What is an Income Tax Refund?

An income tax refund arises when the tax paid by the taxpayer is higher than the tax liability at the time of filing the income tax return. The tax paid by the taxpayer can be an advance tax, self assessment tax, foreign tax credit, or tax deducted at source.

How is Income Tax Refund Processed?

The taxpayers file and verify the ITR income tax return providing the details of total taxable income and taxes paid. The ITR must be electronically verified through aadhar number OTP, EVC generated through a bank account, or physically verified. For physical verification, taxpayers must post the signed ITR-V (acknowledgment) to the Centralised Processing Centre (CPC) within 120 days of filing the return.

The Centralized Processing Center, Bengaluru processes the ITR filed. Upon processing, if the tax payment is higher than the tax liability, it generates an income tax refund. The Income-tax refund banker will process the income-tax refund. The refund banker then credits the amount to the bank account of the taxpayer.

Steps to Check ITR Refund Status from Income Tax E-filing Portal

Time needed: 5 minutes

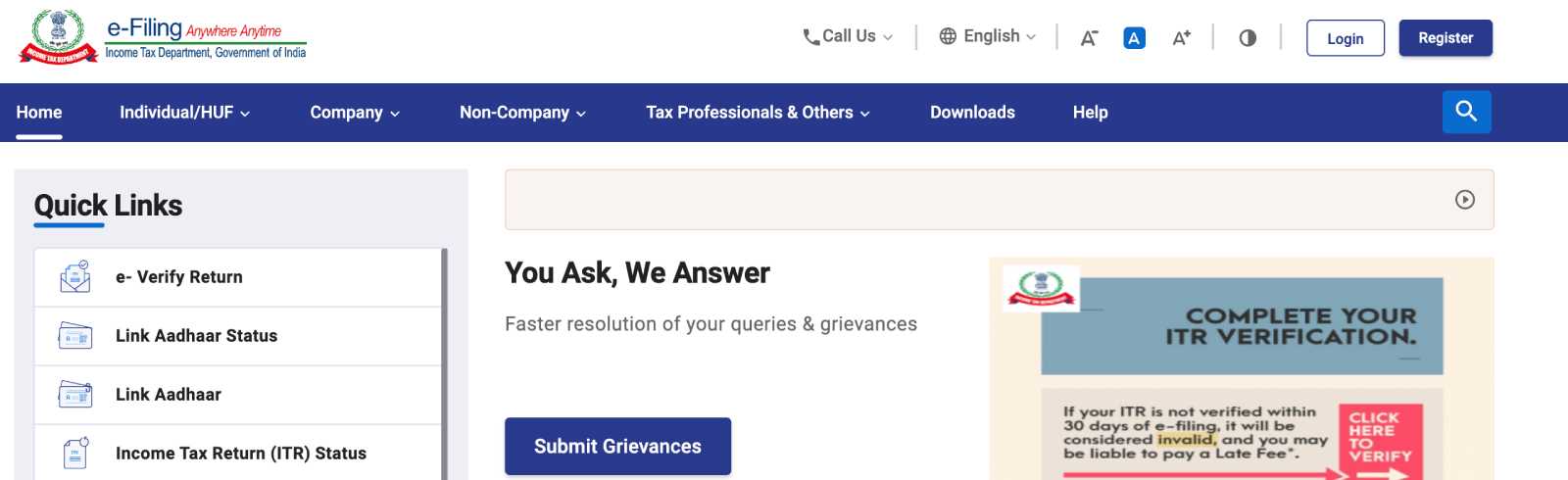

- Visit Income Tax efilling portal

Visit the e-filling website incometax.gov.in

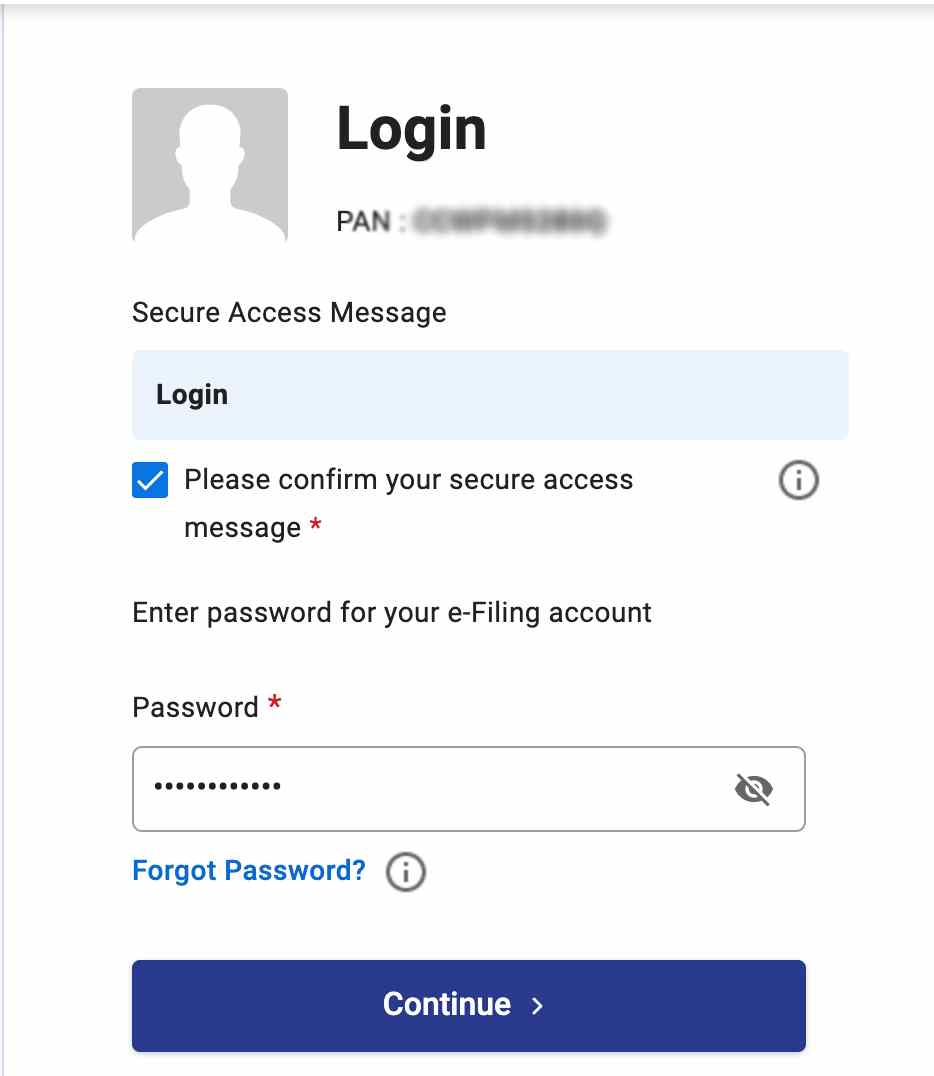

- Login to your account

Enter your User ID, Password, and Captcha Code. Your User ID here is your PAN number

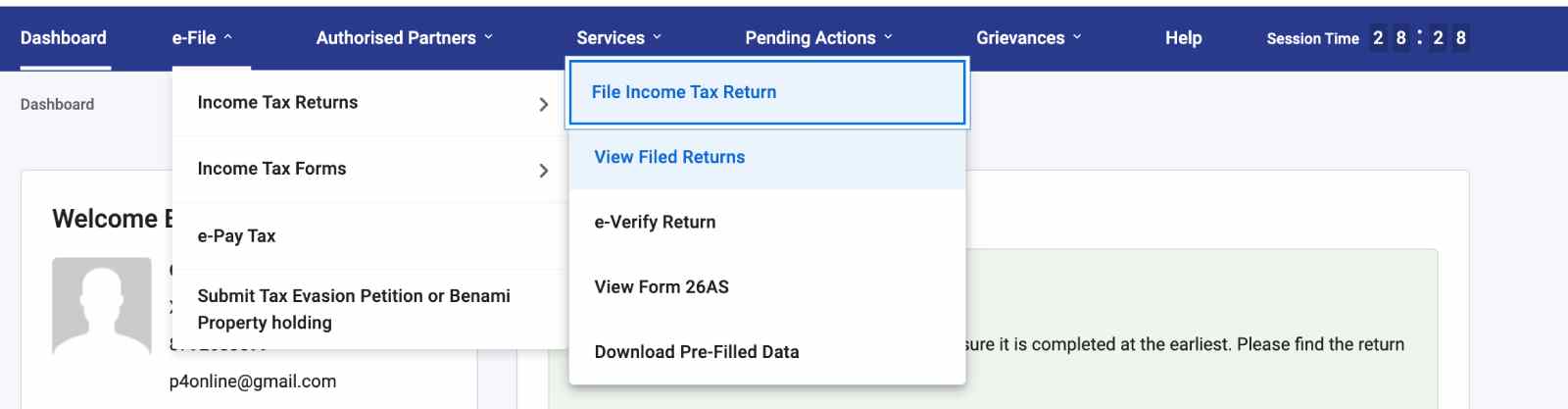

- Select e-fille from the menu

Select e-file from the menu and from the drop down navigate towards view filled returns through income tax returns.

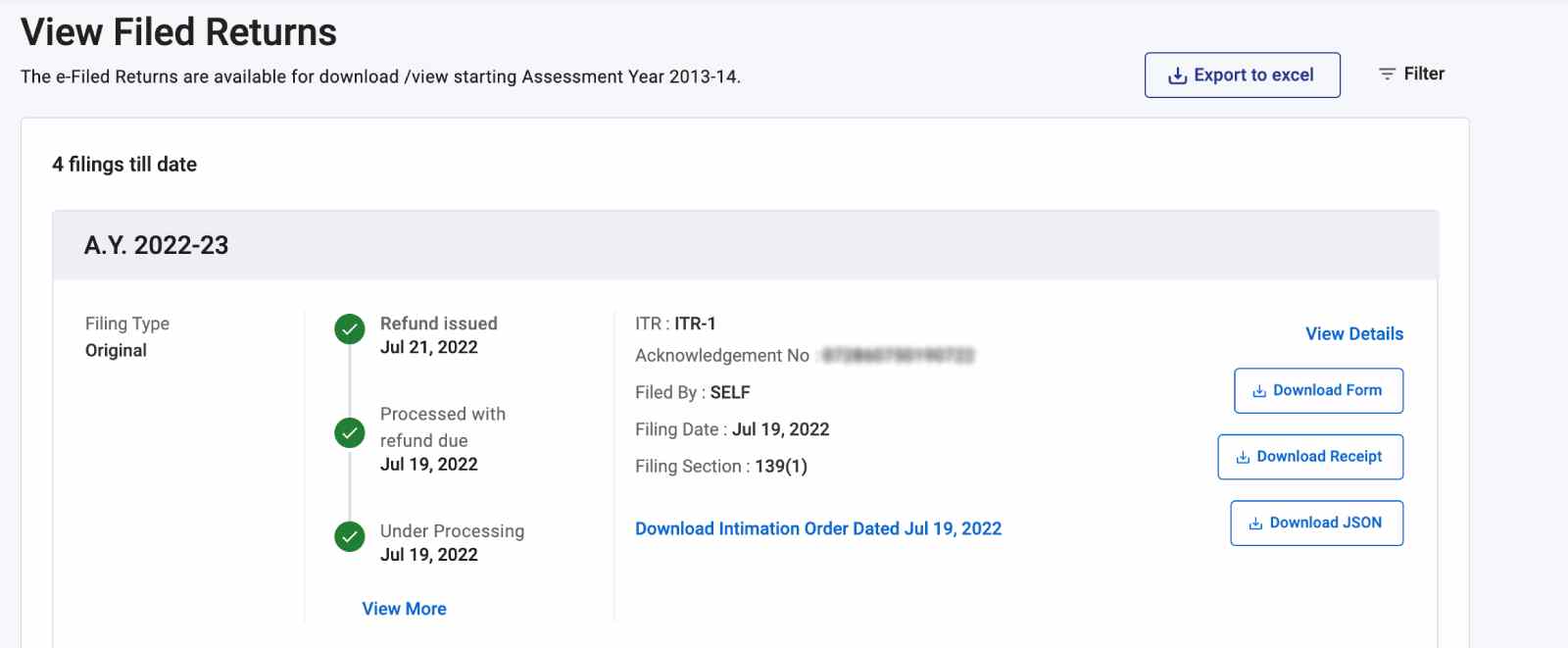

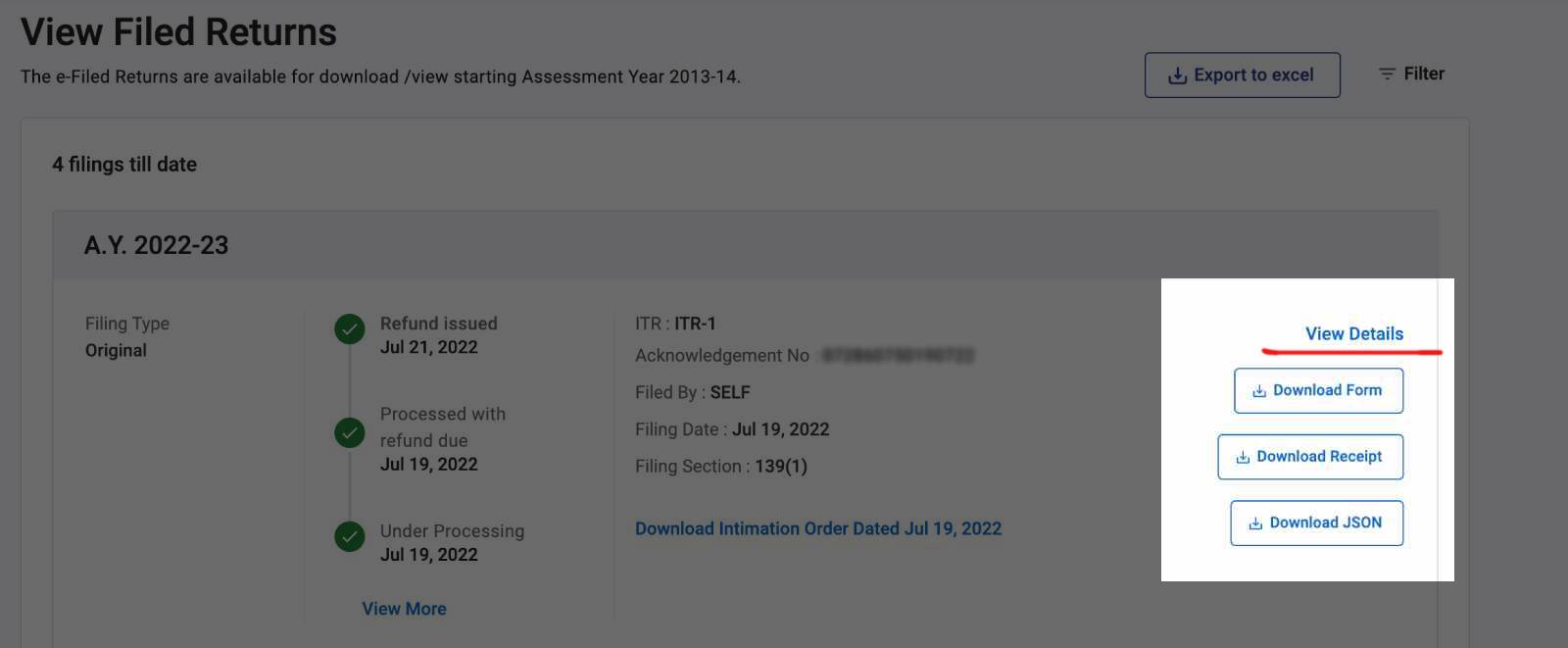

- Check Assessment Year

Find the ‘Assessment Year’ by scrolling in the page

- Download or view details

You will be able to view your ITR filed and income tax refund status for the assessment year.

Steps to Check Tax Refund Status from TIN NSDL Portal

-

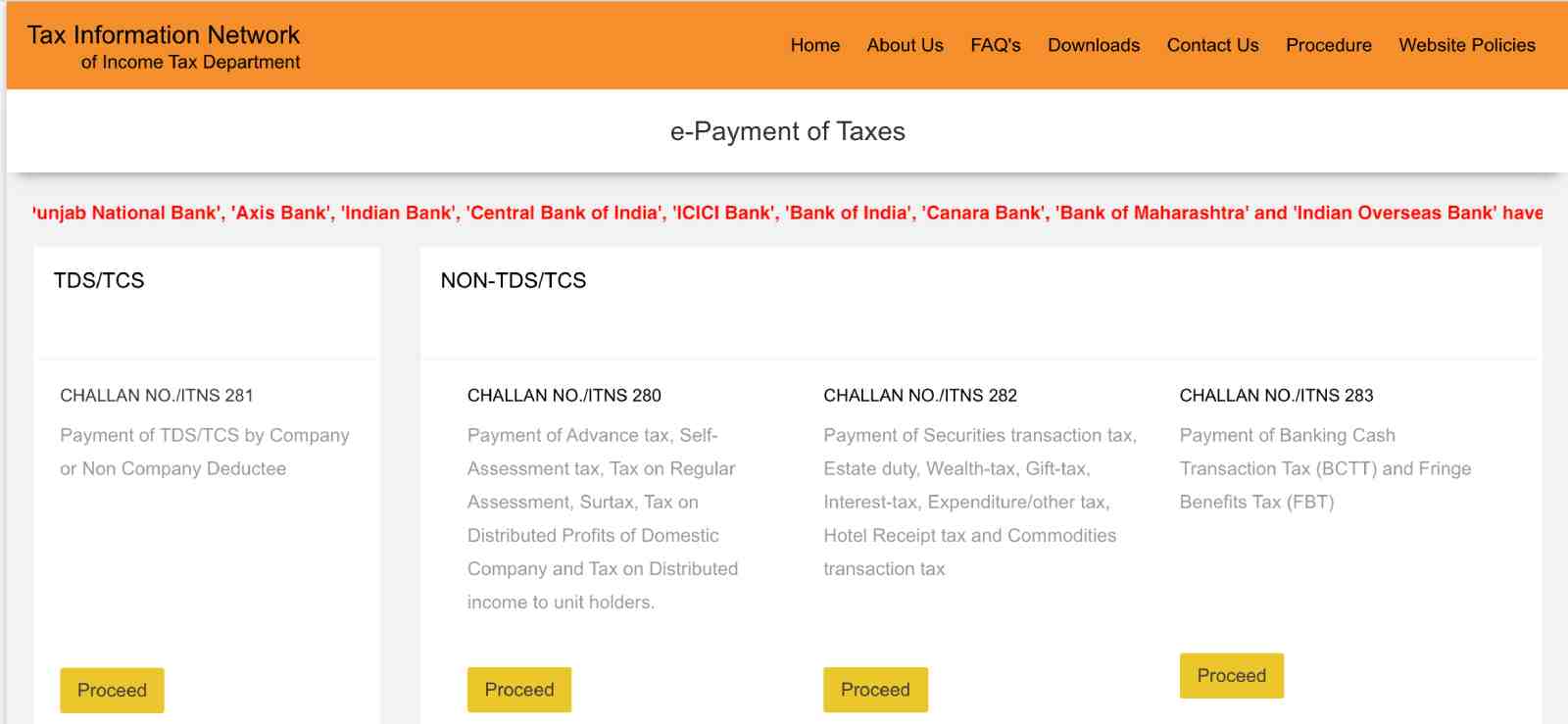

Visit NSDL Website

rnrnVisit the TIN NSDL website here for ‘Check Refund Status’

rnrnVisit the TIN NSDL website here for ‘Check Refund Status’ -

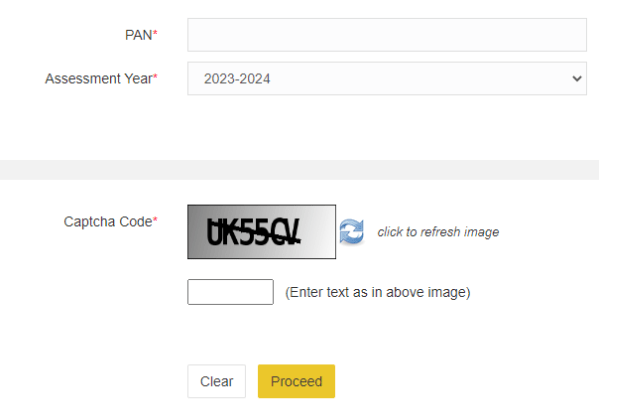

Enter Details

rnrnEnter the assessment year, PAN number, and captcha code

rnrnEnter the assessment year, PAN number, and captcha code -

Proceed to Check Status

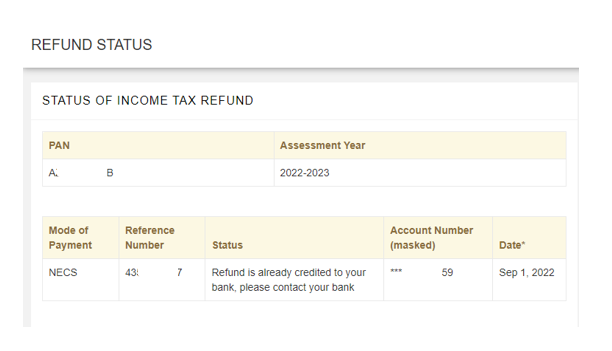

rnrnClick on Proceed. The refund status will be displayed as shown below in the image.

rnrnClick on Proceed. The refund status will be displayed as shown below in the image.

What are the Types of Income Tax Refund Status?

- Not Determined– Your ITR has not yet been processed and you can check the ITR processing status after a few days.

- Refund Paid– Your income tax refund has been credited directly to your bank account or an account payee cheque has been sent

- Refund Failed– Your refund could not be credited due to incorrect or incomplete bank account details

- Refund Expired– The refund cheque is valid for a period of 90 days. In case you have not encashed your cheque before the expiry of 90 days, the cheque will expire. You will have to request for issuance of another cheque to the IT department through your account.

- The cheque has been encashed– The cheque has been cashed by you and the amount is credited to your bank account.

- Refund Returned– The cheque was sent to you but it was not received by you. Here the IT department receives the cheque back. In this case, you will have a request for a re-issue of your refund.

- Refund adjusted against last Year’s outstanding demand. You will view this status only during refund adjustment. In case you have an outstanding tax demand for any previous years, there will be an adjustment to the demand. You will receive the net amount if any, post-adjustment. The IT department will always send you an intimation of such an adjustment. A taxpayer must respond within 30 days of receiving such an intimation. In case no response, the department will go ahead with the refund adjustment.

Interest on Income Tax Refunds

Many times, you might have noticed that your refund is higher than the expected amount. This is because of the interest you received on the refund amount.

Under section 244A, a taxpayer is eligible for an interest on income tax refund on the basis of below conditions:

- Interest payment is mandatory if the refund is 10% or more for tax paid.

- An interest rate of 0.5% per month or part of the month on the refund amount

- The Interest calculation will be from April 1st of the assessment year till the date of grant of refund. It is applicable only if a refund is due to excess advance tax paid or TDS deducted / TCS collected.

In the event of any discrepancy in the calculation of the interest amount, a taxpayer can raise a request for rectification through his/ her account.

Things to Consider Before Claiming an Income Tax Refund

ITR Filing Due Date

Any taxpayer can claim an income tax refund only after filing the ITR within the due date. Hence, it is crucial for any taxpayer to remember the due date and never miss the deadline.

The due date to file ITR is usually 31st July of every financial year. This due date may change by the IT department from time to time due to uncertain or unseen circumstances.

Know tax-related information

A taxpayer must be aware of all the required information for any financial year. These details could be your Form 16, Form 26AS, other income statements, self assessment tax payments, advance tax payments, and tax-saving investments.

You need to fill in all these details in your ITR accurately to avoid missing your refund without any hassle.

File your ITR correctly and timely

You must file your tax return correctly by mentioning the income earned during the financial year, the investments made, claim the deductions and finally, the taxes paid.

The taxes paid could be in the form of TDS, TCS, advance tax, and self assessment tax.

The tax refund is nothing but the tax paid in excess of the tax payable. Hence it is important to mention this information correctly.

Know Your Refund Amount

It is always better to know whether you have a refund amount to receive or not. If yes then what is the amount. Sometimes we tend to forget this information and don’t track our refund status.

If the refund is still with the assessing authority, it becomes very important to know the issue with refund process.

Verify Your ITR

Just like it is crucial to file ITR to claim a refund, it is important to verify your return. Without verification, ITR filing is not complete. The CPC will process your ITR only upon verification. And you will receive your refund only after its processing.

Hence verify your ITR with 120 days of the filing of ITR. You can verify online or physically verify your ITR.

Frequently Asked Questions

If you have e-filed my income tax return but haven’t received my refund then make sure to do these 2 things. First of all make sure that you ITR e-verification is complete. This is a very common mistake by taxpayers. If you don’t verify your ITR then it is as good as not submitting your ITR. This will lead to no refund of tax. Secondly, check the refund status on the income tax website using your credentials. The status will show the progress and by when you can expect the refund.

If the refund status is ‘Refund Returned’ then you need to apply again for the refund. Simply login to your income tax account, click on ‘My Account’ and go to ‘Service Request’. Select the request type as new request. Go to the ‘Request Category’ and select ‘Refund Reissue’. In the screen you will see the PAN, Return Type, Assessment Year (A.Y), Acknowledgement No, Communication Reference Number, Reason for Refund Failure and Response. Verify these details and click on ‘Submit’. Lastly, select the bank account to which you want the refund credit.

Yes, there is a delay with your income tax refund, then you will receive interest. An interest rate of 0.5% per month or part of the month on the refund amount.

You will become eligible for an income tax refund if the net tax payable is less than the tax payments during the financial year.

To claim the income tax refund you must file the income tax return on or before the due date of filing ITR. Hence, in a way the due date of claiming income tax refund is in a way due date of filing ITR.

There is no straight answer to how long does it take for the income tax refund to reflect in the account. Usually, it takes 1 month to 3 months for the Income Tax Department to credit the refund in the taxpayer’s account.

Yes, you can check your income tax refund status online. You need to login to your account, click on ‘View Returns’, enter ‘Assessment Year’. You will be able to view the status.

An income tax return is a document which lists all the income, expenses and deductions for a financial year for the taxpayer. By filing the income tax return a taxpayer declares their income and submits it to the Income Tax Department. On submission, the Income Tax Department will assess the return. If the income tax payment is higher than the income tax payable then the Income Tax Department will issue an income tax refund.

You should contact the Income Tax Department for any queries with respect to your income tax refund.

Yes, you have to file an income tax return on or before the due date to get an income tax refund.

No, there is no limit to the number of times you can revise your return after filing the original return on or before the due date.

The jurisdictional assessing officer will review all the unprocessed taxpayer’s records. An intimation is sent to the taxpayer when AO assesses the tax records. The taxpayer can follow-up with the assessing officer regarding the refund by writing a letter to him/ her.

After the submission of ITR, a taxpayer can verify the ITR within 120 days. Now the processing of ITR by CPC starts only after the e-verification of your ITR. Hence, the earlier you verify your return the sooner ITR refund process will start.

Now, after processing the ITR by CPC at the primary level for arithmetical errors etc, the refund issue will be on the basis of tax payable and earlier tax payments. So, if there is a delay in verification, the processing and refund will also be late.

Also, nowadays e-verification is more popular and preferrable than physical verification. Firstly, the process is online and easy to complete. Secondly, it saves time. The physical verification can take up to 5 days but online verification finishes within minutes.

Related Articles

- What is an Income Tax Refund?

- How is Income Tax Refund Processed?

- Steps to Check ITR Refund Status from Income Tax E-filing Portal

- Steps to Check Tax Refund Status from TIN NSDL Portal

- What are the Types of Income Tax Refund Status?

- Interest on Income Tax Refunds

- Things to Consider Before Claiming an Income Tax Refund

- Frequently Asked Questions

Show comments