What is Savings Plan?

A savings plan is a way to set aside money over time, whether it’s for a short-term goal like buying a favorite gadget or a long-term milestone like funding your child’s education or planning for retirement. It’s a habit of putting something aside now so you can use it later, often with added benefits such as interest or tax advantages. People save in all sorts of ways, from stashing cash at home to depositing money in banks, investing in government schemes, or exploring market-linked avenues. Over time, as economies and financial systems have evolved, the concept of “savings” has come to mean money safely tucked away, often in formal financial instruments like bank accounts or official savings schemes.

Today, there are numerous savings plans available, offered by institutions like the Government, banks, and financial companies. With so many choices, it can be overwhelming to figure out which option best suits your goals. At Scripbox, we simplify this by grouping savings plans into three main categories: Government Savings, Bank Savings, and Market-Linked Savings. Understanding these categories helps you compare features, risks, returns, and tax benefits, so you can find a plan that meets your needs.

Best Saving Plan: Types of Savings Plans

Government Savings

Government savings schemes are created by the Government of India to encourage citizens to develop a habit of saving regularly. Many of these plans are tailored to specific needs for example, some focus on securing a girl child’s future, while others cater to senior citizens. These schemes generally provide guaranteed returns, have low to almost zero risk, and come with lock-in periods ranging from 5 to 20 years. While the tax treatment varies across different plans, many qualify for tax deductions under Section 80C of the Income Tax Act. Popular examples include the Public Provident Fund (PPF), National Savings Certificate (NSC), Senior Citizen Savings Scheme (SCSS), and Sukanya Samriddhi Yojana (SSY).

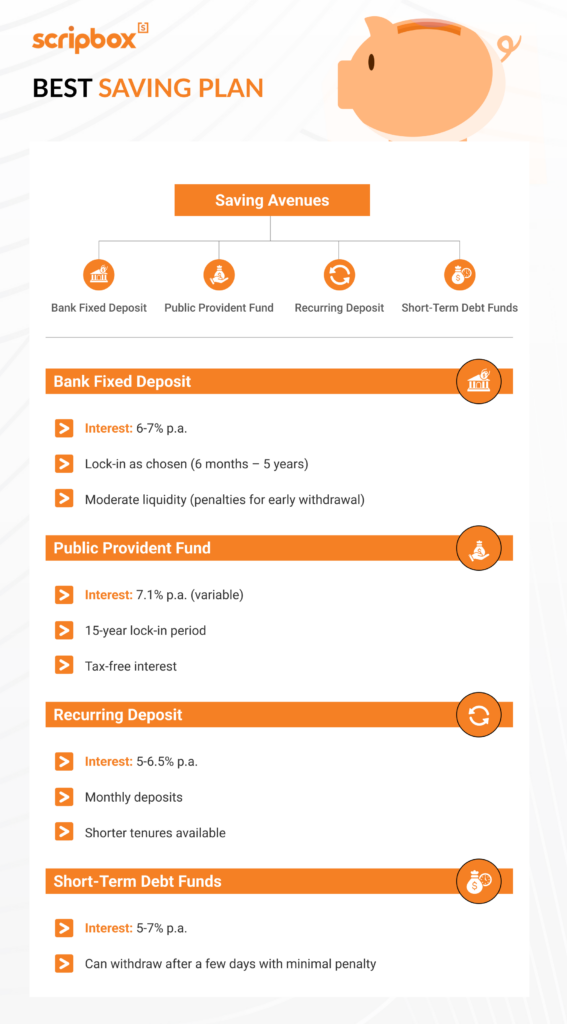

Bank Savings

Bank savings options are offered by banks and certain financial institutions under the regulation of the Reserve Bank of India (RBI). They cater to all citizens by providing secure and easily accessible ways to save money. Returns are fixed and guaranteed, and these products often have shorter lock-in periods compared to government schemes—ranging from as little as 7 days to as long as 10 years. Although these returns are taxable and may be subject to TDS, the advantage lies in their higher liquidity. Common bank savings products include Fixed Deposits (FDs) and Recurring Deposits (RDs).

Market-Linked Savings

Market-linked savings plans are offered by asset management companies and involve various investment options like stocks or bonds. While these can deliver higher returns, they do not offer any guarantee and are more sensitive to market fluctuations. They carry more risk than government and bank options, but can also be more flexible and liquid. Some market-linked products, such as ELSS (Equity Linked Savings Schemes) funds, offer tax benefits and have shorter lock-in periods typically around 3 years. The returns, however, are subject to capital gains tax depending on the investment’s performance and duration.

In essence, choosing the right savings plan depends on your financial goals, time horizon, and comfort with risk. By understanding these three categories—government, bank, and market-linked savings you can confidently select the option that best aligns with your future plans.

Best Savings Plans in India to invest in 2025

| Savings Plan | Interest Rate (p.a.) | Best for |

| Fixed Deposit | 3.50% to 9.00% p.a. | Savings |

| Recurring Deposit | 4.50% to 8.25% p.a. | Regular Savings |

| Public Provident Fund | 7.10% p.a. | long-term saving |

| Liquid Mutual Funds | 4.5%-7.5% | Short Term Investment |

| Equity Linked Savings Scheme (ELSS) | 12.00% to 30.00% p.a. | Tax Saving |

| Equity Mutual Funds | 12%-15% | High Return |

| Employee Provident Fund | 8.25% p.a. | Retirement Corpus |

| National Savings Certificate | 7.70% p.a. | Small and middle-class investors |

| Post Office Senior Citizen Savings Scheme | 8.20% p.a. | Low Risk |

| Post Office Monthly Income Scheme | 7.40% p.a. | Fixed Income |

| Kisan Vikas Patra | 7.50% p.a. | Low Lock in |

| Sukanya Samriddhi Yojana | 8.20% p.a. | Triple Tax Benefits |

| Atal Pension Yojana | Depends on Contribution Rates | Assured Income |

| Pradhan Mantri Jan Dhan Yojana | 4% p.a. | Low Income Group |

| Unit Linked Insurance Plan | 10.00% to 12.00% p.a. | Securing Future Goals |

Fixed Deposits (FD) for Savings

- Purpose: Saving

- Interest: 3.50% to 9.00% p.a., guaranteed returns

- Minimum Investment: Varies from bank to bank

- Maximum Investment: No limit

For decades, fixed deposits have been the best savings option for Indians. Fixed deposits are bank-based investment products. RBI closely monitors the FDs and assures safety. These are low-risk investments. With FDs, investors invest a fixed sum of money for a specified period and earn a fixed interest rate. The money invested can be redeemed along with interest earned upon maturity. This savings plan has a five-year lock-in period, offering significant tax benefits.

Premature withdrawals are not available for FDs. The interest rate offered by FD’s is higher when compared to savings bank accounts. It allows only a one-time lump sum deposit. Interest earned is subject to TDS upon maturity. Investments up to INR 1,50,000 are eligible for tax redemption under Section 80C of the Income Tax Act.

Investors can avail loan against their FD investments at lower interest rates. The interest rate for an FD investment is fixed when the account is opened. The interest rates are independent of any fluctuations in the market. Additionally, investors have the option to reinvest the interest to receive a lump sum amount upon maturity. FDs offer higher interest rates to senior citizens on their deposits. This helps them manage their post-retirement expenses.

Recurring Deposit (RD) for Regular Savings

- Purpose: Regular Savings

- Interest: 4.50% to 8.25% p.a., guaranteed returns

- Minimum Investment: INR 500

- Maximum Investment: INR 1 Lakh per month

A recurring deposit is a term deposit that banks offer. RD is a savings plan that helps investors deposit money regularly and earn high returns upon maturity. RDs encourage saving habits among people. Investors can choose their term period, number of deposits and the amount that they wish to deposit.

The minimum amount for a bank RD is INR 500, and for a post office RD, it is INR 10. The interest offered varies from bank to bank and is sensitive to market fluctuations. The tenure of an RD savings plan varies between 7 days and 10 years.

RD schemes allow premature withdrawals but with a penalty. Also, one can use RD investments as loan collateral. Any individual, HUF, corporate, company, NRI, government organization, minor above the age of 10, or minor below the age of 10 under a legal guardian can open an RD account.

RDs offer higher interest rates to senior citizens. This savings plan doesn’t allow investors to change their monthly investment amount. Unlike equities, RD is a guaranteed income plan that provides financial security. A 10% TDS is applicable if the interest earned is more than INR 10,000 from RD investments.

Public Provident Fund (PPF) for Long Term Savings

- Purpose: Retirement

- Interest: 7.10% p.a.

- Minimum Investment: INR 500

- Maximum Investment: INR 1,50,000

PPF was launched in 1968 by the National Savings Institute. It is also one of the post office savings schemes. Government of India backs this tax saving investment plan and PPF is one of the most popular savings plans.

PPF contributions are eligible for tax deduction. Investments up to INR 1,50,000 qualify for tax deduction under Section 80C of the Income Tax Act. Most importantly, returns from PPF are completely tax exempted as well. The minimum investment into a PPF account is INR 500 and the maximum investment is INR 1,50,000.

Investors cannot open multiple accounts. The interest is compounded annually. PPF investments can be payable in the form of lump sum or up to 12 deposits per financial year. PPF is easily transferable from one post office or bank to the other. The lock-in period is 15 years for PPF. Investors can extend their PPF savings by another 5 years.

Any Indian citizen can avail benefits of this savings plan. However, NRIs and HUFs are not eligible to open a PPF account. Additionally, investors can avail a loan against PPF investments. The loan can be availed between the third and fifth year.

Liquid Mutual Funds for Short Term Investment

- Purpose: Short term savings

- Interest/Growth Rate: 6.5% – 7.5% (Historical returns)

- Minimum Investment: INR 500

- Maximum Investment: No Limit

Liquid Funds are debt mutual funds that invest in very short-term market instruments. The short term market instruments such as government securities, treasury bills, and call money. Liquid funds invest in low-risk securities. They invest in securities which have maturity up to 91 days. Also, their average maturity is much lower than other funds. The average historical return of liquid funds is around 4.5% – 7.5%.

One can invest their surplus money for a short time. Liquid funds are the best alternative to savings accounts and FDs. Since liquid funds are a subset of debt funds, the taxation is similar to debt funds. Therefore, short term capital gains (investments held for less than three years) are added to the investor’s taxable income and are taxed as per the applicable tax slab. While, the long term capital gains (investments held for greater than three years) are subject to 20% tax with indexation benefits.

However, from April 1st 2023, debt mutual funds will no longer have the LTCG benefit. Capital gains from debt fund investments from April 1st 2023, will be taxed as per the investor’s income tax slab rate.

Additionally, liquid funds have the lowest risk associated when compared to other debt funds. This is because liquid funds invest in fixed income securities with short maturity. Also, liquid funds do not have any entry or exit loads (after a 7 day period during which a staggered exit load is applicable).

Equity Linked Savings Scheme (ELSS) for Tax Savings

- Purpose: Wealth creation through equity

- Returns: Market linked ( 12.00% to 30.00% p.a. historical returns)

- Minimum Investment: INR 500

- Maximum Investment: No cap on maximum investment,

ELSS are equity mutual funds that qualify for tax savings under Section 80C of the Income Tax Act. Indian citizens (residents and non-resident Indians) can invest in ELSS funds. They are diversified equity mutual funds that invest across market capitalization and sectors. They have a lock-in period of 3 years.

One can continue to invest in this scheme even after a 3 year lock-in and they need not withdraw their investments after. They charge an expense ratio on the NAV of the fund. No premature withdrawals are available. The investment up to INR 1.5 lakhs is eligible for tax exemption. However, the long term capital gains (LTCG) over INR 1 lakh are taxed. The minimum investment is INR 500 through SIP and there is no limit on maximum investment. Historically, these funds have given 12-15% annualized returns. However, past fund performance is only an indication as the returns from the funds are market linked.

They are the only kind of mutual fund that are eligible for tax savings. The key benefits of ELSS funds is that they can be used as tax saving instruments and for long term wealth creation.

One can invest in ELSS funds through online or offline mode. Through offline mode, one can directly approach the fund house to invest. Or they can go with an intermediary. Online investing can be again done through the fund houses’ website or any other online platform like Scripbox. There are many ELSS funds in the market. However, Scripbox uses its proprietary algorithm to rank the top funds.

ELSS Funds to start with:

Equity Mutual Funds for Highest Return

- Purpose: Long term wealth creation

- Interest/Growth Rate: 12% – 15% p.a (Historical returns)

- Minimum Investment: Rs. 500

- Maximum Investment: No Limit

Equity mutual funds invest in stocks/equities. As per SEBI categorisation, each mutual fund has to invest based on its investment objective. There are multiple categories under Equity mutual funds. They are Large Cap Fund, Mid Cap Fund, Small Cap Fund, Multi Cap Fund, Sector or Thematic, Value, Balanced, ELSS, and Index Funds.

Equity funds are best suited for long term goal based investing.

One can link their investments to a goal and invest towards it. Investments in equity mutual funds can be done either through lump sum route or SIP route.

These funds offer significant returns only when invested for long durations. Equity mutual funds are highly volatile and hence one can benefit only in the long term. Historical returns from investing in equity mutual funds vary based on the category. However, on an average the historical returns (fund performance) has been around 12% – 15%.

Equity mutual funds are taxed based on their holding period. Short term capital gains (investments held for less than one year) are taxed at 15%. While the long term capital gains (investments held for greater than one year) above INR 1 lakh are taxed at 10%. Equity mutual funds come with exit loads. Equity mutual funds are subject to market risks, therefore, investors who understand and are willing to undertake the risk associated should only invest.

Employee Provident Fund (EPF) for Retirement Corpus

- Purpose: Encourage savings for retirement

- Interest: 8.25% p.a.

- Minimum Investment: 12% of basic salary by employer and employee

- Maximum Investment: 12% of salary by employer, maximum limit of INR 15,000 salary. Employees can contribute more if he/she wants.

EPF is a popular savings scheme introduced by the Employee Provident Fund Organization (EPFO) under the supervision of the Government of India. It is a scheme that encourages savings among the salaried class employees.

Under the scheme, the employee has to pay a certain contribution which is matched by the employer. On retirement, the employee gets the lump sum amount along with interest. If the employee is below the pay of INR 15,000 a month then he/she is eligible for the scheme. Employees above this pay can also contribute to the scheme voluntarily.

12% of the basic salary goes towards EPF contribution. The employer also makes a similar contribution for the employee. The interest on EPF is calculated monthly and the current interest rate is 8.10%.

To withdraw money from an EPF account, the person has to attain the age of 55. A partial withdrawal is allowed when the person is above 54 years and 90% of the amount can be withdrawn. If the person decides to quit the job before the age of 55, EPF can still be withdrawn. However, only 75% can be withdrawn if the person remains unemployed for one month and the balance 25% can be withdrawn if the person remains unemployed for more than 60 days.

If the employee has provided 5 years of continuous service then he/she doesn’t have to pay tax on his/her premature withdrawal. EPF falls under EEE category under Section 80C of the Income Tax Act. The investment, interest, and maturity amount all are exempt from tax.

National Savings Certificate (NSC) for Small and Mid Class Investors

National Savings Certificate is a Government of India initiative to help investors start small savings. This tax saving investment plan encourages small to mid-income investors to invest while saving tax through tax deductions. One can invest in NSC by visiting the nearest post office.

The interest rates are revised every quarter. NSC investments are eligible for tax savings under the Section 80C of the Income Tax Act. For investments up to INR 1,50,000 investors can claim tax benefits. The interest earned from NSC investment is compounded annually. Also, by default, the interest earned is reinvested into the scheme.

Therefore, NSC offers fixed income to its investors. Upon maturity the investor gets the entire corpus. There is no TDS for NSC payouts. However, the returns add to the income of the investor and are taxable at the applicable Income Tax rate.

NSC doesn’t allow premature withdrawals. But there are exceptions, in case of death of the investor, or on a court order or on forfeiture by a pledgee who is a Gazetted Government Officer for it. Investors can use the NSC as a collateral. Banks and NBFCs accept NSC as a loan collateral. Finally, NSC suits anyone looking for a safe investment avenue to save taxes while earning fixed income.

Senior Citizen Savings Scheme (SCSS) for Low Risk

- Purpose: Retirement Income

- Interest: 8.20% p.a.

- Minimum Investment: INR 1,000

- Maximum Investment: INR 15 Lakhs

A Senior Citizen Savings Scheme is a safe investment option available for retirement purposes. It is also one of the post office savings schemes. SCSS offers safety and regular income for its investors. Additionally, it is also an excellent tax saving plan. The plan is best suited for retired individuals looking at less risky products and focusing on minimising tax. Investors can invest through a certified bank or a post office across India.

Indian individuals who are at least sixty years old can invest in SCSS. However, individuals who have taken voluntary retirement or Senior Citizen Savings and are in the age range of 55 years to 60 years are also eligible for investing in SCSS.

HUFs and NRIs are not eligible to invest in this savings plan. An individual can open multiple SCSS accounts, however, the total across all the accounts shouldn’t exceed a maximum of INR 15 Lakhs. Also, a point to note is that the amount invested in the scheme cannot be higher than the money received at retirement.

Cash deposits are accepted if the amount is below INR 1 lakh, and for all investments above INR 1 lakh cheque deposit is mandatory.

The average tenure of the savings plan is five years, also it can be extended for three more years. Premature withdrawals attract certain penalties. In case of the demise of the investor, no penalty is charged for premature closure.

The interest rates offered under the scheme are revised every quarter. Also, investors are eligible for quarterly disbursals against their deposited amount. Investments up to INR 1.5 Lakhs are eligible for tax exemption under Section 80C of the Income Tax Act. However, the interest received is subject to taxation as per the applicable income tax slab rate. Finally, SCSS savings are very safe, reliable and are one of the best saving plans available for retired individuals.

Post Office Monthly Income Scheme for Fixed Income

- Purpose: Monthly Income

- Interest: 7.40% p.a.

- Minimum Investment: INR 100

- Maximum Investment: INR 4,50,000

Post Office Monthly Income Scheme is a savings plan that gives its investors monthly returns in the form of interest payments. This is a low risk monthly income scheme. Therefore, the plan offers steady income for investors. POMIS is a government sponsored scheme. Upon maturity of the savings plan, one can choose to withdraw or reinvest the amount into the scheme. Returns from POMIS are high when compared to other savings plans and the returns are subject to taxation. Also, no TDS is deducted.

This savings plan is available only for Indian citizens.

Any number of accounts can be opened by an individual. However, the total amount held in all the accounts cannot exceed INR 9,00,000 in a single account and INR 15 Lakhs in a joint account.

The minimum amount for this post office savings plan is INR 100. In case of investor relocation, the account can be transferred to the new post office without any extra costs. The savings plan has a five year lock-in period. POMIS allows investors to withdraw the deposited amount one year from the first deposit.

However, withdrawal between one and three years attracts 2% penalty and between three and five years attracts 1% penalty. Point to note, if the interest earned every month isn’t claimed by the account holder, then the interest shall not earn any additional interest. The interest earned isn’t subject to TDS, however it is added to the taxable income of the investor and is taxed as per their tax slab.

Use Post Office Monthly Income Calculator

Kisan Vikas Patra (KVP) Low Lock in Period

- Purpose: Small Savings

- Interest: 7.50% p.a.

- Minimum Investment: INR 1,000

- Maximum Investment: No Limit

Kisan Vikas Patra is one of the post office savings schemes. Under this savings plan, the amount an investor invests doubles in a period of 124 months i.e. ten years and four months. Initially, this plan was only for farmers, however, now it is made available for everyone. The minimum investment is INR 1,000.

The government has made it mandatory to provide PAN Card as a proof for all investments above INR 50,000. And, for investments beyond INR 10,00,000 income proofs have to be submitted. Indian citizens above the age of 18 years can open Kisan Vikas Patra at any local post office.

Most importantly, this savings plan isn’t subject to market fluctuations and hence is a guaranteed income plan. The current interest rate is 6.90% and it is revised every quarter. KVP savings plan has a lock-in period of thirty months.

Investors can redeem the investment at intervals of six months once the lock-in period is over. Additionally, a KVP investment certificate can be used as a loan collateral. KVP savings plan is not eligible for Section 80C deductions of the Income Tax Act. Therefore, the investments and returns are taxable. The KVP savings plan is a low risk savings option that provides guaranteed returns and is a safe investment option.

Sukanya Samriddhi Yojana (SSY) Triple Tax Benefits

- Purpose: Girl child education and marriage

- Interest: 8.20% p.a.

- Minimum Investment: INR 250

- Maximum Investment: INR 1.5 lakhs

SSY is a Government of India initiative to support the ‘Beti Bachao Beti Padhao Campaign’. It is also one of the post office savings schemes. The scheme was launched in 2015 and the interest rate is decided by the Government every quarter.

For the current quarter, the interest rate is 8.20% p.a. compounded annually. It is a fixed income savings plan and the returns are guaranteed. A SSY account can be opened in a post office or in designated private and public sector banks. The account can be opened only in the name of the girl child by the parent or legal guardian.

The girl has to be a resident of India and the account can be opened for a girl child below the age of 10. At the age of 18, the girl child can take control of her account.

The maximum and minimum investment is INR 1.5 lakhs and INR 250 respectively which should be done till the girl child reaches the age of 15. The government allows only one account per girl child and two accounts per family and three in case of triplets. The account is transferable from one bank to another. One can withdraw the investment and the proceeds from the account during the girl child’s marriage or at the age of 21, whichever is earlier. At the age of 18, 50% of the money can be withdrawn for higher education of the girl child.

Premature withdrawal is allowed if the girl child unfortunately dies or needs money for treating a life threatening disease. After the scheme matures (when the girl child reaches 21), no interest will be earned even if the money is not withdrawn. Sukanya Samriddhi Yojana falls under EEE (Exempt Exempt Exempt) category. The investment amount, the interest earned, and the maturity amount all are exempt from tax.

explore our article on Government Schemes for Girl Child

Atal Pension Yojana (APY) for Assured Income

- Purpose: Pension for unorganized sector workers

- Interest: Depends on Contribution Rates

- Minimum Investment: NA, the monthly contribution is calculated based on the pension selected

- Maximum Investment: NA, monthly contribution is calculated based on pension selected

APY is a Government of India initiative for the unorganized sector to be included under the social security scheme and provide financial security. Launched in 2015, this scheme is a voluntary pension scheme for unorganized sector workers. Under the APY scheme, the subscribers would receive fixed pensions of INR 1,000, INR 2,000, INR 3,000, INR 4,000, and INR 5,000 per month at the age of 60 based on the contributions they made.

Individuals can join this scheme at the age of 18 and the maximum age to join is 40 years. Individuals can contribute only up to the age of 40. The contribution levels will be low if the person joins early and increases if he/she joins late. All bank account holders are eligible to contribute to this scheme. However, the main focus is on the unorganized sector workers.

The subscription amount is decided based on the fixed pension amount the person chooses. At any point, the subscriber can reduce or increase the pension amount. But this switching option is only provided once a year only in the month of April.

Learn How to Calculate APY Maturity Amount

Pradhan Mantri Jan Dhan Yojana (PMJDY) for Low Income Group

- Purpose: Financial Inclusion – a bank account for every adult

- Interest: 4% p.a.

- Minimum Investment: NIL

- Maximum Investment: No cap on maximum investment

PMJDY is a savings scheme launched for National Mission for Financial Inclusion (NMFI) by the Government of India in 2014. Its motive is to provide banking services to all unbanked adults who are citizens of India.

One account can open a zero balance and there is no minimum amount to be that they must maintain in the account. Interest of 4% per annum is credited into the account. Account holders get RuPay debit cards. Accident insurance cover of INR 2 lakhs is available for these debit card holders. An overdraft of INR 10,000 is available to account holders. The interest charged on this is 3.5% above 1 year MCLR.

One can open a PMJDY account in any bank or business kiosk. These accounts are Basic Savings Bank Deposit Accounts (BSBDA) and they provide few basic facilities like withdrawals, ATM and debit card, cash deposits free of cost. A person cannot have any other savings account if he/she has a BSBDA account. PMJDY accounts are easily transferable from one branch to another upon the request of the account holder.

The documents required to open a PMJDY account are an Aadhar card, Voter ID or Driving Licence or Passport and NREGA card. A person can still open an account with any of these documents with just an ID card issued by Central/state departments and a letter issued by a gazetted officer.

Unit Linked Investment Plans (ULIP) for Securing Future Goals

- Purpose: Insurance plus investment

- Returns: 10.00% to 12.00% p.a.

- Minimum Investment: Depends on the investment term chosen

- Maximum Investment: Investments are through premium. Hence maximum investment depends on the plan and term.

ULIP Plan is a traditional plan. It is an insurance plus investment product. It provides a life insurance policy to the holder along with investment options. The premium payment by the policyholder is done either monthly or annually. The sum assured from ULIPs insurance is around 10 times the premium paid.

A small part of the premium paid goes towards insurance and the rest is invested in stocks, bonds or mutual funds. Indian citizens (residents and non-resident Indians) can invest in ULIPs. The returns from ULIPs are market linked and hence aren’t guaranteed. They have historically given 12-15% return. ULIPs usually are offered based on goals like retirement, child’s education and marriage or for pure investment purposes.

ULIPs suit investors across all life stages, with varying risk profiles and investment horizons.

Investors can choose the funds to invest through a ULIP. The ULIP plan provides investments in funds after deducting insurance premium, asset allocation charges and other charges like charge for managing funds, policy administration etc.

Though ULIP is a traditional plan, it is quite flexible. It allows investors to switch between funds, add in single premium payment to the existing investments and also allow partial withdrawal, but subject to charges and commission. ULIPs come in single premium and regular premium of annual, semi-annual and monthly payments.

ULIPs have a lock in period of 5 years, but however they come with insurance (sum assured of 10 times the premium paid). And investors might not benefit from ULIPs if they do not hold it for an entire term which is usually 15-20 years. Investments and returns from ULIPs are exempted from tax.

ULIPs have a lot of hidden charges and hence investors are often discouraged to invest in them. Instead, a good alternative to this is a term insurance plus investment in mutual funds. A term insurance plan provides life insurance cover for a specific term.

Benefits of Having a Savings Plan

A well-structured savings plan isn’t just about putting money aside; it’s about creating a stable financial foundation for yourself and your family. Here are some key benefits that highlight why having a savings plan is so valuable:

- Helps You Achieve Your Financial Goals: Whether you’re dreaming of buying a home, funding a child’s education, starting a business, or planning for retirement, having a savings plan can guide you toward your objectives. By regularly setting aside money, you gradually build the resources you need to turn your plans into reality.

- Offers Financial Security and Peace of Mind: Life can be unpredictable, and unexpected costs—from medical emergencies to sudden job losses—can arise at any time. A savings plan ensures you have a financial cushion ready when you need it most, helping you stay calm and confident even in uncertain situations.

- Encourages Good Money Habits: Building a habit of saving teaches discipline and responsible money management. Over time, you become more aware of your spending patterns, learn to prioritize your needs, and develop a steady approach to growing your wealth.

- Makes Your Money Work for You: Many savings plans, whether through banks, government schemes, or market-linked options, offer returns or interest on your money. Instead of just sitting idle, your funds can grow over time, helping you achieve your goals faster and more efficiently.

- Provides Flexibility and Adaptability: With numerous savings products available—each varying in terms of risk, returns, and lock-in periods—you can choose the plan that aligns best with your comfort level and timeline. This flexibility allows you to adjust your approach as your financial situation and goals evolve.

Compare all Savings Schemes in India

| Scheme Name | Lock-in Period | Returns | Tax | Eligibility | Minimum Investment | Maximum Investment |

| Fixed Deposit | 5 Years | 3.50% to 9.00% p.a. | Returns are taxable | Indian Individuals, HUFs, NRIs, PIO, OCI | Varies from bank to bank | No Limit |

| Recurring Deposit | 6 month – 10 years | 4.50% to 8.25% p.a. | Returns are taxable | Individual, HUF, corporate, company, NRI, government organization | ₹ 500 | ₹ 1,00,000 per month |

| Public Provident Fund | 15 years | 7.10% p.a. | No Tax on returns | Only Indian Citizens | ₹ 500 | ₹ 1,50,000 |

| Liquid Mutual Funds | No Lock-in | 6.5%-7.5% (Historical Returns) | Returns are taxable | Individual, HUF, corporate, company, NRI, government organization | ₹ 500 | No Limit |

| Equity Linked Savings Scheme (ELSS) | 3 Years | 12.00% to 30.00% p.a. | Returns are taxable | Indian Citizens and NRIs | ₹ 500 | No Limit |

| Equity Mutual Funds | No Lock-in | 12%-15% (Historical Returns) | Returns are taxable | Individual, HUF, corporate, company, NRI, government organization | ₹ 500 | No Limit |

| Employee Provident Fund | Attain the age of 55 | 8.25% p.a. | No Tax on returns | Only Indian Citizens | 12% of basic salary by employer and employee | 12% of salary by employer, maximum limit of INR 15,000 salary |

| National Savings Certificate | 5 Years | 7.70% p.a. | Returns are taxable | Indian individual citizens | ₹ 100 | No Limit |

| Senior Citizen Savings Scheme | 5 Years | 8.20% p.a. | Returns are taxable | Indian individual citizens of at least 60 years old | ₹ 1,000 | ₹ 15,00,000 |

| Post Office Monthly Income Scheme | 5 Years | 7.40% p.a. | Returns are taxable | Only Indian Citizens | ₹ 100 | ₹ 9,00,000 |

| Kisan Vikas Patra | 10 Years and Four Months | 7.50% p.a. | Returns are taxable | Only Indian Citizens | ₹ 1,000 | No Limit |

| Sukanya Samriddhi Yojana | Girl attains 21 years or gets married, whichever is earlier | 8.20% p.a. | No Tax on returns | Girl has to be resident of India | ₹ 250 | ₹ 1,50,000 |

| Atal Pension Yojana | 20 Years | Depends on Contribution Rates | Investment is tax free | All bank account holders | Monthly contribution is calculated based on pension selected | Monthly contribution is calculated based on pension selected |

| Pradhan Mantri Jan Dhan Yojana | NA | 4% p.a. | NA | Only Indian Citizens | NIL | No Limit |

| Unit Linked Insurance Plan | 5 Years | 10.00% to 12.00% p.a. | No Tax on returns | Indian Citizens and NRIs | Depends on the investment term chosen | Depends on investment plan and term chosen |

Features of Savings Plans

Policy Tenure and Entry Age

Savings plans come with a fixed policy tenure, which can range from a few years to several decades. The entry age for savings plans varies, but most plans allow individuals to enter between the ages of 18 and 65. Some plans may have a maximum entry age of 70 or 75. This flexibility ensures that individuals at different life stages can find a plan that suits their needs and financial goals.

Guaranteed Returns

One of the key features of savings plans is the guarantee of returns. These plans offer a fixed rate of return, which is typically higher than traditional savings accounts. The returns are usually guaranteed by the insurance company, making it a low-risk investment option. This assurance of fixed returns helps in planning for future financial needs with greater certainty.

Riders and Life Cover

Savings plans often come with additional riders and life cover options. Riders are add-on benefits that can be purchased to enhance the policy’s coverage. Common riders include critical illness cover, accidental death benefit, and waiver of premium. Life cover, on the other hand, provides financial protection to the policyholder’s family in the event of their demise. The life cover amount is usually a multiple of the policy’s premium or sum assured, ensuring that your loved ones are financially secure even in your absence. These features make savings plans a comprehensive financial tool that not only helps in wealth accumulation but also provides essential life insurance coverage.

Conclusion

Choosing the right savings plan is about knowing your goals, comfort with risk, and the time you have to invest. With options ranging from secure government and bank schemes to market-linked funds with potentially higher returns, there’s a plan out there that fits your needs. By understanding what each type offers, you can make an informed choice that helps you grow your wealth and secure your financial future.

Frequently Asked Questions

Not all savings schemes have tax benefits. For some savings plans, only investment is tax free. While for others, the interest and maturity amount are also tax free. Here is a list of schemes where returns are tax free.

Public Provident Fund

Sukanya Samriddhi Yojana

Employee Provident Fund

Unit Linked Insurance Plan

One can use the Scripbox income tax calculator to determine their tax outflow and taxable income after investing in the above saving and investment plans. The income tax calculator also suggests suitable ELSS funds in case there is scope to save more tax.

Saving money is very important. It will help us handle any unnecessary expenses and uncertain situations with ease. Experts advise having an emergency fund that covers at least 6 months to 1 year expenses. But saving can be combined with investment with the schemes launched by the Government of India.

Emergencies : Emergency situations can knock anyone’s door at any time. One has to be prepared for medical emergencies, national emergencies, etc. To be prepared, having an emergency fund is important. One can use any savings bank account to deposit money for emergency purposes. Bank savings account gives interest on deposits.

Uncertainties : Uncertainties like job loss are more common now. There is no security for anyone’s job. A sudden loss of income might affect an entire family.

Financial Discipline : Saving and investing regularly can inculcate discipline in one’s life. Bank auto debits have made this easier to achieve.

Future planning : One doesn’t just have a saving plan for emergencies or uncertainties. They need to plan for a better future. Investing in long term plans like PPF, NSC and FDs can aid the person during retirement or any other financial goals.

Hassle free life : Planning now for the future is important. With savings and investments in place for all financial life goals like retirement, children’s education and marriage, one can lead a hassle free life.

Choosing which savings plan to invest in isn’t not really a difficult task. One has to consider the following things before they choose a savings plan. This makes their selection easy.

Decide Goals/Purpose

Choose Investment horizon

Lock for Lock in period

Look for Interest rate or Growth rate

Choose the plans with least expenses.

Choose a plan which has auto debit options.

While creating a savings plan, one should make sure that they plan for all emergencies and needs. Therefore, one should first start by creating an emergency fund to address all their medical and unforeseen emergencies. Ideally, an emergency fund should have at least three to six months of an individual’s salary.

Next, one should have a well-covered insurance plan. The insurance plan should cover an individual’s medical expenses and as well as their life. Insurance is a basic requirement for a secure future. In case of unforeseen events, the family of the insurer should be secure financially. Hence, adding an insurance policy to one’s savings plan is important.

After setting aside for emergencies and insurance, one should focus on their investments. There are multiple investment options available for investors. One can choose to invest in equity, debt, bank deposits, gold, or real estate, etc. It is ideal to invest at least 20%-30% of one’s salary. Among the different investment options, one can choose the schemes that best suit their investment objective, horizon and profile. Also, if one doesn’t have the knowledge or time to create an investment plan, they can always approach a financial advisor. Scripbox is one such platform that helps investors with the best plans and helps them save towards their lifegoals.

- What is Savings Plan?

- Best Saving Plan: Types of Savings Plans

- Best Savings Plans in India to invest in 2025

- Fixed Deposits (FD) for Savings

- Recurring Deposit (RD) for Regular Savings

- Public Provident Fund (PPF) for Long Term Savings

- Liquid Mutual Funds for Short Term Investment

- Equity Linked Savings Scheme (ELSS) for Tax Savings

- Equity Mutual Funds for Highest Return

- Employee Provident Fund (EPF) for Retirement Corpus

- National Savings Certificate (NSC) for Small and Mid Class Investors

- Senior Citizen Savings Scheme (SCSS) for Low Risk

- Post Office Monthly Income Scheme for Fixed Income

- Kisan Vikas Patra (KVP) Low Lock in Period

- Sukanya Samriddhi Yojana (SSY) Triple Tax Benefits

- Atal Pension Yojana (APY) for Assured Income

- Pradhan Mantri Jan Dhan Yojana (PMJDY) for Low Income Group

- Unit Linked Investment Plans (ULIP) for Securing Future Goals

- Benefits of Having a Savings Plan

- Compare all Savings Schemes in India

- Features of Savings Plans

- Conclusion

- Frequently Asked Questions

Show comments