PAN Card is a 10-digit unique alphanumeric code assigned to each individual by the Income Tax Department. The IT department issues a duplicate PAN Card in case of loss or theft, or change in personal details. This article covers the process of applying for a duplicate PAN Card and surrendering the duplicate card in detail.

What is a duplicate PAN Card?

There might be instances where one might lose their PAN Card or be stolen or even damaged. In such cases, the Income Tax Department issues the duplicate PAN Card on request. To apply for a duplicate PAN Card, one requires an FIR. After filing the FIR, the applicant must raise a request for reprint of PAN.

When the Income Tax Department reprints or issues a duplicate PAN Card, the PAN Card number will not change. Only a new PAN card is issued, and all other details will remain the same in case the applicant has requested for reprint of PAN.

Explore: How to Download PAN Card Online?

How to apply duplicate PAN card?

One can apply for a duplicate PAN card either online or offline mode.

Online Duplicate PAN Card

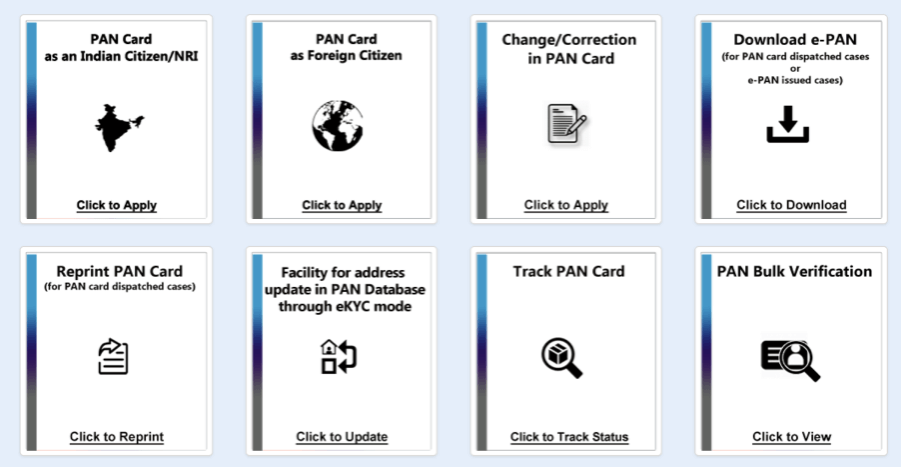

Step 1: Visit the TIN- NSDL website to apply for the duplicate PAN.

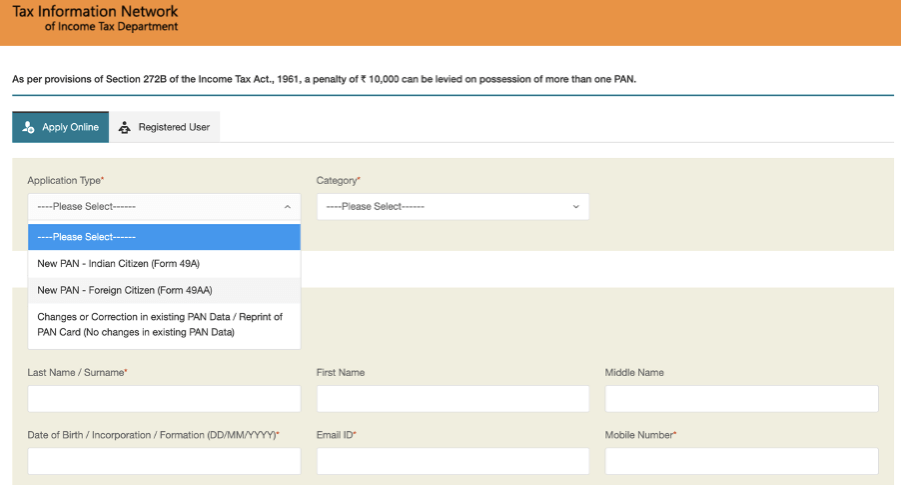

Step 2: Under the ‘Application Type’ select ‘Changes or correction in PAN Data / Reprint of PAN Card (No change in existing PAN Data)’ option in the drop-down menu.

Step 3: Fill in all the required details, enter the Captcha and click on ‘Submit’ to proceed.

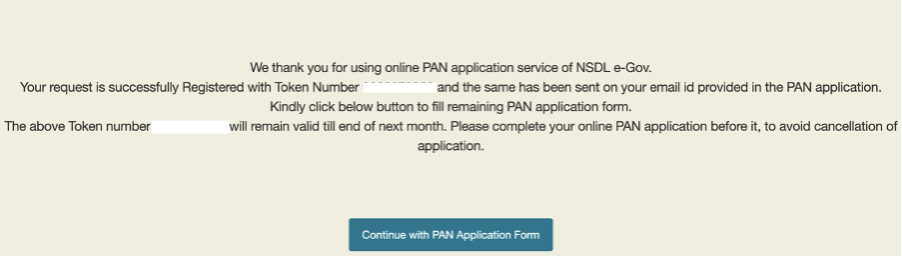

Step 4: A token number is generated, and an email is sent. Click on ‘Continue with PAN Application Form’

Step 5: Next, fill in all the Personal Details, Contact & other details and upload all the necessary documents to complete the online PAN application.

Step 6: Upon successful payment of the fee, the acknowledgement will be generated. One can check the status of their duplicate PAN card using the 15 digits acknowledgement number generated.

Step 7: The applicant has to indicate whether a physical PAN card is required while submitting the PAN application form. If the applicant chooses a physical PAN card, then the card will be sent to the communication address. The e-PAN card in PDF format is sent to the email ID mentioned in the PAN application form.

Explore: PAN Card Acknowledgement Number

Offline Duplicate PAN Card

Follow the below steps.

- One can apply for a duplicate PAN Card by submitting the filled PAN application form and all the necessary documents.

- One can get the form at TIN-Facilitation Centres, IT PAN Services Centres, or PAN Centres. Or they can also download the form from the official Income Tax Website, UTIITSL website, or TIN-NSDL Website.

- Following are the steps to fill the offline application form:

- The applicant has to use only BLOCK letters and fill the application in Black Ink.

- Mention the ten-digit PAN for reference.

- For individual PAN applicants, two passport size photographs are to be attached and cross-signed carefully. Make sure the face is not covered while signing.

- Fill in all the necessary details in the form and sign the relevant boxes.

- The application form and the payment, proof of identity, proof of address, and PAN proof have to be sent to any NSDL facilitation centre. After receiving the payment, a printed 15 digit acknowledgement number is generated and printed for the applicant.

- The applicants can check the status of their duplicate PAN card using the 15 digit acknowledgement number generated.

- It takes up to 2 weeks to dispatch the application after it reaches the department.

When do you need to apply for a duplicate PAN card?

An individual can apply for a duplicate PAN Card only in the following situations:

- In the event of loss or theft: When individuals lose their PAN Card, or it gets stolen, one would need a new card. In such cases, one can apply for a duplicate card.

- When the card is misplaced: When individuals misplace the card, in other words, when they don’t know where they left their PAN Card, they can request a duplicate card.

- When the card is damaged: PAN Cards, if not handled with care, can be damaged. In such cases, one has no option other than requesting another card.

- Change in information: When individuals personal information changes, like name, signature, mobile number, address, etc., in such cases, one would need a new card. Hence, they can apply for a duplicate card.

Who can apply for duplicate PAN card?

In India, there are different types of taxpayers, for example, individuals, partnership, companies and HUF. Only individual taxpayers can file for their PAN card application. For all other taxpayers, an authorised signatory is the one who files for the application. Following are the list of authorised signatories:

| Tax Payer | Authorised Signatory |

| Individual | Self |

| HUF | Karta of the HUF |

| Company | Any one of the directors of the company |

| Firm or Limited Liability Partnership (LLP) | Any one of the partners of the firm/LLP |

| AOP(s) or Body of Individuals or Association of Person(s) or Local Authority or Artificial Juridical Person | Authorised signatory as mentioned in the incorporation deed of the several taxpayers |

How to surrender the duplicate PAN card?

There can be instances where one is issued two PAN Cards with different numbers or similar information. One needs to surrender the duplicate PAN or the PAN with incorrect information in such cases. One can surrender their card online or offline. The following section explains both the processes:

Online surrender of Duplicate PAN Card

- Visit the NSDL PAN portal website. Here, in the application type drop-down, select ‘Application for Changes or Correction in existing PAN data’.

- Fill out the form with all necessary details and click on submit. A token number will be generated and sent to the email address mentioned in the form. Note this token number down for future use. Click on continue.

- Next, you will need to upload scanned copies of images. Select ‘Submit scanned images through e-Sign’ and enter the PAN Card number you want to retain.

- Then, fill out all the necessary personal details and contact details form, and click on submit.

- The next step is to give proof of identity, residence and date of birth. Here you will have to upload scanned copies of all necessary documents.

- A preview of the application is displayed, check all the details and proceed towards payment.

- Make the payment and save the acknowledgement receipt as proof. Print the acknowledgement receipt along with all required documents to the following address

- NSDL e-Gov at ‘Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk,

Pune – 411 016.

Offline surrender of Duplicate PAN Card

To give an application for surrendering the duplicate PAN card offline, follow the steps below:

- Download the ‘Request for New PAN Card Or/And Changes Or Correction in PAN Data’ form from the official NSDL website.

- Please fill the application with all necessary details and send it to the nearest NSDL collection centre with all required proofs. Also, enclose a letter with the details of the PAN Card that needs to be cancelled. An acknowledgement number is given after the form is submitted. Store it for future reference.

- You can also visit an Income Tax Assessing Officer of your jurisdiction and request a duplicate PAN Card’s cancellation.

Documents required to apply for a duplicate PAN card

Following are the list of documents to be submitted for applying for a duplicate PAN Card:

- Identity proof such as Aadhaar, driving license, or voter ID, etc.

- Address proof such as Aadhaar, bank account statements, or utility bills, etc.

- Date of birth proof such as Passport, matriculation certificate, or certificate of birth, etc.

- A self-attested copy of PAN or PAN allotment letter

- Note: All the above documents have to be self-attested.

Process for a reprint of PAN Card online

One can reprint their PAN Card online by following the steps below:

- Click here to go to the reprinting application form.

- Enter PAN Card number, Aadhar Card number and date of birth. Click on ‘submit’.

- All your personal details like mobile number, email, the address will be displayed. Select the mode of OTP (mobile or email) and click on submit.

- OTP will be sent to your mobile or email ID. Enter the OTP. Then the Income Tax Department will send the PAN Card to the available communication address in their database.

How to apply for a correction in PAN data?

One can correct the PAN data, either online or offline.

PAN Card Correction Online

NSDL Web site

Visit the TIN- NSDL website for changing the PAN data.

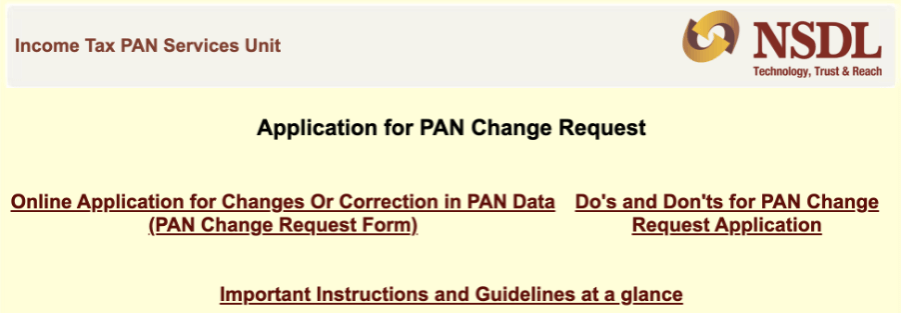

Click on the Online Application for Changes Or Correction in PAN Data (PAN Change Request Form)

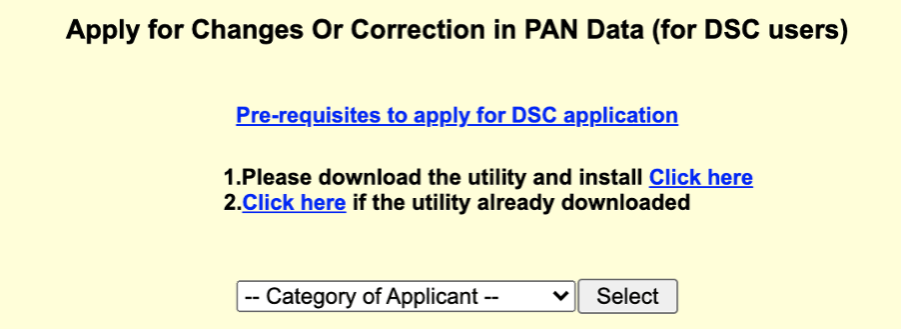

Read all the guidelines carefully, choose the ‘Category of Applicant’ and click on the select button to proceed.

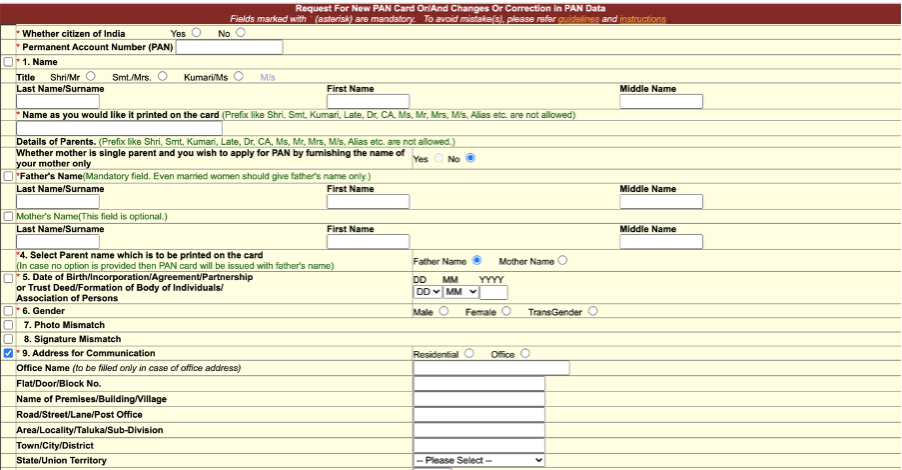

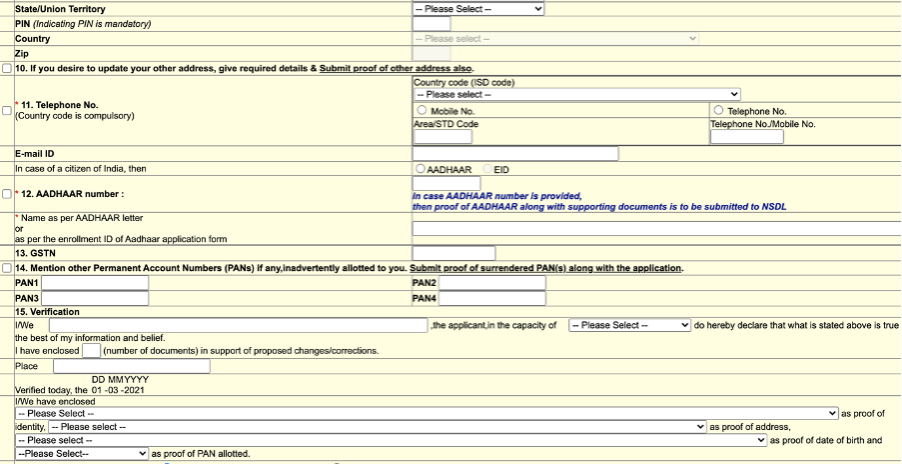

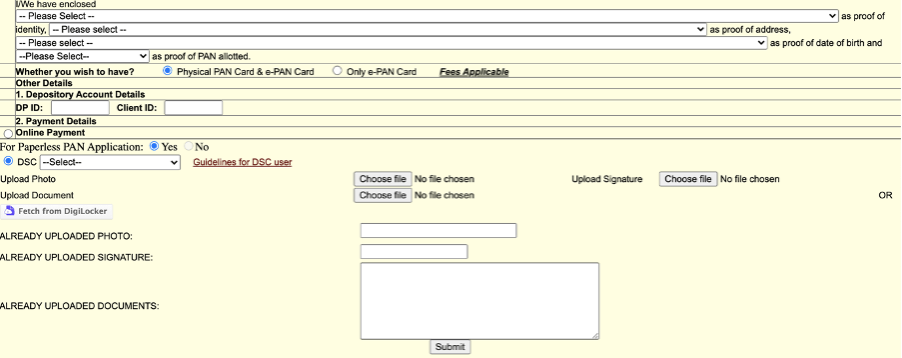

For Changes or Correction in PAN data, the applicant must fill all mandatory fields (marked with *) of the form. Also, they have to select the corresponding box on the left margin of the appropriate field where correction is required.

The application requires details such as whether the applicant is a citizen of India, PAN number, name to be printed on the card, father’s name, mother’s name, date of birth, and gender. Also, the applicant chooses which parent’s name they would want to be printed on the card. Other details, such as an address for communication, telephone number, email ID, Aadhaar number, name as per Aadhaar, are also required.

In case the applicant wishes to change their address for communication, then they have to check the 10th point in the application and upload the address proof. In the case of photo and signature mismatch, they can check the 7th and 8th point in the form, respectively.

Furthermore, an applicant can also mention all the other Permanent Account Numbers (PANs), if any, inadvertently allotted to them. Also, they have to submit proof of surrendered PAN(s) along with the application.

The applicant then has to declare that all the information is incorrect and upload all the necessary documents.

Following are the screenshots of the online application form

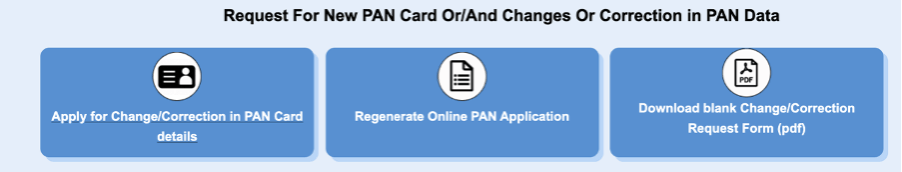

UTIITSL Website

Visit UTIITSL Website

Under the PAN menu, select ‘Apply PAN.’

Next, click on the ‘Change/ Correction in PAN Card.’

Click on the ‘Apply for Changes or Correction in PAN Card details.’

Fill the entire form with all the necessary details and upload all the documents required.

PAN Card Correction Offline

One can correct their PAN card offline. All they have to do is download and print the PAN correction form.

- Fill the PAN correction form. It should be submitted at the nearest NSDL or UTIITSL centre.

- Submit all the required documents.

- Furthermore, while filling the form, remember to tick the box on the left margin for details that one would like to change on your PAN card.

I lost my PAN, and I do not remember my PAN number. What to do?

If you list your PAN Card and do not remember the PAN number, it is important to first get the details of your PAN. Visit the income tax website and click on ‘Know your PAN’. Fill in all valid details and validate with the OTP sent to the registered mobile number. Once the details are verified, the screen will display PAN Card number, name, jurisdiction etc. Now that you know your PAN Card number request for a reprint of the PAN by clicking here.

You may also like to read about the How to Download PAN Card?

Read also about the How to link Pan card with Aadhaar card?

Frequently Asked Questions

The cost that the IT department charges for issuing a duplicate PAN Card in INR 110. The processing fee is INR 93, and the GST is 18%. The payment of the fee can be done online or offline. Online payment options are net banking and offline payment options are DD or cheque.

If an individual loses their PAN card by theft, then they have to file an FIR at the nearest police station. It is mandatory to submit the FIR copy and the other documents while filing the duplicate PAN card application.

It is mandatory that your Aadhaar Card and PAN Card are seeded to each other. There are multiple ways of linking PAN with the Aadhaar Card. It can be done online or through SMS or by submitting a form offline. If the PAN card is not linked to your Aadhaar, then the government may cancel the PAN Card.

Once an applicant applies for a duplicate PAN Card, it takes approximately 15 days or two weeks for the card to be dispatched.

Related Articles

- What is a duplicate PAN Card?

- How to apply duplicate PAN card?

- When do you need to apply for a duplicate PAN card?

- Who can apply for duplicate PAN card?

- How to surrender the duplicate PAN card?

- Documents required to apply for a duplicate PAN card

- Process for a reprint of PAN Card online

- How to apply for a correction in PAN data?

- I lost my PAN, and I do not remember my PAN number. What to do?

- Frequently Asked Questions

Show comments