity Mutual Funds, you get a diversified equity portfolio.

3. Lower Cost

Mutual funds use economies of scale when buying and selling. They even negotiate with brokers to get better rates, which leads to lower costs. The benefits are indirectly passed on to the unitholders.

This is not the case when you buy shares. Plus, you do not have to maintain a Demat account when you invest through mutual funds.

Conclusion

We hope you now have some clarity on mutual funds vs. stock and which is a better investment option. If you want to benefit from the inflation-beating returns generated by equities without many of the drawbacks of direct equity investing but are constrained by time and expertise, then the best way to earn those returns is by investing through mutual funds.

Learn about Consolidated Mutual Fund Statement

Frequently Aksed Questions

Yes, certain mutual funds accept SIP investments as low as INR 100. Therefore, you can identify such funds whose minimum SIP investment is INR 100 and invest in the best one. Such low investments have helped any investors to start their investment journey in mutual funds.

Yes, mutual funds are affected by the stock market. As the disclaimer goes, Mutual fund investments are subject to market risks. Hence investors should be mindful while selecting and investing in a fund. In other words, mutual funds invest the money pooled from investors across different asset classes. Equity mutual funds primarily invest in shares or stocks of companies. Therefore, any price fluctuation in these shares will impact the fund’s NAV. Stock market fluctuations impact mutual funds though they may not be very high as a mutual fund is a collection of many shares and stocks.

Shares are riskier. Even though mutual funds invest in shares, they offer a diversified portfolio. Thus, the fluctuations in the stock market will not affect the mutual fund as much as they would an individual stock. The diversified portfolio averages out the volatility.

You can start investing in mutual funds with as low as INR 100 through SIP investing. The minimum investment amount for shares depends on the current market price of the share.

Both mutual funds and stocks do not offer security. They are market-linked instruments and are subject to market volatility. Both instruments do not guarantee returns. However, mutual funds offer a diversified investment portfolio, such the impact of market fluctuations is comparatively lesser.

Open-ended mutual funds can be withdrawn anytime. ELSS mutual funds have a three-year lock in period. These funds cannot be withdrawn until the lock in period is completed.

The investment duration for mutual funds depends on the type of fund. For equity mutual funds, the recommended investment tenure is at least 5 years. For debt mutual funds, the recommended investment tenure is at least 3 years.

Related Pages

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Mutual Fund vs Stock: What are Mutual Funds?

- What are Stocks?

- Difference Between Mutual Funds and Stocks Investment

- Mutual Funds Vs Stocks Investment

- Pros and Cons of Mutual Funds

- Pros and Cons of Stocks

- Why You Should Choose Mutual Funds Over Individual Stocks

- Conclusion

- Frequently Aksed Questions

Show comments