A strong financial market that involves broad participation is key to building a developed economy. With this goal in mind, India’s first mutual fund, Unit Trust of India (UTI), was established in 1963. It was created through the efforts of the Government of India and the Reserve Bank of India to promote savings, investments, and public participation in the income generated from managing securities.

Over the years, the mutual fund industry in India has grown significantly, offering individuals a wide range of investment options. The journey of mutual funds in the country can be divided into five distinct phases, each reflecting the progress and transformation of this investment vehicle.

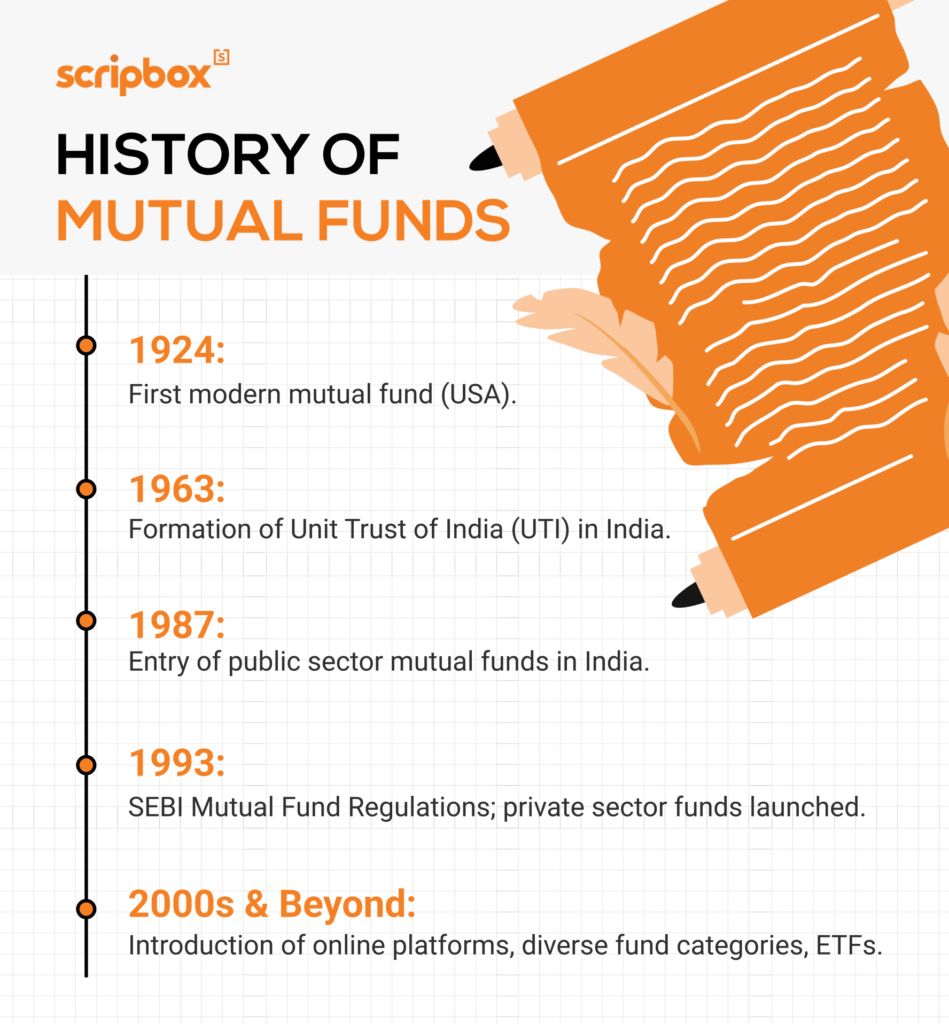

Mutual Funds History

Early Beginnings of Mutual Funds

The concept of mutual funds has its roots in the 18th century when a Dutch businessman named Adriaan Van Ketwich introduced the idea of pooling resources to invest in a diversified portfolio of securities. This innovative approach allowed investors to spread their risk across various assets, making it an attractive option for those with limited capital. The idea quickly gained traction and spread to other parts of the world.

In the United States, the mutual fund industry began to take shape in the late 19th century. The first mutual fund, the Massachusetts Investors Trust, was established in 1893. This fund laid the groundwork for the modern mutual fund industry by offering investors an opportunity to invest in a diversified portfolio managed by professionals. The concept of open-end mutual funds, which allow investors to buy and sell shares at any time, was introduced in 1928 by the Massachusetts Investors Trust. This marked a significant milestone in the history of mutual funds, setting the stage for the industry’s future growth and development.

1st Phase (1964 – 1987)

The mutual fund industry started with the Unit Trust of India (UTI) formation in 1963 by the Parliament Act, marking the entry of public sector banks into the mutual fund industry. It functioned under the regulatory and administrative control of the Reserve Bank of India (RBI). Also, Unit Scheme 1964 was the first scheme launched by UTI. Later on, UTI was delinked from RBI in 1978. The Industrial Development Bank of India (IDBI) took over the administrative and regulatory control in place of RBI. By the end of the year 1988, UTI had Rs.6700 crores assets under management (AUM).

2nd Phase (1987 – 1993)

The second phase of mutual fund history marked the entry of public sector banks. In 1987, public sector mutual funds were set up by public sector banks, financial institutions like the Life Insurance Corporation of India (LIC), and the Insurance Corporation of India (GIC). SBI Mutual Fund was the first non-UTI MF to start in June 1987. Subsequently, Canara Bank became Canara Bank Mutual Fund in December 1987. Similarly, some other bank’s mutual funds came into existence, such as –

- Punjab National Bank Mutual Fund in August 1989

- Indian Bank Mutual Fund in November 1989

- Bank of India Mutual Fund in June 1990

- Baroda Mutual Fund in October 1992

- LIC Mutual Fund in June 1989

- GIC Mutual Fund in December 1990

By the end of 1993, the total assets under management of the mutual fund industry was Rs.47,007 crores.

During the second phase, the observers claim that the second stage was not only the foundation for industry expansion but also encouraged investors to invest more savings in mutual funds. As a result, the mutual fund industry in India was poised for higher growth.

3rd Phase (1993 – 2003)

The new era of the mutual fund industry began in 1993 with the introduction of private sector funds by private sector players, which gave investors a wide choice of funds.

With the establishment of SEBI in April 1992, the Indian Securities Market gained importance. Also, in 1993, the first set of SEBI Mutual Fund regulations existed for all mutual funds except UTI. All mutual funds were governed and regulated under SEBI to protect investors’ interests.

The former Kothari Pioneer (now merged with Franklin Templeton Mutual Fund) was the first private-sector mutual fund company registered in July 1993. This was the first private-sector mutual fund. Later, in 1996, the SEBI regulations were replaced and revised with more comprehensive rules. Therefore, the mutual fund industry currently functions under SEBI Regulations 1996.

Over the years, the number of mutual funds increased, with many foreign sponsors setting up a mutual fund in India. Also, the MF industry witnessed numerous mergers and acquisitions during this phase. By the end of January 2003, there were 33 mutual funds with total assets of Rs.1,21,805 crores, of which UTI alone had an AUM of Rs.44,541 crores.

4th Phase (February 2003 – April 2014)

In February 2003, UTI was divided into two distinct organizations following the abolishment of the Unit Trust of India Act 1963.

- The first is the Specified Undertaking of Unit Trust of India (SUUTI), which operates under an administrator and regulations set by the Indian government. It does not fall under the authority of Mutual Fund Regulations.

- The second is the UTI Mutual fund, which was carved out of the Unit Trust of India and functions under SEBI MF regulations from February 1, 2003.

After the global economic recession in 2009, the global financial markets were at an all-time low, and so was India. Most investors who put their money when markets were at their peak suffered huge losses. The faith of investors in MF was severely shaken. The Indian mutual fund industry struggled to recover from these hardships and remodel itself for over two years. Also, the situation worsened with SEBI abolishing the entry load and the repercussions of the global economic crisis. This scenario is evident from the sluggish growth in the overall AUM of the Indian mutual fund industry.

Existing Growth of Mutual Funds (Since May 2014)

Recognizing the lack of penetration of mutual funds in India, especially in Tier II and Tier III cities, SEBI introduced several progressive measures in September 2012. The purpose behind these measures was to bring more transparency and security to the interests of various stakeholders. SEBI’s idea was to ‘re-energize’ the Indian mutual fund industry and boost the overall penetration of mutual funds.

During the course, measures were taken to counter the negative trend because of the global financial crisis. However, the situation improved significantly after the new government was formed at the centre.

Key Milestones in the History of Mutual Funds

The history of mutual funds in India is a fascinating story that spans over six decades. Here are some key milestones that highlight the growth and evolution of the mutual fund industry in India:

- 1963: The Unit Trust of India (UTI) was established as the first mutual fund in India, marking the beginning of the mutual fund industry in the country. This initiative aimed to provide small investors with an opportunity to invest in a diversified portfolio of securities.

- 1964: UTI launched its first scheme, the Unit Scheme 1964 (US-64), which was a huge success and helped to establish mutual funds as a popular investment option in India. The scheme’s success demonstrated the potential of mutual funds to attract a broad base of investors.

- 1987: The government allowed public sector banks and financial institutions to establish mutual funds, marking the beginning of the second phase of the mutual fund industry in India. This move diversified the market and increased competition, benefiting investors with more choices.

- 1993: The Securities and Exchange Board of India (SEBI) was established, and the mutual fund industry was opened up to private sector players, marking the beginning of the third phase of the industry. SEBI’s regulatory framework aimed to protect investors’ interests and ensure the industry’s transparency and integrity.

- 2003: The Unit Trust of India Act was repealed, and UTI was split into two entities: the Specified Undertaking of the Unit Trust of India (SUUTI) and UTI Mutual Fund. This restructuring aimed to streamline operations and enhance regulatory oversight.

- 2014: The mutual fund industry witnessed a significant surge in growth, with the Assets Under Management (AUM) crossing the ₹10 trillion mark for the first time. This milestone reflected the increasing popularity and acceptance of mutual funds among Indian investors.

- 2020: The mutual fund industry continued to grow, with the AUM crossing the ₹30 trillion mark, and the number of folios exceeding 10 crore. This growth was driven by rising investor awareness, improved accessibility, and a broader range of investment options.

These milestones highlight the significant growth and evolution of the mutual fund industry in India over the years. Today, the industry is one of the largest and most popular investment options in the country, with a wide range of schemes and options available to investors.

Growth of the Mutual Fund Industry

Here are some key highlights showing the remarkable growth of the mutual funds industry in India:

- As of June 2024, the industry’s average Assets Under Management (AUM) reached an impressive ₹61.33 lakh crores.

- Over the last decade, from 2014 to 2024, the AUM has grown more than six times, showcasing rapid expansion and increased investor interest.

- In May 2021, the industry achieved a significant milestone by surpassing ten crore folios.

- By June 30, 2024, the total number of folios had grown to 19.10 crore, reflecting a steady rise in participation.

- Out of this, the folios for Equity, Hybrid, and Solution-Oriented Schemes stood at approximately 15.33 crore, highlighting the popularity of these categories among investors.

These numbers demonstrate the mutual fund industry’s strong growth trajectory, driven by greater awareness, accessibility, and investor trust.

Facts of Mutual Fund Industry Growth

- Since May 2014, the Indian MF industry has experienced a steady inflow and rise in AUM and the total number of investor accounts (folios).

- The MF industry’s AUM crossed a milestone of Rs.10 lakh crore for the first time on 31 May 2014. By August 2017, it had increased twice and crossed Rs.20 lakh crore for the first time. Finally, by November 2020, it had crossed Rs.30 lakh crore.

- The overall size of the MF industry grew from Rs.6.89 lakh crores to Rs.35.54 lakh crores from June 2012 to June 2022.

- The MF industry grew twice in five years, from June 2017 to June 2022.

- The number of investor folios increased from 5.82 crores to 13.47 crores from June 2017 to June 2022.

- Moreover, observers say that many Indians have shifted some of their savings from physical assets (gold, land) to financial instruments like equities, bonds, ETFs, etc.

- The MF distributors have also played a significant role in popularising SIP plans. In April 2016, the total number of SIP accounts crossed the one crore mark. As of June 2022, the total number of SIP accounts is 5.55 crore.

Future of Mutual Funds

The MF industry’s AUM has been increasing, and we still have a long way to go. It is estimated that Indians save Rs.20-30 lakh crore (approximately) annually. This industry can grow further if Indians save more for mutual funds. Moreover, observers say that many Indians have shifted some of their savings from physical assets (gold, land) to financial instruments like equities, bonds, ETFs, etc.

SEBI has devised various initiatives to raise investor awareness and expand its reach beyond the top cities. The mutual fund industry has a bright future with increasing incomes, population urbanization, digitalization, and better connectivity. Also, the MF industry can grow multi-fold with more encouragement from AMFI and the government.

Discover More

Show comments