Parag Parikh Flexi Cap Fund is among the popular and well-managed funds in the flexi cap category. The fund has a unique investment strategy that combines value investing and international diversification. The fund has delivered a return of 18.02% over the long term. Over the years, the fund consistently outperformed its benchmark and peers. However, the fund has also faced some challenges in the recent market conditions, lagging behind its category average in 2023.

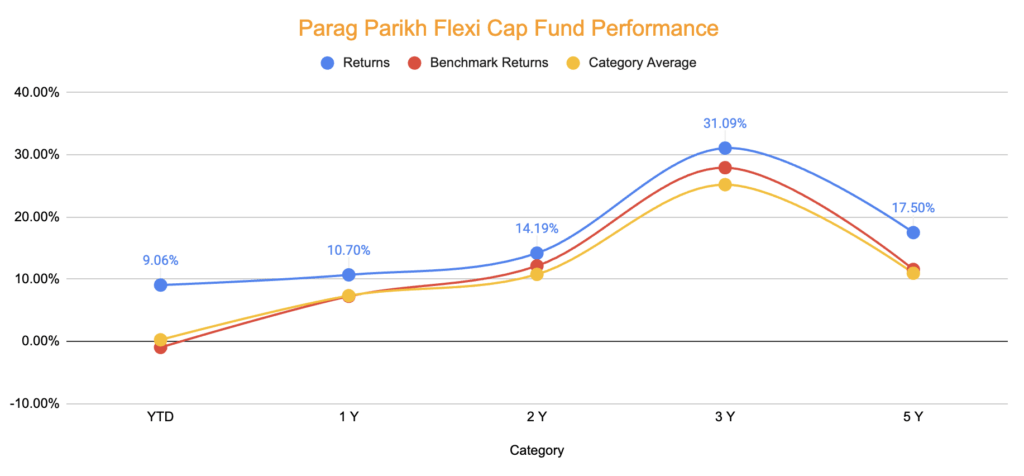

Parag Parikh Flexi Cap Fund Performance

Parag Parikh Flexi Cap Fund (earlier known as Parag Parikh Long Term Equity) was launched in May 2013 by PPFAS Mutual Fund. The fund follows a flexi cap mandate, which allows it to invest across market capitalizations and sectors without any restrictions. The fund also invests up to 35% of its assets in foreign equities.

| Category | Returns | Benchmark Returns | Category Average |

| YTD | 9.06% | -0.97% | 0.25% |

| 1 Y | 10.70% | 7.25% | 7.35% |

| 2 Y | 14.19% | 12.14% | 10.78% |

| 3 Y | 31.09% | 27.94% | 25.21% |

| 5 Y | 17.50% | 11.57% | 10.96% |

| Since Inception | 18.02% | 10.87% |

The fund has been a consistent outperformer since its inception, delivering an annualized return of 18.02% as on 05th May 2023, compared to 10.87% by its benchmark NIFTY 500 TRI. The fund has also outperformed its peers in the flexi cap category.

Portfolio of Parag Parikh Flexi Cap Fund

Parag Parikh Flexi Cap Fund follows a bottom-up stock selection process based on value investing and international diversification. The fund seeks to invest in high-quality businesses that are available at reasonable valuations and have a long runway for growth. The fund also aims to reduce home bias and currency risk by investing in foreign equities that offer attractive opportunities and diversification benefits.

The fund’s portfolio reflects its value-oriented approach and its preference for high-quality businesses with strong moats, growth potential and reasonable valuations. The fund has significant exposure to technology stocks, both in domestic and foreign markets, which have been the main drivers of its performance over the years. Parag Parikh Flexi Cap Fund also has a healthy exposure to financial services, consumer cyclical and consumer defensive sectors, which offer stability and growth opportunities in the Indian market. The fund has low exposure to cyclical sectors like energy, metals and real estate, which are prone to volatility and uncertainty.

International Exposure

The Parag Parikh Flexi Cap fund offers diversified exposure to overseas markets, contrary to popular belief that it only holds Nasdaq stocks. While it has faced recent setbacks due to declines in tech stocks like Alphabet, Amazon, and Microsoft, its overall strategy of selecting quality stocks from different markets and segments remains intact.

Although restrictions on overseas investments limited its ability to capitalize on price dips, recent changes have allowed the fund to increase its stakes in stocks like Alphabet and Amazon.com. The fund focuses on quality stocks and a buy-hold strategy.

Domestic Exposure

Flexi-cap funds give the fund manager the flexibility to navigate across market caps – large, mid and small-cap stocks. Until December 2020, this flexi-cap fund had nearly equal allocation between large-cap and mid-plus small-cap stocks. However, the portfolio has since shifted towards a greater allocation in large-cap stocks, possibly influenced by the fund’s size and market correction. Currently, Parag Parikh Flexi Cap Fund holds about 58.01% of its assets in large-cap stocks, 3.36% and 6.61% in mid and small-cap stocks, respectively.

Parag Parikh Flexi Cap’s success is not solely reliant on its overseas exposure. It is just one component of its overall portfolio. It should not be mistaken as an overseas fund, as it has demonstrated strong performance through its domestic portfolio choices as well. Additionally, its ability to maintain low volatility and contain downside risks through its stock selection differentiates it from other diversified equity funds.

Why Invest in Parag Parikh Flexi Cap Fund?

When there are a large number of funds available in the market, it is often quite difficult to choose the right funds. Scripbox uses its proprietary system to rate mutual funds and, based on that, make a recommendation or rate the fund as top-ranked. Parag Parikh Flexi Cap Fund is Scripbox recommended fund. Let’s look at the parameters on which Scripbox recommends Parag Parikh Flexi Cap Fund:

- Consistency of Outperformance: Our evaluation focuses on the fund’s consistent ability to outperform. We prefer funds that demonstrate high consistency. This Flexi cap fund has consistently outperformed and has been recognized as a category leader in terms of outperformance consistency.

- Rolling Returns (1-Year and 3-YearHolding Period): We assess the average one-year and three-year returns generated by the fund over an extended period. The fund has consistently delivered returns and has been recognized as a category leader in terms of rolling returns over a one-year and three-year holding period.

- Volatility of Outperformance: We analyze the volatility of the fund’s outperformance compared to the benchmark. A lower volatility is preferred, indicating a more stable performance. The fund has exhibited low volatility.

- Downside Protection Measure: We examine the fund’s resilience during market downturns. We prefer funds that demonstrate higher resilience. The fund has shown resilience and has been recognized as a category leader in terms of downside protection measure.

- Upside Participation Measure: We assess how well the fund has capitalized on upward market movements. We prefer funds that effectively participate in market upswings. The fund has demonstrated good performance in terms of the upside participation measure.

- Fund Size: We consider the fund’s size in relation to other funds in the category. Larger funds are generally preferred. The fund has been recognized as a category leader in terms of fund size.

Who Should Invest in Parag Parikh Flexi Cap Fund

Parag Parikh Flexi Cap Fund is suitable for investors who are looking for long-term capital appreciation with moderate to high-risk tolerance levels. The fund offers a diversified and balanced portfolio that can benefit from the growth potential of domestic and foreign markets. The fund also follows a value-oriented approach that can protect the downside during market corrections and generate alpha over the long term.

However, investors should also be aware of the risks involved in investing in this fund. The fund’s exposure to foreign equities can increase the volatility and currency risk of the portfolio.

Therefore, investors should have a long-term investment horizon of at least five years and a high conviction in the fund’s investment strategy before investing in this fund. Investors should also monitor the fund’s performance and portfolio regularly and review their asset allocation accordingly.

Show comments