What is Salary Slip?

A salary slip or payslip is a document issued monthly by an employer to its employees. A salary slip contains a detailed breakdown of employee salary and deductions for a given period. This document can be either a printed hard copy or mailed to the employees. The employees can download salary slip format in pdf formats. Also, a company is legally bound to issue a pay slip periodically as proof of salary payments to its employees and deductions made.

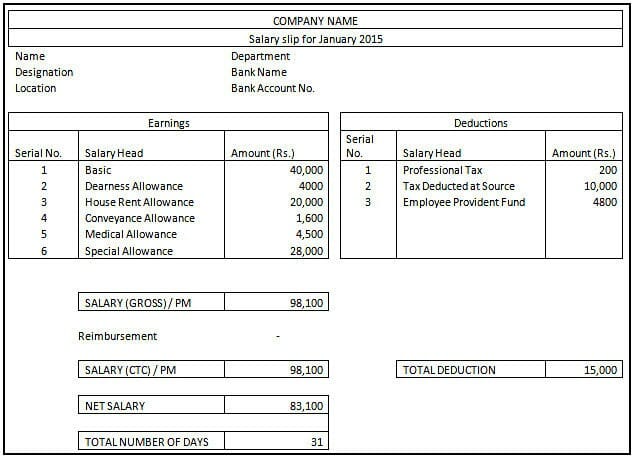

Salary Slip Format

The below components that form part of the Income/Earnings side of the salary statement are:

- Basic Salary

- Dearness Allowance

- House Rent Allowance

- Conveyance Allowance

- Medical Allowance

- Special Allowance

The below components that form part of the Deductions side of the salary statement are:

- Professional tax

- Tax Deducted at Source

- Employee Provident Fund

What are the Components in a Salary Slip?

The employer generates a salary statement every month. The employee can download salary pay slip in pdf formats. However, how many understand the salary slip format and components of salary slip to its entirety? The confusing terms and figures are like a puzzle that one doesn’t want to solve.

For most people, the importance of salary slip is only when they apply for a loan or a new credit card. However, here’s why its essential to understand salary slip format better.

- Choose smartly from competing offers when one is looking to switch jobs.

- Optimize tax liability by making full use of the deductions available

- Understand what percentage of the salary is forced savings (Employee Provident Fund EPF, ESI, etc.)

A salary slip or pay slip will have basic information like company name, employee name, designation and employee code, etc. Salarys components primarily fall under two categories: Income/Earnings and Deductions.

Incomes

The income part of the salary slip has a basic salary and allowances. The same is explained below.

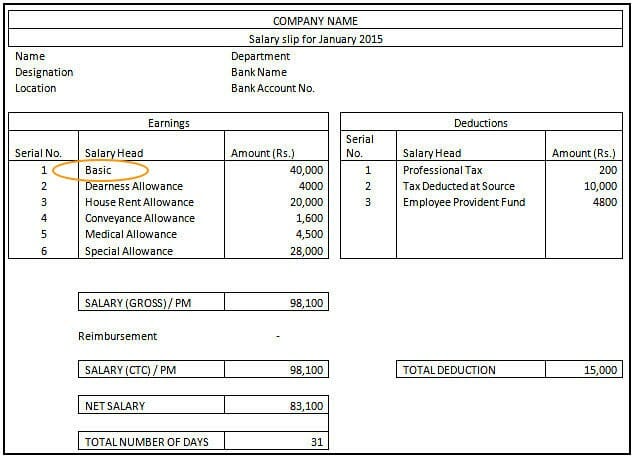

Basic

Basic, as the name suggests, is the basic component of the salary. It constitutes 35-50% of the salary. It forms the basis of other components of the salary. At junior levels, the basic tends to be high. As the employee grows in the organization, other allowances tend to be higher. Organizations tend to keep basic low so that the allowance pay won’t be topped. The salary is 100% taxable in the hands of the employee. Basic is the first component on the earnings side of the salary slip.

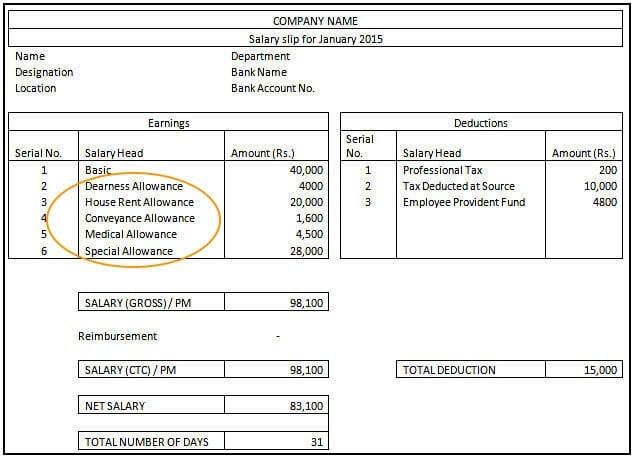

Dearness Allowance

Dearness Allowance paid to offset the impact of inflation on one’s pay. It is usually 30-40% of the basic pay. Dearness allowance da is directly based on the cost of living. Hence it is different for different locations. For income tax, basic and DA are considered as pay. Therefore it is taxable. It appears in the earnings side of the pay slip right after the basic pay.

House Rent Allowance

House Rent Allowance (HRA) is given to employees living in rented facilities. The HRA depends on the city of residence of the employee. For a metro city, HRA is 50% of the basic pay. For all other cities, it is 40% of the basic pay. Since housing rent allowance is an allowance, it is exempted from tax up to a specific limit, provided the employee pays the rent. It appears in the earnings side of the salary slip. One can save income tax on HRA. The exemption is the minimum of the following:

- Rent paid annually minus ten percent of the pay (basic + DA)

- Actual HRA received

- 50% of (basic + dearness allowance da) in case the location is (Mumbai, Kolkata, Chennai, Delhi) or 40% of (basic + dearness allowance da) in case of other cities.

Conveyance Allowance

Conveyance Allowance is the amount an employer pays an employee to travel to and from work. It is an allowance. Hence is exempt from tax up to a specific limit. It appears in the earnings side of the salary slip. One can save income tax on conveyance allowance. The exemption is the minimum of the following:

- INR 1600 per month

- Actual conveyance allowance received

Medical Allowance

Medical Allowance is the amount an employer pays to an employee for medical expenses during the term of the employment. One can save income tax on medical allowance. However, the employee only receives this amount on the submission of medical bills as proof. If the employee fails to submit evidence of medical bills, he/she will receive the allowance, but it will be fully taxed. In case the proof is provided, the allowance up to INR 15,000 is only exempt from tax. It appears in the earnings side of the salary slip.

Leave Travel Allowance

Employers give it to cover the cost of employee travel while on leave. It includes the travel expenses of the employee’s immediate family members as well. Proof of the journey is required to avail deduction subject to certain limits. Any expenses incurred during the trip apart from travel do not count towards the leave travel allowance tax exemption. The exemption is also applicable only for two journeys undertaken in a block of 4 calendar years. It appears in the earnings side of the salary slip.

Special Allowance in Salary

Special allowances include performance-based allowances. These are usually given to encourage employees to work better. Also, these allowances vary from company to company. Special allowances are 100% taxable. It appears in the earnings side of the salary slip.

Deductions

The deduction part of the salary slip has the professional tax, TDS and EPF.

Professional Tax

Professional tax is a small tax levied by state governments on earing professionals. It is payable only in a few states. Namely, Karnataka, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamilnadu, Gujarat, Assam, Chhattisgarh, Kerala, Meghalaya, Orissa, Tripura, Jharkhand, Bihar, and Madhya Pradesh. It is not only levied on professionals but to anyone who earns a living through a medium. This amount is deducted from the taxable income. Also, it usually amounts to just a few hundred rupees each month and is subject to the gross tax slab. It appears on the deductions side of the salary slip.

Standard Deduction

A standard deduction of Rs 50,000 is available under the old tax regime as well as new tax regime. The standard deduction has replaced the transport allowance and medical reimbursement.

Tax Deducted at Source

It is the amount the employer deducts on behalf of the income tax department. It is based on the gross tax slab of the employee. One can reduce this amount by investing in tax-exempt investments like equity funds (ELSS), PPF, NPS, and tax-saving FDs. It appears on the deductions side of the salary slip. Hence, investing in section 80C instruments of the Income Tax Act increases your takehome salary. One can invest in mutual funds (ELSS), submit investment proof to the company and claim tds returns.

Employee Provident Fund (EPF)

It is the contribution of the employee to the provident fund. This qualifies for section 80C of the Income Tax Act. Provident fund is the accumulation of funds for employee’s retirement period. The Employees’ Provident Fund Organisation governs it. 12% of the employee’s basic salary goes towards EPF. The employer also makes a similar contribution on behalf of the employees for their retirement.

However, not all the contributions made for Employee Provident Fund goes to the provident fund. Out of employee’s contribution, 8.33% goes to the Employees’ Pension Scheme. If their salary is above INR 15,000, the contribution is INR 1,250. For employees with a salary below INR 15,000, 8.33% goes towards the Employees’ Pension Scheme. The balance amount is retained in the EPF scheme. However, employees can opt-out of the EPF scheme (up to a limit) and invest in better-earning instruments like equity funds (ELSS). Employee Provident Fund appears on the deductions side of the salary slip.

Why is a Salary Slip Important?

Preserving salary slips is as important as the employment certificate. The salary slip helps employees in seeking loans, future employment, income tax planning, availing government subsidies, and acts as a legal document of employment.

With an in-depth understanding of the salary slip components, let us first examine its importance.

Proof of employment

A salary slip serves as legal proof of employment. While applying for travel visas or universities and colleges, applicants must submit a copy of salary slip as legal proof of the last drawn salary and designation. Also, the salary slip is one of the most critical documents for background checks. The document holds as legal proof against the salary claim. The salary slip also has the current designation. All the past slips can be used to show the career trajectory of the employee at the firm.

Income Tax Planning

A salary slip contains the monthly break-up of earnings and deductions. It also includes components that are tax-deductible. The break-up of earnings, i.e., basic salary, HRA, medical allowance, travel allowance. As well as deductions i.e., profession tax, EPF, and TDS. TDS helps an employee plan his/her tax liability in advance. The takehome salary is hence higher due to these deductions. The tax is then calculated on takehome salary based on income tax slabs.

A proper income tax planning helps in managing tax outflow. Tax planning is an integral part of managing finances. Thus, it helps in availing maximum benefits of tax deductions, rebates, allowances, and concessions within the accepted bounds under the Income Tax Act of 1961.

Salary slips not only help in assessing the tax outflow, but also assist in calculating the tds returns and income tax refund. Therefore, it is essential to keep track of the salary break-up to keep up with Income Tax.

Seeking future employment

A salary slip is a legal proof of current employment and the pay scale at which the employee is currently working at. This document helps in negotiating with prospective employers at an aggregate level i.e., total cost to company CTC and each component level, i.e., basic salary, allowances. Almost all companies ask for past payslips as proof of employment and earnings.

Also, the employees can compare the offers given by new employers based on past salary slips. It plays a significant role in evaluating the experience. Therefore, salary slip plays an important role in the job search. It also helps in deciding the hike that one should be getting. Moreover, the salary slip is a deal-breaker in the salary negotiation with a new employer. Also, previous salary slips can be used to prove the career trajectory.

Avail loans and credit card

A salary slip has all the details of the salary and designation. It serves as legal proof of the credit paying ability of an employee. Further, availing loans, credit cards, mortgages, and other borrowing are based on the salary slip. Therefore, this document is required when applying for a loan, credit card, mortgage, etc. Lending institutions and banks ensure they take a copy of the salary slip. The creditworthiness of the borrower is analyzed based on the salary statements.

The salary slip helps in setting a credit limit. Also, it acts as an eligibility criterion to avail of a loan or credit card. With this, salary slip determines your taxes in the financial year as well.

Avail government subsidies

The pay slip can be used to avail of certain free services. In fact, they can also be used to avail services that have a heavy subsidy. Such services include medical care, food grains, etc.

One can use Scripbox’s income tax calculator to determine the taxable income which will help in filing income tax returns. The calculator also recommends mutual funds investment (ELSS) for tax savings. Use the calculator and save the tax.

What is the difference between Cost to Company (CTC) and in-hand/gross salary?

Cost to the Company CTC is the total amount the employer spends on an employee. The cost to company comprises components such as housing rent allowance hra, Conveyance allowance, Gratuity, Medical expenses, employee provident fund epf, other allowances, etc. While Gross salary is the amount, an employee receives before any deductions. In other words, it is the amount the employer commits to the employee every month. Gross Salary doesn’t include PF and gratuity. Net pay is the salary employee receives after deductions.

Cost to company is the amount an employer spends on hiring and sustaining the services of an employee. It is considered to be variable pay. CTC varies based on various factors and thus has an impact on the net salary an employee receives. An individual can correct it by merely matching the CTC to the actual amount they are receiving.

Let’s understand the difference between cost to company and gross salary with a sample pay slip. Mr. Charan’s CTC is INR 5,50,000. Below is the break of his cost to company :

Basic Salary: INR 2,75,000 (50% of salary)

DA: INR 82,500 (30% of basic)

HRA: INR 1,43,000 (40% of basic + DA)

CA: INR 19,200 (INR 1600 per month)

Special Allowance: INR 8,700 (based on performance)

EPF Contribution: INR 21,600

Gross Salary is the amount before deductions of taxes and others. However, it is inclusive of bonuses, overtime, etc. While Charan’s gross salary is INR 5,50,000 – 21,600

Gross Salary = INR 5,28,400. The net pay is calculated on this amount.

Frequently Asked Questions

A salary slip or payslip is a document issued monthly by an employer to its employees. A pay slip contains a detailed breakdown of employee salary and deductions for a given period.

Understanding the pay slip is important as It helps one understand their salary and components Also, the salary slip acts as proof of employment. It also helps in filing income tax returns and apply for loans and mortgages and negotiate for a salary hike when applying for a new job.

The salary slip is important as it helps employees in seeking loans, future employment, income tax planning, availing government subsidies, and acts as a legal document of employment. Preserving salary slips is as important as the employment certificate.

The employer provides your salary slip on a monthly basis. A salary slip is either printed or emailed to you by the employer. You can also check the salary slip on your employee’s internal portal. The pay slip will have details of your salary and deductions. Basic Salary, Dearness Allowance, House Rent Allowance, Conveyance Allowance, Medical Allowance, Special Allowance, Professional tax, Tax Deducted at Source and Employee Provident Fund are the various components of a salary slip.

Salaried employees can claim a deduction of Rs. 50,000 as a standard deduction. The standard deduction replaces transport allowance and medical reimbursement components in the salary slip. It reduces the tax outgo for salaried and pensioners.

Related Articles

- What is Salary Slip?

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Salary Slip Format

- What are the Components in a Salary Slip?

- Why is a Salary Slip Important?

- What is the difference between Cost to Company (CTC) and in-hand/gross salary?

- Frequently Asked Questions

Show comments