Are you covered?

Do you need life insurance cover? Well, the answer depends on you. The benefits of insuring your life will be availed by your loved ones who depend on you when you are not there.

6 Questions To Ask Yourself Before You Invest

Recently, a friend of mine said, “I should probably go beyond merely saving”. Now he is a person who hasn’t really invested anywhere except for keeping money in the bank.

If you have been saying this a lot to yourself thanks to peers or family or changing circumstances in your life, you might be ready for, and need, investing. You should, however, know certain basic facts about yourself and your conditions before you take the leap. Start by asking yourself these questions.

5 Steps To Ensure You Are Never Out Of A Job

Investing is not just about investing to grow your money, it’s also to grow your ability to make money.

5 Questions First Time Investors Ask Us

We have covered many of these questions in our articles over time and decided to put them together at one place for you.

3 Ways You Can Save Tax Beyond 80C

Here are three ways you can save a bit more in addition to the deductions allowed under Sec. 80C. Note that not all might apply to you but if they do, you can unlock more tax savings this year.

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

Is that shiny new gadget worth 50 days of your life?

What if you had to pay for something with your time rather than money? Curious? We can use this to decide the worth of different things which compete for our money.

Love To Spend On Things That Make You Happy? Here’s Why You Probably Should

We write a lot of articles about how to plan your spending – but most of these are about necessary spending. By ignoring what gives us pleasure and forcing ourselves to ‘sacrifice’ we may not be helping our long term plan.

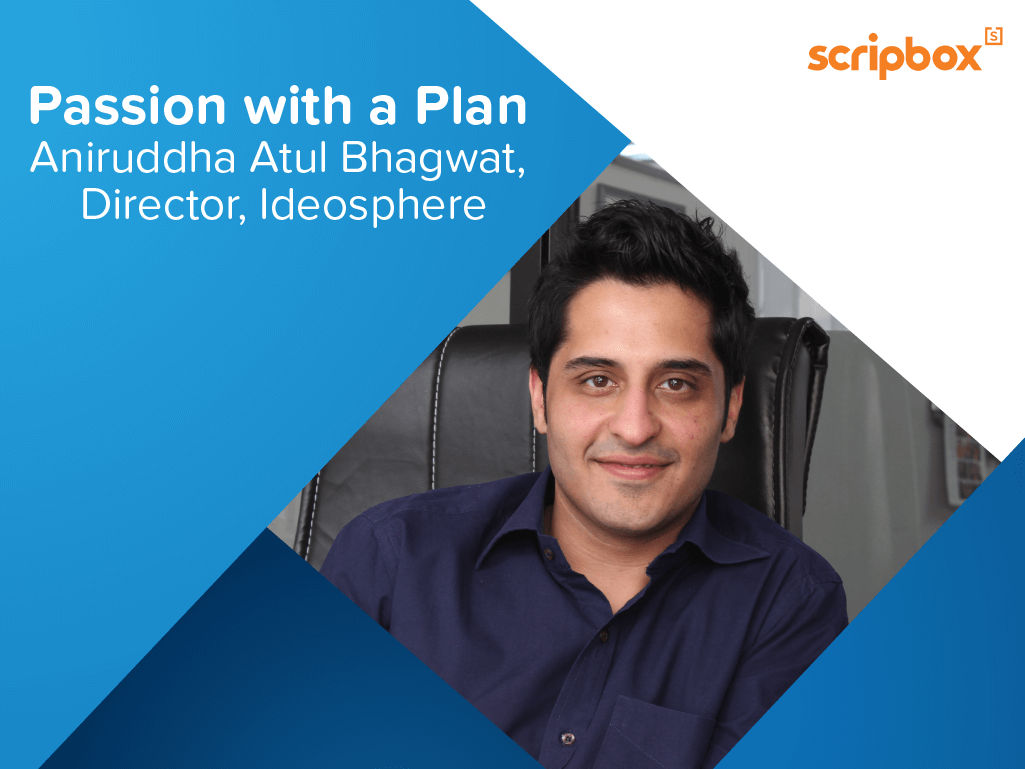

Passion with a plan – Aniruddha Bhagwat, Director, Ideosphere – I had a financial plan for myself ready by the time I was 23.

Aniruddha Atul Bhagwat is a young entrepreneur who, along with his co-founder and leadership team, aspires to redefine communications in India. With a focus on emerging brands and start-ups, Ideosphere, intends to bring stakeholder insights and consumer focus to communications to the forefront. Aniruddha has been one of the few entrepreneurs who has been focused on a solid financial education to help him achieve his goals.