Bonds are investment products that fall under the fixed income asset class. They are instruments that allow the government or corporations to raise money publicly or privately for funding various projects. They pay an interest rate for the money borrowed. These are issued at a premium or discount to face value or par value. Upon maturity, face value (principal amount) is paid back to the investors. In this article, we have covered investment in bonds, its features, categories and pricing in detail.

What is a Bond?

A bond is one of the fixed income investment products that represents a loan given to a borrower by the investors. The investors get interest income in return for the money they lent. A bond includes details of the loan like the date when the principal payment is due, the interest and the terms of interest payments.

These are issued by the government, corporates, municipalities, and states to find their projects. Also, they pay regular interest to bondholders. If this financial instrument is held until maturity, the lender (investor) gets back the principal amount. Alternatively, the investors can sell it in the secondary market at a higher price and make a profit.

Bond investment has certain risks too. The borrowers can default. There are chances that the company which issued them might not repay back at the time of maturity. Also, bond yields can fluctuate according to the change in bond prices. In a rising interest rate regime, the bond prices may fall. The coupon payments become unattractive to the investors as they can sell the existing bond with a low coupon rate and rather invest in another bond with a high coupon rate. In a falling interest rate regime, the bond prices can increase, causing the bond yield to fall. This is because the investor would want to profit from the price increase and sell the bond. Leading to lower yields form bonds.

Who are the issuers of a bond?

Institutions primarily use bonds to borrow money. The issuers of a bond are:

- Government: Government raises funds to sponsor roads, dams, schools and other infrastructure projects. Therefore, government institutions at all levels need funds to complete projects and hence raise funds through bonds.

- Corporations: Businesses or corporations often borrow money to grow their business. The browning can be for buying equipment and property, for research and development, to undertake profitable projects, etc. Large corporations usually need far more money than what a bank can typically lend.

With bonds, individual investors assume the role of a lender. Hence, thousands of investors lend a portion of the capital to the borrower. Also, the public debt market enables lenders to buy and sell bonds in the secondary market.

Learn: Difference Between Primary Vs Secondary Market

How does a bond work?

Bond is a debt security that is one of the popular asset classes known to investors apart from stocks (equities) and cash and cash equivalents.

They are issued by corporations or governments to fund a new project or refinance an existing project. Hence helping them in raising money for future projects or ongoing projects. This instrument can be issued directly to investors in the market. These are publicly traded in the market. Alternatively, they can be issued privately and are traded only over-the-counter (OTC) and are circulated privately.

When the borrower issues bonds to the lender, an agreement is made between both the parties. The issuer of the bond promises to pay back the principal on the maturity date. The issuer also pays interest on the money borrowed (coupon payment) throughout the tenure of the loan period.

The bond‘s face value is mostly INR 1,000. The issuer will fix the coupon rate. However, the market price or issue price will depend on the credit quality of the borrower, holding period until maturity, and the coupon rate.

A bond includes details of the amount borrowed, date of maturity on which the money will be paid back to the investor, and details of coupon payments, including the coupon rate. Once the bonds are issued, investors or bondholders are entitled to receive interest annually or semi-annually. And upon maturity, will receive the face value (principal amount). However, this is only valid when the bondholder holds it until maturity.

There is no compulsion that one has to hold the bond until maturity. When interest rates fall, and prices increase, the investor can sell it to earn profits. The bondholder will stop receiving coupon payments once they sell the bond.

Moreover, the issuer of the bonds can buy back the bonds in case of a decline in interest rates or if the credit rating of the borrower has improved. Then the issuer will reissue new bonds at a lower cost. This is because, the higher the credit quality, lower will be the interest rate. This way, the bond issuer can reduce their debt obligation.

Features of a Bond

All bonds share certain characteristics. They include the following:

- Face value: The worth of the bond upon maturity. It is also the base amount on which interest is calculated.

- Coupon rate: The interest rate on the bond paid by the issuers of the bond to the investors. Coupon payments are made annually or semi-annually.

- Coupon dates: The dates on which the investors receive the coupon payment.

- Maturity date: The date on which the bond issuer pays back the face value of the bond to the investor. It indicates repayment of the loan taken.

- Issue price: The price at which the bond is initially sold to the investor by the issuer. In other words, it is the price at which investors buy them. When the interest rate rises, the issue price will go down. Similarly, the issue price will go up when the bond rates (interest rates) fall.

- Bond duration: Duration measures the sensitivity of a bond‘s price to the interest rate changes. It is not an indicator of the length of time until maturity.

- Credit quality: Credit quality is one of the principal determinants of a coupon rate. If the issuer of the bond has a low credit rating, the default risk is greater, and as a result, these bonds pay more interest. The credit rating agencies frequently keep updating the ratings of a bond. Usually, bonds issued by the governments are very stable and are considered to be the highest quality. These are called investment-grade bonds. On the other hand, bonds that are not investment grade, but are not in default, are known as high yield or junk bonds. These junk bonds have a high risk of default in the future. Also, to compensate for the risk, investors demand higher coupon payments.

- Time to maturity: Certain bonds have long maturity dates. Hence, they tend to pay higher interest rates. A high-interest rate is paid because the bondholder is exposed to inflation risk and interest rate risk for an extended period. As interest rates change the value of bond and bond portfolio will either rise or fall.

What are Different Bond Categories

Primarily there are four categories of bonds that are sold in the market.

1. Government Bonds

Government bonds are issued by the Central and State Government of India. The Reserve Bank of India manages and regulates them. These include:

- bills that mature within less than one year

- notes that mature between one to 10 years

- bonds that mature in more than ten years

Since the Government of India issues them, the credit risk or default risk is almost nil. Government bonds are considered to be the safest type of investment options to earn regular interests and principal on maturity. However, the long term/ duration bonds are exposed to inflation risk.

2. Municipal Bonds

Municipal bonds are another type of government bonds issued by municipalities or government bodies. In comparison to government bonds, municipal bonds carry higher risk. However, the chances of a state government or a municipality going bankrupt or defaulting their payments are very low. But they suffer from inflation risk. Also, these are tax free bonds.

3. Corporate Bonds

Companies issue corporate bonds. Companies issue them because the bond market offers debt at a lower interest rate and favourable terms. Hence most companies prefer issuing bonds over bank loans. The corporate sector represents a large portion of the bond market. They pay higher yields than government bonds. However, they suffer from inflation risk, interest rate risk and credit risk.

4. Asset Backed Securities

Asset-backed securities ABS are bonds issued by banks and other financial institutions. Banks usually bundle cash flows from a pool of assets and offer them as asset backed securities to investors. One of the most common ABS is a mortgage loan pool of a bank. The bank offers mortgage backed securities.

Types of Bonds

Following are the types of bonds:

- Traditional bond: A traditional bond allows the bondholder to withdraw the entire principal amount at one upon the bond’s maturity.

- Callable bond: A callable option is an option exercised by the bond issuer. When an issuer calls out their right to redeem the bond before its maturity is called a callable bond. An issuer can convert a high debt bond to a low debt bond through a callable bond.

- Fixed rate bond: Bonds whose coupon rate remains constant through the tenure of the bond.

- Floating rate bond: Bonds whose coupon rate varies during the tenure of the bond.

- Putable bond: Puttable bonds are those where an investor sells their bonds and gets the money back before the date of maturity.

- Mortgage bond: Mortgage bonds are ABS bonds. These types of bonds are often backed by securities. For example, they can be backed by real estate companies and equipment.

- Zero coupon bond: Zero coupon bond is a bond with a zero coupon rate. The bond issuer pays only the principal amount to the investor on maturity. They do not make any coupon payments. However, they are issued at a discount to their par value. The bondholder generates returns once the issuer repays the amount at face value.

- Serial bond: In a serial bond, is the one where the issuer pays back the loan amount to the investors in small amounts every year. This is to reduce the final debt obligation on the issuer.

- Extendable bond: An extendable bond allows the investor to extend the maturity period.

- Convertible bond: A convertible bond allows the bondholder to convert their debt into equity (stock) at some point. However, it depends on conditions like share price. These are suitable for companies as the interest outflow becomes lower. The investors can benefit from this when they can make a profit from the upside in the stock. However, this only happens when the project is successful.

- Dynamic Bonds: Dynamic bond funds are open-ended debt mutual funds that invest across duration. They follow a dynamic approach in terms of the maturity of securities in the portfolio. One of the main objectives of dynamic bond funds is to provide optimal returns in both falling and rising interest rate scenarios.

Pricing of bonds

The bonds have a face value and issue price. Most of the time, these two differ and are not the same. The face value is what the bondholder gets back at the time of maturity. However, the issue price depends on the credit rating of the borrower, coupon payment and holding period until maturity. Investors buy at issue price, and they are paid back the face value if held until maturity.

A bondholder can hold it until maturity or can sell it off before maturity. The price at which the bondholder sells it depends on the interest rates prevailing at that time. The price of the bond is subject to fluctuations based on the interest rate changes. When the market interest rate rises, the price falls. When the interest rates go down, the prices rise. And sometimes, these prices fluctuate dramatically, causing the bondholder to sell them.

The interest rate of a corporate bond is determined by the short term interest rate of a government bond. When the bond is first issued, the investor is indifferent to a corporate bond and government bond as both will have similar interest rates.

However, when the bond rates of the government bond fall, the corporate bonds will be more attractive to the investors. And the investors will bid up for the prices of the corporate bond until it trades at a premium. With excessive buying, the prices go up and both the bond rates normalize.

Similarly, when the interest of the government bond shoots up, the corporate bonds become less attractive and will be sold. The prices of these bonds fall until the interest rate normalizes.

Explore: What is Yield Curve?

What is YTM?

Yield to maturity (YTM) is one of the ways to price bonds. It is the total expected return for an investor if the bond is held to maturity. YTM is the long term yield of the bond but is expressed as an annual rate. Yield to maturity is similar to the internal rate of return (IRR). However, all the proceeds must be reinvested at a constant rate, and it must be held until maturity, which is not the case with the internal rate of return (IRR).

YTM can be a complex concept to understand and calculate. However, it is a very useful tool that helps in evaluating the attractiveness of one bond relative to the other.

YTM accounts for the time value of money. It factors all the present values of future cash flows from an investment. This usually is equated to the current market price. However, this is based on the assumption that all the proceeds are reinvested back at a constant rate, and the investment is held until maturity.

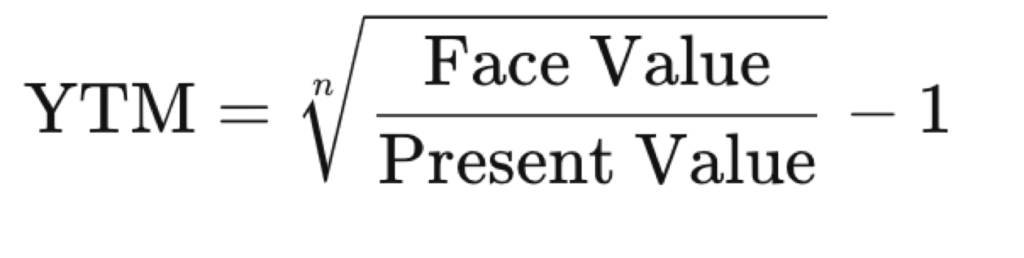

For a zero coupon bond, the YTM is calculated using the formula below:

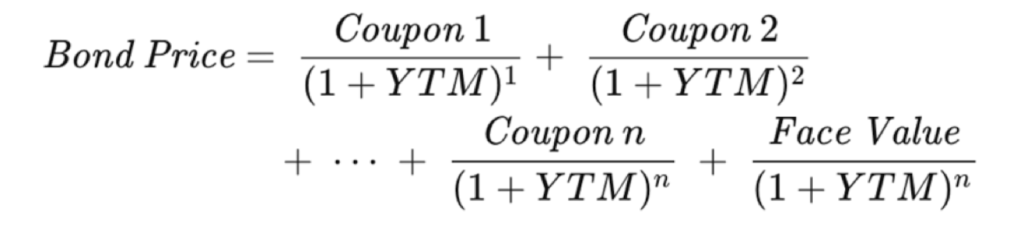

However, most of the bonds in the market pay an interest (coupon payment). Hence to estimate YTM, one can also use a trial and error basis. When the price, coupon rate and face value of the bond are known, then the YTM can be estimated by trial and error basis. The formula below will help in calculating the same.

Conclusion

Bond is a debt security (fixed income investment). They have a considerably lower risk than equities. To diversify their portfolios, certain investors can consider to invest in bonds. They can provide stability of returns to an investment portfolio. However, investors can simply choose good debt mutual funds which invest in bonds to invest in this sub-asset class in a simplified manner.

Discover More

Frequently Asked Questions

Bonds are debt securities that help the government and corporates to raise money from the public to fund their projects. There are both short and long term bonds. Short term bonds have a maturity of one to three years. In contrast, long term bonds have a maturity of beyond three years.

Returns from bonds are two-fold. Investors get interest from the bonds, and they can gain from capital gains by selling the bonds in the secondary market. Returns from bonds are quite predictable. Hence investors looking for short term investment options with stable returns can invest in bonds.

A bond is a fixed income instrument that the government or corporates use to raise funds. It represents the loan given by the investors. The investors, in turn, get interest against the money lent by them. A bond will have a face value, tenure, and coupon rate. The face value of the bond is the issue price of the bond. Tenure is the number of years in which the bond will mature. And coupon rate is the interest that the investor will receive for lending money.

Let’s take an example of a bond issued by a company with a face value of INR 1,000 and a coupon at 10%. The bond will mature in 5 years. Hence investors will lend INR 1,000 per bond to get an interest of 10% per annum for the next five years. At the end of the fifth year, the bond issuer will pay back the entire principal along with interest to the investor.

Explore: Best Bonds to Invest in India

Show comments