Every transaction starts with someone giving money to another one. In the pre-pandemic times, e-commerce was on the rise. With the COVID-19 outbreak, digital payment adoption has accelerated. It has become the most popular way of transacting today and will stick around in the times to come. As more customers are becoming tech-savvy, businesses large or small are taking advantage of electronic funds transfers (EFT). To meet the rising demand for electronic money transfers, it is important for merchants and businesses to understand how they work.

What is an Electronic Fund Transfer?

An electronic funds transfer (EFT), involves the movement of money from one bank account to another digitally. Also known as direct deposit, these transfers take place independently without any involvement of bank employees.

The digital transaction does not require heaps of documentation. Owing to its simplicity, EFT has now become a predominant method of transfer of funds. It is also the most easily accessible and direct method of payment. The rise in usage of EFT is leading to the drop in usage of paper checks. They are quickly becoming obsolete due to involved expenses, slower expedition, and overall effort.

How do EFT Payments work?

An EFT transfer usually involves two parties: the sender and the receiver of funds. An EFT payment process starts when the sender initiates a transfer. The payment request channels through a series of digital networks originating from a payment terminal over the internet. The sender’s bank sends a request to the receiver’s bank. Most payment cycles are completed within a couple of days, known as the clearance period.

Senders can be anyone from a business to an individual. They may pay an employee, a vendor, or a service provider. Likewise, recipients can be entities or individuals like employees, service providers, goods suppliers, retailers, and utility companies.

For Transactions In India

EFT can be done to any bank account across the country. For instance, you can transfer money to an account in a particular branch of HDFC Bank in New Delhi by providing the IFSC Code.

You must consider factors like transfer limit, time, and cost to decide the best method of transferring money online.

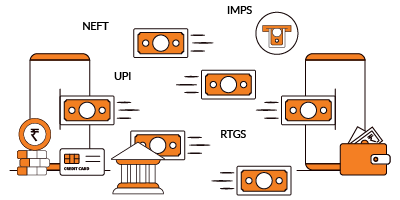

You can select from one of the following methods for making an electronic fund transfer from your account-

- Initiate transaction between your two linked accounts of the same bank

- Transact between different accounts of the same bank.

- Opt for NEFT to send money into a different bank’s accounts

- Transfer money through RTGS into another bank’s accounts

- Use IMPS to transfer money into various accounts

For International Payments

As e-commerce is on a rise across the world, EFT is helping businesses thrive. EFT technology enables businesses to reach the global population as it can collect payments from across the globe. EFT is an easy, convenient, and cost-effective procedure for international payments. Consequently, international payments increase the income potential of any business. It widens the scope of reach for businesses of all sizes. It simply provides the same opportunities to all of them from start-ups to large corporations. The Fintech industry has largely benefited from EFT.

Although international payments work the same way as local EFT payments, they are however subject to some rules. Foreign transaction fees and exchange rates are applicable as per the transaction amounts.

Types of EFT Payments

As already discussed, people are preferring to transfer money using electronic fund transfer methods during the pandemic. The convenience of electronic payment options allows users to transfer funds from the comfort of their homes. They can easily transfer money online using their mobiles and laptops simply using IFSC Codes.

You can select from the following electronic methods for transferring money between two accounts:

NEFT

National Electronic Funds Transfer or NEFT is the most popular online payment option to transfer money. You can easily transfer money from one bank account to the other through this method. Companies use it mostly for salary transfers.

The funds transferred are settled on a deferred settlement basis. It means the money is transferred in batches and settled in 3 business days (T+3). There is generally no maximum limit for NEFT but this depends on the bank as well. For instance, SBI allows retail banking ETFs up to Rs. 10 lakhs only.

Cost Involved

Banks charge a fee for NEFT when you are transferring money to a different bank. They may charge anywhere between Rs. 2.50 to Rs. 25. However, the service fee is based on the amount being transferred.

Constraints

You can complete an NEFT transaction only on bank working days. In case you transfer money over weekends or on bank holidays your transaction will not go through on the same day. Instead, it wion the next working day. Thus, NEFT is not useful for instant transactions. Though some banks now offer the service round the clock and even on non-working days.

Requirements-

- Name of recipient

- Bank’s name of the receiver

- Account number of the recipient

- IFSC code of the beneficiary bank

IMPS

IMPS or Immediate Payment Service (IMPS) involves the instant transfer of money, usually through mobile devices. You can make transactions 24X7X365 across banks using this inter bank electronic fund transfer service. IMPS allows fund transfer on all days including weekends and bank holidays. Besides transferring money through phones you can also use the IMPS facility at ATMs, Mobile Money Identifier (MMID), and internet banking. The payments are sent to the mobile number linked with the bank account of the beneficiary.

Requirements

- 7 Digit MMID of the beneficiary

- Name of the beneficiary

- Mobile number of the beneficiary

- Account Number of the beneficiary

- IFSC Codes of the beneficiary’s bank

RTGS

RTGS or Real Time Gross Settlement is useful for transferring money from one bank to another in real-time. This form of EFT is allowed only on transfers for a minimum amount of Rs. 2 lakhs. However, there is no upper limit for the transaction amount. These transactions e process during the RTGS business hours. Usually, the amount is transferred to the recipient’s account within 30-minutes.

Both the sender and receiver should hold accounts in RTGS enabled banks. The list of RTGS authorized banks is available on the RBI website.

Cost Factor-

RTGS involves more cost in comparison to NEFT and it varies from bank to bank. Though the fee depends upon the amount you are transferring, it usually does not cost more than Rs. 30 for transactions up to Rs. 5 lakhs.

Requirements-

- Amount of the transaction

- Account number of the sender

- Name of beneficiary

- Account number of the beneficiary

- Beneficiary’s bank and branch name

- IFSC code of the receiving branch

ATM Transaction

All ATM transactions are powered by EFT systems. Therefore, every time you use an ATM it involves electronic fund transfer. This includes using an ATM machine for withdrawing money, transfer funds between your accounts, or deposit an amount to an account.

Debit/ Credit Card Transactions

Similar to ATM transactions, all debit and credit card payments process using the EFT system.

UPI Money Transfer

UPI Money Transfer is also enabled by EFT. You can use apps on any smartphone having a VPA (Virtual Payment Address) to complete your transaction. UPI Money Transfer involves fewer steps in comparison to other modes of EFT.

In this method, smartphone apps enable users to quickly transfer money to a beneficiary account. Both sender and receiver may not share personal details like credit/debit card number or bank account.

Moreover, UPI Money Transfer works round the clock and all transactions are done on a real-time basis.

The Cost Factor

UPI Money Transfer does not involve any charges, so neither the sender nor receiver have to pay for using the UPI platform.

What are the Benefits of EFT payments?

Electronic fund transfers offer convenience and a lot of other benefits to all users. Following are the main benefits of EFT payments:

- Transactions are fast and much work is not required at either end of the transaction.

- EFT is reliable as human intervention is minimal.

- The solution is cost-effective and allows businesses to save money.

- It is cost-effective compared to paper checks as the costs of check printing and postage can be saved.

- EFT eliminates the risk of misplacing checks due to mail loss, or tampering of checks.

- EFT solutions mitigate the risk of fraudulent bills and cash miscalculations.

- It also offers safety and establishes the participating entities as trustworthy.

Are EFT Payments Safe?

EFT payments are safe in comparison to traditional payment methods. While transmitting money over the internet may involve an element of risk, EFT is safer than other methods of payment like paper checks or cash. The best way to ensure a tamper-proof EFT is to involve trusted partners. Partnering with reliable third-party entities helps to easily navigate EFT for your own business.

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- What is an Electronic Fund Transfer?

- How do EFT Payments work?

- Types of EFT Payments

- What are the Benefits of EFT payments?

- Are EFT Payments Safe?

Show comments