Attention mutual fund investors! Is your SIP returns negative? Do you know how to deal with loss making SIPs? Have you started investing in mid-caps and small-caps after looking the high returns they gave in 2017? The nifty midcap index and small-cap index both are down by 21.85% and 34.09% respectively this year. So if you were in a misconception that SIP investments always increase, it is time that you cleared it. Mutual fund investments, even SIPs, go up and down in value. Should you stop loss making SIP or continue them?

SIPs have losses

If someone has said that you made a mistake by investing in small and mid-cap funds then they are absolutely wrong. Investing through SIPs helps you to invest small and regular amounts at different market conditions. They spread out the cost of investment but that doesn’t mean there is no risk involved. But as the market keeps falling and you continue to invest your average cost fall. You will be buying more units at a lesser cost. The primary advantage of SIP is to lower the average cost of buying mutual funds. SIPs work well in a falling market condition or volatile markets. With lump-sum investments timing the market becomes important but with SIPs or lump sum with STPs one doesn’t have to worry about the market timing.

Recommended to Use: SIP Calculator and Find Returns

With a market correction should you stop or redeem your loss making SIPs?

Well, that depends on how the mutual fund is performing in the past 18 months. If the mutual fund is underperforming for less than a year then that’s probably because of the market conditions. But if the mutual fund is underperforming for more than 18 months it’s time you look at different funds. In the former case do not stop or redeem the SIP, instead just continue investing and stay invested. But in the latter case, stop the SIPs and redeem the investments so it can be invested in other funds. But one cannot categorize a mutual fund based on its 18-month returns, there are factors like 5-year and 10-year returns, the funds’ consistency in returns and fund managers experience are just a few of the many factors. It’s always better to consult an expert in the field than doing it all by ourselves.

Will the frequency of SIP make a difference in the return?

The frequency of the SIP is one question that people tend to ask a lot. SIPs can be done weekly, fortnightly, monthly and quarterly. But the best SIP is monthly as income is earned on monthly basis. Read more to find out why monthly SIPs are a better option. Another question people tend to ask a lot is the date of the SIP. Timing the market is never a problem with SIPs. People often think that investing during the start of the month is better than the end or vice versa. Having a monthly SIP at a convenient date for the investor is the entire goal of monthly investing. Few will have money towards the start of the month and few towards the end. It is all based on convenience and not based on any strategy. People think that since the options expire towards the end of the month the market tends to be less then. In the long-run, there will only a little difference between the returns of SIPs of different dates.

Asset allocation is important

Another important aspect of mutual fund investing is asset allocation. Investing in only small-caps or mid-caps as they gave a higher return in the past or because a friend of yours has invested in it is wrong. How each individual is different so is each investor and his/her needs. Having a portfolio that best suits risk appetite, investment horizon and financial conditions of a person is very important. If you are a person who panics seeing huge losses in the short-term then probably small and mid-caps are not for you. A less risky portfolio might suit you better. Investing in mutual funds in the long-term is very important.

Entering the market with a short-term horizon (1-2 years) and investing in equity is a complete no-no. If you are a person with average to above average risk taking capacity then a diversified portfolio with small, mid and large-cap funds best suits you. For a high-risk taker, only a concentrated portfolio is better, like only small and mid-cap portfolio. Also, investing only in one asset class (even equity) is not good. Spread out the investments across debt, equity, gold, real estate etc. It’s always better to consult an expert in the field than doing it all by ourselves.

SIP and Long-term investing

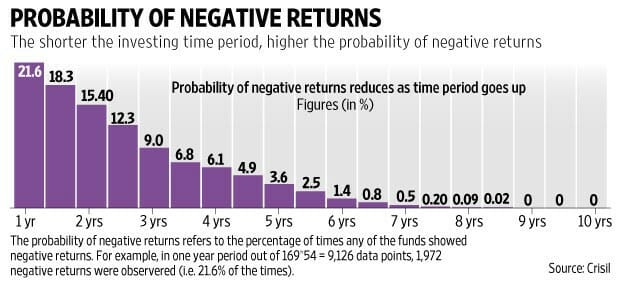

SIP and long-term investing are a great combination for creating wealth. CRISIL/Mint have a done a study on long-term investing. The longer your SIP investment period, the probability of negative returns from the equity investments become smaller and smaller. In my opinion, run your SIPs for at least 5 years. Do not stop or pause your SIPs if the markets undergo correction like the current time. Do not panic, one would only be buying more units at a lower price when the markets are down.

If you have a lump sum amount to invest now, then invest it and do an STP. Waiting for the market to fall more or improve a little is not advisable. Dealing with loss-making SIPs is not that tough. All one requires is be patient. A quick recap of the article is given below.

- SIPs also face losses

- SIP works well in falling markets

- SIPs lower the average cost of investment

- Do not stop or redeem SIPs based on their performance this year

- Monthly SIPs are the best than weekly, fortnightly or quarterly SIPs

- The date of the SIP doesn’t affect the returns in the long-run

- Asset allocation is important

- Take expert advice

Recommended Read: Best Date for SIP

Show comments