A Permanent Account Number or PAN is a 10-digit unique alphanumeric code assigned to each individual by the Income Tax Department in India. PAN Card allows individuals to carry out financial transactions and pay tax in India. It also helps the IT Department to track all financial transactions of an individual. This article covers PAN Card download through the NSDL PAN portal and UTIITSL portal.

What is e-PAN?

The Income Tax Department issues e-PAN. It is a recent introduction by the IT department after there is a surge in the number of people applying for a PAN Card. e-PAN is an instant allotment of Permanent Account Number (PAN) to first time taxpayers. Individuals who already have a PAN Card cannot apply for e-PAN. It is issued free of cost and is issued on a first-come-first basis. Also, e-PAN is available only for a limited period of time.

To apply for e-PAN, one must be a resident of India. Also, only individual taxpayers can apply for e-PAN and not HUFs or associations. To apply for an e-PAN, one should already have an Aadhar Card, which is linked to the registered mobile number, and all the details of Aadhar have to be correct. Most importantly, an individual already holding a PAN Card cannot apply for an e-PAN.

How to Download e-PAN Card From NSDL Portal?

e-PAN Card can be downloaded using the NSDL portal. There are two ways to download a PAN card using the NSDL portal: using PAN number and date of birth and using the acknowledgement number.

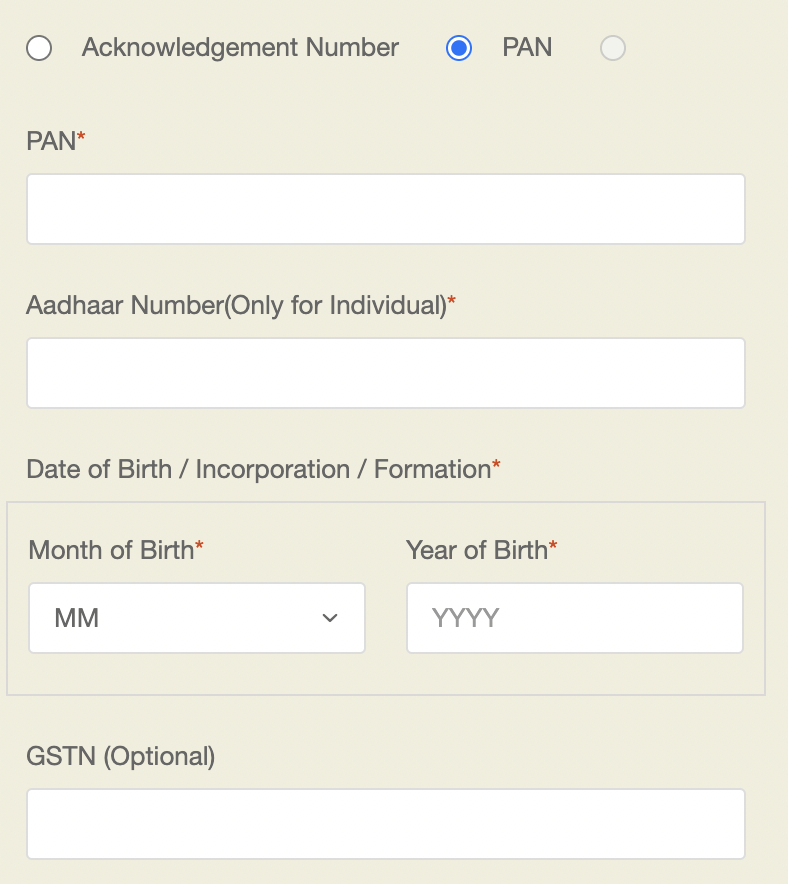

ePAN Card Download Using PAN and Date of Birth

By using the date of birth and PAN Card, you can download e-PAN Card. Following are the steps to download PAN Card.

Step 1: Visit the NSDL PAN portal.

Step 2: Here, enter PAN number, Aadhar Card number and date of birth in MM and YYYY format. Enter GSTIN number if available.

Step 3: Then, click on the check box after reading the contents, enter the captcha code for verification, and click on submit. You will be able to download PDF format PAN Card.

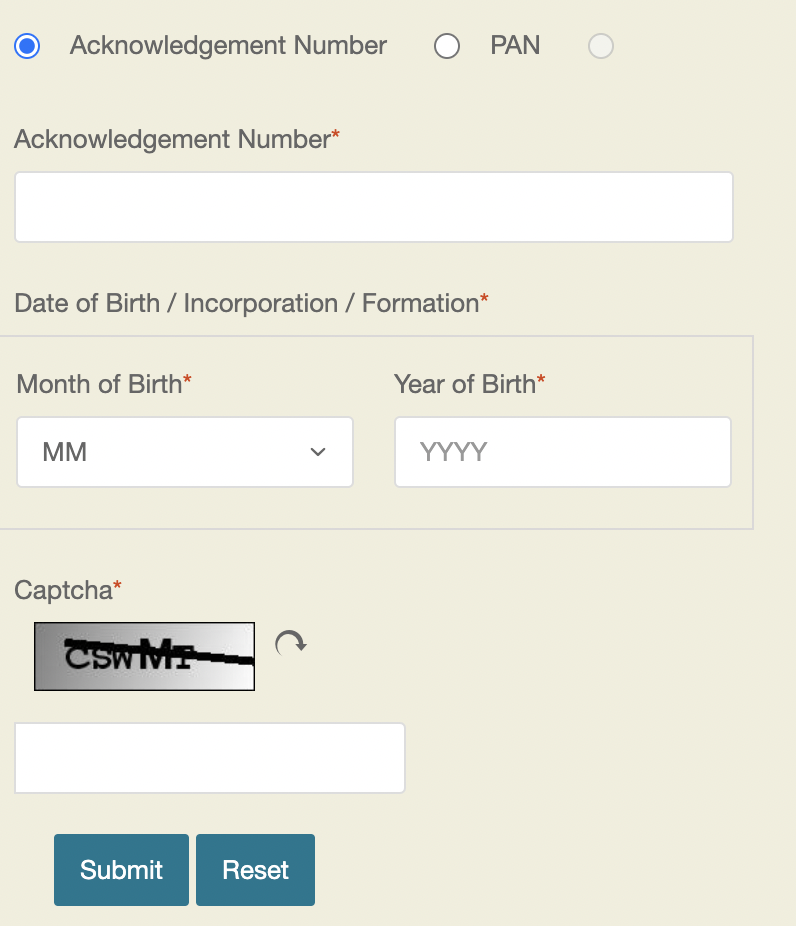

Download e-PAN Card Using Acknowledgement Number

You can download e-PAN Card using the acknowledgement number. Following are the steps for Pan Card download through the NSDL website:

Step 1: Visit the NSDL Pan portal and select the acknowledgement number.

Step 2: Enter the Acknowledgement number and date of birth in MM and YYYY format. Enter the captcha code and submit it.

Step 3: Then enter mobile number and e-mail ID and click on ‘Generate OTP’.

Step4: In the next step, enter the OTP and click on ‘Validate’.

Step 5: A PDF file will be available for download. Click on it to download PDF format PAN Card. The e-PAN Card is a password-protected file, and the password is the date of birth in DDMMYYYY’ format.

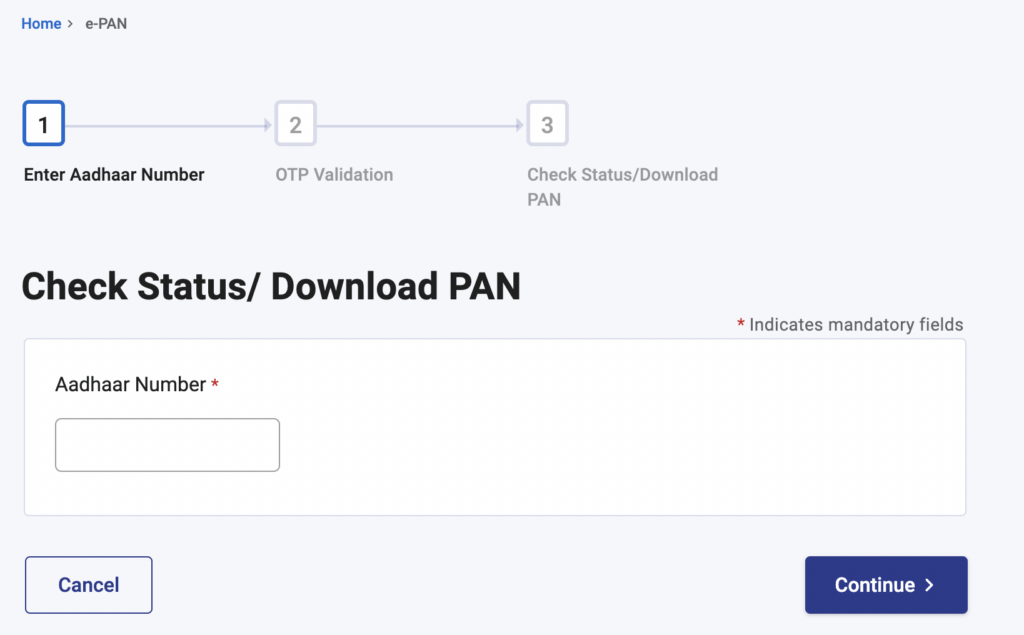

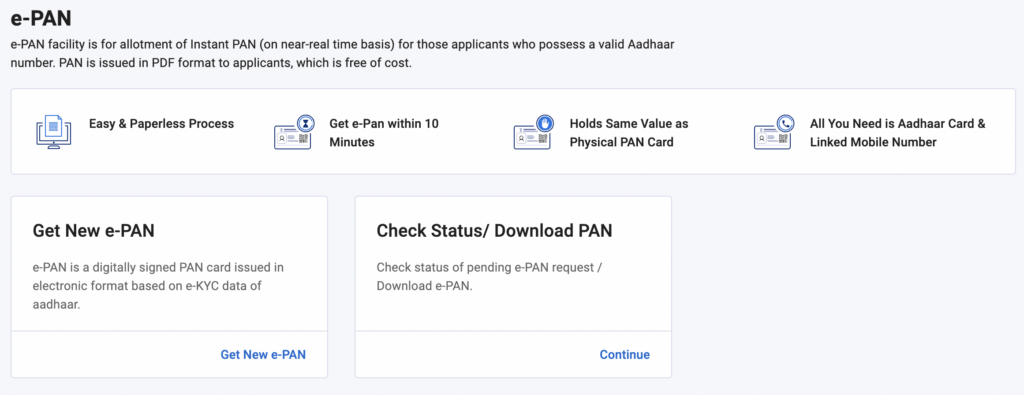

e-PAN Card Download Through Aadhaar Number

The Government of India has introduced a service that enables individuals to get their PAN easily with their Aadhaar Card number. The entire process is completely paperless and free. The following steps will guide you how to download PAN card using Aadhaar Number:

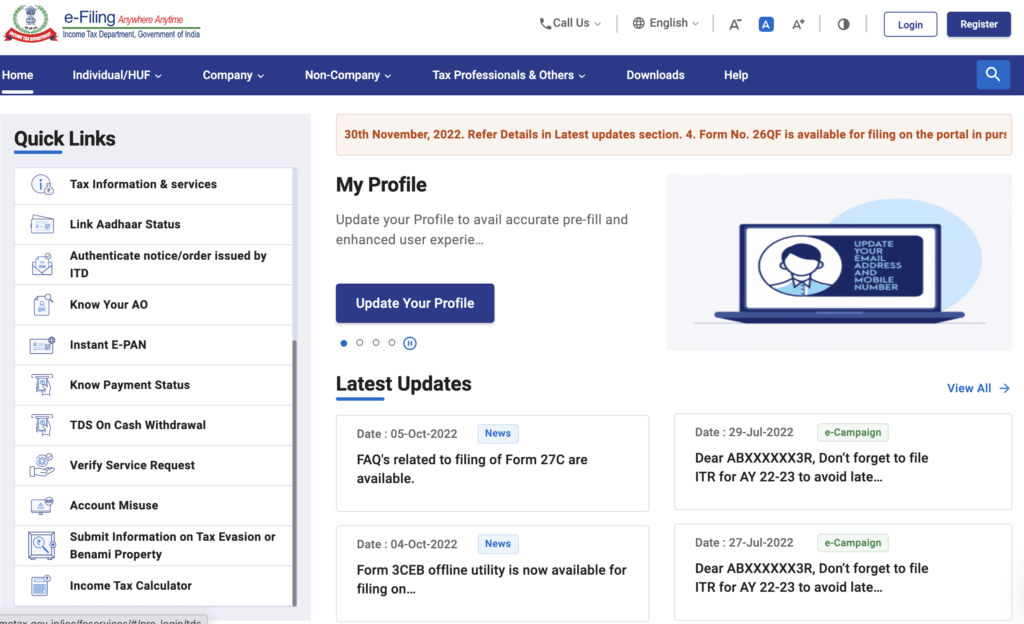

Step 1: Visit the Income Tax e-Filing portal.

Step 2: Under the ‘Quick Links’ section, select the ‘Instant e-PAN’ option.

Step3: On the next page, click on the ‘Check Status/ Download PAN’ button.

Step 4: Next, enter the Aadhaar Number and the captcha code to get an OTP for authentication. Enter the OTP for verification.

Step 5: Upon successful verification, one can view the status and download their ePAN card.

You may also like to read about the How to link Pan card with Aadhaar card?

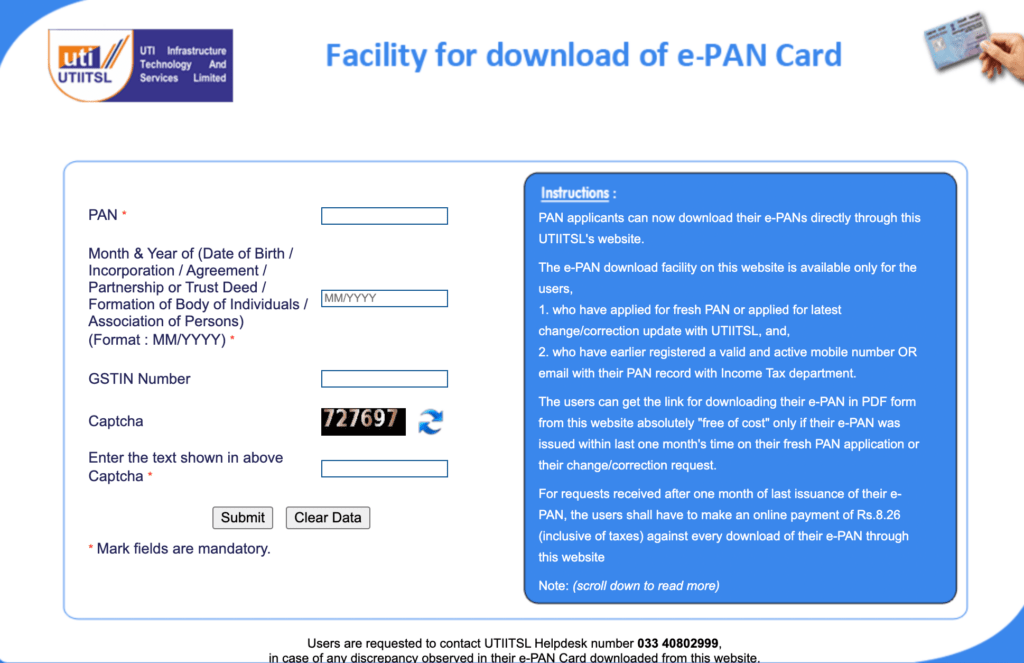

Downloading e-PAN Card Through UTIITSL

Step 1: Visit the UTIITSL portal & Select the ‘Download e-PAN’ option.

Step 2: Here, enter the PAN Card number, and date of birth in the format ‘MM/YYYY’ format. Enter GSTIN number if available. Then, enter the captcha code and click on submit.

Step 3: On the next page, the registered mobile number and email ID will be displayed. Check these details carefully and enter the mode of OTP and click on ‘Generate OTP’.

Step 4: Enter the OTP and make payment. Once the payment is made, you can download e-PAN Card.

Step 5: However, to apply for e-PAN through the UTIITSL website, one should’ve applied for PAN or the latest correct with UTIITSL. Or they should have a valid and active registered mobile number with the IT Department.

Check Out How to Apply for a Duplicate Pan Card?

Learn PAN Card Verification

How to Download e-PAN from the Income Tax Website?

Download your e-PAN from the income tax website in just a few steps. Before we look at the steps, its necessary that you have a valid Aadhar card number. Following are the steps to download e-PAN from the Income Tax website:

- Step 1: Visit the income tax e-filing homepage. Under the Quick Links section, click on ‘Instant e-PAN’.

- Step 2: On the following page, under the ‘Check Status/Download PAN’ option click on continue.

- Step3: Enter your Aadhar number and click on ‘Continue’. You will then receive an OTP on the registered mobile number.

- Step 4: Enter the OTP and log in.

- Step 5: You can see the ‘Current Status’ of your e-PAN Request. If the e-PAN is allotted, you can download it by clicking on ‘Download e-PAN’.

How to Download Duplicate Pan?

Following are the steps to download a duplicate PAN copy using your Aadhaar card on the NSDL website:

- Visit the NSDL website

- Enter the following details:

- PAN number

- Aadhaar number

- Date of Birth

- Accept the declaration and enter the security Captcha.

- Next, click on ‘Submit’ to proceed.

- On the following page, you can see your PAN details.

- Next, select ‘Receive OTP on Email ID or Mobile Number’ option and enter the OTP.

- Click on ‘Validate’, to download a duplicate copy of your PAN.

What is the PAN Card Customer Care Number?

Following are the PAN Card customer care numbers:

- Income Tax Department Call Center Number: 0124-2438000, 18001801961

- NSDL Call Center Number: 020‐27218080, (022) 2499 4200

- UTIITSL Portal Call Center Number: 022-67931300, +91(33) 40802999,

- PAN Card Tollfree Numbers:

- Income Tax Tollfree Number: 18001801961

- NSDL Tollfree number: 1800 222 990

- PAN Card Email ID:

- NSDL: tininfo@nsdl.co.in, info@nsdl.co.in

- UTIITSL: utiitsl.gsd@utiitsl.com

Who Is Eligible To Use The E-PAN Download Service?

- You can use this facility only if you have a PAN and you applied for it or updated it on the NSDL e-Gov portal or the UTIITSL portal.

- You can download your e-PAN card for free three times if you got your PAN or updated it on either portal in the last 30 days.

- To download your e-PAN card, you must pay a fee if you got your PAN or updated it more than 30 days ago.

- Your e-PAN card will be in a password-protected PDF file. You must use your date of birth to unlock it.

What Should I Do If I Have More Than One PAN?

If you have more than one PAN, you will have to fill and submit the PAN Change Request application. Mention the PAN which you are currently using on top of the application form. All other PAN numbers inadvertently allotted to you should be mentioned in item no. 11 of the form. Also, the corresponding PAN card copies have to be submitted for cancellation along with the form.

Read also about the CDSL vs NSDL

You may also like to read about the How to Download the eAadhar?

Frequently Asked Questions

Yes, an email ID is mandatory while applying for PAN. One can receive their e-PAN Card on the same email ID.

Yes, you can download the PAN card online if you have lost it. You can visit any of the following websites to download the soft copy of your PAN NSDL or UTIITSL.

One can download the e-PAN Card without the PAN number. However, they should have the Acknowledge Number of the PAN application to do so.

Yes, one can download the ePAN Card without having the acknowledgement number. An applicant can enter their PAN Number, Date of Birth, or Aadhaar number to download the pan card. They can download it through the NSDL e-Governance or e-filing portal of the IT Department or UTIITSL.

An applicant can download the e-PAN card for free during the first month of its issuance. Post that, an applicant has to pay a fee of INR 8.26 for each e-PAN card download through UTIITSL.

e-PAN Card is a valid document, just like a regular PAN Card.

No, one cannot have more than one PAN. Having more than one PAN is against the law, and it may attract a penalty of up to INR 10,000. Therefore, it is advisable not to have more than one PAN.

Related Articles

- What is e-PAN?

- How to Download e-PAN Card From NSDL Portal?

- e-PAN Card Download Through Aadhaar Number

- Downloading e-PAN Card Through UTIITSL

- How to Download e-PAN from the Income Tax Website?

- How to Download Duplicate Pan?

- What is the PAN Card Customer Care Number?

- Who Is Eligible To Use The E-PAN Download Service?

- What Should I Do If I Have More Than One PAN?

- Frequently Asked Questions

Show comments