Larger companies continue to grow at rates higher than GDP, stay invested despite the news

Our analysis suggests that many of the larger companies, leading the Nifty, continue to grow at rates higher than nominal GDP growth and are trading at valuations that are reasonable. Moreover, as and when the economy recovers, growth rates will be stronger than long term expected growth rates as companies start re-stocking their inventories.

Markets likely discounting economic weakness, maintain positive note

Despite the weak economy, the stock markets have been holding up well on the back of the reduced corporate income tax rates leading to higher earnings growth. Moreover, this step is expected to trigger an investment cycle.

Markets rebound on FM announcement, economy yet to follow

Stock markets in India rebounded strong, post the announcement of reduced tax rates for Indian companies. The Nifty was up sharply, making up for the losses over the past few months.

How does the corporate tax rate change benefit equity investors?

In one stroke, the FM reduced the corporate rates from 34.9% to 25.2%. Let’s find out how it benefits shareholders and thus you, as an investor.

2019 Report Card: Performance of Scripbox Recommended Short Term Money (Debt Mutual Funds) Portfolio

Scripbox debt index has returned 8.43% in the past year (Aug 18 – Jul 19) while the Fixed deposit rate for the said period has been around 6.25%. There was an outperformance of the Scripbox funds to the tune of...

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

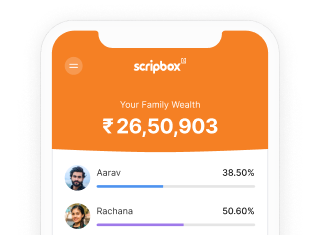

Upwardly merges with Scripbox

Coming together will strengthen both platforms resulting in a superior experience for customers. Bengaluru, 9 August 2019: Bengaluru-based financial advisory startup, Upwardly is merging with leading online investment service, Scripbox. Similar brand philosophies, and a customer-centric approach for creating long...

Post-election reality and NBFC concerns dominate June

NBFC Credit flow impacting GDP growth. Scripbox Market Commentary June 2019.

Scripbox Market Commentary – April 2019

Here’s our assessment of equity and debt markets in April 2019. Equity markets were muted after a strong March. Election outcome and the resulting clarity in terms of policy is expected to guide market direction post April.