What is Address Proof?

Address proof is a government-issued or legal document that helps verify where you live. Agencies, banks, and authorities require address proof and proof of identity for communication purposes and to find you when necessary.

Criteria for address proof:

- It should be in your name

- It should contain the current address

- It must be issued by a recognized agency and contain the name and logo

Individuals need to provide documentation such as Social Security numbers, state-issued IDs, and proof of address to comply with these requirements.

Definition and Importance

Address proof is a crucial document that verifies an individual’s residence and is required by various institutions, including banks, government agencies, and financial organizations. It serves as a security measure to ensure the accuracy of the address information provided and to prevent fraud. Address proof is essential for Know Your Customer (KYC) processes, loan applications, and other official interactions. By confirming where someone lives, these institutions can communicate effectively, collect payments, and assess the financial stability of the individual. This verification process helps in maintaining the integrity of financial transactions and safeguarding against fraudulent activities.

What is the List of Accepted Address Proof including Aadhaar Card?

Here is the list of KYC documents based on resident status. When sharing the clear color scanned documents, please ensure they have your e-sign.

Providing proof of identity and address is crucial for various processes, such as obtaining a library card or opening a bank account. Certain documents, like an Aadhaar card or passport, can serve as both proof of identity and proof of address, simplifying verification during applications.

What are the Accepted List of Address Proof?

Here is the list of KYC documents based on the resident status. While sharing the clear colour scanned documents, please make sure that the documents have your e-sign on them.

For Resident Indian, NRI Mariner & PIO Residents –

This list applies to customers whose KYC has not been processed, is on hold, rejected, or is incomplete or old. It is necessary to provide proof of identity along with address proof to complete the KYC process.

- Aadhaar Card

- Voter ID

- Passport

- Driving License

For NRI & PIO non-residents –

This list applies to customers whose KYC has not been processed, is on hold, rejected, or is incomplete or old.

- Local Government ID

- Letter Issued by Indian Embassy/Notary Public

- Passport

- Driving License

- Electricity Bill

- Landline Bill

- Gas Bill

- Bank Statement

If we modify or modify the existing KYC, the proof of address below will be accepted. (Resident Indian, NRI Mariner & PIO Resident)

- Aadhar Card

- Driving license

- Passport

- Voter ID

- Landline bill

- Electricity bill

- Bank statement

- Gas bill

Note:

- Your phone number and email ID will be verified via OTP.

- As per the latest regulatory requirement, you can register for KYC only when you are physically present in India.

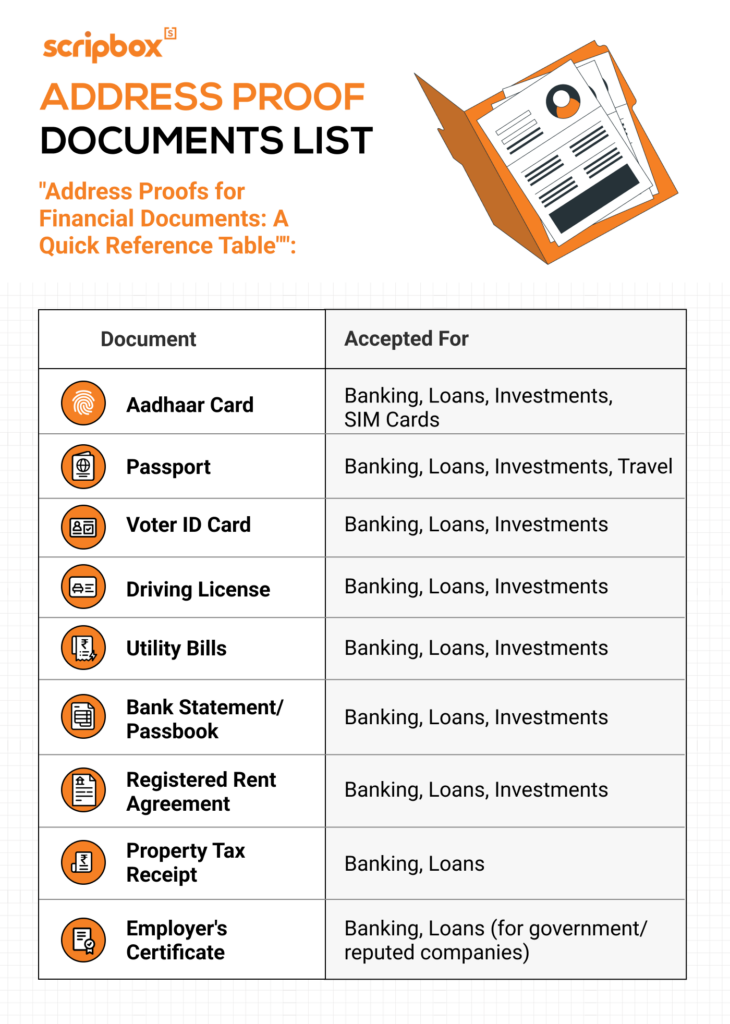

What are the Valid Address Proof Documents?

Valid address proof documents include a variety of government-issued and utility documents. These include:

- Government-issued ID cards, such as Aadhaar card, passport, and driving license

- Utility bills, such as electricity, gas, water, and landline phone bills

- Bank statements and credit card statements

- Rent agreements and property tax receipts

- Lease agreements and mortgage contracts

- Social insurance statements and pensioner cards

- Photo ID cards issued by government ministries and departments

These documents must be in the individual’s name, match their ID, have their current address, be issued by a recognized authority, and be dated within the last 3 to 12 months, depending on the type of document. Ensuring these criteria are met is essential for the document to be accepted as valid proof of address.

Problems with Proof of Address Documents

Common challenges associated with proof of address documents include incomplete or inaccurate information, expired or invalid documents, and difficulty in obtaining or verifying documents. Discrepancies in the documents provided can also pose significant issues. In case of a proof of address mismatch, the loan application may be rejected or negatively impact the credit score. It is crucial to ensure that all information is accurate and up-to-date to avoid these potential problems.

Using Aadhaar Card as Proof of Address

An Aadhaar card can be used as proof of address, as it contains the individual’s name, address, and other demographic information. However, it is essential to ensure that the Aadhaar card is updated with the current address, as an outdated address may not be accepted as valid proof. Using an Aadhaar card as proof of address is convenient and widely accepted, but keeping the information current is crucial for its validity.

Importance of Proof of Address and Proof of Identity

Proof of address is essential for businesses to confirm where someone lives. You need to gather specific identification documents and address proof to secure these documents. This is especially true for lenders. Knowing a customer’s address helps them communicate better and collect payments if needed. It also gives clues about a person’s money situation because people with similar incomes often live in the same areas. Asking for proof of address also makes things safer by stopping fraud. Bad actors can’t just use someone else’s ID to get a loan, they also need actual address proof, which makes it harder to trick the system.

Frequently Asked Questions

Yes, you can use a single document for proof of identity and proof of address. Officially valid documents (OVDs) for KYC purpose include: Aadhaar Card, Passport, NEGRA card driving licence, and voters’ ID card serves as both proof of identity and proof of address. However, PAN card will serve as only proof of identity. Furthermore, to make the process easy, information such as personal details like name, address, age, gender, etc., and photographs made available from UIDAI as a result of e-KYC process can also be considered as an ‘Officially Valid Document’.

There are a wide range of documents that are considered address proof – Aadhaar card, driver’s licence, passport, voter’s ID, etc. You can apply for any. The majority of applications and processes require an Aadhaar card. Thus, getting an Aadhaar card will work as both identity proof and address proof. You can apply for Aadhaar by visiting the nearest UIDAI centre or online.

Furthermore, individuals who are changing locations, they can get update their Aadhaar card by providing rental agreements, utility bills, etc.

You can change the address in aadhar card without address proof by validation letter. Address validation letter is for individuals who do not have address proof to provide for a change of current address in Aadhaar.

For this, you need to log in to the UIDAI portal. Under the Update section, select Update demographics. Choose the option update via secret code. Enter the secret code and proceed. Next, you need to upload the ‘Address Pin Issued by UIDAI’ document and submit it. Save the URN number for future reference.

IDFC mutual Fund with 1,18,816 Cr AUM size and 49 funds scheme is now rebranded as Bandhan Mutual Fund effective from 13th March 2023, BFHL will be the new sponsor of all mutual fund schemes.

- What is Address Proof?

- What is the List of Accepted Address Proof including Aadhaar Card?

- What are the Accepted List of Address Proof?

- What are the Valid Address Proof Documents?

- Problems with Proof of Address Documents

- Using Aadhaar Card as Proof of Address

- Importance of Proof of Address and Proof of Identity

- Frequently Asked Questions

Show comments