To invest in mutual funds, you need to know how to invest in them. In this article, we have explained different ways to start investing in mutual funds in India online. Mutual funds are one of the best investment options because they offer a wide range of options that have the potential to fulfill the needs of every investor, irrespective of their financial investment objectives or risk appetite.

How to Invest in Mutual Funds Through Scripbox Investment Plans

This article helps you understand the different types of mutual funds available in India and how you can make an investment. Here, you can find out why you should pick mutual funds for your investments and how to invest in mutual funds using a sound investment strategy.

Know about how a mutual fund works.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. By investing in a mutual fund, individuals can gain exposure to a professionally managed portfolio and potentially benefit from economies of scale while spreading risk across multiple investments. This means that even with a small amount of money, you can invest in a wide range of assets, reducing the risk of investing in individual securities. Mutual funds are managed by professional fund managers who make investment decisions on behalf of the investors, aiming to achieve the fund’s investment objectives.

How to decide between mutual funds and Stock Investments. Read our article here.

Advantages of Investing in Mutual Funds

Mutual funds offer several benefits, making them a popular choice for many investors. Here are some key advantages:

Diversification

One of the primary benefits of investing in mutual funds is diversification. Mutual funds invest in a variety of assets, spreading risk across different securities. This helps to reduce the risk of investing in individual stocks or bonds, as the performance of one security is less likely to significantly impact the overall portfolio. By diversifying your investments, you can achieve a more balanced and stable return over time.

Professional Management

Mutual funds are managed by experienced fund managers who deeply understand the market. These professionals make investment decisions on behalf of the investors, leveraging their expertise to achieve higher returns. This professional management can be especially beneficial for individual investors needing more time, expertise, or resources to manage their investments effectively.

Liquidity

Mutual funds offer high liquidity, which means investors can buy or sell fund units at any time, providing flexibility to their investments. This can be especially useful for investors who need to access their money quickly or who want to take advantage of market opportunities. Unlike other investment options, mutual funds allow you to convert your investments into cash when needed quickly.

Factors to Consider When Investing in Mutual Funds

When investing in mutual funds, several factors must be considered to ensure that your investments align with your financial goals and risk tolerance. Here are some key considerations:

- Identifying Investment Goals: Determine what you want to achieve through your investments, whether it’s long-term growth, income generation, or capital preservation. Clear goals will help you choose the right type of mutual fund.

- Considering Time Horizon: Align your investment horizon with your goals. Long-term objectives suit growth-oriented equity funds, while mid-term goals benefit from a balanced portfolio. Your time horizon will influence the type of mutual fund most appropriate for you.

- Assessing Risk Tolerance: Assess your risk tolerance to determine whether you prefer a conservative or aggressive investment approach. Understanding your risk tolerance will help you choose a mutual fund that matches your comfort level with market fluctuations.

- Evaluating Fund Performance: Research the fund’s historical performance, fees, and investment strategy to ensure it aligns with your investment goals and risk tolerance. Past performance can give you an idea of how the fund has managed market ups and downs.

- Considering Fees and Expenses: Mutual funds come with fees and expenses, including annual fees, expense ratios, or commissions, that will affect your overall returns. Be sure to understand these costs and how they impact your investment.

- Evaluating the Fund Manager: Research the fund manager’s experience, track record, and investment philosophy to ensure they align with your investment goals and risk tolerance. A skilled fund manager can significantly improve the fund’s performance.

By considering these factors, investors can make informed decisions when investing in mutual funds and potentially achieve their financial goals.

Types of Mutual Funds to Invest in India

Here are the details which will help you understand the nature of various types of mutual funds.

- Equity Mutual Funds: Growth funds invest mainly in equities and equity-related instruments. Their primary objective is capital appreciation. Although growth funds are risky, they offer high returns in the long term.

- Debt Mutual Funds: Income funds are debt funds with the primary motive of capital preservation. They earn money by investing in fixed-income instruments like government securities, bonds, and debentures, where you get regular income in the form of interest. The objective of the income fund is to generate stable income with moderate capital growth.

- Liquid Mutual Funds: Liquid funds provide very short-term liquidity to investors. They invest in debt and money market financial instruments like treasury bills and deposit certificates with a maturity of up to 91 days. Liquid funds have the lowest risk and give average returns just above bank deposits. They are ideal for people looking to park surplus money until they find a suitable investment avenue.

- Tax-Saving Mutual Funds or ELSS: ELSS or tax-saving mutual funds help you save taxes and plan your taxes. Investments up to Rs.1.5 Lakh qualify for a deduction under section 80C of the Income Tax Act, 1961. However, you have a lock-in period of 3 years on the ELSS investment.

- Fixed Maturity Funds: Fixed-maturity mutual funds invest a major chunk of the corpus in closed-ended debt funds with a fixed maturity date. On the date of maturity, the money received from the investment is repaid to investors after adjusting for expenses, and the fund ceases to exist.

- Retirement Funds: Pension funds have the primary objective of amassing a corpus sufficient to provide a regular pension to the investor after retirement. They are also called retirement funds and have a lock-in period of at least 5 years or until the age of retirement. The pension fund can be withdrawn as a lump sum, a regular pension, or a combination of both.

Understanding asset allocation is crucial as it helps distribute investments across different types of mutual funds to balance risk and return.

Ways to Invest in Mutual Funds online

Any investor can start investing in the mutual fund using either the single lump-sum payment option or the more flexible systematic investment plan (SIP) option. When choosing between a lump-sum payment and a systematic investment plan (SIP), consider your investment horizon to determine which option aligns best with your financial goals.

You can start an SIP with a minimum amount of Rs. 500 for some ELSS funds, but usually Rs 1000. The regular contribution interval can be monthly, quarterly, semi-annual, or annual payments. SIP is an ideal approach if you are a salaried individual. You can invest in direct mutual funds or regular mutual funds. Both options have their own pros and cons.

1. How to Buy Mutual Funds From AMC (Direct Plans)

Mutual funds investment can be done directly online and offline by visiting the AMC Mutual funds investments can be made directly online and offline by visiting the AMC website. One of the key factors to consider when choosing a direct plan is the expense ratio, which can significantly impact your overall returns. The process involves;

- Opening a new account

- Provide personal details for the investment

- Fill FATCA form

- Provide bank details

- Upload an image of the canceled cheque

- Verify KYC through Aadhar and transfer money

The offline investment can be made by visiting the AMC local office, submitting an application and KYC documents, and making a payment.

Learn: Difference Between Direct and Regular Mutual Fund Plans

2. How to Buy Mutual Funds From Investment Platform (Regular Plans)

An online investment platform allows you to invest in mutual funds hassle-free. When using an online investment platform, it’s important to assess your risk tolerance to choose the most suitable mutual fund scheme. The platform offers single account access, which helps with investing, tracking, and managing all your mutual fund investments with various AMCs.

The steps required to invest using an online investment platform are;

- Create an account with the investment platform

- Pick up the scheme or plan

- Choose the payment type (SIP or lump-sum) and the amount

- Fill in a few personal details like PAN and bank details

- Transfer money online to complete the investment

Recommended Read: Best Mutual Fund for Lumpsum Investment

3. How to Invest in Mutual Funds through a Demat Account

You do not need to make an additional effort to invest in a mutual fund if you already have a Demat account. Investing through a Demat account allows you to manage your investments efficiently, but it’s essential to be aware of market volatility and its potential impact on your portfolio. Your existing Demat account and bank account can be used to invest and transact in mutual funds.

To invest in a mutual fund through a demat account, you need to log in to your demat account and look for the option to invest in a mutual fund. In the next step, you need to choose the fund in which you want to invest. Then, you need to complete the investment by transferring the amount online.

4. How to Invest in Mutual Funds through Karvy and CAMS

You can invest online and offline in mutual funds through registrars like Karvy and CAMS. Using registrars like Karvy and CAMS can help you manage your investment portfolio more effectively by providing a centralized platform for all your mutual fund investments.

- In the Online Method, you need to visit the website of CAMS or Karvy, create an account, provide a folio number, select the scheme, and make payment.

- In Offline Method: You can invest by visiting the local office, completing the application form, handing over the canceled cheque, and providing a copy of your KYC documents.

5. How to Buy Mutual Funds through an Agent

This method is not recommended because it is a costly and time-consuming method to inThis method is not recommended because investing in a mutual fund is costly and time-consuming.

While investing through an agent, it’s important to ensure that the agent is a qualified financial advisor who can provide sound investment advice. Just for information, the investment can be made through an agent by;

- Calling your agent, who should be a mutual fund distributor

- Hand over the filled-in application form and a copy of all the KYC documents and canceled cheques.

Recommended Read: Explore our article on what offshore funds are.

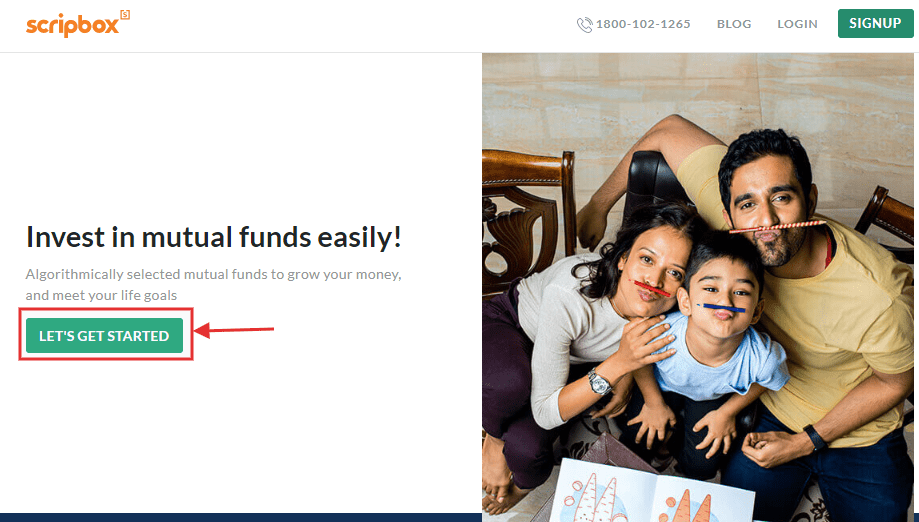

You can use Scripbox to invest in a mutual fund online in India. The step-by-step process is as follows.

Step 1: Visit Scripbox and Select an Investment Goal

Visit the Scripbox app and fill in the details to get the plans. Each plan is designed to meet a specific investment objective, helping you align your investments with your financial goals. The plans are nothing but life goals based on the information provided by you.

You can pick any of the plans that are close to your financial goals.

1. Lifestyle Goals

The lifestyle plan is for a young person who is anticipating various life events to unfold in his coming years’ and want to enjoy those events by making a prior investment.

Why Planning is necessary for lifestyle goal

- Because they are big expenses which require some planning

- EMIs and credit cards can be a burden

- You pay less when you invest

- Saving up adds to your enjoyment

2. Start Growing Wealth Goals

To get the plan details, you have to fill in the investment amount and the number of years.

3. Be Emergency Ready Goal

The plan is suited for everyone who wants to build an emergency fund.

Why is emergency planning necessary?

- There can be big medical expenses if you or your family members suffer from a major illness or a physical injury.

- Accidents and natural disasters can happen which requires repair and replacements costs for personal assets, such as a vehicle, or your home.

- Temporary loss of income due to any health crisis.

- Your job security is linked to the health of the economy, so you need some kind of planning to face the emergency situation.

4. Give your child Rs 1 Crore advantage! Goal

The plan is for individuals who want to create wealth for their child’s future so that s/he gets a head-start in life.

5. Become a Crorepati Goal

The plan is for individuals who are looking to save and build a significant corpus. The plan helps your savings grow into a crore in a certain number of years.

It gives three choices depending on one’s monthly investment capacity in the range of Rs. 5 to 15K, Rs. 15 to 25K and Rs. 25 to 50K.

6. Maintain your lifestyle in retirement Goal

The plan is suited for your retirement planning and it should start as soon as you start earning so that you can take advantage of low SIP amounts and benefit from the power of compounding.

Start thinking about retirement early because;

- Your 9-5 job has an end date: Whether it is by law or personal choice, your regular salary cheques will stop one day.

- Need to maintain relative lifestyle: Just because you have retired, it doesn’t mean you need to forego things you have gotten used to.

- Why depend on anyone else: Your children cannot be your retirement plan. Being financially free means not being dependent on anyone when you decide to retire.

- Plan to live longer: Thanks to medical advances, 50% of Indians will live longer than the age of 78. The longer you live the more will be the need to plan for an income.

7. Scripbox Tax Saver Goal

It helps you in tax planning through ELSS. The plan is suitable for all taxpayers who are looking for an avenue to save taxes prudently.

8. Child Education

The plan is for young couples who want to save and build a corpus for their child’s education.

Why is planning necessary

- A college education is expensive: Current costs range from Rs. 3-9 Lakh annually, or Rs. 14 – 40 Lakhs in total (including hostel, books, and fees).

- There is a regular increase in costs: College costs are increasing every year at about 10%.

- The joining date cannot be changed: Unlike other financial goals, there cannot be any change in the timelines.

- Education options are increasing: As a parent, you want to be financially prepared for your child’s dreams.

After picking up the goals, the rest of the process is about providing the necessary information required for making an investment.

explore our article on Emerging Market Funds

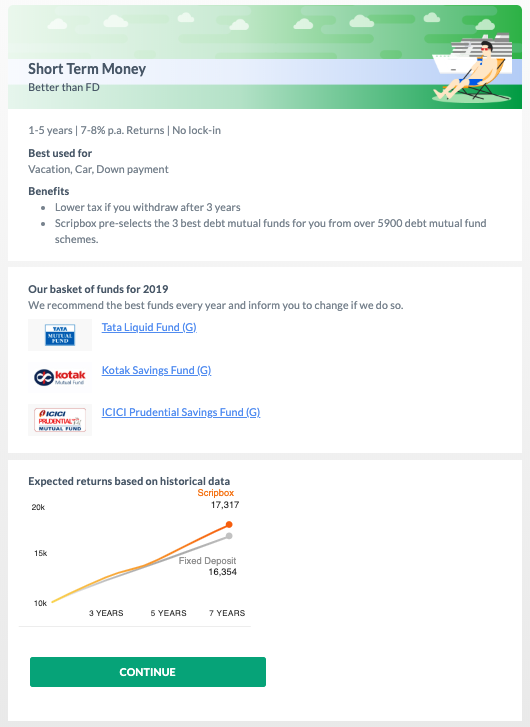

Step 2: Choose the Right Mutual Fund Product Type

Next, you need to select a suitable fund type.

Based on the investment goals which you have selected, you will be shown the plan details and the list of the funds in which you would be investing.

You will also find details on historical returns, plan details, and best use life goal case.

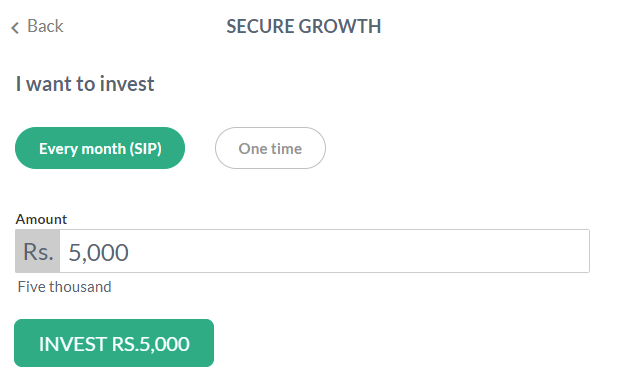

Step 3: Proceed for Investment

After getting the plan details you can click on invest. This will open the page as above where you can choose between SIP and one-time lump-sum payment.

If you are a first time user, then you need to create an account first.

Step 4: Investor Information and Money Transfer

At the last step, you need to provide information to add a bank account and PAN details.

The bank account will be used for investment and crediting the redemption amount by the mutual fund houses directly to your specified bank account.

Check Out ETF vs Mutual Fund

Conclusion

This is a starter guide for you to start investing in mutual funds. But remember, it is imThis is a starter guide for investing in mutual funds. But remember, it is important that you have a clear idea of your goals first so that you can choose the right asset class and mutual fund.

Mutual funds are one of the easiest financial instruments to start investing. Investing in Mutual funds can benefit the economic goal of an investor and prove advantageous. However, before investing, you must know everything about it to make a well-informed decision;

- Diversified

- Professionally managed

- Optimized for returns

- Caters to most of your investment needs.

Plus, there are online mutual fund investment platforms that provide an easy, hassle-free investment experience. So, whatever your life or investment goals are, you should consider fulfilling them through mutual funds.

Check Out the SIP Calculator

- How to Invest in Mutual Funds Through Scripbox Investment Plans

- Types of Mutual Funds to Invest in India

- Ways to Invest in Mutual Funds online

- 1. How to Buy Mutual Funds From AMC (Direct Plans)

- 2. How to Buy Mutual Funds From Investment Platform (Regular Plans)

- 3. How to Invest in Mutual Funds through a Demat Account

- 4. How to Invest in Mutual Funds through Karvy and CAMS

- 5. How to Buy Mutual Funds through an Agent

- Conclusion

Show comments