In the past couple of years, small-cap funds have gained a lot of importance in the investing space. They gave more than decent returns and attracted retail investors’ attention. Being the most volatile among all equity funds, they have the capacity to deliver huge returns. However, this also means these funds have to go through difficult market phases.

With a large chunk of equity already present in your portfolio in the form of large caps, mid-caps, and multi caps, should you invest in small-cap equity funds at all? Are they a lucrative investment option? Will they deliver good returns in the long term as well?

What is a Small Cap Fund?

Small-cap funds invest in companies that rank beyond 250 in terms of market capitalization. According to SEBI, small-cap funds should invest at least 65% of their assets in small-cap companies. Small-cap companies are in their nascent stages of growth and have a long way to go before they deliver growth consistently.

Small-cap funds can perform exceptionally well during a bullish market phase. However, these funds can go through some difficult market phases, leading to an abrupt fall in their returns. Investors should practice caution while investing in these funds. Invest in these funds only if you understand the risk involved in them and you are patient enough to stay invested for longer investment horizons, like a minimum of 7 years.

Check out: Small Vs Mid Vs Larg Cap Funds

Performance

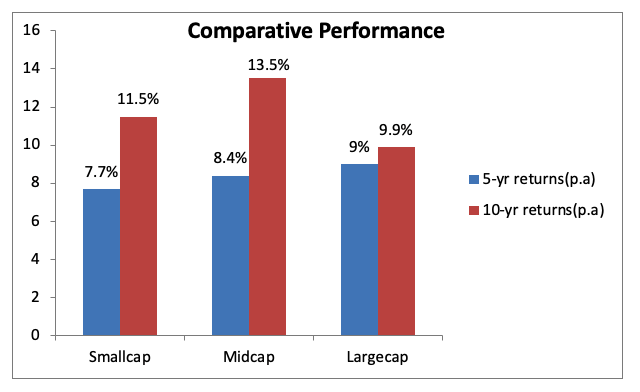

In the last five years, small cap funds on an average gave annualised growth rate of 7.7 percent as against 8.4 percent for mid cap and 9 percent for large cap. In the last 10 years, while their growth rates were higher than large cap funds, it was lesser than that of mid cap funds by a wide margin. Long-term investors haven’t benefited significantly by taking higher risk of small cap equity funds.

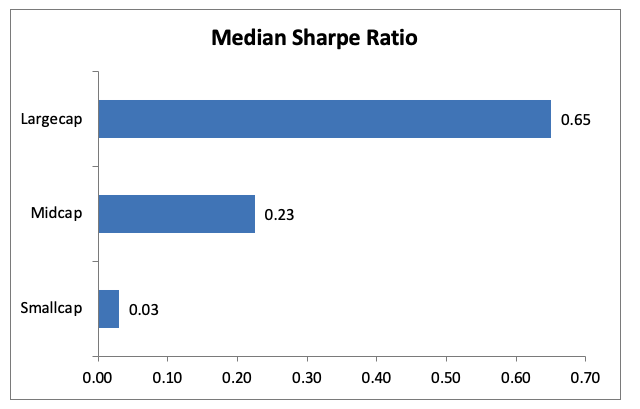

In fact, for every unit of risk taken, small cap have poorly rewarded its investors in terms of absolute growth rates as compared to that of mid-cap or large cap funds (see table). A high Sharpe ratio implies a better reward (in terms of return) for the unit of risk taken.

In fact, for every unit of risk taken, small cap have poorly rewarded its investors in terms of absolute growth rates as compared to that of mid-cap or large cap funds (see table). A high Sharpe ratio implies a better reward (in terms of return) for the unit of risk taken.

Highly Volatile

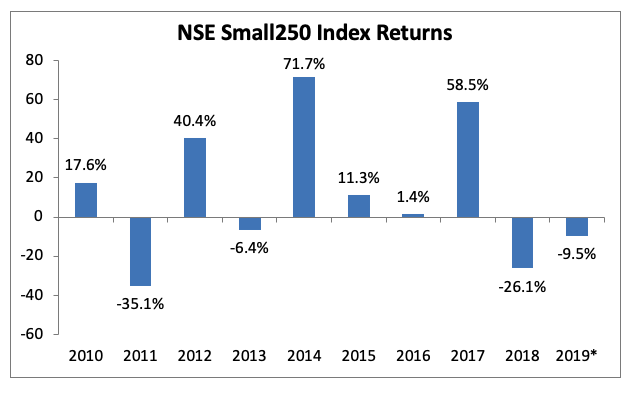

Small cap funds do well in rising markets but also might take a beating during downturns. After a rollicking year in 2017, when NSE Small cap 250 index gave a return of 59 percent, it has been lagging the returns of that of large cap and mid-cap indices in 2018 and 2019.

The Promise

Small cap funds promise to capture the growth stories early on by investing in tomorrow’s mid cap or large cap companies. Being small has its set of advantages; management is nimble enough to capitalise on business opportunities during the good times. However, when the tide turns, they are also the most vulnerable. For every success story, there are many that go kaput. Investing in small cap funds therefore requires a distinct approach.

Track the Fund Manager

Besides returns, check if the fund manager is still there. No other category of funds has such divergent performance as small cap equity. With a large investment horizon of stocks, staying ahead is all about spotting the right stocks ahead of the market. And many a time performance moves along with the fund manager.

Apples with Apples

The mutual fund regulation allows investing up to 35 percent of portfolio in large cap or mid cap stocks. Check fund portfolio and if it’s digressing from the rest in term of portfolio allocation. Large-sized funds tend to increase stake in mid caps and large cap stocks for dearth of investing opportunities and the need to retain fund liquidity.

Stay Put

You need to cool your heels for at least 7-10 years to beat market volatility. Additionally, review fund performance and shuffle if need be.

Satellite Portfolio

Don’t over-invest in small cap funds. Commit not more than 5-8 percent of your portfolio for it, if you have the savings for it. That way you can rejoice at the upside and not feel too cheated if the returns disappoint. For those who can’t stomach the volatility, they are better off with multi cap or even mid-cap funds. They anyway invest a small portion of their portfolio in small cap stocks.

Takeaway

Contrary to popular belief, small-cap funds have actually ranked lower than large-cap and mid-cap funds in terms of returns. These funds don’t deliver good returns in the short term. They take their own time to weather out the volatility before actually delivering sizable returns.

Should you invest in small-cap equity funds at all, or should you ignore them? Well, we sometimes underestimate the impact the little things make. You can consider investing in small-cap funds. However, restrict them to 5-8% of the portfolio. Please take advantage of their ability to deliver good returns by staying invested for longer horizons. Else, you are better off with diversified equity funds.

Discover More

Show comments