Is it possible to retire with a corpus of Rs 5 crore at the time of retirement? Well, it depends on your age, expenses, lifestyle after retirement and how much are you willing to contribute to retirement at that age. Ideally one should start planning for retirement right from the time they started working. This makes it easier to invest small amounts and arrive at a huge corpus. Considering the retirement age of 60, the monthly investment at different ages has been calculated. It is assumed that the annual return will be 12%.

The above table shows that smaller amounts are invested regularly at young ages as the investment horizon is longer. As the person’s age is increasing so is the monthly investment to reach the goal amount. This is because the investment horizon is reducing and return is earned for the lesser number of years. This means investing from younger ages will reduce the financial burden on you. Investing in small amounts for a long period of time aids in earning high returns due to compounding.

Identify your expenses

For example, house rent, bills, salaries to household help, fuel, maintenance, medicines etc.

Expenses Breakdown:

- Monthly Rent – Monthly rent if you are staying in a rented house.

- Household Expenses – This would include salaries to household help, groceries, personal care, commute, water, and electricity etc.

- Shopping & Dining – Include monthly average amount spent on garments, dining out, electrical appliances, electronics, furniture etc.

- Health Care – Expenses on hospital visits, medicines, medical tests, gym subscription etc.

- Vacation – Expenses on travel to other cities, visits to hometown, relatives & friends, tourism etc.

Your personal details like marital status, dependents, your smoking habits and place of stay during retirement also matter while deciding your portfolio. Depending on the number of dependents i.e. children and parents, the retirement fund requirement will be scaled down. And your smoking habits would scale up your medical expenses.

How Much to Save for Retirement?

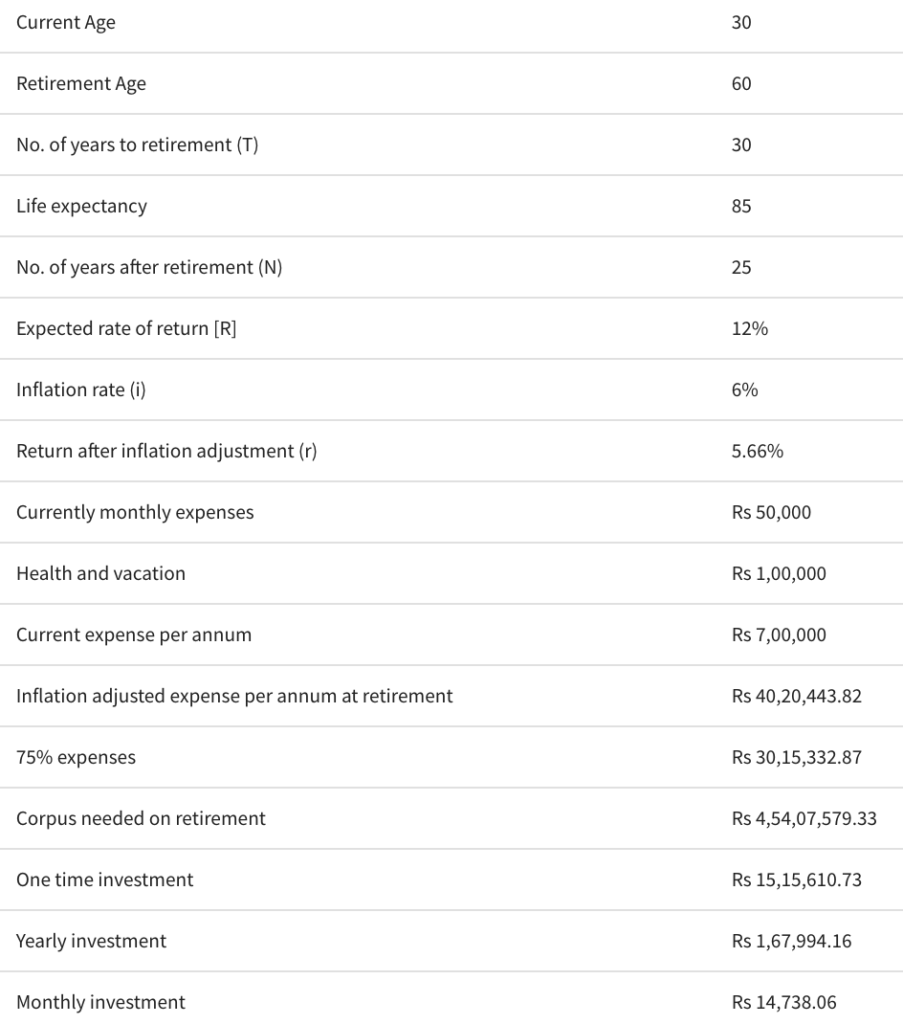

Let’s see how much Mr. Aansh Malhotra would need at retirement. He is 30 years old married man who is planning to retire at the age of 60 and expects to live till 85 years. The rate of return for his investments is considered to be 12% p.a. The inflation rate considered is 6%. His monthly expenses are Rs 50,000. Also, he spends Rs 1,00,000 annually on health and vacation. It is assumed that the expenses after retirement will reduce to 75% of his current expenses and that he currently has no investments for retirement.

Mr. Aansh Malhotra would need Rs 4.54 Cr at the time of his retirement. He can invest Rs 15.15 lakhs as a one-time investment or invest Rs 1.67 lakhs yearly for the next 29 years or invest Rs 14.7K monthly for the next 29 years 11 months to get the desired amount at the time of retirement. Mr. Aansh Maholtra is planning for retirement at an early age, hence the monthly investment is on the lower end.

Know what you’ll do after retirement

Knowing what you’ll do after retirement plays a major role. If you want to travel, or just relax in the countryside or take up a new hobby or work anywhere, any of these can affect the retirement age. By knowing what you’ll be doing right after retirement is important as it gets easier to calculate the expenses and incomes post-retirement. Relaxing in your own house in the countryside will be less costly than you traveling. Also, working anywhere will give you a source of income apart from your EPF and PPF. All these can be factored in while planning for retirement and one can decide on an ideal age based on this.

Be sure that you can afford retirement

This basically means to know what your incomes and expenses are during retirement. What are your current investments and will they be sufficient to cover your expenses post-retirement? Most of the time it’s the money that decides the retirement age and now us. If the current investments do not cover your expenses after retirement, then make an investment plan and start investing immediately.

Factor your health into the decision

Most of the time the health of a person forces them to retire at an early age. Or if a person who plans to retire after the age of 65 might have to face heavy healthcare expense as the employer might not provide insurance to people aged above 60. Factoring in health and calculating accordingly will give you a rough estimate about when to retire.

Deciding on retirement age is not just dependent on these three factors. The number of people dependent on him/her, financial stability and lifestyle are few of the many other factors that help one decide on the retirement age. Ideally, in India, people do work up until the age of 60 or 65 but with long working hours and routines in a job, people can be tired mentally and physically. Also, switching jobs is always not an option with high unemployment rates. Also after 50, it gets difficult to find a new job too and there won’t be much potential in the existing job. So it is important that people usually plan their retirement with the retirement age of 50 in their mind instead of 60. Well, there is no harm to be able to retire late with excess money if one decides that they will not retire at 50.

Start your retirement planning today! With a plan in place, retirement doesn’t sound as dreadful as it is portrayed by others. Happy investing! Happy retirement!

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Identify your expenses

- How Much to Save for Retirement?

- Know what you’ll do after retirement

- Be sure that you can afford retirement

- Factor your health into the decision

Show comments