incometax.gov.in portal helps the taxpayers to file their returns along with the facility to view the taxpayer’s information relating to pending notices, previous year returns, etc.

How to File Income Tax Return Online?

Time needed: 10 minutes

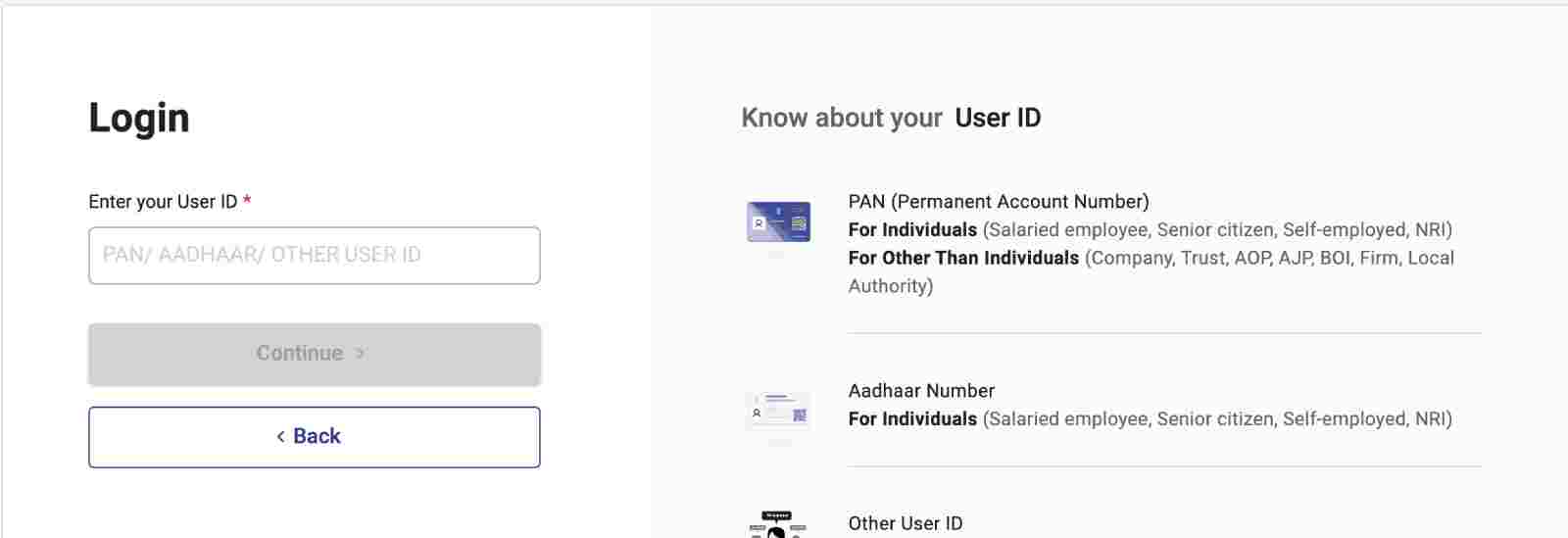

- Login or Register to incometax.gov.in

Login to the income tax website. If you are a new user then you will have to create an account. If you are an existing user then you must use your credentials to login.

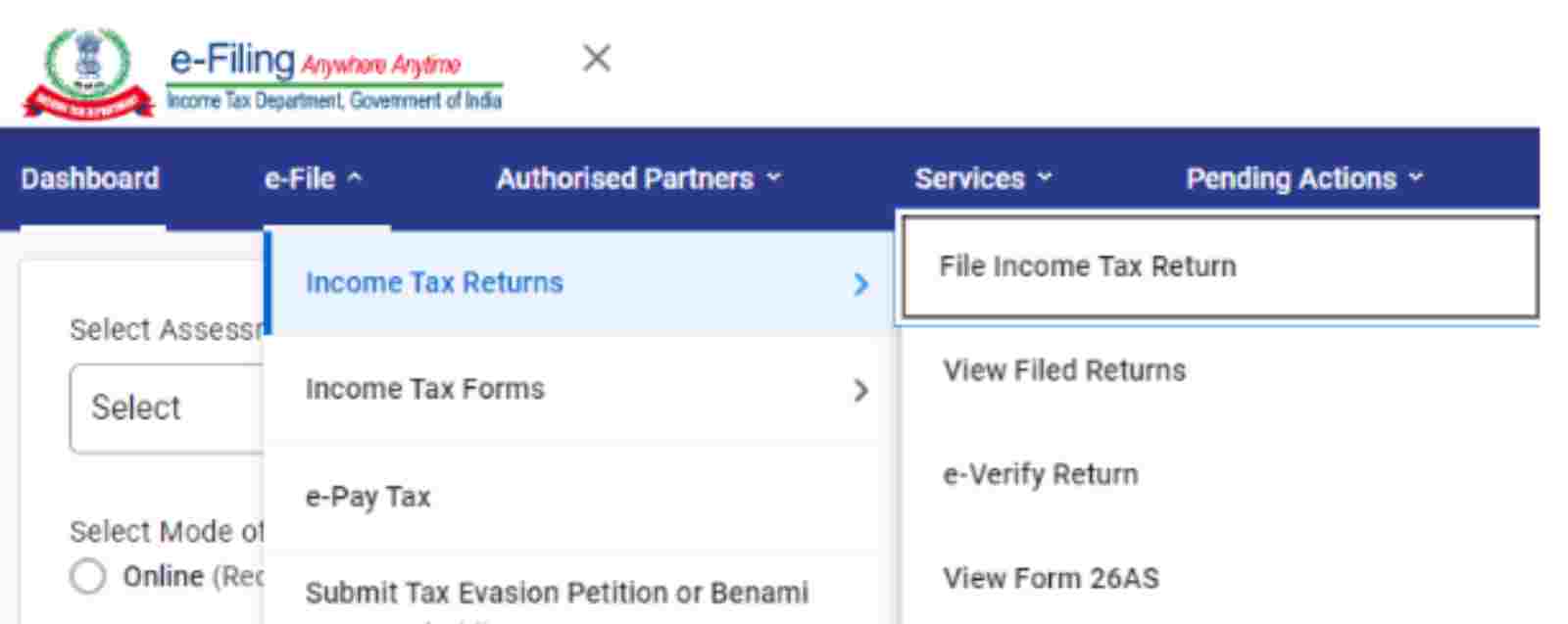

- File Income Tax Returns

Go To the E-File menu and click on ‘Income Tax Returns’, now select ‘File Income Tax Returns’

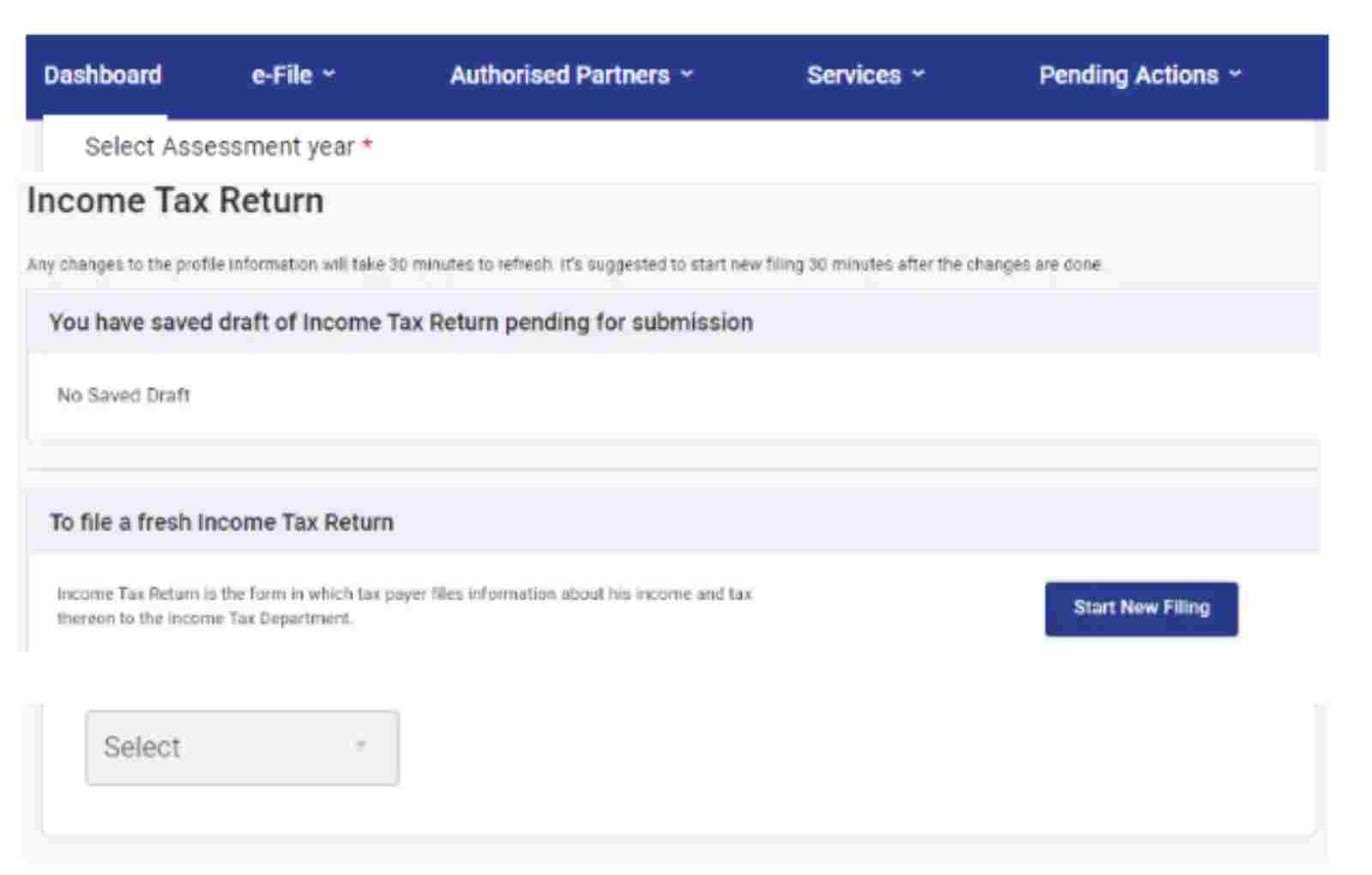

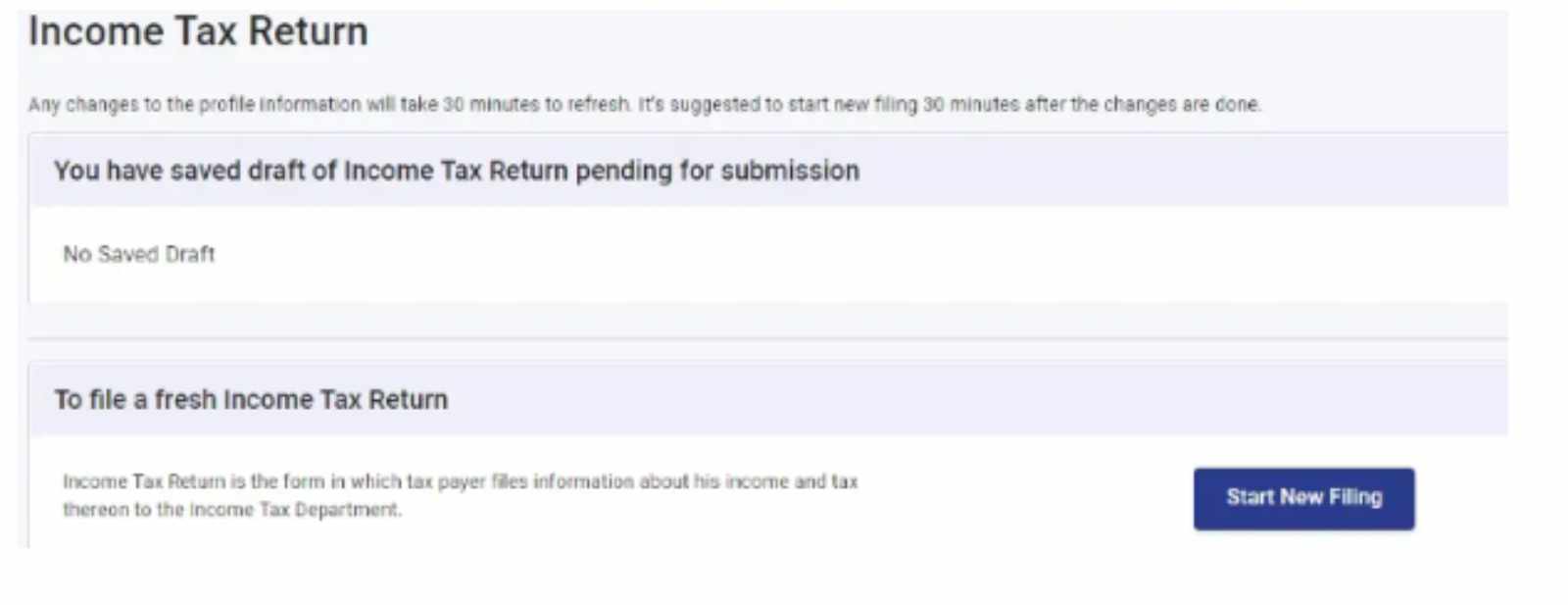

- Provide Assessment Year

Select the Assessment Year, Filing Type, and ITR Type

- Create Income tax Return

To Create Your Income Tax Returns Click on ‘Start New Filing’, Select the type of Taxpayer you are.

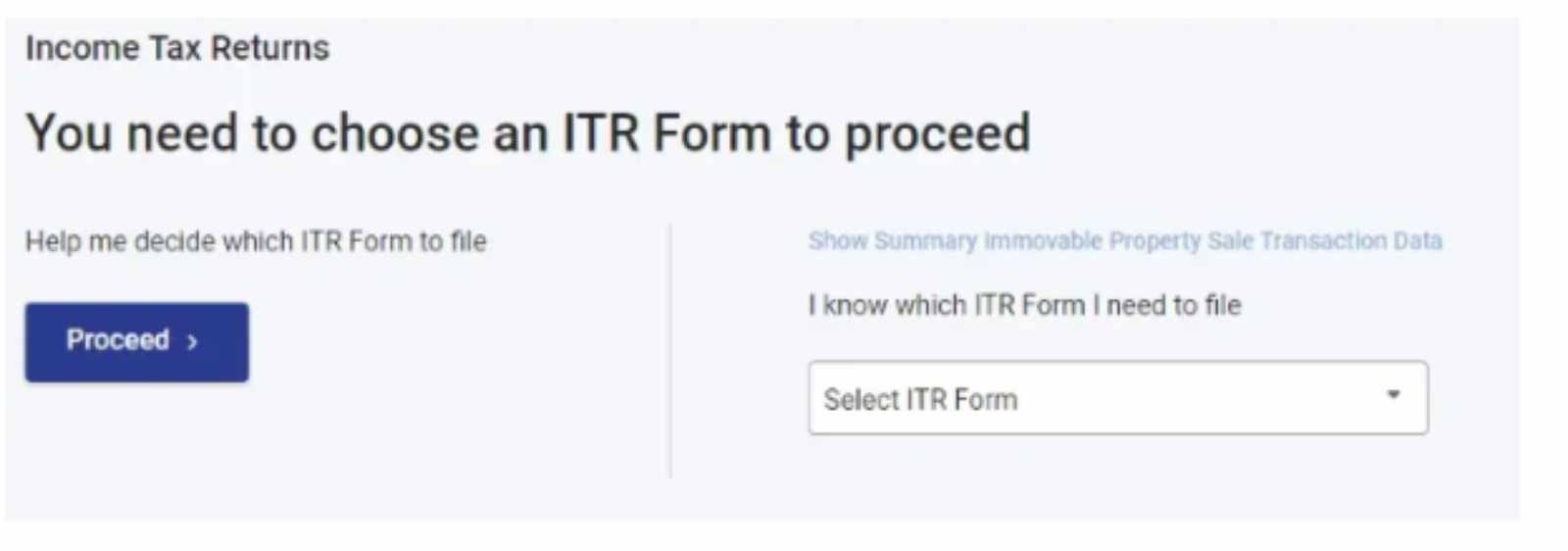

- ITR Form

Select the ITR Form you wish to file

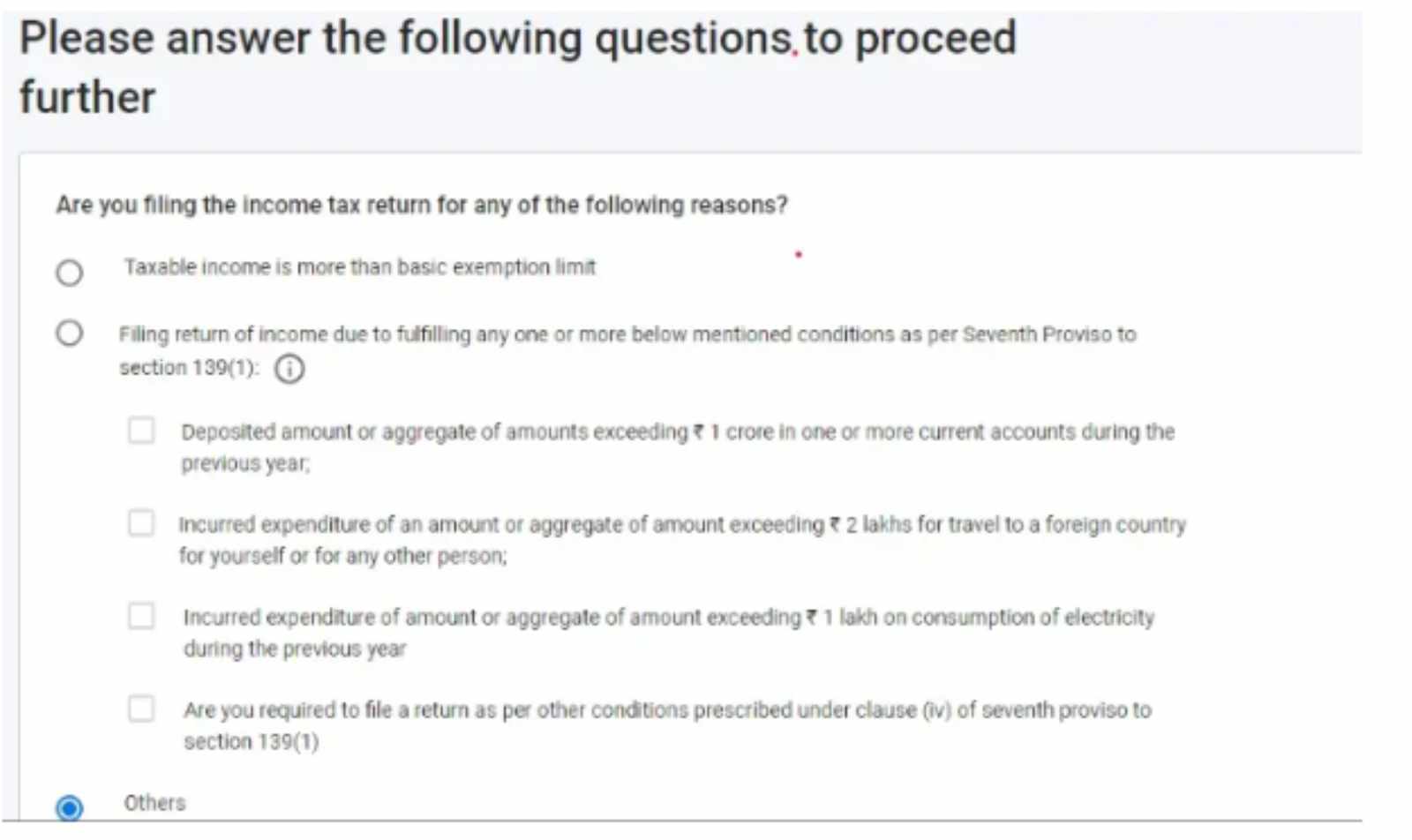

- Reason To File

State your reason for filing the income tax return

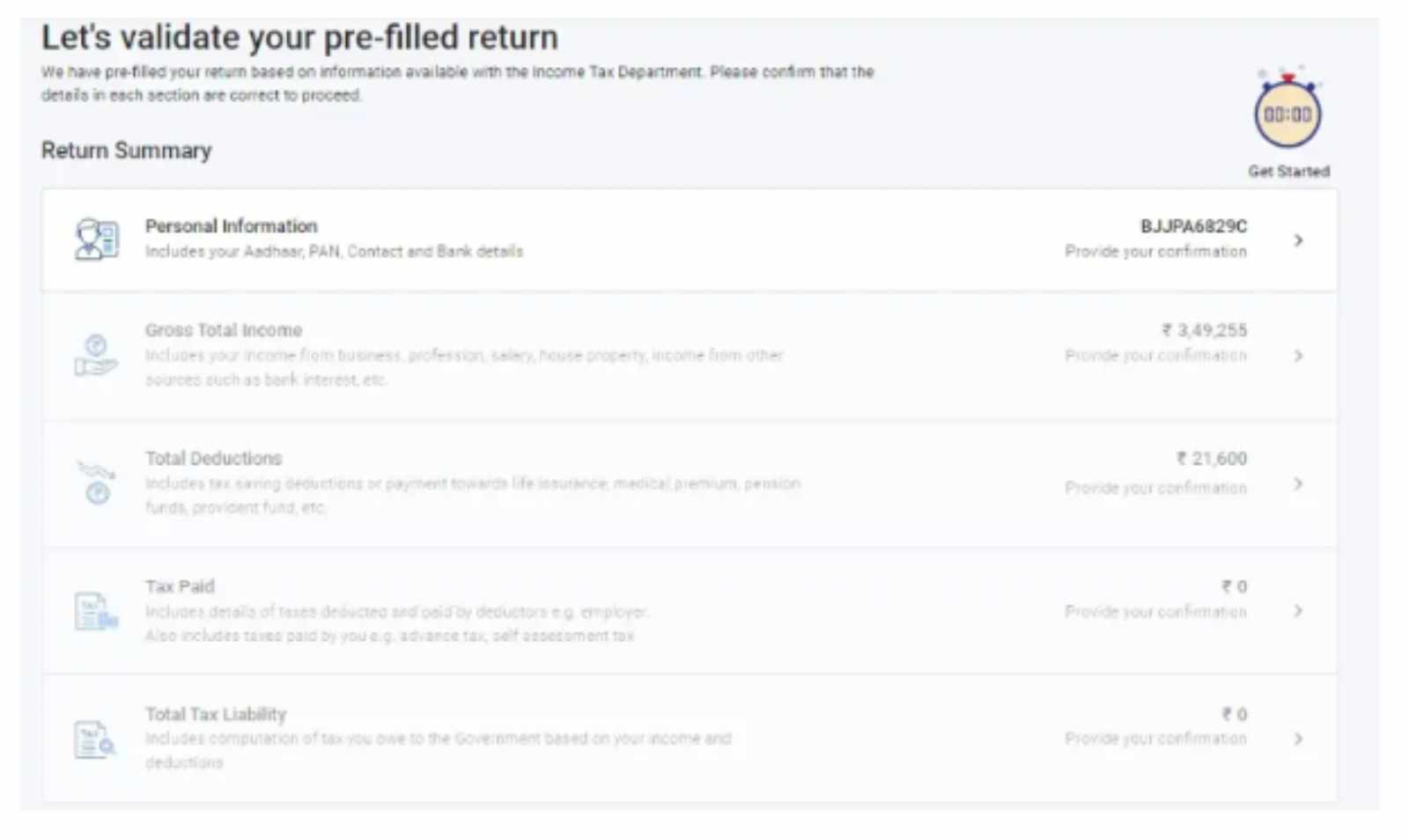

- Validate Your Details

You can pre-fill your tax return details and validate these details. This will save you time and effort. You will avoid making errors as well. Add any missing information.

Verify all details, click on submit and file your ITR. You will receive a confirmation over your registered email address.

How to Activate your Income Tax Account ?

- Step 1: Login to the income tax website. If you are a new user, click on the ‘register yourself’ section.

- Step 2: As a next step, select the user type from the drop-down depending on which category you fall under. Make sure that you select the correct category as the next steps would be impacted by the same.

- Step 3: Enter the basic details such as Surname, PAN, date of birth, etc. The PAN will be the user id which will be used post successful registration to login to the income tax website.

- Step 4: Once the taxpayer has entered the basic details, they need to set up the password on the ‘registration form’ screen along with the security questions. Most of the time taxpayers will forget their password and they can recover the same through the security questions.

- Step 5: Enter your mobile number and email ID. Put in your personal email ID and phone number. Make sure that you do not provide the company email ID because these contact details will be used by the IT department for all further communications.

- Step 6: Enter your present and permanent address details:

- Step 7: Once the above information is entered correctly, the website will then verify the taxpayer’s PAN from their database and display the transaction ID and the contact details.

- Step 8: If a correct email address is mentioned while filing the form, an activation link will be shared on the same email address. The link needs to be activated by clicking on the same.

How to Retrieve your Income Tax Login Credentials?

Income tax filing is a one-time task that is to be done once for the previous financial year. Despite the advancement in technology, it is still very natural for taxpayers to forget their income tax password. Taxpayers find it difficult to find any detailed information w.r.t reset their income tax login credentials. The taxpayer can follow the below steps in order to retrieve their login credentials:

- Log in to incometaxefiling website

- Post step 1, click on the ‘login now’ button.

- Once the taxpayer clicks on ‘login here’, they can find the forgot password option at the bottom of the screen.

- Next, provide your User ID and captcha code. Now you will be directed to the ‘Reset Password’ dialog box. Now, select any one option from the drop-down list and provide mandatory details.

- You can use the option of Answer Secret Question, Upload DSC, Using OTP, or Using Aadhaar OTP

- After using any of the above options, the taxpayer will be able login to the income tax portal.

Frequently Asked Questions

Every taxpayer must file an income tax return after the end of the financial year to declare their income, expenses, deductions, and exemptions for the year. ITR filing is optional for taxpayers with no income tax payable and income below the exemption limit. The Income Tax Department has laid down penalty and interest charges for default in filing the income tax return. Hence, it is important for taxpayers to remember the due date of filing their ITR and file correctly to avoid interest.

It is not mandatory for a taxpayer to file income tax returns if the taxable income is below the basic exemption limit. However, if the taxpayer has a TDS deduction for the year then it is important to file ITR and claim a refund of the TDS. Moreover, filing ITR has other benefits like getting a loan, VISA applications, and others. Furthermore, you can carry forward your losses only if you file an ITR.

If you have only FD interest income and no other income then you are not liable to file an income tax return. However, if there are any TDS deducted on such FD interest then you must file an income tax return. This is because if you do not file ITR you will not be able to claim the tax refund of the TDS. You can submit Form 15G or Form 15H with the payer of FD interest and avoid TDS deduction. This way you will not have to file ITR as well.

For income tax e-filing the selection of ITR depends on the type of taxpayer and the type of income. The most common ITR for a salaried person is ITR-1. ITR-6 is applicable to only companies in India. While ITR-5 is applicable to any taxpayer other than an individual, HUF or a company. To know more about which ITR to file click here.

To file an income tax return you need a few documents that depend on the type of income you have. A salaried person ideally needs Form 16 and Form 26AS. If you have capital gains then you need a capital gain statement that provides details of the cost of acquisition and sale amount. Usually, a taxpayer needs Form 16, Form 26AS, a bank statement, a capital gain statement, an investment statement, a house property loan interest paid statement, an education loan paid statement, and interest income statements.

Yes, you can correct an ITR after filing. If you have filed the ITR on or before the due date then you can file a revised return and the revised return will be treated as the original return.

The penalty for not filing an income tax return is Rs 5,000 under section 234F. However, if the total taxable income does not exceed Rs 5 lakh then the penalty for default in filing ITR is Rs 1,000. Usually, there is a delay in paying the income tax due to a delay in filing the ITR. A taxpayer must pay interest for delay in paying the total income tax. Hence, if there is a delay in paying taxes then interest is applicable at a rate of 1% per month or part of the month.

The due date for filing income tax returns is 31st July for individual taxpayers and taxpayers on whom tax audit is not applicable. For instance, the due date for filing ITR for a salaried individual for the financial year 2022-23 will be 31st July 2023. For other taxpayers, the due date is 31st October. However, the income tax department may change this due date from time to time.

No, you cannot file your income tax return manually. However, only a super senior citizen who is above the age of 80 years can file ITR manually.

Yes, verification is mandatory after Income Tax E-filing. Every taxpayer must verify within 120 days of filing the income tax return. If the taxpayer fails to verify the ITR then it will be considered as if ITR is not filed at all. You can verify your ITR by sending a print of the signed acknowledgement letter. You can verify online by generating EVC through bank ATM, Aadhaar OTP, or prevalidated bank account/ Demat account.

If you don’t file your income tax return then you will have to pay a penalty of Rs 5,000. This penalty is Rs 1,000 if the total taxable income is less than Rs 5 lakh. Moreover, you will not be able to receive your tax refund, if any. You will not be able to carry forward a loss over the next financial year. Lastly, you will have to pay interest on late payments of taxes, if any. There are other benefits of filing a tax return such as assistance in maintaining financial records, visa applications, and loan applications.

Yes, you can check your income tax return status by logging into your income tax account.

No, income tax returns and income tax refund statuses are not the same. The income tax return status is a status update on the ITR you would have filed for a financial year. The income tax refund status is the status of the refund that the income tax department owes to its taxpayers. You will receive a tax refund if the tax payable is less than the tax already paid.

In order to view and download Form 26AS, the user can log in to their income tax portal and follow the necessary steps to view and download the same. Form 26AS is a tax statement that allows the taxpayer to view the tax deduction on their PAN. The statement also shows the tax refund is given to the taxpayer for a financial year along with the details of the tax collected at the source.

Show comments