Most of us can easily determine when to invest, where to invest and how to invest, but many fail to understand when to exit from our investments. While everyone talks about the right time to invest, let’s focus on when to exit from investments, as this is one of the most important strategies to have.

We usually get impulsive with our investment decisions. For example, we think it’s the best idea to withdraw our investments each time we see a gain or loss. However, that’s not the advisable strategy. Most of us invest to achieve a certain goal. Its always recommended knowing what your goal is. The goal could be anything, to purchase a car, a house or go on a vacation with the family. Along with your goal, having an exit strategy is always helpful.

Have a Disinvestment Plan

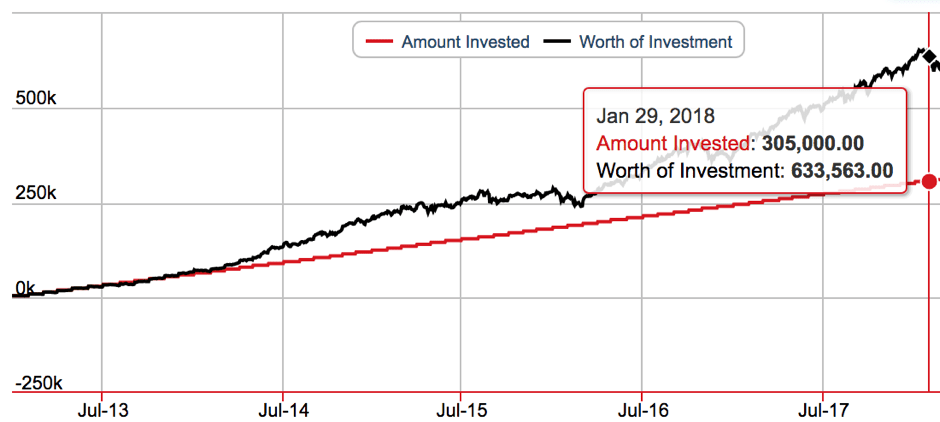

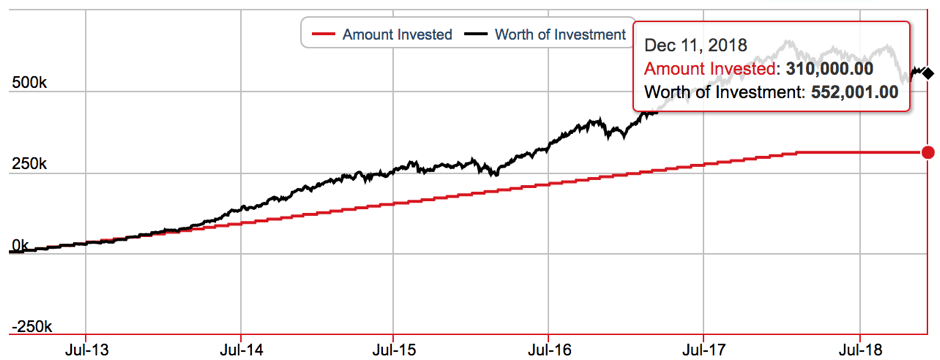

Its always said that the longer you stay invested in a mutual fund, the better are the returns. Though this statement seems to be very much true, its always good to have a disinvestment plan. For instance, a SIP made since January 1st, 2013, would have earned you higher returns when withdrawn in January 2018, rather than holding until December 2018.

From the above graphs, you can see that holding the investment a little longer would affect your returns. At first glance, you may feel nothing was wrong and think that markets are volatile. But with a closer look, it proves the lack of exit strategy.

When you know you are closer to achieving your goal or would need to withdraw your investments soon, you should have a plan to systematically exit the investments. Ideally, to safeguard your wealth, start accumulating one year prior to the actual date from when you need the capital. From about 9-12 month prior to your need for the money, is the right time to start withdrawing your investments. However, do not do it in one shot, follow a systematic strategy for this as well, like Systematic Withdrawal Plan (SWP) or Systematic Transfer Plan (STP). This way you’ll be able to transfer your investments to a safer or less volatile fund, such as a debt fund. So the basic principle is that moving money to a less volatile investment instrument one year prior to the need.

Know When to Exit from Investments in Mutual Funds

Sometime even during your goal period, there might be instances demanding you to exit from investments. In such scenarios, exiting the investment is suggested only when:

- There is an emergency: In case of financial emergencies, when your emergency fund isn’t sufficient to meet your requirement, you need to consider exiting your mutual fund investments.

- Change in fund manager: Fund managers experience and expertise are considered before investing in a fund. The major part of the fund’s performance depends on how well the manager is able to manage the funds in extreme situations. Hence, a change in fund manager can have a great impact on the fund’s performance. As long as there is no change in the fund’s investment objective, there is no need to worry. However, keep an eye on his performance to see if his investment decisions are churning good returns.

- Change in fund’s strategy: Investors invest in funds only if their investment objective is aligned with the fund’s investment objective. Therefore, any change in the fund’s strategy signals as reconsidering your investment in the fund.

- The underperformance of the fund: Mutual Funds are market-linked instruments and hence are subject to volatility. Any movement in the stock market would also affect mutual fund performance. Short-term fluctuations in the market may be misleading. And, it is not a good idea to base your decision on this. Consistent underperformance for over and above 18 months is a good indicator to consider disinvesting from the fund to cut further losses.

- Need for rebalancing your portfolio: To have your investments aligned with your risk appetite and financial goals is very important. Timely review of your investment portfolio is required to maintain a balanced between your investment mix and the fund.

If not for the above reasons, holding your investments for longer durations is always suggested. Along with an investment plan, always have an exit strategy ready for your investments. It’s difficult to hit the bullseye when it comes to entering or exiting the market at the right time, but having a plan will always come for your rescue.

10 Scenarios You Should Consider Selling Mutual Funds

Following are the scenarios under which you can consider selling your mutual fund holdings:

1. When Your Investment Objectives are Met

Most of us invest in mutual funds intending to achieve our financial goals. Therefore, when you are nearing your goal tenure, you can consider exiting your investments or moving them to less risky options. For example, if your investments were in a pure equity scheme and are almost nearing your investment tenure, you can move your investments to a less risky option, say debt funds.

2. When Your Investment Preferences Change

Our investment preferences may not be the same throughout the investment tenure. For example, when we are young, we would want to invest across high-risk funds to be able to generate significant returns. But with age, we would become more conservative with our investments and would want to invest across more stable assets. Thus, if you realize a change in your investment objective, you may want to reconsider your portfolio allocation and make necessary adjustments to it. For example, selling your high risk mutual funds and replacing them with medium-risk ones.

3. Consistent Underperformance of the Fund

Consistent underperformance of the fund can often be a cause for concern. Especially with actively managed funds, consistent underperformance of the fund can significantly impact the overall returns. The fund manager plays a very important role in the fund’s performance.

However, you should not sell your mutual funds if the underperformance is for a very short duration. It may sometimes be due to the fund manager’s error in picking the right securities for investment. For instance, if the fund has performed well across market conditions, you may wait to see if the fund is able to recover quickly from this underperformance.

Furthermore, the underperformance of a mutual fund can be due to the overall market collapse. Taking the example of the Covid 19 pandemic, where the markets were highly volatile. Most investors engaged in panic selling in response to the pandemic, resulting in a market crash. Thus, you must carefully analyze the reason for underperformance and also compare your fund’s performance with its peers.

You need to understand if the drop in performance is only for your fund or across all the schemes belonging to the category. If the latter is true, you may want to wait until the market recovers before exiting the scheme. In the case of the former, you may want to analyze the portfolio, changes and take the exit call.

However, it is important to exit your holdings if you observe a consistent underperformance of the fund for a period of more than six months. Since markets are volatile, underperformance for a short period doesn’t necessarily lead to exiting the scheme.

4. When the Fund’s Strategy Changes

While investing, we all carefully consider the fund’s investment objective and invest only when it perfectly aligns with our financial goals. Furthermore, we ensure that the asset allocation and risk exposure are comfortable for us. In case of any change in the fund’s investment strategy or risk exposure levels, we must re-evaluate whether the fund still aligns with our investment objective or not.

Therefore, if you realize that the fund’s investment objective no longer aligns with your goals, you may consider selling your holdings. Also, when a fund investment strategy changes, the exit load is often waived off. Though there may not be any exit load, you may have to consider the tax implications for your redemptions.

explore our article on Mutual Funds without Exit Load

5. When the Fund Manager Changes

For actively managed mutual funds, the fund manager plays an important role. The fund manager’s decisions significantly impact the fund’s performance. However, this may not be the case with passively managed funds. Since passively managed funds replicate the benchmark index, and thus, the fund manager’s role is limited.

The change in fund management can impact the fund’s performance either positively or negatively. The fund performance may enhance with the new fund manager. At the same time, the risk of underperformance is also high. Therefore, if you notice any changes in the fund management for actively managed funds, you may have to keep a close eye on the fund. If you witness that the fund manager’s investment strategies do not align with your goals, you may consider exiting the scheme.

6. Increase in Fund Size

When a fund has significant growth, its performance may be compromised. It becomes more difficult to manage a large portfolio. This problem is most common in concentrated or small-cap funds, which invest in equities with limited volume and liquidity or deal with fewer shares. It is preferable to sell your mutual fund units in such a situation.

7. In Case of Emergencies

Emergencies can knock on your door at any time. The biggest advantage of investing in mutual funds is liquidity. Thus, you can redeem your fund units at any time. In case of emergencies, you need not worry about timing your exit. You can simply exit the investments to meet your emergency needs. However, some funds may take up to two working days to transfer the amount to your bank account.

8. Portfolio Rebalancing

Portfolio rebalancing is necessary to analyse if your investment portfolio is still in line with your goals and risk tolerance levels. Especially when you have a long-term investment tenure, you should analyse your portfolio from time to time. In case of any changes in your goals or risk levels, or any changes in the fund’s objectives and strategies, you should consider rebalancing your portfolio.

Rebalancing does not necessarily mean that you should exit your holdings. Rebalancing your portfolio can be stopping current investments in a scheme and diverting them to another scheme. Also, if you witness underperformance of certain funds, you may want to replace them with new funds.

Furthermore, you may want to adjust your holding across asset classes with time. For example, you may be conformable with high equity exposure when you are young. While you near retirement, you may have to rebalance your portfolio by increasing the debt allocation and reducing equity exposure. Thus, portfolio rebalancing strategies will help you decide whether or not to sell your mutual funds.

9. When You Want Regular Income

When you want regular income from your mutual fund investments while protecting your capital, you can plan for Systematic Withdrawal Plan (SWP). Do not convert a mutual fund scheme to a dividend option for regular cash flows. Following an SWP approach will be more efficient. SWP is also tax efficient.

You can redeem your assets in instalments when you choose an SWP plan. Your mutual fund investments can be directed to your savings account. The mutual fund’s value in an SWP is reduced by the number of units you remove.

10. Market Circumstances

While this is not a highly suggested approach, you can benefit from it if you are well aware of the market conditions. Timing the market is never advisable. However, if you witness a good opportunity to exit your investments, you may consider it. Do not hesitate to consult a financial advisor in case of any doubt. Consulting an advisor will help you analyze the situation with a broader perspective and help you make a more informed decision.

Avoid Selling Mutual Fund Under These Scenarios

Now that you are well aware of when to sell your mutual funds, it is important to know when you shouldn’t sell your mutual funds. The following scenarios will tell you when you should not sell your mutual fund investments:

1. Don’t Sell Mutual Fund Units Based on Stock Performance

It’s important to keep a watch on the stock market, but don’t let it affect you too much. When the markets begin to collapse, many people make the error of selling their mutual funds in anticipation of large losses. However, selling mutual funds based on stock market performance may deprive you of otherwise available benefits.

Mutual funds have a diversified portfolio that invests across different securities apart from equities, for example, fixed income instruments, gold, and forex. Since the investments are diversified across different asset classes, the impact of a stock market crash may not be as harsh as a pure equity investment. Moreover, during a market crash, you will be able to accumulate a higher number of units of a fund with your investments. As a result, your gains will be higher when the fund recovers.

Therefore, do not sell the mutual fund in a hurry because you may lose out on future profits. Before selecting whether or not to sell a mutual fund, you should consider the actual impact of market volatility.

2. Avoid Making Decisions Based on Short-Term Performance

You won’t make much money if you buy mutual funds with a short-term outlook. Make a long-term investing goal and set realistic performance expectations for mutual funds. Invest in mutual funds for the long term to get the full benefits. Selling a mutual fund after a period of poor performance may not be the right strategy, and you may lose the potential to generate significant returns in the long term.

Conclusion

Withdrawing from a mutual fund should be well-thought off. Investing towards achieving a certain goal is the most common among investors today.

When you know you have made enough towards achieving the goal, do not be in greed and expect to earn more money through the investment and prolong your exit. When you know you have earned enough to achieve your goal, withdraw your investments.

Volatility can burn out your wealth and leave you with lesser amounts. Finally, have a planned exit strategy for your investments. Make sure you start withdrawing systematically by transferring your investments into less volatile and risky instruments at least one year prior to your goal achievement.

Discover More on Mutual Funds

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Have a Disinvestment Plan

- Know When to Exit from Investments in Mutual Funds

- 10 Scenarios You Should Consider Selling Mutual Funds

- Avoid Selling Mutual Fund Under These Scenarios

- Conclusion

Show comments