Wealth Management vs Financial Planning: Key Differences Explained

Financial Planning and wealth management are essential part of personal financial management. Even though financial planning and wealth management is related to money, they are significantly different. Understanding the differences between financial planning and wealth management is crucial as it...

What is a Portfolio: Components, Meaning, Concept

A portfolio is one of the basic concepts while investing and in finance. The term can have a variety of meanings depending on the context. However, the simplest meaning of a portfolio is a collection of assets owned by an...

Treasury Bills (T-Bill) – Calculation, Meaning and Types

The Government of India needs money to meet its financial obligations. They approach the general public to raise funds. The funds can be raised by offering different financial instruments. Treasury bill is one such money market instrument that the government...

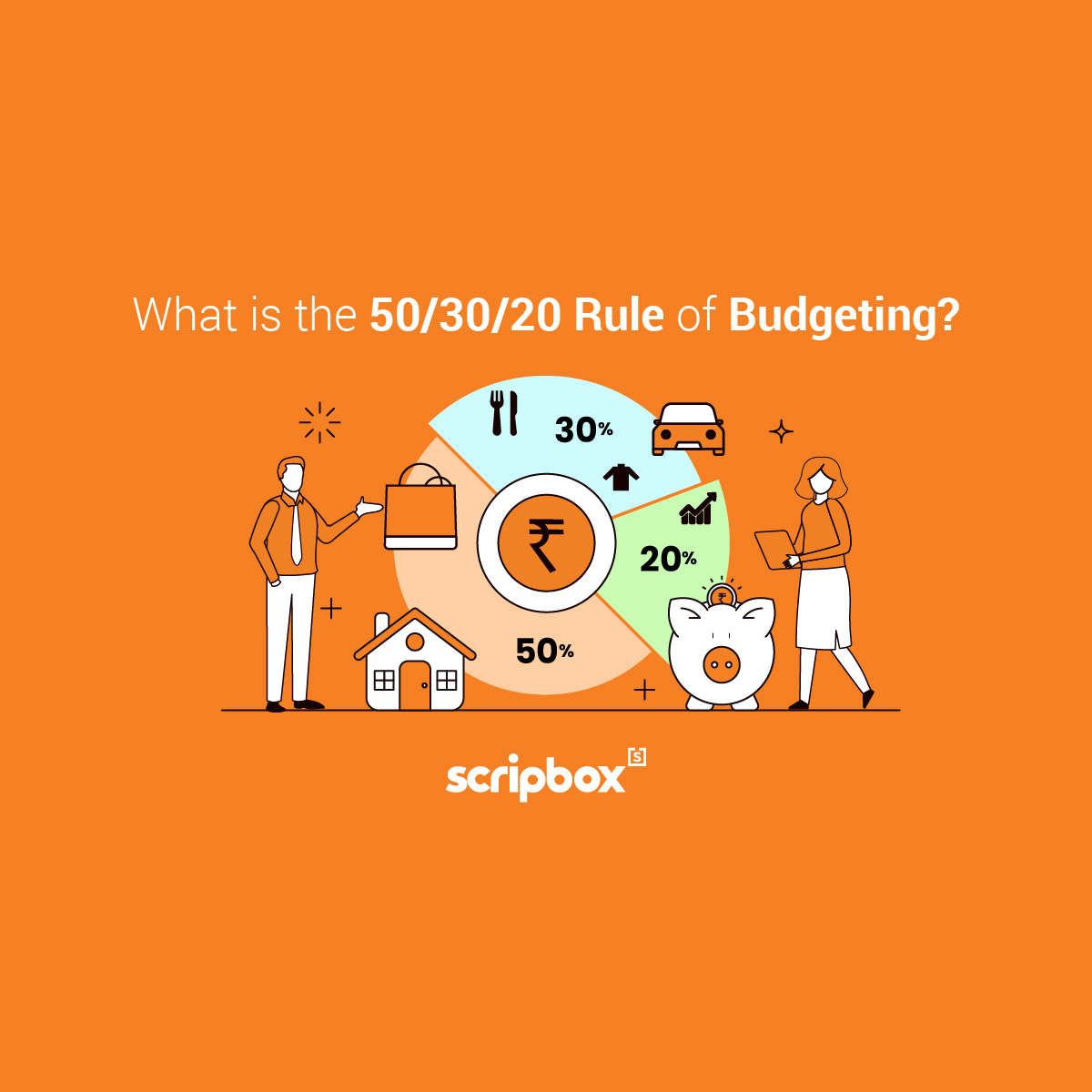

50/30/20 Rule of Budgeting

What is the 50/30/20 Rule of Budgeting? The 50/30/20 rule of budgeting is a simple method that helps you manage your money more effectively. This basic thumb rule is to divide your post-tax income into three spending categories - 50%...

SBI Revamped Gold Deposit Scheme

In 1999, the Government of India launched a gold deposit scheme that could not gain success. But in 2015, the scheme was reintroduced as Revamped Gold Deposit Scheme (R-GDS) along with another gold scheme, the gold metal scheme, under the...

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

How to Link Aadhar with Mobile Number?

The Government of India has made it mandatory to link your Aadhaar card with some documents. This makes Aadhaar one of the most important identity proof in our country. The government offers various benefits for linking Aadhaar card to any...

GPF vs EPF: Difference Between GPF and EPF

Every working professional comes across a provident fund. All provident funds are savings schemes categorised based on their name, which helps create a substantial corpus for post-retirement life. There is EPF, which stands for Employee Provident Fund, while GPF stands...

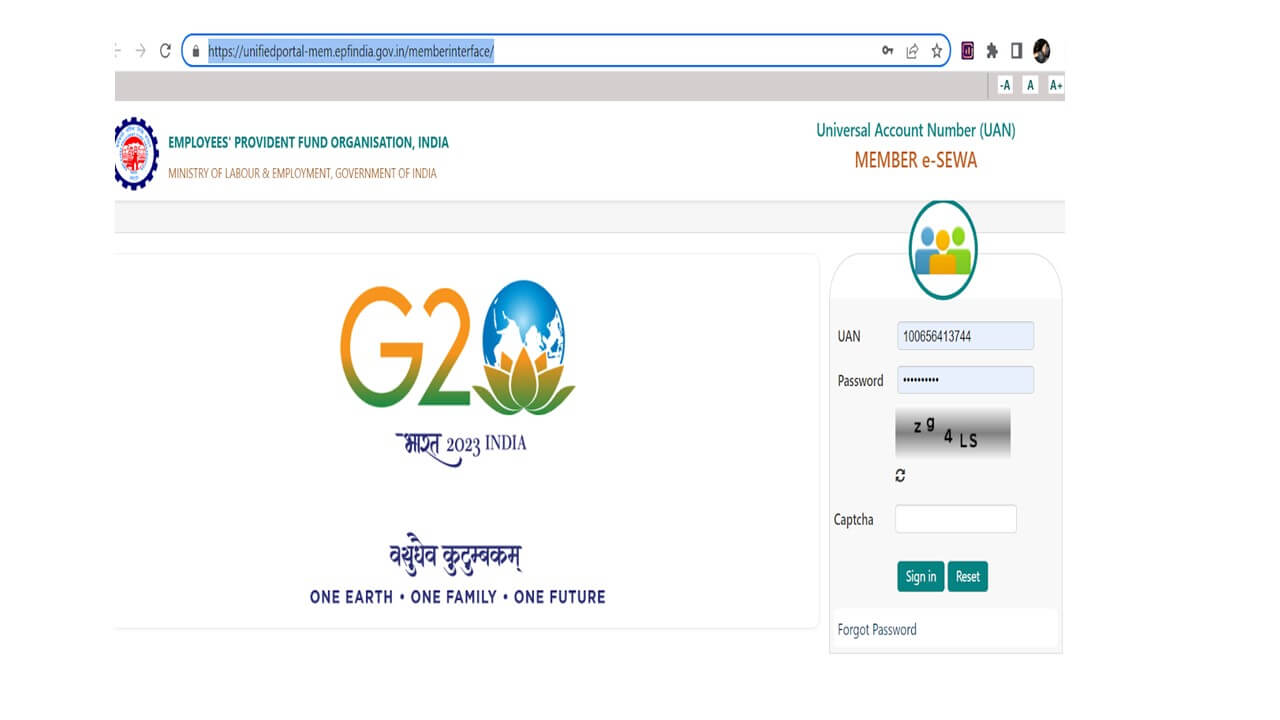

How to Update EPF Nominee Online

EPF Nominee Every salaried employee in India has an account with Employee Provident Fund Organisation (EPFO). Also, every EPF account holder must have a nominee for their EPF account. This will enable the nominee to withdraw from their EPF account...