An SBI PPF account can be opened across any of its branches across the nation. The return on a PPF account is fully exempt from taxes under Section 80C of the Income Tax Act. Deposits need to be made for Rs. 500 or more up to Rs. 1.5 lakh during a financial year. Depositors also receive facilities such as loan advances, an extension of account, etc. against their PPF deposits.

SBI PPF Account Eligibility

Opening of a PPF account in SBI is easy, but you must fulfill the following eligibility criteria:

- You must be an Indian resident and must open a PPF account in your name. PPF accounts in SBI cannot be opened by Hindu Undivided Family (HUF) and Non-resident Indians (NRIs).

- You can open a PPF account in the name of a minor being a parent/ guardian.

How to Open SBI PPF Account Online

5 Mins 5 minutes

Following is the step-by-step process to open an SBI PPF account online:

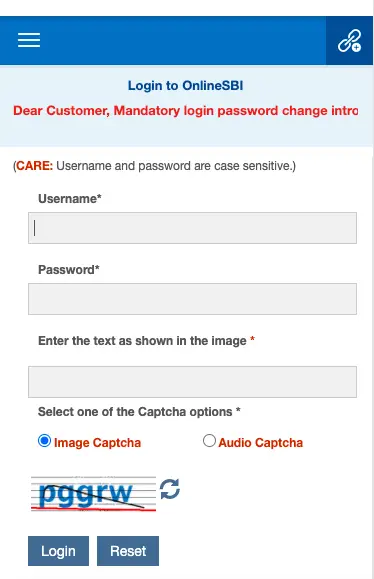

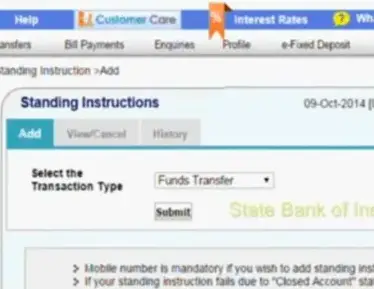

- Login to SBI Net Banking

Firstly, you must log on to your SBI banking online account using your username and password.

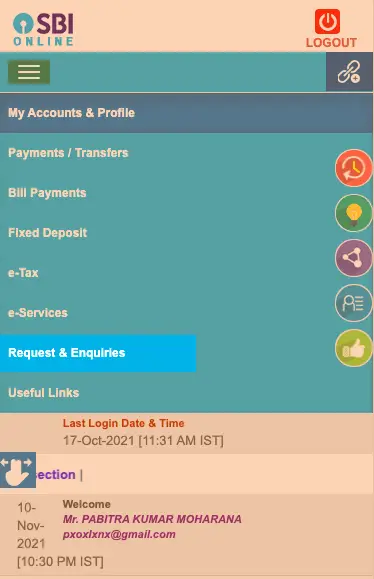

- Visit Request Tab

Click on the ‘Request and inquiries’ tab on the top right corner of the webpage.

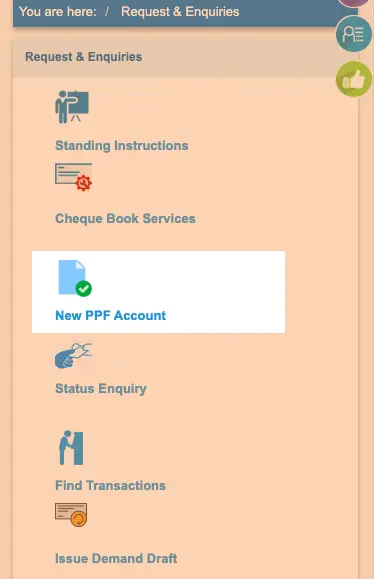

- Click on New PPF Account

Click on the ‘New PPF Accounts’ option from the drop-down menu under the tab.

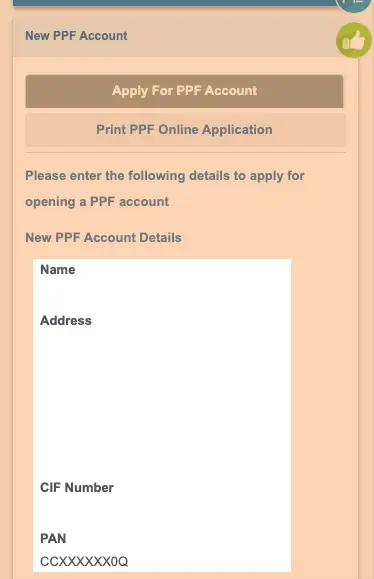

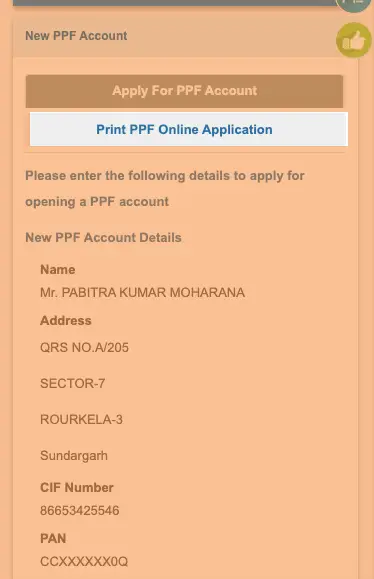

- Fill Personal Details

On the ‘New PPF Account’ page you must fill in the details. Enter your name, address, CIF number, and PAN (Permanent Account Number).

- Provide Account Details

Provide your bank account number and PAN number for your account from which you would like to contribute funds. Enter the branch code of the contributing bank account and click on proceed. Verify the branch name that the portal automatically displays.

- Click on Submit Button

Submit the online PPF account opening form that you have filled. You will receive a reference number for your application and a link to download or print your application form.

- Print Online Application Form

You must print the completely filled account opening form from the tab ‘Print PPF Online Application’. Next, you have to sign the applicable pages and visit the nearest SBI PPF account branch within 30 days. Carry self-attested copies of all applicable KYC documents, i.e. proof of identity and proof of address. You must also carry a passport size photograph to complete the account opening process.

- Deposit Amount in your Account

Upon successful verification of your KYC documents, your PPF account in SBI will be opened. You must deposit an initial deposit amount through cheque or cash. The minimum amount is Rs. 500 for account opening.

Check Out How to Open PPF Account in HDFC?

How to Open SBI PPF Account Offline By Submitting a Form

Following are the steps to open an offline PPF account in SBI:

- Firstly, you must visit any SBI branch with the facility to open PPF accounts.

- You must fill and submit a signed copy of the SBI PPF account opening form – Form A. The form is available at the branch or you can carry a print by downloading it from the SBI website.

- You must attach the applicable KYC documents, i.e. copy of PAN or Aadhar card along with your photograph.

- Submit the minimum initial deposit amount in cash or cheque at the time of account opening.

How To Transfer SBI PPF Account?

SBI allows you to transfer your PPF account from one of their branches to another. You can transfer your PPF account from other banks and post offices to SBI and vice-versa. The following steps allow you to transfer your SBI PPF account:

- Visit the SBI branch or post office where you have your current PPF account.

- You have to fill and submit the account transfer application. It must contain key details of your current PPF account, including PPF account number and branch. In case your account is in any other bank or post office, you will have to provide their details, too.

- You will need to provide the passbook of your current PPF account along with your application.

- The bank official will sanction your PPF account transfer. Now, your current bank/ post office will send your application and supporting documents to the new bank branch.

- You need to visit your new bank branch/ post office for verification of your original KYC documents. The new bank or post office branch official will verify all your documents. Once verification is done, your new PPF account is activated with the new branch/ bank/ post office.

- Once your new account is active, you will receive your new passbook from the new bank/ post office. You can see key details of your PPF account as well as all information of credits/ debits and account balance.

Process to Close a PPF Account in SBI

In case you wish to close your PPF account, you must submit Form C at the SBI branch where the account exists.

You must fill the following sections of Form C:

Declaration Section

Provide all details, including your PPF account number and the reason for the closure. You must mention the total number of years since the opening of your account.

Bank Details Section

Fill in the details of the bank where you want the amount to be credited. In case the account holder is a minor, all applicable details must be submitted. After thorough verification, SBI will process your account closure request. The entire amount in your PPF account will be sent to the account you have mentioned on Form – C.

Recommended Read: PPF Account for Minors

Things to Remember before Opening SBI PPF Account

- Investment Limits: The minimum investment in PPF is Rs. 500 per year and the maximum investment amount is Rs. 150,000. You can deposit the amount in a lump sum or twelve installments per annum.

- Scheme Duration: The maturity period of a PPF deposit is 15 years. You can extend the account in blocks of 5 years. You must fill the extension form to extend the investment period

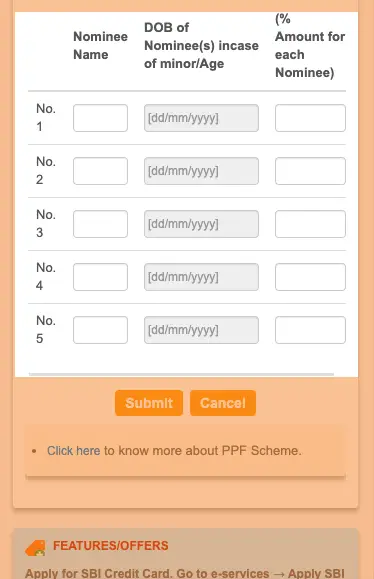

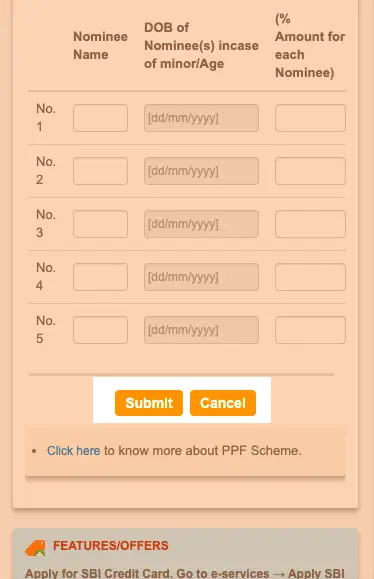

- Nomination: The nomination facility is available at the time of opening a PPF account. You can add one or more nominees after opening the account.

- Transfer of PPF Account: You can transfer your PPF account from one branch of SBI to another or from an SBI bank to another bank. You can transfer your account from SBI bank to the Post Office.

- Tax Benefits: The Public Provident Fund (PPF) is one of the best investment options for tax savings in India today. You can claim a tax deduction of up to Rs 1.5 lakhs under section 80C. The interest earned and maturity amount received are tax-free as well.

- Loans & Withdrawals: The aging and balance of PPF accounts decide loans and withdrawals. You can make withdrawals after the seventh year of opening your PPF account. Loans are available after the third year of account opening.

- Rate of Interest: The Government of India regulates the rate of interest and announces it on a quarterly basis.. Currently, the rate of interest for State Bank of India PPF accounts is 7.1% per annum.

- Premature Closure: SBI PPF account has a mandatory lock-in period of 15 years. You can make a premature withdrawal under specific circumstances on fulfilling a few conditions.

Show comments