Investing is no longer considered fancy. It has become a necessity to secure one’s future. At the same time, one cannot ignore insurance and its benefits. Insurance is a preliminary step in the investing journey. There are a lot of financial products at a person’s disposal to fulfill their investment and insurance needs. Choosing from a universe of options can get overwhelming, and investors often get confused and end up with investments that don’t suit their needs. This article covers how to fulfill one’s insurance and investment needs by focusing on LIC vs Mutual Funds.

Choosing the Right Investment Option

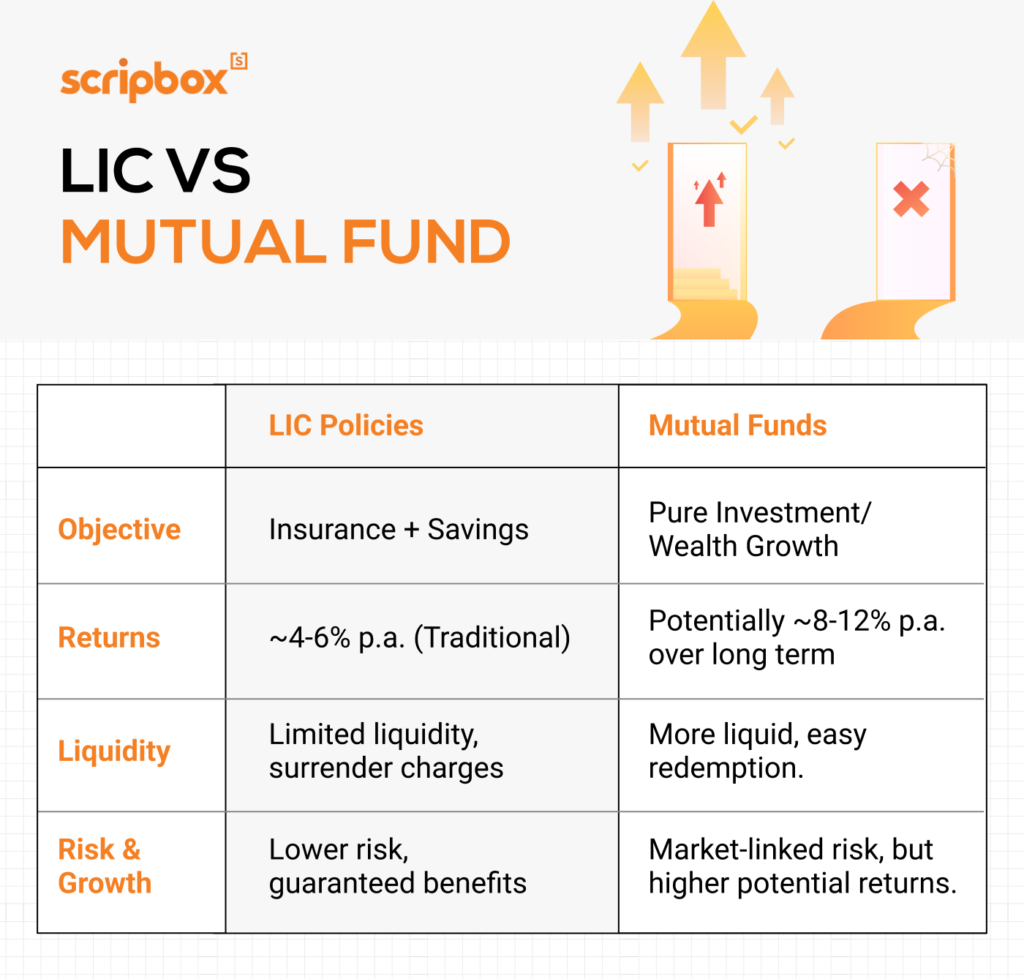

Understanding the nuances between LIC policies and mutual funds is crucial when selecting the right investment option. Both have their unique advantages and cater to different financial needs and goals. While LIC policies offer the dual benefit of life insurance and guaranteed returns, mutual funds provide the potential for higher returns through market-linked investments.

Evaluating Risk and Return

Evaluating the risk and return associated with each investment option is essential for making an informed decision. LIC policies are generally considered safer, offering guaranteed returns and life insurance coverage. This makes them suitable for risk-averse people who prioritize financial security. However, the returns from LIC policies may be lower than those from mutual funds.

Conversely, mutual funds carry market risk but also offer the potential for higher returns over the long term. They are managed by professional fund managers who invest in a diversified portfolio of securities, aiming to maximize returns while managing risk.

To evaluate the risk and return, consider the following factors:

- Risk Tolerance: LIC policies may be a better option if you have a low-risk tolerance and prefer stability. They provide a safety net with guaranteed returns and life insurance coverage. Conversely, if you are willing to take on more risk for the possibility of higher returns, mutual funds might be more suitable.

- Investment Horizon: Your investment horizon plays a significant role in determining the right investment option. If you have a long-term investment horizon, mutual funds can be advantageous as they have the potential to generate substantial returns over time. LIC policies might be more appropriate for shorter investment horizons due to their guaranteed returns and lower risk.

- Financial Goals: Aligning your investment choice with your financial goals is crucial. Mutual funds may be a better option if your primary goal is wealth creation due to their potential for higher returns. However, if your goal is to secure your family’s financial future, LIC policies might be more suitable with their life insurance component.

By carefully evaluating these factors, you can make a well-informed decision that aligns with your financial goals and risk tolerance, ensuring a balanced and secure financial future.

Parag Parikh Flexi Cap fund (G)

HDFC Large and Mid Cap Fund (G)

ICICI Prudential Value Discovery Fund (G)

ICICI Prudential Bluechip Fund (G)

What is Life Insurance Corporation of India (LIC)?

Life Insurance Corporation of India (LIC) is a government-owned insurance and investment organization. It fulfills individual’s insurance needs by offering plans that suit them. LIC is one of the oldest life insurance companies and an industry leader in the insurance space.

Life insurance protects a family against unforeseen events like death. It helps financially secure a family’s future. The primary purpose of life insurance is to offer a ‘death benefit’ to the dependants upon the premature death of the family’s earning member.

Different types of insurance plans cater to both insurance and investment needs. The most basic one is term insurance, a pure insurance plan. The other types of life insurance plans are Unit-Linked Insurance Plans (ULIPs), endowment plans, money-back plans, child insurance plans, and retirement plans. All these plans cater to insurers’ investment needs.

Having life insurance is very essential. It comes with a lot of benefits. The following are some benefits of life insurance:

Risk coverage and financial security

Insurance protects the form of monetary compensation against unforeseen events like death. The money from the insurance acts as a cushion and offers the family financial security to continue their lives.

It helps in creating wealth.

Some insurance policies also help create wealth by investing a portion of the premium paid in different asset classes to beat inflation and create a corpus that will aid in fulfilling financial goals.

Tax benefits

Insurance plans come with tax benefits. The premium paid up to INR 1.5 lakhs per annum is completely tax-free under Section 80C of the Income Tax Act, 1961.

Stress-free life

Financially, taking care of one’s family is the primary goal of every earning member. A life insurance policy that will help the family carry on with their life will help an individual lead a stress-free life. One can live peacefully knowing their family has a safety net in case of unforeseen events.

What are Mutual Funds?

Mutual funds are popular investment options that pool money from investors and invest in securities like stocks, bonds, and money market instruments. The Securities Exchange and Board of India (SEBI) regulates mutual funds.

Through mutual funds, investors get access to professional fund management. The fund management team makes investments after thorough research and based on the fund’s objective. This expert management helps outperform traditional investments like bank savings accounts and fixed deposits.

Different types of mutual funds exist, such as equity and debt. Equity mutual funds primarily invest in equity and equity-related instruments. Some equity fund types are large-cap, mid-cap, small-cap, multi-cap, sectoral or thematic, tax saving, etc. On the other hand, debt mutual funds invest in government securities, corporate bonds, money market instruments, etc. Some debt mutual funds are short-term and ultra-short-term funds, liquid funds, dynamic bond funds, etc.

Mutual funds offer multiple schemes that suit different investment needs. Therefore, one can pick a suitable fund based on the investment objectives and financial goals. Apart from this, mutual funds offer various other benefits such as:

Expert Fund Management

Professional managers manage mutual funds. Not everyone has the knowledge of the markets or the time to manage their investments. Mutual funds are a good investment option for such individuals who can invest and forget about managing their money.

Predefined Objective

Each mutual fund has a predefined investment objective that helps it generate significant returns over time. Therefore, one can invest in a fund that best suits their investment goal.

Easy to Invest

Mutual fund investments are as easy as online shopping. With just a click, one can buy, sell, or redeem funds at NAV.

SIP Option

Mutual funds accept lump sum or monthly investments. In other words, MFs have a Systematic Investment Plan (SIP) option that offers the flexibility to invest a small amount regularly. Therefore, one can start their investment journey at a price as low as INR 500.

LIC vs Mutual Funds – Key Differences Between LIC and Mutual Funds

Following are some of the key differences between LIC vs Mutual Funds:

| Parameter | Life Insurance | Mutual Fund |

| Meaning | Life insurance provides protection to a family against unforeseen events like death. | A mutual fund is an investment option that helps in generating significant returns through investing in market-linked instruments. |

| Purpose | The main purpose of a life insurance policy is to safeguard the financial future of dependents. | The primary motive for mutual fund investments is to generate significant returns for long term financial goals. |

| Risk | Life insurance is less risky in comparison to mutual funds. However, it offers guaranteed death benefits. | Mutual funds are market-linked investments, and hence are highly volatile. |

| Returns | LIC schemes offer low returns. | Mutual funds offer significant returns in the long term. Long durations help in addressing the market volatility. |

| Tax Benefits | Premium payments up to INR 1.5 lakhs qualify for tax exemption under Section 80C of the Income Tax Act, 1961. | Only investment in ELSS mutual funds qualify for tax deduction under Section 80C of the Income Tax Act, 1961. |

You may also like to read about the LIC Vs PPF

What Should You Choose Mutual Funds or LIC?

Life insurance is a must-have for anyone looking to secure their family’s financial future in case of unexpected events. It’s the foundation of financial independence and provides a safety net during difficult times. While insurance is a priority, investing is equally crucial for building wealth and achieving long-term financial goals. However, many people make the mistake of combining these two needs, which can lead to suboptimal results.

Here’s the key: insurance and investment serve completely different purposes. Life insurance, especially term insurance, is designed purely to protect your family financially in case of your untimely demise. Term insurance is straightforward and affordable, offering a substantial life cover for a small premium. This premium should be viewed as an expense for ensuring your family’s financial safety, not as an investment.

On the other hand, insurance plans that mix investment and protection—like endowment or ULIPs—are often expensive. They come with high management fees and don’t provide sufficient life cover. Worse, these plans rarely offer competitive returns, making them unsuitable as either a robust insurance or investment option.

Financial experts recommend a simple yet effective strategy: keep insurance and investment separate. Opt for term insurance to meet your protection needs, and for wealth creation, choose mutual funds. Mutual funds are regulated by SEBI, ensuring transparency and capped expenses through an upper limit on the expense ratio. These funds invest in diverse asset classes and can deliver higher returns over the long term compared to insurance-based investment plans.

With mutual funds, you can select the best options based on your risk appetite and financial goals. This separation allows you to build wealth effectively while maintaining financial security for your loved ones.

Related Pages

Show comments