Investment in mutual funds needs good understanding and knowledge. Nowadays, investors can gain all information related to mutual funds online. Investors can also compare different funds. However, a mutual fund distributor can help an investor put things in perspective for them.

Here, in this article, we will provide you with a complete guide on mutual fund distributors along with their qualifications, roles and responsibilities. We will also help you understand how to become a mutual agent.

Who is a Mutual Fund Distributor?

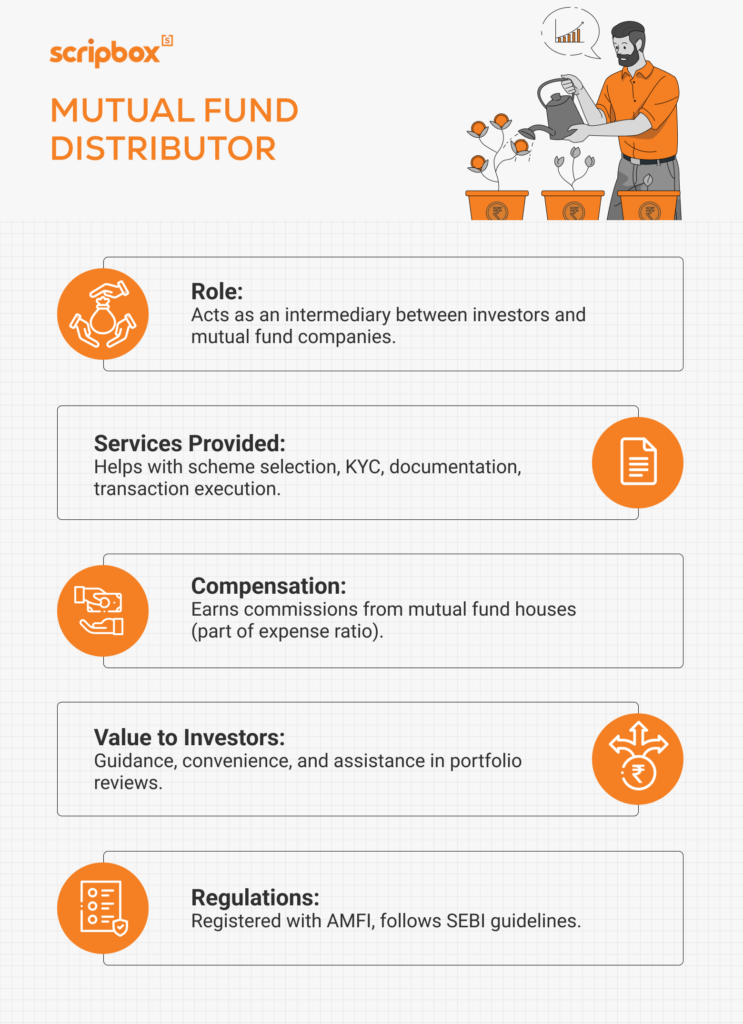

A mutual fund distributor is one who helps in the buying and selling of mutual funds in India for its investors. The mutual fund distributors earn commission by bringing in investors to the mutual fund scheme. They also advise the investors about the various schemes of different mutual fund houses. They play a crucial role in financial planning by helping investors make informed decisions. Every mutual fund is registered with SEBI (Securities and Exchange Board of India) and hence considered to be safe. Furthermore, the mutual fund distributors help the investors in carrying out investment transactions. These transactions include investing, switching between mutual funds or redemption. They also periodically guide the investors on the performance of their investments.

The mutual fund distributor is also known as a mutual fund agent. The mutual fund agent needs to track the functioning and performance of mutual fund industries. Moreover, this type of mutual fund agent needs to conduct qualitative and quantitative analysis using databases and monitor fund information regularly. Also, they need to keep an eye on essential developments in the mutual fund industry, markets and the economy.

Additionally, the mutual fund distributors coordinate and collaborate with mutual fund houses from time to time. This will help them identify the various investment options for their investors. Also, this allows them to create a database with fund recommendations and conclusions.

Qualifications of a Mutual Fund Distributor

Any individual above the age of 18 years can act as a mutual fund distributor or agent. Also, the candidate should qualify for class 12 or class 10 with three years of diploma. Career opportunities in this field are vast and rewarding.

The minimum requirement to become a mutual fund distributor is the completion of NISM Series V-A: Mutual Fund Distributors Certification. For any entity or a person engaged in marketing and selling of mutual funds, SEBI has made it mandatory to clear the NISM Certification.

Upon passing the NISM Series V-A: Mutual Fund Distributors Certification Examination’, (National Institute of Securities Markets) NISM will issue an ARN number which will make the individual eligible to sell mutual fund products. Along with this, they also receive an Employee Unique Identification Number (EUIN) registration number. The NISM certification is valid for three years from the date of examination.

After ARN is received from AMFI, the distributor needs to empanel themselves with Asset Management Companies (AMC’s), whose products they want to sell. To know about the empanelment process, including documentation, the distributors can visit the AMC websites. Also, the AMC will provide necessary training material, marketing material and guide the distributors for sales. Finally, they also pass on the commission for sales to the distributors.

In case the mutual fund distributor is a non-individual, then every sales staff member of the company shall be ARN holders. Basically, the persons advising investors for mutual funds investment shall have EUIN.

In case senior citizens wish to become mutual fund distributors or mutual fund agents, they must attend the CPE program (Continuing Professional Education) training module. Those who complete the CPE program (Continuing Professional Education), shall complete the documentation process to apply for ARN as mentioned above.

Moreover, many insurance agents sell mutual funds after getting ARN from AMFI.

Benefits of Becoming a Fund Distributor

Becoming a mutual fund distributor can be a rewarding career choice, offering numerous benefits and opportunities for growth. Some of the advantages of becoming a fund distributor include:

- Unlimited Earning Potential: As a mutual fund distributor, your earnings are directly tied to your performance and the number of clients you serve. The more clients you bring in and the more investments you manage, the higher your commission earnings will be.

- Flexibility: You can work as a mutual fund distributor on a full-time or part-time basis, depending on your schedule and preferences. This flexibility allows you to balance your professional and personal life effectively.

- Opportunity to Build a Business: As a mutual fund distributor, you have the opportunity to build a business and create a loyal client base. Over time, you can establish a reputation for providing excellent service and sound investment advice.

- Personal Satisfaction: Helping clients achieve their financial goals can be a highly rewarding experience. Knowing that your guidance has contributed to someone’s financial well-being can provide a great sense of accomplishment.

- Opportunities for Advancement: With experience and success, you can move into leadership roles or start your own mutual fund distribution business. The mutual fund industry offers numerous pathways for career growth and development.

Advantages of a Career in Mutual Fund Distribution

A career in mutual fund distribution offers many advantages, including:

- Job Security: The demand for mutual fund distributors is high, and the industry is expected to grow in the coming years. This growth ensures a steady demand for skilled professionals in the field.

- Opportunities for Professional Development: As a mutual fund distributor, you can access ongoing training and education to help you stay up-to-date on industry developments and best practices. This continuous learning helps you enhance your skills and knowledge.

- Variety: Every client is unique, and as a mutual fund distributor, you will have the opportunity to work with a diverse range of clients and help them achieve their financial goals. This variety keeps the job interesting and challenging.

- Autonomy: As a mutual fund distributor, you will be free to work independently and make your own decisions about how to build your business. This autonomy allows you to effectively implement your strategies and grow your client base.

Building Your Brand as a Mutual Fund Professional

Building your personal brand is essential to attracting and retaining clients as a mutual fund distributor. Here are some tips for building your brand:

- Develop a Strong Online Presence: Create a professional website and social media profiles to showcase your expertise and connect with potential clients. Regularly update your online platforms with valuable content to engage your audience.

- Establish a Niche: Specialize in a particular area of mutual fund distribution, such as retirement planning or investment management, to differentiate yourself from other distributors. This specialization can help you attract clients looking for specific expertise.

- Network: Attend industry events and conferences to connect with other professionals and potential clients. Networking helps you build relationships and expand your professional circle.

- Develop a Unique Value Proposition: Clearly define what sets you apart from other mutual fund distributors and communicate this to potential clients. Your unique value proposition should highlight your strengths and the benefits clients can expect from working with you.

Steps to Become a Mutual Fund Distributor in India

Becoming a mutual fund distributor in India requires several steps, including:

- Passing the NISM Series V-A: Mutual Fund Distributors Certification Examination: This exam is mandatory for anyone who wants to become a mutual fund distributor in India. It tests your knowledge of mutual funds and the regulatory environment.

- Obtaining an AMFI Registration Number (ARN): After passing the NISM exam, you must apply for an ARN from the Association of Mutual Funds in India (AMFI). The ARN is essential for selling mutual fund products.

- Getting Empanelled with Mutual Fund Houses: Once you have obtained your ARN, you must get empanelled with mutual fund houses to start selling their products. This process involves submitting necessary documentation and completing any required training.

How to Start a Mutual Fund Distribution Business

Starting a mutual fund distribution business requires careful planning and execution. Here are some steps to follow:

- Conduct Market Research: Understand the demand for mutual fund distribution services in your area and identify your target market. This research helps you tailor your services to meet the needs of potential clients.

- Develop a Business Plan: Create a comprehensive business plan that outlines your goals, target market, marketing strategy, and financial projections. A well-thought-out business plan serves as a roadmap for your business.

- Obtain Necessary Licenses and Registrations: In addition to obtaining an ARN, you may need to obtain other licenses and registrations to operate a mutual fund distribution business in your state. Ensure you comply with all regulatory requirements.

- Build a Team: As your business grows, you may need to hire additional staff to help you manage your client base and provide support services. A skilled team can enhance your service quality and client satisfaction.

- Develop a Marketing Strategy: Create a marketing strategy that outlines how you will attract and retain clients, including social media marketing, email marketing, and other tactics. Effective marketing helps you build your brand and grow your business.

By following these steps and leveraging the benefits and advantages of a career in mutual fund distribution, you can build a successful and rewarding business in the financial industry.

Duties and Responsibilities of a Mutual Fund Distributor?

Providing investment advice means addressing an investor’s concerns. A professional with the requisite skills, qualifications, and expertise can offer sound investment advice. Therefore, as an investor, one must consult a certified mutual fund agent with relevant experience. The following are the roles and responsibilities of a mutual fund distributor. Effective client relationship management is also crucial in ensuring long-term success and trust.

Educating the Investor

The mutual fund distributor must construct a suitable plan for their investors based on their financial goals. They need to educate the retail investor on investment strategies to achieve them. It also involves exploring different investment options. Therefore, this helps to evaluate how each can help or hinder the client’s financial goals.

Evaluating Risk Tolerance

A mutual fund distributor can suggest an investment strategy based on the investor’s risk management and risk tolerance level. For instance, equity mutual funds are riskier than debt mutual funds. Hence, not every retail investor might consider equity funds each time. Thus, the distributor must consider the long-term and short-term financial goals, investment tenure, age, family status, total expenses, and current financial responsibilities before devising an investment plan.

Analysing Investment Options

Once the investor’s goals and requirements are in place, the mutual fund distributor conducts a market analysis to understand the market conditions. Accordingly, they recommend equity mutual funds, debt mutual funds or money market instruments. The distributors must stay up-to-date with the latest financial news and trends to ensure they offer relevant advice.

Devising an Investment Strategy

After analyzing the customer’s different investment options, the mutual fund distributor plans a suitable portfolio management strategy. The strategy involves combining other investment options to diversify the portfolio minimizing risks and and maximizese returns. For instance, a portfolio could be built by combining equity mutual funds with some portion of debt mutual funds.

The investor’s portfolio requires frequent assessment. This is necessary because the client’s goals might change. Therefore, the distributor must closely watch the client’s portfolio and suggest modifications as and when required.

Helping Investors for Portfolio Diversification

Asset allocation plays a crucial role in spreading the portfolio’s overall risk. As a distributor, it is essential to stay updated with the current market conditions and new products being introduced. Also, a lot of research goes into tracking the best investment options across sectors and markets. Therefore, a mutual fund distributor plays a significant role in ioptimizingng the investor’s portfolio anminimizingng the risks.

Investors can also use Scripbox’s mutual fund calculator to calculate their returns, which can help them estimate their financial goals.

Documentation

A critical aspect of a mutual fund distributor is handling the discreet financial details of the client. Hence, they must maintain a service record to ensure regulatory compliance. For example, they must keep records of invoices, details of the services offered, and any other transactions. This documentation is mandatory during regulatory bodies’ audits of the firm.

Mutual Fund Distributor Commission

A mutual fund distributor’s commission structure is dependent on multiple factors.

Mutual Fund Trailing Commission

The aim of trailing commissions is to reward the distributors for sourcing investors from outside of the top 30 cities. The trailing commissions are categorized into

- T-30 Cities: The commission in the top 30 cities across India is subject to a standard commission rate. There are no additional benefits or bonuses for sourcing clients from these cities. The commissions range from 0.1% to 2%, depending on the fund house and the type of mutual fund.

- B-30 Cities: The below 30 cities are cities that don’t fall under the top 30 list. Sourcing clients from B-30 cities will give the distributor an additional incentive. In addition to the regular commission, extra incentives can be earned on every investment made during the first year. Along with the standard commission rate between 0.1% and 2%, the distributor earns a special commission on each investment.

Know Your Distributor (KYD) Guidelines

To curb financial frauds played on investors by mutual fund distributors or their employees, AMFI has initiated specific penal actions. These actions include suspension for ARN holders, advising all AMC to suspend the payment of a commission, trail commission, incentives, etc. To control this fraud, SEBI (Securities and Exchange Board of India) has advised AMFI to tighten the procedure for distributor registration. Therefore, the current registration procedure for mutual fund distributors which is more stringent is known as Know Your Distributor (KYD). The KYD process involves obtaining relevant documents and validation of such documents, personal verification and biometrics.

AMFI has commenced the KYD process for the mutual fund distributors with effect from September 1, 2010. The KYD (Know Your Distributor) is very similar to that of KYC (Know Your Customer) for investors. It requires distributors to submit identity proof, address proof, PAN and bank account details with evidence mandatorily. Furthermore, it has also introduced biometrics as a part of the KYD process.

The prescribed form for KYD is available under the ‘Distributor Related Forms’ Tab on the AMFI also. Also, update forms such as change of address, contact details, bank details, etc., are available under this tab.

AMFI has decided to use the services of CAMS for the KYD process, including biometrics. They can carry out this process through their centres referred to as “CAMS POS”. This would help to have better control of the movement of documents and data. Therefore, a mutual fund distributor/agent is required to apply for KYD. Also, simultaneously the need to submit the application for registration of ARN.

What is the Difference Between Mutual Fund Distributor and Investment Advisor?

Differentiating between a mutual fund distributor and an investment advisor is quite tricky as they both assist in making investment decisions and have a fiduciary duty to their clients. Both entities are enrolled and managed by different regulatory bodies. The mutual fund distributor is controlled by AMFI (The Associations of Mutual Funds in India). At the same time, the investment advisors are controlled by SEBI (Securities and Exchange Board of India). However, the following are the differences between a mutual fund distributor and investment advisor.

Meaning

Mutual fund distributor is an individual or entity that helps investors to buy and sell mutual funds. They earn income in the form of commission from mutual funds investment. They should understand the investor’s situation, risk tolerance levels and financial goals to suggest a suitable plan for them.

An investment advisor is an individual or entity that gives financing or investment advice. They also manage security analysis for investors. They earn income as a fixed fee or a percentage of commission from the investor’s portfolio. Investment advisors are also known as financial advisors. They can enrol themselves as Registered Investment Advisors (RIA). They evaluate investor’s assets, liabilities, income and total expenses to advise a suitable investment plan.

Commissions

Mutual fund distributors earn commissions from buying and selling of mutual funds. Here, the AMC pays commissions to them. To avoid mis-selling, SEBI has directed AMC’s to pay only trail commissions. Also, up fronting of trail commissions has been eliminated.

Investment advisors usually charge a fixed fee from their clients. Sometimes, they also charge a fixed percentage of the client’s portfolio.

Depositary Duty

The mutual fund distributor sometimes gives investment advice for which they earn commissions.

Investment advisors are committed to giving investors honest advice as they are bound by depositary duty.

Examination and Mutual Fund Distributors Certification

Mutual fundis distributor needs to have a valid certification NISM Series V-A: Mutual Fund Distributors Certification Examination.

Investment advisors need to clear two levels of National Institute of Securities Markets NISM examination.

- NISM-Series-X-A: Investment Adviser -Level 1

- NISM-Series-X-B: Investment Adviser -Level 2

Advising and Distributing

Mutual fund distributors can both advise and distribute mutual funds. In other words, they guide the investor about investing in mutual funds.

Investment advisors can advise investors to invest in mutual funds. However, they cannot act as a distributor. This means that they can recommend, but it is the investor’s choice whether to invest or not. Hence, a distributor ensures that the investor invests in mutual funds.

Direct/Regular Plan

Mutual fund distributors generally suggest regular plans as this helps them to earn commissions.

Investment advisors suggest mutual fund schemes where the investor can opt to invest in a direct plan or regular plan. Usually, they advise clients to invest in direct plans because direct plans have more economical expense ratios than regular plans.

Gathering Relevant Information

Mutual fund distributors also gather information from investors to advice. However, they do not collect detailed information. They understand the investor’s risk tolerance levels and financial goals to suggest a suitable investment plan.

Investment advisors concentrate on all financial information related to the client. For instance, they gather information about the client’s income, total expenses, assets, liabilities, tax status, short term and long term goals, etc. Based on this information, the investment advisor creates a financial plan for the client. Also, the investment advisor is expected to offer unbiased advice that fits the client’s necessities.

Therefore, mutual fund distributors, as well as investment advisors both, are an essential source for right investment decisions in mutual funds.

Points to Consider Before Choosing a Distributor

The following are the points to consider while choosing a mutual fund agent.

- Firstly, one must check the experience of the mutual fund advisors. Also, one should look for a distributor who has been in the financial market for a couple of years.

- Secondly, one should also ask for referrals from the mutual fund distributor. They can share the contact details of some investors with whom they worked. This helps the investors understand their experience on the advice and the services offered by the agent.

- One of the significant roles of a mutual fund distributor is to explain to the investor about the underlying asset classes in the mutual fund schemes. Also, helping the investor to combine their investments to achieve their financial goals. Therefore, looking for a mutual fund distributor who is willing to give an overall view of the investor’s portfolio.

- When it comes to investing, one must spend time on choosing the mutual fund advisors. Only when the investor is fully satisfied, they should go ahead with the agent. Thus, selecting a mutual fund agent shall not be done under pressure.

- Lastly, one has to be sure that the mutual fund distributor is accountable for any suggestion they provide. They must comply with AMFI and SEBI requirements. Also, they must adhere to the Code of Conduct as laid down by the regulatory body. In short, working with a competent mutual fund agent who upholds professional ethics can make a difference in the investment journey.

Do You Really Need a Distributor?

A mutual fund distributor is expected to provide some services and bring convenience to investors. If they wish to invest directly in mutual funds or without any broker, then the investor needs to do all the services themselves. Moreover, suppose the investors have enough time, know-how and discipline to do all these activities themselves, in such a case. In that case, the investor can consider investing in mutual funds directly or without any broker.

On the other hand, a mutual agent/distributor can help investors to manage their mutual fund portfolio more efficiently. The mutual fund distributors have enough knowledge and experience as they work in the financial market. Therefore, with continuous portfolio monitoring, they advise timely changes to the investor’s portfolio.

However, many investors invest in different mutual fund schemes where they do not have time to track them. There are various products available across the different asset classes. Therefore, a professional offering financial advisory services can help investors with proper asset allocation. Also, they help in investing in products as per the investor’s financial goals and time horizon.

Check Out Financial Regulators in India

Frequently Asked Questions

To become a mutual fund distributor, you need to complete the NISM Series V-A: Mutual Fund Distributor Certification. SEBI mandates that a person or an entity engaging in selling or marketing mutual funds has to clear the NISM certification. After successfully clearing the exam, NISM will issue an ARN number, enabling you to sell mutual funds. Also, an Employee Unique Identification Number (EUIN) registration number will be allotted to you. The NISM certification is valid for a period of three years from the date of examination.

Upon receiving the ARN, you have to empanel yourself with the Asset Management Companies (AMCs) to sell the products. Furthermore, the eligibility criteria to appear for the certification exam is, you must be at least 18 years old and should be qualified in class 12 or class 10 with a three years diploma.

A mutual fund distributor earns a commission for signing up an investor to a mutual fund scheme. The Asset Management Company (AMC) pays the commission to the distributor. The commissions vary based on the type of mutual fund and the fund house. The distributor also provides investors with all the necessary information related to the mutual fund and the fund house. Furthermore, the distributor also assists investors in performing transactions. Transactions such as investing, redemptions, switching between funds, etc. Also, distributors perform periodic reviews of their investor’s portfolios and suggest necessary changes.

The primary source of income for an MF distributor is upfront commission and trailing commission. Sometimes, AMCs also pay one-time transaction charges to distributors. In addition to these, the distributor can also earn a commission from the client.

To become an MF distributor, you must complete the NISM Series V-A: Mutual Fund Distributor Certification.

- Who is a Mutual Fund Distributor?

- Qualifications of a Mutual Fund Distributor

- Benefits of Becoming a Fund Distributor

- Steps to Become a Mutual Fund Distributor in India

- Duties and Responsibilities of a Mutual Fund Distributor?

- Mutual Fund Distributor Commission

- Know Your Distributor (KYD) Guidelines

- What is the Difference Between Mutual Fund Distributor and Investment Advisor?

- Points to Consider Before Choosing a Distributor

- Do You Really Need a Distributor?

- Frequently Asked Questions

Show comments