A systematic Investment Plan (SIP) is the most common approach to investing in mutual funds. It helps investors to plan for their short term and long term financial goals. SIP is an investment method where investors can invest a fixed amount of money at regular intervals ( monthly, quarterly, half-yearly or yearly). This amount is deducted automatically from your account on the specified date. Moreover, investing in SIP mitigates risks and promotes disciplined financial planning. In this article, we will understand the different methods how to invest in SIP.

3 Different Ways To Invest in SIP

Investing in SIP has become very easy. Investors can do it online through different methods, which we will discuss below. However, investors must have their KYC completed and updated.

1. Through an AMC

SIP investment can be made directly online or offline by visiting the AMC website. For the online process, the investor has to open a new account by providing personal details for investment. Next, they have to fill out the FATCA form and provide the bank account details and a cancelled cheque image as bank proof. Finally, through the Aadhaar card, the KYC gets verified, and the money is transferred to the respective mutual fund scheme.

The offline investment can be made by directly visiting the local AMC office. They have to submit an application form, KYC documents and cheque/ demand draft for payment.

2. Intermediary Platform

Investors can also invest in SIP in a hassle-free manner by using an intermediary platform. This platform is single account access, and it helps in investing, tracking and managing all SIP and mutual fund investments with different AMCs.

To invest in SIP, investors have to open an account with an intermediary platform. Next, they have to pick a scheme and select the investment amount. Also, a few personal details and bank details will be required. Finally, they can transfer money online to complete the investment.

3. Through a Broker

Investing in SIP through a broker can be costly and time-consuming because investors have to call their broker, who is a mutual fund distributor. They collect the SIP investment application form along with KYC documents and a cancelled cheque. However, recently many brokers have their own website or app for investment. If the broker provides all the facilities, then it can be hassle-free to invest in SIP.

Additionally, investors can invest in SIP through mutual fund registrars like CAMS or Karvy online through their website or offline by visiting their local branch office.

How to Invest in SIP with Screen Shots

Start your SIP investment right away with the help of the simple steps provided below.

Time needed: 4 minutes

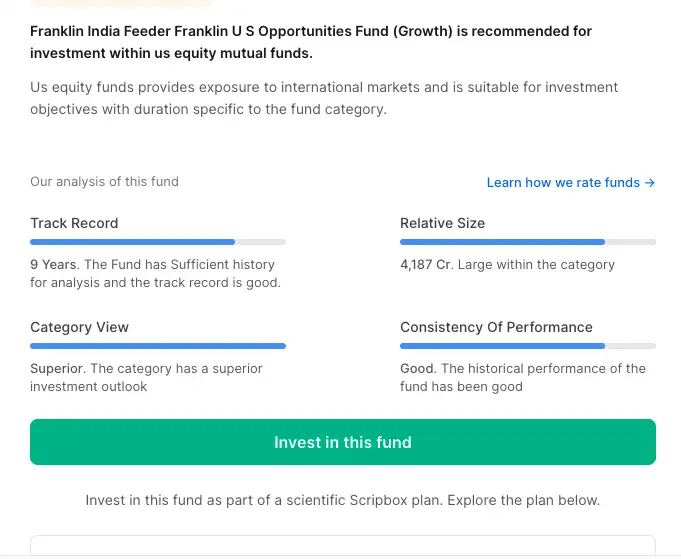

- Select the mutual fund and click on Invest in this fund

Select the right mutual fund you want to invest in and click on invest in this fund.

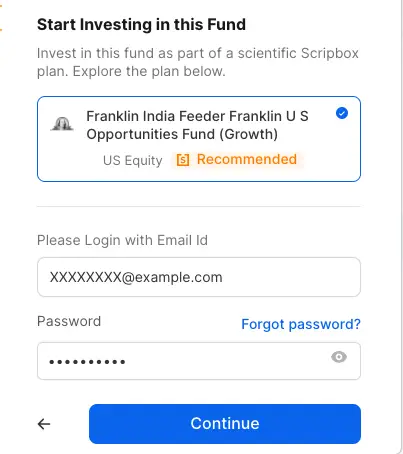

- Verify your account

Verify your account and log in to proceed.

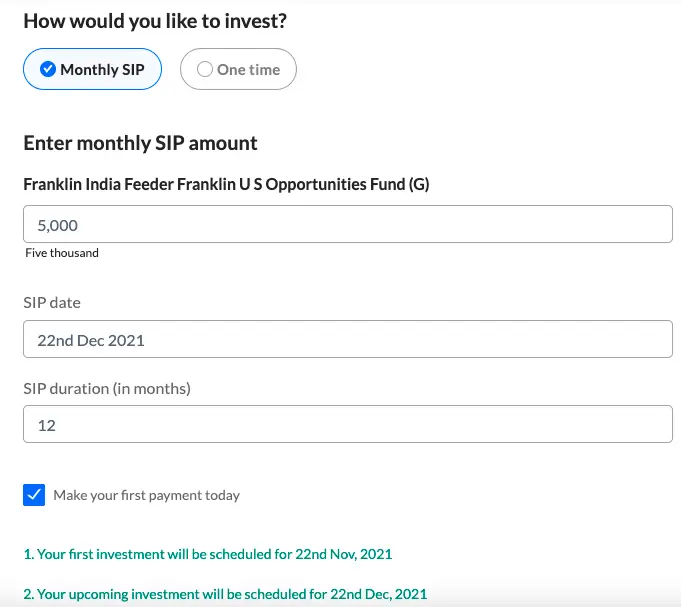

- Fill SIP Details

Fill in the sip amount, SIP date and SIP Duration to proceed.

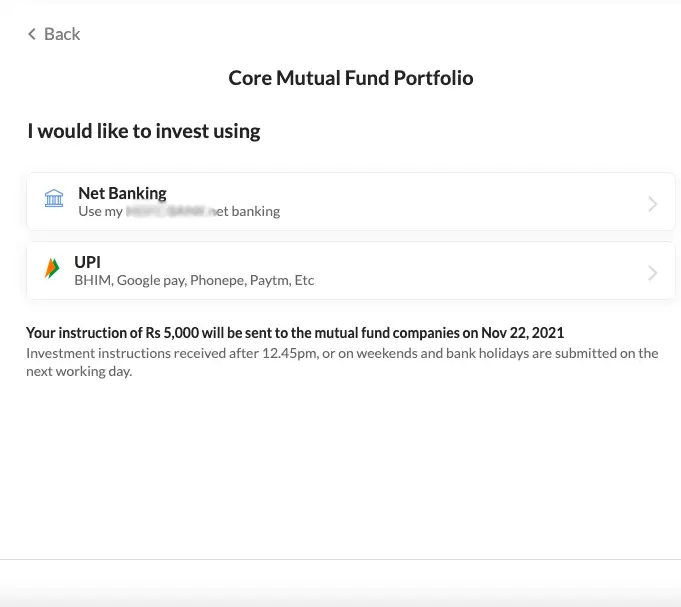

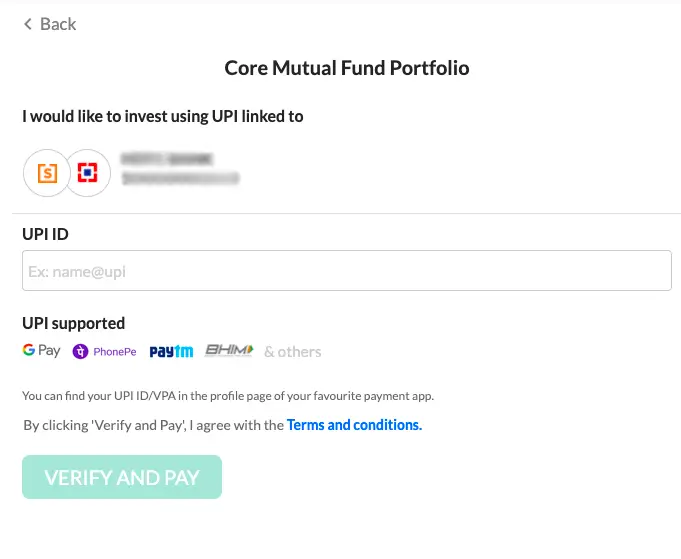

- Choose your Payment Option

Start your investment by paying through net banking or UPI payment mode.

- Verify and Pay

Verify your payment and you will receive the success confirmation on your dashboard.

The concept of selecting the best mutual fund is a myth. This is because a mutual fund performing today does not guarantee to perform the same in the future. Similarly, today’s worst-performing fund can become the best-performing fund tomorrow.

Normally, retail investors look at the fund returns for the last 3-5 years before investing. However, there are certainly other factors to consider. The following are things that investors must consider to select the best mutual fund for SIP –

- Investment objectives like children’s education, retirement planning, etc.

- The time horizon for investment – For instance, 1 year or 3 years or even 10 years. Based on the time horizon, the investor can choose a debt fund or equity fund.

- Investor’s risk tolerance level

Based on these attributes, investors can select the best-suited mutual fund for SIP investment. In addition, while selecting a mutual fund, investors must also consider the following factors –

- Fund performance against benchmark

- Consistency of fund performance

- Comparison of fund performance against the specific mutual fund category

- Fund manager’s experience

- Past track record of AMC

- AUM of the mutual fund

- Expense ratio

Explore: Best Mutual Funds for SIP 2026

Advantages of Investing in SIP

1. Instills Financial Discipline

One of the biggest advantages of investing in SIP is that it makes you a disciplined investor. Since the money is automatically deducted from your account, you become more responsible with your money.

As a SIP becomes a part of your monthly financial commitments, you learn to adjust your lifestyle and other spending habits accordingly. You become more aware of any unnecessary expenses and make a deliberate attempt to reduce them significantly.

2. Convenience

As we have already mentioned, SIP doesn’t require any manual payments from your end. SIP payments are completely automated. You can set it up once and not worry about any other needless logistics with regard to your future payments.

3. Efficiently Manages Market Fluctuation

Since you do not invest directly in the stock market, the volatility in the market will not have a major impact on your investment.

As SIPs are consistent and mostly for the long-term, you don’t have to constantly keep an eye on what kind of funds are performing well, which sector is performing well, what kind of asset classes are performing well and so on.

This reduces your risk exposure as compared to other investment options.

4. Flexibility

As discussed under the financial goals section previously, your investments should be in line with your changing financial situation.

If your income/salary increases so should your investments to match your changing lifestyle costs.

SIPs offer a great degree of flexibility as they can be customized according to your changing financial needs. It can be increased with your income or stopped if an emergency arises.

5. Diversification

Since SIP is invested in a mutual fund, which in turn invests in a good mix of different kinds of market instruments like equity, debt and so on, your investment is automatically well-diversified.

6. The Power of Compounding

The power of compounding is probably one of the most important reasons why SIP tends to generate better returns than many other investment options.

In order to benefit from the power of compounding, you are encouraged to start investing early and as soon as you can.

Compound interest ensures better long-term performance. In this case, you earn returns on the returns earned by your investment. This increases the value of your overall investment by multiple folds. You can calculate the expected maturity with the power of compounding with Scripbox’s SIP Calculator.

Popular Funds to Start your SIP

Here are some of the best-performing funds based on their performance history and meticulously designed scientific investment process. These funds are further put into different categories based on your investment requirements and financial goals.

Mirae Asset Tax Saver Fund-Reg (Growth)

Mirae Asset Tax Saver Fund Growth is recommended by Scripbox within the equity-linked tax-saving mutual fund category. Equity-Linked Tax saving mutual funds are designed to help you save taxes while offering the opportunity for growth and appreciation in line with equity returns. The fund is best suited for an investment period of a minimum of 5 years. Moreover, due to the lock-in period of 3 years, the investor cannot withdraw before the maturity of the scheme. Hence, the fund is not suitable for a short-term goal. Additionally, ELSS provides a tax benefit up to Rs 1.5 lakhs in a financial year. However, the tax benefit must not be the sole criterion while evaluating the suitability of the scheme

Canara Rob Bluechip Equity Fund-Reg (Growth)

Canara Robeco Bluechip Equity Fund- Regular (Growth) is recommended by Scripbox for a long-term investment within the large-cap mutual fund category. The fund invests in stocks of companies with a large market capitalization spread across different sectors. Due to exposure to equities, the investor can expect volatility in the short term. This mutual fund is suitable for an investor who understands that the fund is subject to volatility. An investor with an investment objective of more than 5 years must invest in this scheme.

ICICI Pru Liquid Fund (Growth)

Scripbox recommends ICICI Pru Liquid Fund (Growth) for investment within the liquid-debt mutual fund category. The ICICI Pru Liquid Fund (Growth) aims to choose securities with the best yields/returns while keeping the risk-reward ratio in mind. It is suitable for investors who are seeking short-term savings solutions for a reasonable return with low risk and a high level of liquidity.

Check Out our article on Best Date for SIP in Mutual Funds

Frequently Asked Questions

To start a SIP investment, you must first complete your KYC formalities, then register your account and start your SIP investment.

To complete your KYC, you will need your PAN card, Address Proof, Passport size photograph and a cancelled cheque ( to provide bank details).

You can complete the KYC either online on the AMC website or by physically submitting these documents along with the KYC form at the AMC office.

For eKYC, fill in the required information, upload the scanned copies of documents and schedule an appointment for a video call for e-verification.

After you are KYC compliant, you can invest in any mutual fund scheme via SIP or lumpsum.

The next step is to register for SIP, where you can choose any fund and visit the respective AMC website.

Register for a new account (‘New Investor’) with all basic details and provide bank details from which SIP will be debited.

Finally, select the fund for SIP and the amount, and get your SIP started.

You can also visit the respective AMC office, fill out the SIP form along and submit it along with a cheque.

The best SIP in India primarily depends on the investor’s investment objective. An XYZ mutual fund that gives significant returns over the years may be highly volatile. This fund may not be best for all types of investors. In other words, for investors who are not comfortable investing in a highly volatile fund, the XYZ mutual fund may not be the best one.

Therefore, the best mutual fund for SIP differs from one investor to the other. The best sip mutual funds for an investor primarily depends on their investment objective, horizon and tolerance for market fluctuations. Hence, one should carefully align their investment objective with the fund’s objective and assess the fund’s performance over the years before investing.

SIP is a very good way to start one’s investment journey. Especially beginners who are still exploring various investment avenues can start small by investing in mutual funds through SIPs. As beginners, one should have a long-term view of their investments. Also, one should consider investing in long-term goals. Investing in long-term goals will help the investor realise their life goals easily without any hassle.

Furthermore, as a beginner, investors can experiment with their investments and can try to have higher equity exposure. Since the investment horizon may be long, one will be able to earn significant returns over time. Therefore, one should aim at identifying a goal and investing in a plan that will help them achieve it.

Starting with SIP is very easy these days through online mode. Firstly, it is essential for the investor to complete the KYC process. It is a one-time process where the investor can invest in multiple funds. Once KYC is done, the investor can log in to the official website of the chosen fund house to start SIP or through any distributor portal.

To invest through Scripbox online, one can follow the below steps –

Visit the Scripbox website, and click on the ‘Let’s Get Started’ button. Next, click on Start a SIP’ option from the list. Then, select ‘Monthly (SIP)’ and fill in the amount’s details and mention the number of years to invest. Then, click on ‘Create A Plan.’ Select the SIP option from the list appearing on the screen Click on ‘Continue’ and complete the process. Make payment through Net banking or UPI and schedule investment for a future date.

One can stop their SIP either online or offline. However, it depends on their mode of investment. The different ways to stop SIP online are – (a) through the AMC website: where the user can log in using the credentials and click on ‘Cancel SIP’. The SIP will be stopped within 21 working days. (b) Through an agent: Inform your agent to stop your SIP and they will fill the cancellation request and submit it to the AMC. (c) Through an online distribution platform: login to the website with your credentials, select the SIP you wish to cancel, and click on ‘Cancel/ Stop’.

For stopping the SIP offline, one should inform the Asset Management Company. One has to fill in a cancellation form and provide all the necessary details such as personal information and folio number, scheme name, etc. Also, one has to specify the date from which they wish to discontinue the SIP.

The Net Asset Value (NAV) of a mutual fund scheme is the market value per unit of all securities owned by the fund. Total assets minus total liabilities divided by the total outstanding units to compute the NAV of a fund. Knowing the market value of all the securities, the liabilities associated with the fund, and the number of units issued will help determine the NAV. NAV of a fund changes daily, based on the market value of its underlying assets.

Depending on the type of mutual fund, the fund house (asset management company) is required to publish the Net Asset Value on a daily or weekly basis. The NAV of open-ended schemes has to be disclosed on all trading days, while the NAV of closed-ended schemes must be disclosed once a week.

Related Resources

Show comments