Universal Account Number (UAN) is a 12 digit unique number that the Ministry of Employment and Labour issues under the Government of India. The UAN is useful to access various facilities on the Employees’ Provident Fund Organisation (EPFO) portal.

The UAN member portal has information relating to the PF contributions, and one can use it to check their PF balance, details of past employers and any PF details via the E-Sewa portal.

An organization with more than 20 employees has to have EPFO UAN registration online. Click here to access the portal through which one can access the EPF services using the UAN.

How to Register on UAN E-Sewa Portal?

To register on UAN E-Sewa Portal, you have to first activate their UAN. The following steps will help in registering and activating the UAN,

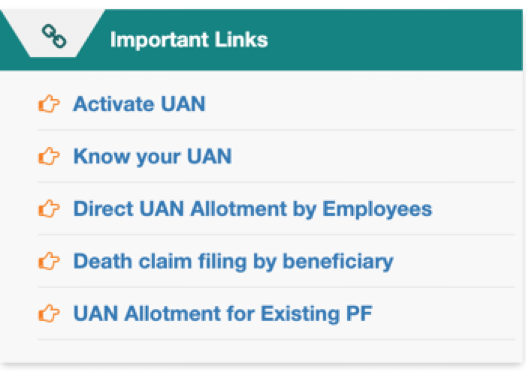

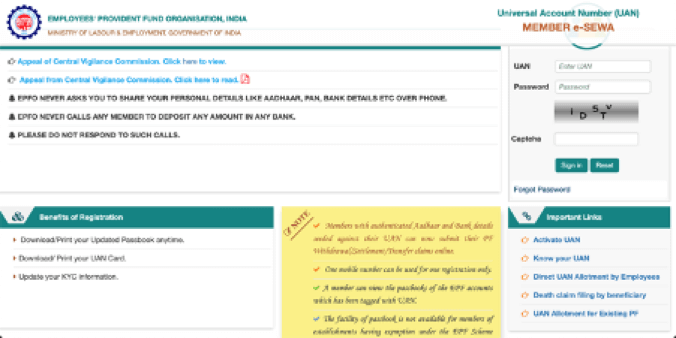

Visit https://unifiedportal-mem.epfindia.gov.in/

Under the ‘Important Links’ section, click on ‘Activate UAN’

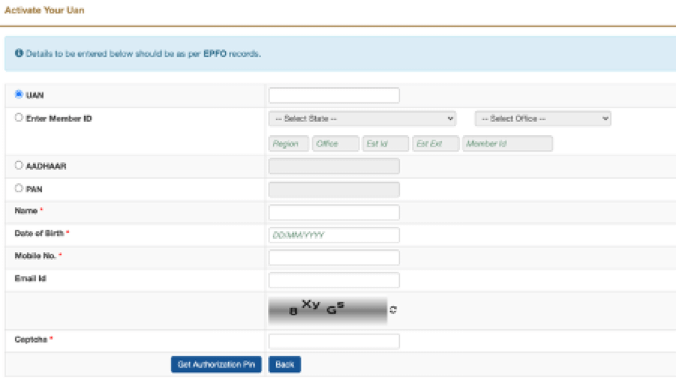

This step requires either a Universal Account Number, Member ID, Aadhar Card number or PAN Card. Also, you will have to enter your name, DOB, mobile number and E-mail ID. After entering the necessary details, click on “Get Authorization Pin’ button.

Upon entering the PIN, the UAN will be activated.

A password generated by the system will be sent through SMS to the registered mobile number. One can log in using this password. After logging in, one has to change their password.

UAN Member E-Sewa Services

The UAN website offers various services, including profile settings, viewing passbook, managing KYC, transferring PF amount from one account to another, raising and tracking claim status. The services that the E-Sewa portal offer majorly fall into three headings.

1. View

2. Manage

3. Online Services

A. View

Under this section, one can view their profile, service history, UAN card and their pass book.

1. Profile

Under profile, one can view their name, DOB, mobile number, e-mail ID, marital status, father’s name, and qualification. One cannot edit any of the above information except for mobile number and e-mail ID.

2. Service history

Every person having a PF account will have only one UAN. While changing jobs, the UAN has to be disclosed as all the EPF contributions can be in one place. Moreover, it can be managed easily, and it increases transparency too. However, each organization that an employee works with will open a new Provident Fund account under the same UAN. Hence service history will include all the information regarding all the jobs that a person has worked. The ‘service details’ section includes member ID, date of joining and date of ending of each job. It also includes the date of joining EPS and FPS and the date of ending EPS and FPS.

3. UAN Card

One can also view and download the Universal Account Number card on the website under the ‘View’ section.

4. EPF Passbook

The pass book option is available on the UAN e-portal. However, one cannot view it here. To view the pass book, EPF subscribers have to visit the EPF website.

Here, under the ‘Services’ tab, one has to select ‘Employees’.

Under this select member passbook. Upon entering the UAN and password, one can view their passbook. The password will be the same as the UAN portal password.

B. Manage

In this section, you can view and modify the member details.

1. Contact details

This section allows a change of e-mail ID and mobile number. An authentication pin will be sent to the new e-mail ID and mobile number. By entering the pin, you can change your contact details.

2. KYC

In this section, you can update your KYC details like PAN Card, Aadhar Card, Passport, Driving License, Election Card, Ration Card and National Population Register number. All supporting documents need to be uploaded as proof.

C. Online Services

This section provides various online services like raising a claim, tracking a claim and transfer of PF amount.

1. Claim form

The Employee Provident Fund Organization (EPFO) has introduced new claim forms from February 2017. This new composite claim form is for full or partial withdrawal. The claim section consists of three forms, namely, Form 10C, Form 19 and Form 31. However, to claim the PF amount through this composite claim form, one has to link their Aadhar with UAN.

2. Transfer

EPF subscribers can claim only one request of transfer from the previous PF account to the current one. They can do so in this section. However, before raising a transfer request, you must ensure that the KYC details have to be updated against the UAN, and they should be correct. The previous and current bank account details are entered in the UAN database.

3. Track claim status

In this section, you can check the status of the claims. Also, you need not enter the PF account number or acknowledgement number. All you have to do is log in to the UAN e-portal.

How to check your UAN status?

One can know their UAN either from their employer or from the EPFO portal.

An employer usually prints the Universal Account Number of the payslips.

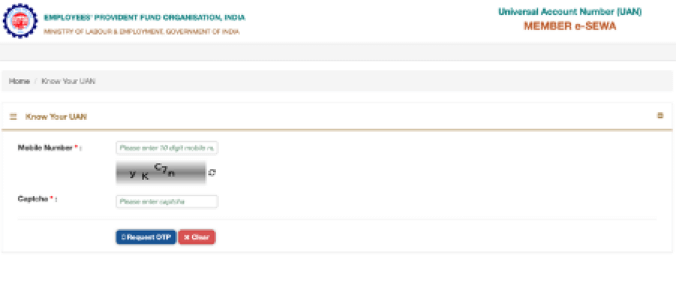

To find the UAN number from the EPFO portal, one needs to follow the below steps:

Visit the EPO portal and under the ‘Important Links’ section, select the ‘Know your UAN’ option.

Next, enter the mobile number and Captcha to generate an OTP to proceed.

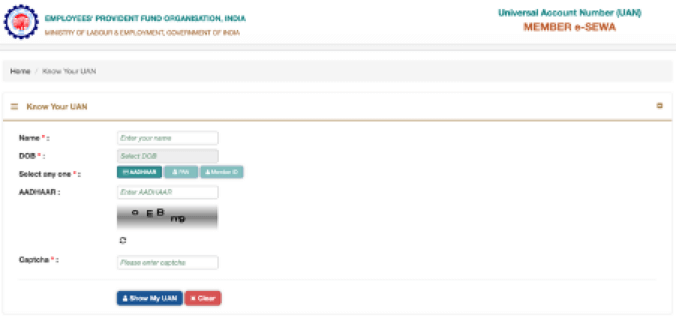

Enter the OTP sent to the mobile number and the Captcha, one has to enter the following details:

- Name

- Date of birth

- Aadhaar or PAN or Member ID

- Captcha

And click on the ‘Show my UAN’ button to proceed.

The UAN will be sent to the registered mobile number.

Login to UAN Member Portal

The UAN login portals for employer and employee are different.

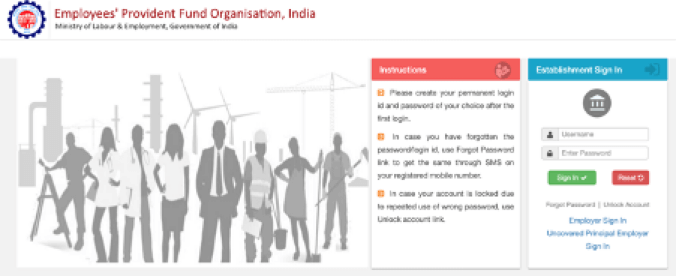

UAN Member Portal for Employer

The prerequisite for an employer to access the Employer portal is that the establishment or employer should have the establishment enrolled through the Shram Suvidha Portal. Following are the steps for employers to login to the EPFO portal:

Visit the Employer login page that shows the panel for establishment Sign in on the right side.

Using the username and password, one can sign in to the employer portal.

Next, in the Employer’s EPFO portal, the employer can approve their employees’ KYC details.

UAN Member Portal for Employees

To be able to access the services of the EPFO portal, an employee must have an activated UAN. To activate their UAN, one has to follow the below steps:

- Visit the EPF official website and go to the ‘Activate UAN’ section.

- Enter the following:

- Universal Account Number

- Member ID

- Mobile Number

- Aadhaar

- PAN

- Name

- E-mail ID

- Date of Birth

- Next, click on ‘Get Authorization Pin’ to get the PIN on the registered mobile number.

- Enter the PIN to verify the request and create the username and password for the UAN portal.

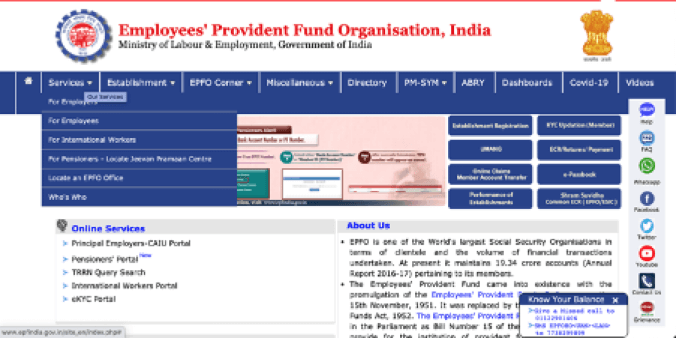

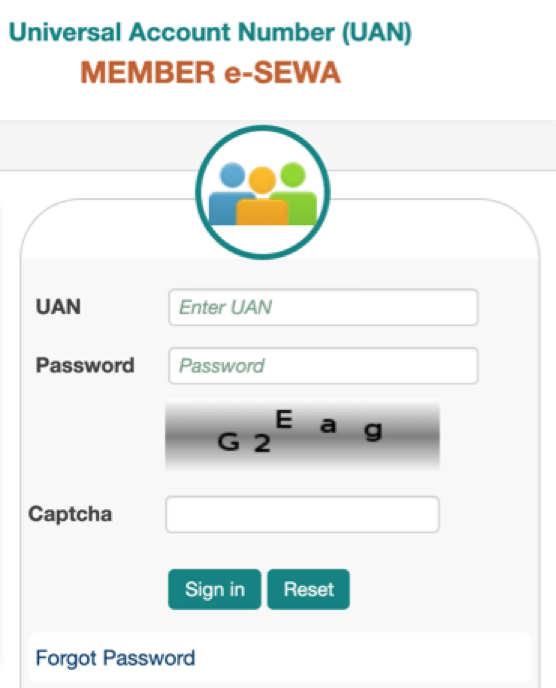

Following are the steps to login and access the UAN portal for Employees:

Visit the EPFO Website

Under the ‘Our Services’ tab, select the ‘For Employee’ option.

On the page, under the ‘Services’ menu, select the ‘Member UAN/Online Service (OCS/OTCP)’ option.

On the login page, log in using the Universal Account Number, password and the Captcha to sign in.

Upon successful sign-in, one can access the EPFO member portal.

How to reset the password on UAN E-Sewa Portal?

To reset the UAN E-Sewa Portal password, follow the below process:

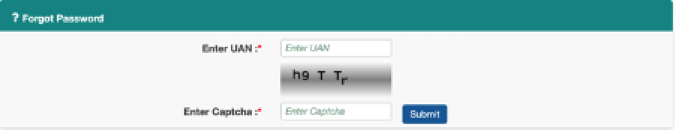

Click on the ‘Forgot Password’ button in the UAN login section.

Enter the UAN and Captcha and click on submit.

OTP will be sent to your mobile number (registered mobile number)

Once the OTP is entered, you can reset your password and access your UAN account.

Features of Universal Account Number (UAN)

The UAN for an employee is the same, even if they change jobs. Though the organisation creates a new member ID for a new employee that joins them, all the member IDs will be linked under one UAN.

Following are the features of UAN:

- UAN is a 12 digit unique number for the employee that helps them manage their EPF account effectively.

- The UAN centralizes all the PF accounts across different companies and functions. Also, it is independent of the employer.

- With the introduction of UAN, EPFO has access to the bank and KYC details of an employee.

- It ensures the genuineness of all the PF accounts that the employee holds.

- The UAN enables tracking the contributions by an employer towards an employee’s PF account every month. However, the employee has to first complete the online registration process through the EPF Member Portal.

- UAN eliminated the chances of an employer not contributing or holding back the employee’s PF amount.

- One can withdraw their PF amount online.

- UAN helps in tracking the number of times an employee has changed jobs.

- One can do Partial withdrawal, full withdrawal, and transfer of PF using the portal.

- With UAN, the employers have a lesser burden on the verification process of an employee.

Advantages of UAN

Following are the advantages of UAN

Easy management

Having a UAN will help in easily managing current and previous PF accounts. Moreover, whenever a contribution is made, SMS alerts will be sent. UAN also enables faster and easier withdrawals and transfers.

No transfers required

When an employee moves jobs, all they have to do is give the UAN and KYC details for verification. The old PF amount will be automatically transferred to a new PF account post verification.

Less involvement of the old employer

To withdraw money from an old PF account or to transfer it to a new account, one need not approach the old employer. With a UAN number, the fund transfer automatically takes place post verification.

UAN Customer Care

One can contact the EPFO help desk at toll-free number 1800118005 from 09:15 AM to 05:45 PM on all seven days for any query relating to UAN or KYC Services.

| UAN Portal | https://unifiedportal-mem.epfindia.gov.in/ |

| EPF Portal | https://www.epfindia.gov.in/ |

| EPF Balance Enquiry | 011-22901406 |

| Official App | UMANG |

How to update personal details at the UAN member portal?

To update your personal details in the UAN website, one has to follow the below steps:

- Visit the EPF member portal website.

- Login using the UAN and password

- Upon successful login, under the ‘Manage’ tab, one can select the ‘Modify Basic Details’ option.

- One can update the following information:

- Aadhaar number

- Name

- Date of birth

- Gender

- Upon entering the new details, click the ‘Update’ button. A message ‘Pending approval by the Employer’ would display.

Reach out to your employer to approve the changes. Upon approval by the employer, the EPFO has to approve the request. EPFO approval may take up to 30 days or more.

Which documents should I submit for updating KYC Details?

The following documents can be used for updating the KYC details:

- Driving Licence

- Bank Account Number

- Ration Card

- Permanent Account Number (PAN)

- Aadhaar Card

- Election Card

- Passport

You may also like to read about the How to update KYC in your EPFO Account?

Check Out How to Change Mobile Number in EPFO?

Frequently Asked Questions

One can link UAN with Aadhar number using UMANG App, EPFO portal, using biometrics on EPFO e-KYC portal and through OTP verification on EPFO e-KYC portal.

Yes, you can view your UAN card on the UAN login portal. After logging in, click on the ‘View’ tab and select the UAN card. Here you can view and download the card.

No, you cannot view the EPF passbook on the UAN website. For viewing the pass book, visit the EPF website. Under the ‘Services’ section, click on the employees option and then select the member pass book.

On the UAN e-portal, under the ‘View’ section, click on ‘Personal’. Here one can view their e-mail ID and mobile number along with other personal details.

When an employee changes their jobs, all they have to do is give the UAN and KYC details for verification to their new employers. The old PF amount will be automatically transferred to a new PF account post verification. Therefore, employees need not worry about transferring their PF account. With every job change, all that an employee has to do is provide the new employer with their UAN number and KYC details. The PF account will automatically get transferred upon successful verification.

The following steps will help you download or view your UAN card – Firstly, log in to the EPFO Portal using your UAN and Password. Under the tab ‘View’, select the ‘UAN Card’ option. The next screen shall display your UAN card. Your UAN card will be displayed. You can download and print the card. The UAN card will have the following information: UAN number, Name, Father’s/ Husband’s Name and KYC.

Your PF account number should be mentioned on your salary slip however if you do not have a salary slip you may contact the human resources section of your work and inquire about your PF.

You can also log in to your UAN portal where you will find details about your FP including your PF balance, otherwise, visit the nearest EPFO office to inquire about your PF account.

In order to log in to your PF account, you need to log in first to your UAN account through the EPFO portal, you can obtain the UAN account from your employer or the pay slip. Once you are logged in to your UAN account, you can access your PF account, find details about the PF account, check your balance, and transfer the PF amount on the EPFO portal.

You can check PF balance without having a UAN account by giving a missed call on 011-229014016 from the registered mobile number. The other way is to log in to EPFO home page “epfindia.gov.in” and then click the button at ‘click here to know your PF balance, You will be redirected to a new page epfoservices.in.epfo where you can view your PF or EPF balance.

UAN is not the same as the bank account number. Universal Account Number (UAN) is a 12 digit unique number allotted to an employee by the Employee Provident Fund Organization (EPFO). The UAN number remains the same irrespective of the job change and regardless to changing the bank account.

Related Articles

- How to Register on UAN E-Sewa Portal?

- UAN Member E-Sewa Services

- How to check your UAN status?

- Login to UAN Member Portal

- How to reset the password on UAN E-Sewa Portal?

- Features of Universal Account Number (UAN)

- Advantages of UAN

- How to update personal details at the UAN member portal?

- Which documents should I submit for updating KYC Details?

- Frequently Asked Questions

Show comments