Universal Account Number or UAN is a unique number allotted by the EPFO to all employees at the time of their first job. The UAN remains the same during the employment tenure despite a change in the employees’ job. Through UAN, one can check their member details and EPF balance online on the EPF member portal website. Updating KYC details for UAN though not mandatory, is necessary for availing all services of the UAN EPFO portal.

How to Update KYC in EPFO?

To update EPFO KYC in UAN, one can follow the below steps:

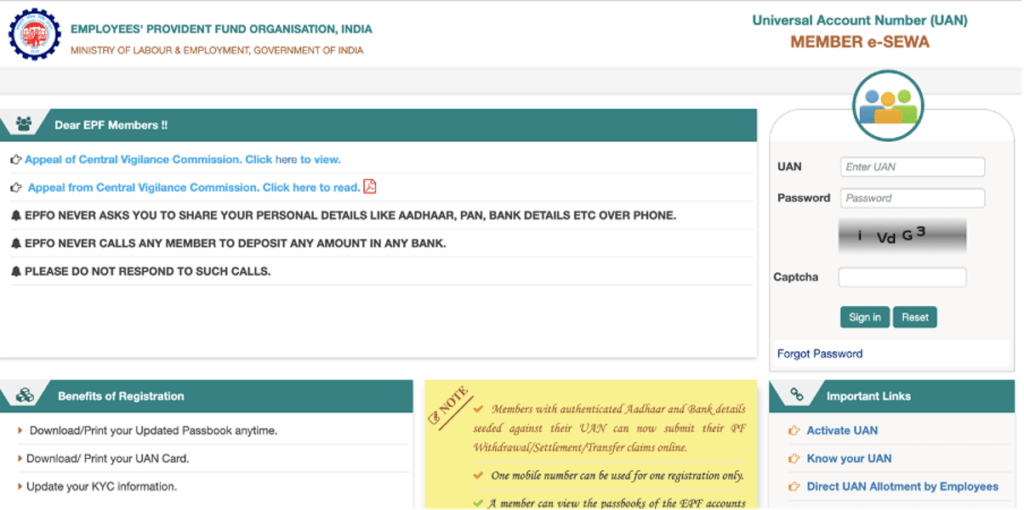

Step 1: Visit the EPFO member e-sewa portal.

Step 2: Enter the EPF UAN, password and the captcha to Sign in.

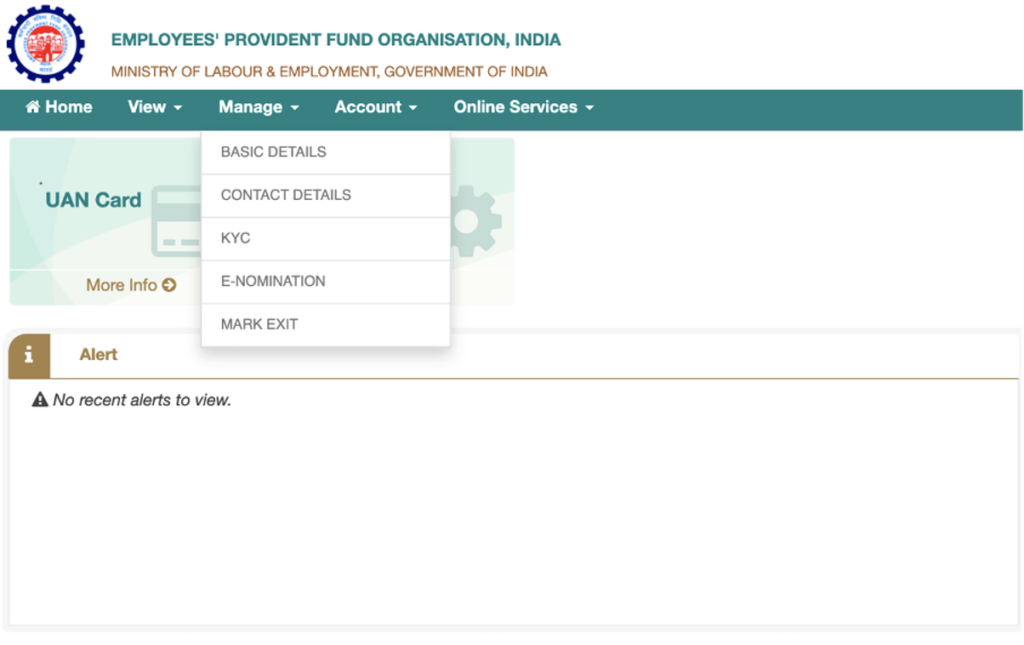

Step3: Upon successful login, select the ‘KYC’ option under the ‘Manage’ tab.

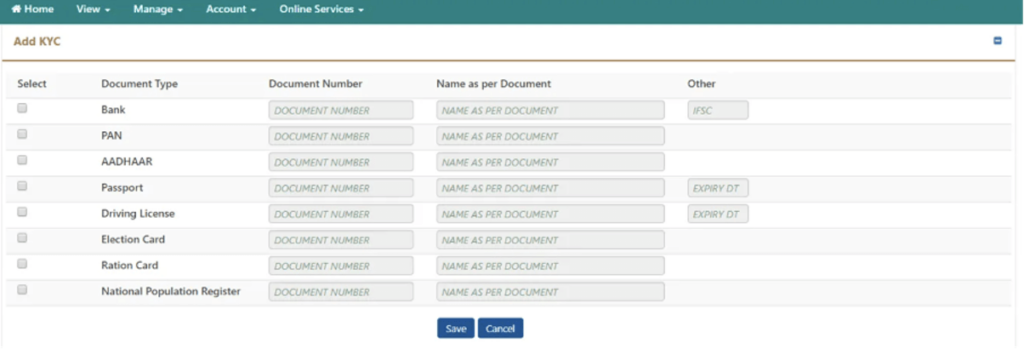

Step 4: Next, on the KYC page, Select the document type, and fill in the required details, such as the Document Number and Name as per the document. Click on Save to proceed.

Step 5: Upon updating the KYC details in the portal, the KYC document’s status will be under the ‘KYC Pending for Approval’ section. After the employer verifies the bank account, PAN number and approves them, the status changes to ‘Digitally Approved KYC.’

After the approval of the KYC document, the UAN holder gets an SMS notification confirming the approval.

Documents Required for EPFO KYC

One can update their Know Your Customer (KYC) information for EPFO online. They can log in to their EPFO portal and complete the KYC process.

The mandatory KYC details are bank account details, PAN card number and Aadhaar card. If the details have not been updated yet, these details on the EPFO portal must be updated immediately. There are many benefits of KYC update in EPF.

Following are the documents required for KYC update for EPFO UAN:

- Bank account details

- PAN

- Aadhaar Card

- Passport

- Driving License

- Election Card

- Ration Card

- National Population Register

Benefits of Updating KYC Details on the EPFO Portal

By keeping EPF KYC updated, an individual will benefit in many ways. Following are some of the benefits:

- One can easily request claim withdrawal online if the KYC details are updated and linked with the UAN.

- Without an updated KYC, the claims get rejected.

- No delay in withdrawal and transfer.

- Having an updated KYC ensures smooth transfer of the employees provident fund EPF accounts.

- With a successful KYC registration, users get alerts notifying the monthly PF balance and regarding activity in the account.

- The individual will not have the privilege of getting SMS alerts if the KYC documents are not up to date.

- If an individual withdraws their PF before the completion of five years of service, then a 10% TDS is chargeable against the amount. For this, the PAN details have to be updated in the EPF account. Furthermore, if the PAN details are not updated, the TDS percentage is 34.608%.

How to Update Contact Details in the EPFO UAN?

It is necessary to link a mobile number and email ID to UAN. This is because the EPFO offers various services to its members through SMS and email. Hence it is mandatory to register a mobile number and email ID while activating UAN. It is also easy to update the contact details in the EPF account.

Registering Contact Details for UAN

Below is the procedure to register contact details for UAN:

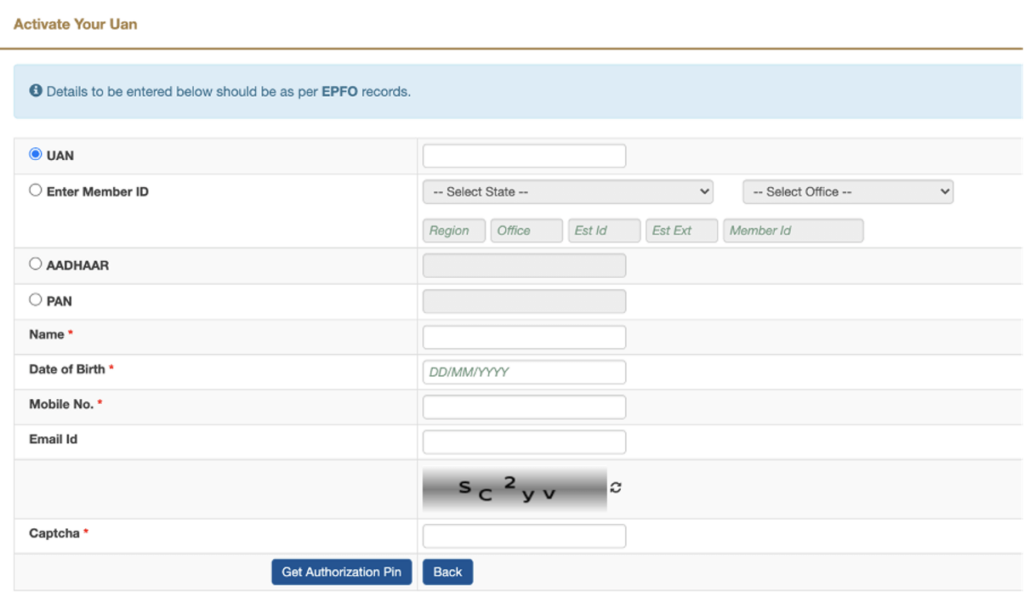

Step 1: To register a mobile number and email ID, one has to activate their UAN. To activate UAN, visit the EPF member portal.

Step 2: Under important links, click on ‘Activate UAN’.

Step 3: Here you have to enter all necessary details like UAN, name, date of birth, mobile number and email ID. Then, enter the captcha verification code and click on ‘Get Authorization Pin’.

You will receive an OTP on the email ID and mobile number.

Step 4: Enter the OTP and activate the UAN.

Upon activation of UAN, the mobile number and email ID mentioned will be registered.

Changing Contact Details of UAN

To change the mobile number and email ID for communication with EPFO, one has to follow the steps below:

Step 1: Visit the EPF member portal website.

Step 2: Enter the UAN, password and the captcha code and click on sign in.

Step3: After logging in, under the ‘Manage’ tab, click on ‘Contact Details’.

Step 4: There are two checkboxes available for changing the email ID and mobile number. Select the checkbox as per the requirement.

Step 5: Enter the new mobile number and email ID and click on ‘Get Authorization Pin’.

Step 6: You will receive an OTP on the new mobile number and email ID. Enter the OTP, to successfully update the contact details.

EPFO UAN Helpline in case KYC Issues

The Employee Provident Fund Organization (EPFO) has established a separate helpdesk for UAN related issues. The helpdesk is available online and offline. Users can either get help from the UAN helpline online and solve their problems. Or, they can solve them by meeting UAN helpdesk officials. UAN helpdesk also solves member queries through email and toll-free numbers.

EPFO helpdesk solves the following queries for EPF subscribers:

- Knowing UAN

- Problems in case of allotment of more than one UAN

- Unavailability of passbook

- Changing contact details

- Technical issues with the portal and UMANG app

- KYC details update

- EPF transfer

- OTP non-reception

Helpdesk contact details

| [email protected] | |

| Toll-free number | 1800 11 8005 |

UAN Helpdesk for KYC

Getting KYC details updates for UAN will help reduce the dependency on the employer while moving jobs. It also helps in a smooth transition from one job to another when transferring PF amount from one account to another. To update KYC, one would need an Aadhaar Card, PAN Card, Passport, and bank account number. One would also need a driving license, voter ID, ration card and national population register number. One need not upload all the KYC documents. They can upload one or more at their convenience.

KYC for UAN can be done online at the EPF member portal website. For all queries with respect to KYC updates, you can contact the UAN helpdesk. They can write an email at any time. And the toll-free number is available between 9:15 AM and 5:45 PM on all days.

Who Approves the KYC documents and How?

Upon successfully updating the KYC details on the UAN EPFO portal, the EPFO department or the employer must approve the KYC inputs. Usually, the employer approves the KYC request. However, suppose they fail to approve the contact details, the administration or the HR department. In that case, if that doesn’t work, one can contact the EPF Grievance Portal.

It may usually take up to three days to five days for approval. One can track the changes online on the portal under the ‘KYC pending for approval’ section.

Regarding any queries, one can contact EPFO Helpdesk on their toll-free number 1800118005. For any other technical support, one can contact the department at [email protected].

How Can I Check My UAN KYC details Online?

To check the status of UAN KYC, you have to login to your EPF account. Visit the EPFO’s member portal. Next, enter the Universal Account Number (UAN) and password. Enter the captcha to Sign in. Upon successful login, select the ‘KYC’ option under the ‘Manage’ tab. The documents can be viewed under the ‘Digitally Approved KYC’ tab by EPF account holders. The tab will show a list of accepted and checked documents.

Check Out How to Change Mobile Number in EPFO?

Frequently Asked Questions

No, one need not upload the KYC documents. They have to type the document number and the name of the document. In some cases, the expiry of the document has to be mentioned too. Uploading KYC details for UAN is important as it helps in a smooth transition from one job to another. It also reduces the employee’s dependency on the previous employer while transferring PF amount from one account to another.

It usually takes 3-5 working days to verify the KYC details. Once the approval is successfully done, an SMS will be sent to the registered mobile number notifying the same.

To check the status of PF KYC, you have to visit the EPFO’s member e-sewa portal. Next, enter the UAN, password and the captcha to Sign in. Upon successful login, select the ‘KYC’ option in the drop down menu under the ‘Manage’ tab. The documents can be viewed under the ‘Digitally Approved KYC’ tab by EPF account holders. The tab will show a list of accepted and checked documents.

No, it is not mandatory for an individual to update KYC details. However, if the KYC details are up to date in your EPF account, you can enjoy a number of benefits. Some of which are regular updates on SMS, ease in claiming your balance, quick and hassle-free transfers, lower TDS charges, etc. Therefore, one to update their KYC for easy claims.

Explore: How to Download PAN Card Online?

Related Articles

- How to Update KYC in EPFO?

- Documents Required for EPFO KYC

- Benefits of Updating KYC Details on the EPFO Portal

- How to Update Contact Details in the EPFO UAN?

- EPFO UAN Helpline in case KYC Issues

- Who Approves the KYC documents and How?

- How Can I Check My UAN KYC details Online?

- Frequently Asked Questions

Show comments