Investing your money can help it grow over time. One popular way to invest is through mutual funds. But did you know there’s a choice between direct and regular mutual funds? Understanding the difference between direct and regular mutual funds is important. It helps you make the best decision for your money.

In this guide, we’ll explore what these mutual funds are and how they differ.

What is a Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by experienced fund managers, mutual funds aim to generate returns for investors while minimizing risk. This professional management allows individuals to benefit from expert investment strategies without needing extensive market knowledge. Mutual funds offer a convenient way to invest in a variety of assets, providing diversification, liquidity, and economies of scale. By spreading investments across different securities, mutual funds help reduce the risk associated with investing in individual stocks or bonds.

Differences Between Direct and Regular Mutual Fund Schemes

The following table summarizes regular plan vs direct plan:

| Parameter | Direct Plan | Regular Plan |

| Third-Party | Not Present | Present |

| Expense Ratio | Low expense ratio (no additional fees to broker/agent) | High expense ratio (includes a commission to distributor/agent) |

| NAV | High due to low expense ratio. | Low due to high expense ratio. |

| Returns | Marginally higher returns due to a low expense ratio. | Marginally lower returns due to a high expense ratio. |

| Market Research | Done by Self | Done by advisor |

| Investment Advice | Not Available | Provided by advisor |

From the above Regular growth vs Direct growth mutual funds comparison, regular mutual funds are best suited for investors who seek financial advice. Even though regular plans seem costly when compared to direct mutual funds. The small percentage of the additional cost is worth the right investment decision. Therefore, compared to an uninformed wrong decision, well-researched advice can earn higher value.

What are Direct Mutual Funds?

A direct mutual fund lets you invest directly with the mutual fund company. There’s no middleman like a broker or agent. This means you don’t pay extra fees or commissions. Over time, this can lead to higher returns.

It is important to choose between a direct plan and a regular plan. In a direct plan, you handle all the decisions yourself, which gives you more control.

What are Regular Mutual Funds?

Regular mutual funds are plans you buy with the help of someone else, like advisors or distributors. These intermediaries charge the mutual fund company a fee for selling their funds. The AMC (Asset Management Company) usually passes on this expense to the customer through expense ratio. This means the expense ratio for regular plans is slightly higher than for direct mutual funds due to commission payments to intermediaries like financial advisory services. Because of this, direct plans often give you slightly higher returns.

Regular plans are great for investors who need to learn more about the market or don’t have time to monitor their portfolios. They’re more convenient for people who aren’t well-informed about investing. With a regular plan, you receive expert advice for a small fee.

In 2012, SEBI introduced direct plans in Mutual Funds to ensure that people were not charged multiple times for advice. If an advisor charges a client for advice, he should not receive a commission from the AMC. Therefore, a Registered Investment Advisor will charge a fee from the client, and the advice is applied to direct funds and not regular funds.

Advantages of a Regular Plan over Direct Plan in Mutual Funds

While regular mutual funds have a slightly higher expense ratio and marginally lower returns, they have quite a few advantages.

Convenience

Investing in a mutual fund isn’t as easy as it looks. An investor has to assess his profile on the basis of risk and financial needs. Then find the mutual fund that fits into this criteria. And finally, invest in the mutual fund. All this is a time taking process. An intermediary will have knowledge of the existing mutual funds. And will help find the best fit based on investors’ profiles. On the other hand, the direct plan lacks this. As a result, investing in a regular plan is convenient.

Professional advice

Intermediaries have in-depth knowledge of the huge array of mutual funds. Hence can assess an investor’s profile to find the best fit for them. A qualified advisor can guide the investors during their investment journey and even impart market knowledge to them to earn higher returns. So, only a regular plan has the option for professional advice. However, in a direct plan, the investor has to rely on his own knowledge.

Regular portfolio monitoring and review

Markets are dynamic and ever changing. As an investor, it would be hard to keep up with the market regularly. In a regular plan, intermediaries keep track of the market and monitor their client’s portfolios regularly. Also as needed, they advise on restructuring it. Investors opting for a direct plan have to take time out to monitor their portfolio regularly.

Value-added services

Intermediaries provide a few additional services for investors’ convenience. Such as keeping a record of investor’s investments, provide tax proofs during tax filing, facilitate redemptions, or etc. All these services aren’t available in direct plans. On the other hand, a regular plan comes with all these value added services.

Which is Better: Direct Plan Vs Regular Plan in Mutual Funds?

Choosing between direct and regular mutual funds can feel confusing. So, which is better: direct or regular mutual fund? The answer depends on what suits you best.

Direct funds work well for someone who has the time, interest, knowledge, and inclination to do the required work for prudent investing. For those who do not have what it takes, using a well-informed intermediary such as a distributor is advisable.

Direct Mutual Funds

- Lower Costs: Direct mutual funds don’t involve middlemen like brokers or agents. This means you save on commission fees.

- Higher Returns: With lower fees, more of your money stays invested, which can lead to higher returns over time.

- Control: You make all the investment decisions yourself.

Regular Mutual Funds

- Expert Guidance: Regular mutual funds come with advice from financial experts.

- Convenience: Advisors handle the paperwork and monitor your investments.

- Support: They help you understand the difference between direct and regular mutual funds and choose what’s best.

Consider Your Needs

- Knowledge: A direct mutual fund might be better if you’re comfortable making investment choices.

- Advice: If you prefer expert help, a regular mutual fund could be the way to go.

Costs vs. Benefits: Weigh the savings from lower fees against the value of professional guidance.

How To Recognize If a Mutual Fund is Regular or Direct?

Knowing whether a mutual fund is regular or direct is important for managing your investments. Here’s how you can tell the difference:

Check the Fund Name

- Includes “Direct”: If the mutual fund is a direct plan, the word “Direct” will be in its name. For example, “ABC Equity Fund Direct Plan.”

- No “Direct” Mention: If it’s a regular mutual fund, it might just have the fund name without “Direct,” or it may say “Regular Plan.” Regular plans are managed through intermediaries like financial advisors, leading to higher expense ratios due to commission payments.

Look at Your Investment Statement

- Plan Details: Your mutual fund statement will specify if your investment is in a direct or regular plan.

- Expense Ratio: Direct mutual funds have a lower expense ratio than regular mutual funds.

Use Online Platforms

- Fund Information: When viewing the fund online, check the details section. It will state whether it’s a direct or regular mutual fund.

- NAV Differences: A direct plan’s Net Asset Value (NAV) is usually slightly higher than a regular plan due to lower fees.

Ask Your Advisor

- Confirmation: If you work with a broker or advisor, they can tell you whether your mutual fund is direct or regular.

- Understand the Difference: They can also explain the difference between direct and regular mutual funds and how they affect your returns.

Regulatory Updates in 2024

In India, new rules in 2024 require mutual fund companies to clearly state whether a fund is direct or regular. This helps investors like you make informed decisions.

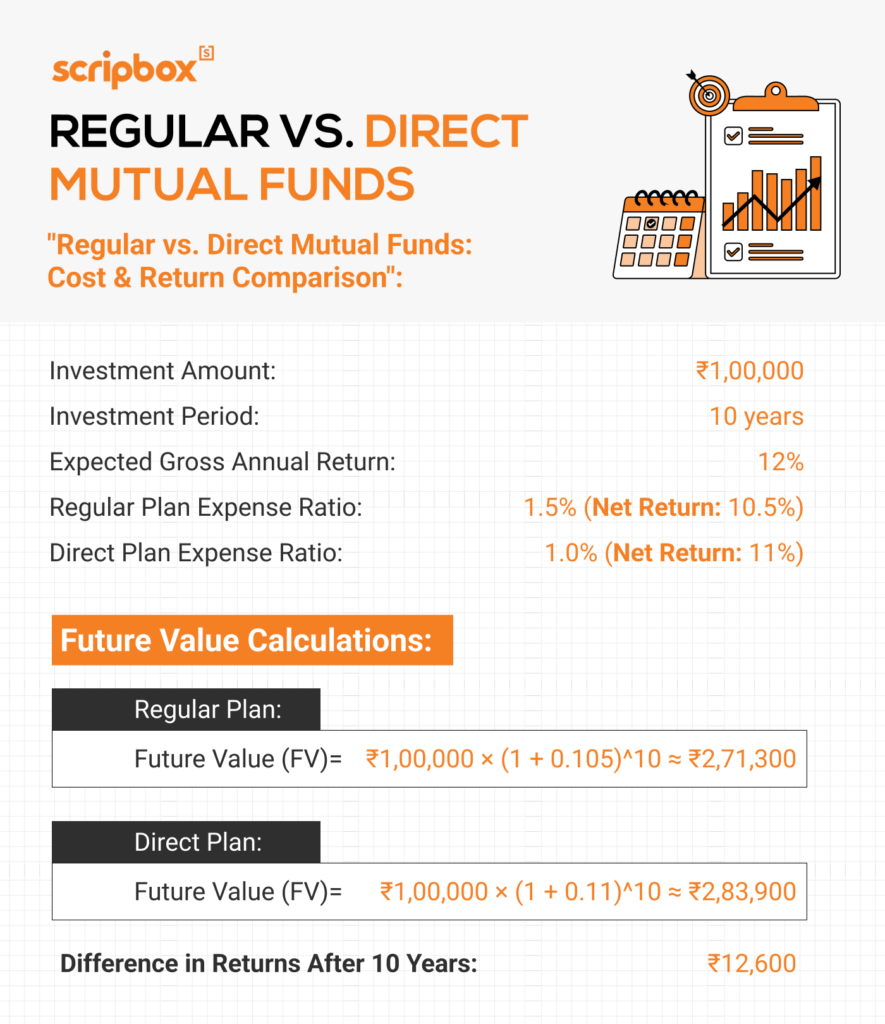

How Does the Expense Ratio Impact the Returns of Direct and Regular Plans?

Conclusion

In the end, the best choice between direct vs regular mutual funds depends on your individual needs, knowledge, and comfort level with investing. By taking the time to understand these options, you’re setting yourself up for a smarter investment strategy. Remember, the goal is to make your money work for you, and understanding the difference between direct and regular mutual funds is a key step in that direction.

Frequently Asked Questions

Usually, there is no separate charge for switching from regular to direct plans within the same mutual fund scheme. However, any switch of plans involves simply selling the units under one plan and buying units of another plan. Hence, the capital gain tax will arise depending on the period of holding and the type of mutual fund.

You can easily switch from regular to direct mutual funds. To switch or change your mutual fund investment plan you can use your investment account. Login to your account, go to the fund investment page and select the option of ‘Switch’ plans. Simply place your request online through your account with your investment manager or broker. It might take up to 5 working days to process your request. Alternatively, you can visit the branch of the AMC and fill out an offline form. This option can be time-consuming and troublesome. However, if you are not comfortable with the online method then you can avail of the offline method.

Under a direct mutual fund, the investor needs to select the funds to invest in. This requires an analysis of past performance and other factors like future prospects. This might be overwhelming considering the large number of schemes offered by the AMCs. Moreover, direct investment in mutual funds involves a continuous performance assessment. Hence, the disadvantage is that it requires an in-depth analysis for the selection of funds and evaluation of the scheme post investment.

Both regular schemes and direct plans are ideal for investors. The aspect which is better depends on the investor and his or her preferences. If the investor possesses an in-depth knowledge of the financial market and time to invest, then a direct fund is suitable. On the contrary, if an investor is looking for investment advice and wishes to invest in well-researched funds then regular funds are a better choice.

To change the SIP from a regular plan to a direct plan you need to switch from one plan to another. You will have to switch your investment from a regular plan to a direct plan. Then set the SIP transaction again with the new plan. This switch will involve selling the units under one plan and buying under another plan.

Investors who wish to directly deal with individual fund houses rather than intermediaries should consider investing through direct plans. Above all, investors with the capacity and knowledge to study mutual funds by doing their own research can invest in direct funds. The entire process of application, documentation, tracking, portfolio reviewing, compliance issues etc. should be taken care of by the investor. Therefore, investors who want to increase returns by reducing the expense ratio and have good knowledge of mutual funds can consider investing in direct funds.

Currently direct plans of equity mutual funds have expense ratios that are typically 0.4-0.5% lower than regular plans. This means that your return by opting for the direct plan is higher by that amount. This approx 0.5% is indirectly a fee that you pay Scripbox for our services. This is similar to the fee you pay your doctor, lawyer or other professionals.

Related Pages

- What is a Mutual Fund?

- Differences Between Direct and Regular Mutual Fund Schemes

- What are Direct Mutual Funds?

- What are Regular Mutual Funds?

- Advantages of a Regular Plan over Direct Plan in Mutual Funds

- Which is Better: Direct Plan Vs Regular Plan in Mutual Funds?

- How To Recognize If a Mutual Fund is Regular or Direct?

- How Does the Expense Ratio Impact the Returns of Direct and Regular Plans?

- Conclusion

- Frequently Asked Questions

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

Show comments